San Francisco | February 18, 2026

Anthropic shipped Sonnet 4.6 at $3 per million tokens on Monday and matched its own $15 Opus on nearly every enterprise benchmark. Hex, Mercury, and Factory AI are already moving traffic. Two weeks was all it took for the flagship to become the fallback.

Over 100 biosecurity researchers published a five-tier framework in Science for controlling which pathogen datasets can train AI models. The gap they cannot close: everything already online stays open.

Tesla removed "Autopilot" from California marketing to avoid a 30-day sales ban. California is a third of U.S. Tesla volume. The word goes. The feature stays.

Stay curious,

Marcus Schuler

Know someone who'd find this useful? Forward this article. They can subscribe free here.

Anthropic's $3 Sonnet 4.6 Matches Its $15 Opus on Enterprise Benchmarks

Anthropic shipped a $3 model that matches its $15 flagship on almost every enterprise metric. Enterprise customers are migrating before the first Opus invoice arrives.

Sonnet 4.6 scores 1633 on GDPval-AA office tasks versus 1606 for Opus. On agentic financial analysis, Sonnet pulls 63.3% to Opus's 60.1%. The only clear Opus advantage is SWE-bench coding, where the gap is 1.2 percentage points.

Enterprise customers noticed immediately. Caitlin Colgrove, Hex's CTO, called it "an easy call" at Sonnet pricing. Leo Tchourakov at Factory AI said his team is transitioning Sonnet traffic over. Mercury's Ryan Wiggins said nobody expected this performance at this price point.

The pattern echoes the semiconductor industry: the midrange chip matches the flagship within months, and volume wins. Anthropic's $100K-plus customers grew 7x year-over-year. Million-dollar accounts jumped from roughly 12 to more than 500 in two years. At $3 per million tokens, the volume math changes entirely.

Computer use tells a separate story. In October 2024, the benchmark sat at 14.9%. Sonnet 4.6 hits 72.5%, nearly 5x improvement in 16 months. Jamie Cuffe at Pace said the model reasons through failures and self-corrects in ways previous models could not.

Software stocks are down 20% year-to-date. Bloomberg reported Anthropic's quiet legal automation launch triggered what analysts call a SaaSpocalypse. If $3 does what $15 does, the question is not which model wins. The question is what happens to every company selling software priced on the assumption that AI capability stays expensive.

Why This Matters:

- Enterprise AI buyers get flagship performance at one-fifth the cost, accelerating the shift from margin-based to volume-based pricing across the entire model market.

- Software companies built on per-seat pricing face existential compression as AI capabilities commoditize faster than anyone expected.

✅ Reality Check

What's confirmed: Sonnet 4.6 matches or beats Opus on GDPval-AA, agentic financial analysis, and computer use. Multiple enterprise customers are publicly migrating traffic.

What's implied (not proven): That volume pricing will generate more revenue than the premium tier it replaces and that Opus becomes a niche product.

What could go wrong: Sonnet underperforms Opus on complex, long-horizon reasoning not captured by standard benchmarks, surprising customers post-migration.

What to watch next: Opus retention rate and whether it holds above 20% of API traffic through Q1.

The One Number

~$1 trillion — Approximate market value wiped from enterprise software stocks since Anthropic launched Cowork and its 11 agentic plugins in late January. Salesforce and Workday are both down more than 40% over twelve months. The per-seat subscription model built the SaaS era. AI agents that replace entire workflows are dismantling it.

Source: Bloomberg

Researchers Propose Five-Tier Framework to Restrict AI Access to Pathogen Datasets

More than 100 researchers from Johns Hopkins, Oxford, Stanford, Columbia, and NYU published a framework in Science for classifying which pathogen datasets AI models can train on.

The system establishes five Biosecurity Data Levels. BDL-0 applies to most biological data and requires no controls. BDL-4 demands government pre-publication review and official control over model access. In between, BDL-2 adds institutional affiliation checks and bad-actor screening. BDL-3 requires a justified use case, a trusted research environment, and prepublication risk assessment.

The framework emerged from a concrete finding. Researchers tested ESM3, a protein model, and Evo 2, a DNA model, and both performed "far worse" on virus-related tasks when trained without viral data. Capabilities returned when the data was reintroduced. If the data matters that much, controlling access to it matters too.

Jassi Pannu at Johns Hopkins's Center for Health Security: "Right now, there's no expert-backed guidance on which data poses meaningful risks."

The catch: only new datasets face restrictions. Everything already published stays fully open. MaveDB held just 45 virus-related datasets, 2% of its total collection, as of late 2024. The proposal controls what gets added, not what already exists.

The policy picture is fractured. Trump's Genesis Mission wants to train AI on massive scientific datasets. China's AI Safety Framework 2.0 flagged WMD knowledge risks. The Pentagon is developing biodata storage requirements under the 2026 NDAA. No international framework governs any of it.

Why This Matters:

- Frontier AI companies release biological models without safety assessments, and this framework offers the first expert-backed classification system.

- The retroactivity gap means the most dangerous existing datasets remain accessible, limiting the proposal's near-term protective value.

AI Image of the Day

Prompt: Labrador with a pink towel on her head, sunglasses and holding a glass of wine in her hand, flat graphics, pastel colours, white background, handpainted look

Tesla Removes Autopilot From California Marketing to Avoid 30-Day Sales Ban

Tesla stripped "Autopilot" from California marketing materials after a DMV judge recommended suspending the company's ability to sell vehicles in the state for 30 days.

The case started in May 2021 when the DMV flagged marketing language on Tesla's website. Formal accusations followed in November 2023. After five days of testimony in July 2025, the judge issued a proposed decision recommending the suspension. The DMV adopted the finding in December 2025 and gave Tesla 60 days to comply.

The marketing changes are specific. "Autopilot" is gone from California-facing materials. "Full Self-Driving Capability" is now "Full Self-Driving (Supervised)." In January, Tesla discontinued Autopilot as standard equipment across the U.S. and Canada. On February 14, FSD converted to a $99-per-month subscription only.

California accounts for nearly one-third of Tesla's U.S. sales. A 30-day sales ban in the company's largest domestic market would have been a first for any automaker.

The numbers behind the marketing dispute are not flattering. Consumer Reports ranked Tesla's driver assistance eighth out of eight manufacturers tested. The robotaxi fleet reported five crashes in December and January, roughly four times the human driver crash rate. California registrations fell 15% in early 2025.

Why This Matters:

- The compliance signals a shift from fighting regulators to managing them, giving other states a template for enforcement.

- Tesla's pivot to subscription-only FSD reprices the technology as a recurring revenue stream rather than a one-time feature sale.

🧰 AI Toolbox

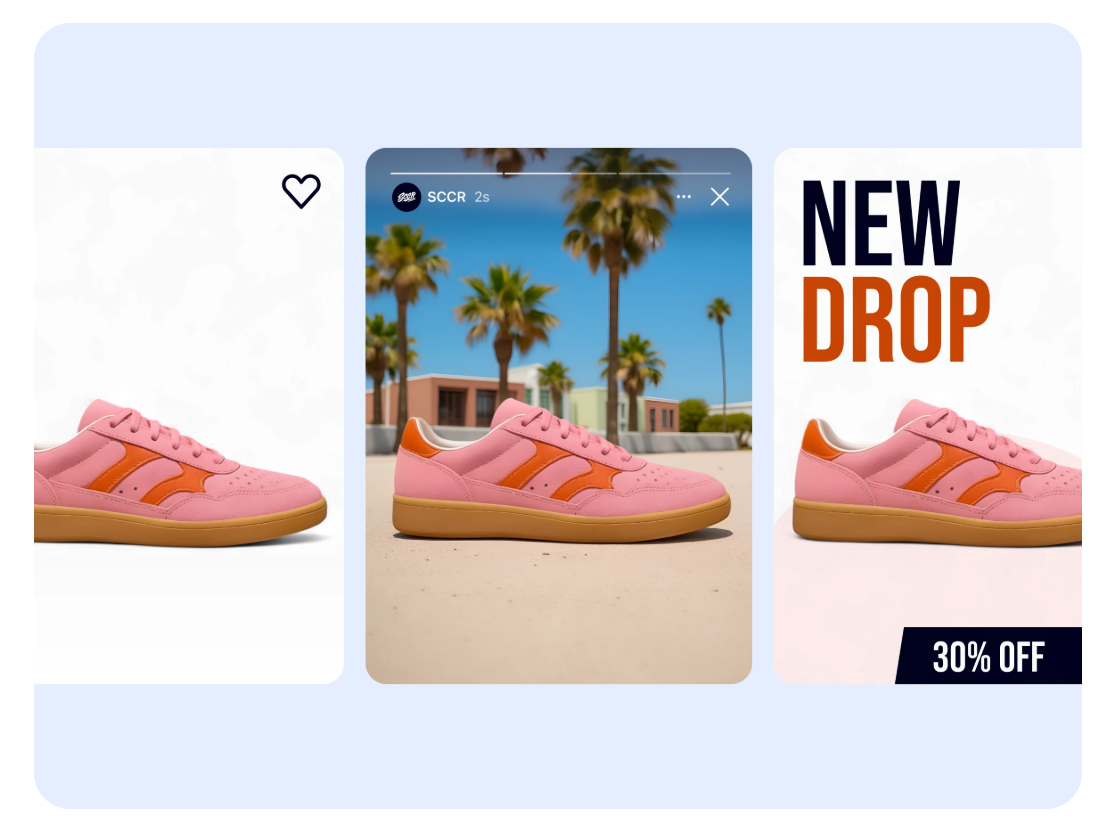

How to Turn Any Product Photo Into a Studio-Quality Image with Photoroom

Photoroom removes backgrounds, generates professional scenes, and batch-edits product images using AI. Upload a phone photo of any item and get back an image that looks like it came from a studio shoot. E-commerce sellers, marketers, and small business owners use it to create listing photos without hiring a photographer. Free plan includes 250 exports per month.

Tutorial:

- Sign up free at photoroom.com or download the mobile app (iOS/Android)

- Upload a product photo, even one shot on your kitchen table with bad lighting

- The AI instantly removes the background and isolates your product with clean edges

- Choose AI Backgrounds to place your product in a professional scene ("marble countertop with soft morning light," "minimalist white studio")

- Use AI Retouch to fix shadows, reflections, or imperfections the original photo carried

- Switch to Batch Mode to process dozens of images at once with the same style and background

- Export in the right dimensions for your platform: square for Instagram, 4:3 for Amazon, custom for your website

What To Watch Next (24-72 hours)

- DoorDash, Booking.com, eBay: All three report Q4 earnings after close today. DoorDash carries the biggest stakes, down 28% in six weeks to around $160 on AI disruption fears. With 26 million DashPass members and Deliveroo now integrated, management needs a clear margin story while Seattle and New York gig-worker wage laws squeeze unit economics from the other side.

- India AI Impact Summit: The formal summit opens Thursday in New Delhi with Modi, Macron, and over 20 heads of state across 500-plus sessions. India is pushing a "global AI commons" framework at the first major AI gathering hosted in the Global South. Nvidia CEO Jensen Huang pulled out and sent a delegate instead.

- DeveloperWeek San Jose: The largest US developer conference of the winter runs through Friday with AI coding tools dominating the agenda for the first time. The timing is pointed: it opens the same week Techmeme reported traffic up 25% in 2025, a sign that human-curated tech intelligence is gaining ground even as AI tools flood the market.

🛠️ 5-Minute Skill: Turn a Competitor's Earnings Call Into a Strategic Briefing

Your competitor just reported quarterly earnings. The transcript runs 14,000 words. Your VP wants a one-page briefing by end of day. Reading the whole thing takes 45 minutes. You have fifteen.

Here's how to pull the signal from the noise in one prompt.

Your raw input:

[Paste the full earnings call transcript — most are available free

on Seeking Alpha, Motley Fool, or the company's investor relations

page within hours of the call]

The prompt:

You are a competitive intelligence analyst at a Fortune 500 company.

From this earnings call transcript, produce a strategic briefing with:

1. **Bottom line** (2 sentences): What is management's primary message

this quarter?

2. **Numbers that matter** (table): Metric | This Quarter | Prior Quarter

| YoY Change — include only the 5-6 metrics most relevant to competitive

positioning

3. **Strategic shifts**: Any changes to product roadmap, market focus,

pricing, or partnerships that weren't in last quarter's call. Quote

the exact language.

4. **AI/automation mentions**: Every reference to AI, automation, or

agents — with context. Count total mentions.

5. **Risks they acknowledged** (bulleted): What did they flag as headwinds?

6. **What they avoided**: Topics an analyst asked about where the answer

was evasive or noncommittal

7. **So what for us** (2-3 sentences): How should a direct competitor

interpret this quarter?

Transcript:

[paste here]

Rules:

- Use their exact words when citing strategic shifts. No paraphrasing.

- If a number is mentioned without context, flag it rather than guessing

the baseline.

- The "what they avoided" section is the most important. Evasion signals

vulnerability.

What you get back:

Bottom line: Management positioned the quarter as a transition period, emphasizing long-term AI investment over near-term margin expansion. The CFO used the phrase "investing through the cycle" three times, which typically signals margin pressure will continue.

Numbers that matter:

Strategic shifts:

- First-ever disclosure of AI product revenue as a separate line item ("We felt it was important to break this out given the trajectory")

- Pricing shift: announced consumption-based tier alongside existing per-seat model

- New partnership with an unnamed "top-three hyperscaler" for distribution

AI/automation mentions: 47 total. Up from 31 last quarter. CEO used "agentic" 9 times. "Platform" appeared 23 times, replacing "suite" as the preferred framing.

Risks they acknowledged:

- Enterprise sales cycles lengthening ("customers are taking longer to commit to multi-year deals")

- Margin compression from AI infrastructure costs

- Currency headwinds in EMEA

What they avoided:

- Analyst asked about churn in the mid-market segment. CFO pivoted to enterprise net retention without addressing mid-market directly. Flag this.

- No mention of the Anthropic Cowork competitive threat despite two analyst questions about AI agents replacing SaaS seats

So what for us: They are feeling the AI agent pressure but will not say it out loud. The consumption pricing pivot is defensive, not offensive. Their mid-market silence and the 18% drop in net new customers suggest acquisition is stalling while they restructure around AI. If we are targeting their mid-market customers, this is the quarter to accelerate.

Why this works

The prompt separates facts from interpretation and creates a section ("what they avoided") that most analysts skip entirely. Executives rehearse the numbers they want to share. The tells are in the questions they dodge. The "quote exact language" rule prevents the model from softening management's words into generic business prose. And the AI mention count gives you a trend line: if they said "AI" 47 times this quarter versus 31 last quarter, the roadmap is shifting whether they admit it or not.

Where people get it wrong: Asking the model to "summarize this earnings call." You will get a book report. This prompt treats the transcript as competitive intelligence, not a summary exercise. The structure forces the model to analyze, not just compress.

What to use

Claude (Claude Opus 4.6): Best for long transcripts. The 200K context window fits any earnings call without truncation. Strongest at the "what they avoided" section because it tracks conversational patterns across the full document. Watch out for: Can be overly cautious about inferring strategy from evasion.

ChatGPT (GPT-4o): Clean table formatting. Handles the numbers section well. Watch out for: On long transcripts, may summarize instead of quoting exact language.

Gemini (Gemini 2.5 Pro): Strong at the AI mention count and pattern tracking. Watch out for: Tables occasionally lose column alignment.

Bottom line: Use Claude for the full analysis. Use ChatGPT if you need the table to look perfect in a slide deck. Either way, the "what they avoided" section is worth more than the rest of the briefing combined.

AI & Tech News

Microsoft Pledges $50 Billion for AI Infrastructure Across the Global South

Microsoft announced it is on pace to invest $50 billion in AI infrastructure across developing nations in Asia, Africa, and Latin America by 2030. The commitment follows a $17.5 billion AI package unveiled in India in 2025.

Google Announces New Fiber Optic Routes Between the US and India

CEO Sundar Pichai unveiled the America-India Connect Initiative at India's AI Summit, a plan to build new fiber optic lines linking the two countries. The announcement is part of a broader Google expansion in India's digital and AI ecosystem.

Berkshire Hathaway Slashes Amazon Stake by 75%, Takes $352 Million New York Times Position

Warren Buffett's Berkshire Hathaway cut its Amazon holdings to 2.3 million shares in Q4, a reduction of more than 75%. The firm simultaneously bought 5.1 million shares of The New York Times in December.

Warner Bros. Joins Disney and Paramount in Suing ByteDance Over AI Video Tool

Warner Bros. Discovery accused ByteDance of training its Seedance AI video tool on Batman, Superman, and Game of Thrones without authorization. The lawsuit extends a growing Hollywood coalition fighting generative AI companies over copyrighted content.

China Advances Brain-Computer Interface Ambitions With State-Backed Human Trials

Shanghai startup NeuroXess has begun human testing of brain-computer interfaces with Beijing's strategic backing. Looser regulation and significant new investment position China as a serious competitor to Elon Musk's Neuralink.

Battery Ventures Raises $3.25 Billion for Software and Industrial Tech Fund

The global VC firm closed its XV fund at $3.25 billion, matching its 2022 fundraise level. The successful close signals investor confidence in software even as AI disruption reshapes the sector.

Uber Commits $100 Million to Autonomous Vehicle Charging Network

Uber plans to build fast-charging stations for autonomous vehicles across San Francisco, Los Angeles, and Dallas. The investment signals the ride-hailing giant's deepening bet on self-driving and electric vehicle infrastructure.

Federal Judge Orders OpenAI to Drop "Cameo" Branding on Sora Products

A US district court in Northern California ruled in favor of celebrity video platform Cameo, ordering OpenAI to stop using the name on its video generation products. The ruling marks another legal setback as OpenAI expands into creative tools.

Conservative Communities Revolt Against Trump-Backed AI Data Center Expansion

Grassroots resistance is building in Missouri and other Republican-leaning states against rapid AI infrastructure expansion backed by the White House. Republican strategists worry the backlash could cost the party votes in 2026 midterms.

Sarvam AI Unveils Two Models Built for India's Languages at New Delhi Summit

Bengaluru-based Sarvam AI announced two new models tailored to Indian languages and cultural contexts. The launch positions the startup as a domestic challenger to global AI players at the AI Impact Summit.

🚀 AI Profiles: The Companies Defining Tomorrow

Legora

Legora wants to be the operating system for law firms. The Swedish startup builds an AI workspace that handles legal research, document review, and contract drafting, all embedded inside Microsoft Word where lawyers already live. ⚖️

Founders

Max Junestrand was a competitive World of Warcraft player before he dropped out of college at 23. After a stint at McKinsey, he watched friends at law firms burn nights copying text between documents and decided to fix it. He co-founded the company as Leya in Stockholm in 2023 with August Erseus and Sigge Labor. Erseus departed in November 2024. Junestrand, now 26, made the 2026 Forbes 30 Under 30 AI list. About 250 employees work across six offices.

Product

Lawyers type a question, pick jurisdictions, and Legora returns a sourced research memo. Upload a stack of contracts and the AI rips through them, surfacing key clauses and flagging risks. The Word sidebar is the hook: attorneys query, review, and accept edits without switching apps. More than 600 law firms across 50 markets use it. Linklaters rolled it out across 30 offices. White & Case deployed 2,500 seats.

Competition

Harvey dominates U.S. BigLaw at an $11 billion valuation with $190 million in ARR. Thomson Reuters CoCounsel claims 20,000 firms. LexisNexis shipped Protege. Then there is Anthropic, Legora's own model supplier, which launched competing legal tools on February 3 and wiped $300 billion off software stocks. Robin AI, a London rival, collapsed in late 2025 after failing to close a $50 million round.

Financing 💰

In talks for $400 million at $5 billion-plus, per Forbes, with Accel participating. That follows $80 million at $675 million in May and $150 million at $1.8 billion in October. Total raised in six months: $600 million. ARR: $23 million. Only $1 million of that comes from the U.S.

Future ⭐⭐⭐ At 260 times revenue, Legora carries the highest multiple in enterprise software. The European client base is real but the American legal market, where the money is, barely knows the name. Anthropic selling legal tools directly to law firms while Legora runs on Claude is the kind of supplier-competitor squeeze that kills middleware companies. If U.S. revenue scales, the bet pays. If it doesn't, $5 billion was a number, not a valuation. ⚖️

🔥 Yeah, But...

Anthropic released Sonnet 4.6 on Monday at $3 per million tokens. On enterprise benchmarks, it matches or beats the company's own $15 Opus 4.6, which launched two weeks earlier. Multiple enterprise customers told Implicator.ai they are already migrating majority traffic from Opus to Sonnet.

Source: Implicator.ai, February 17, 2026

Our take: Anthropic spent two weeks selling Opus as the premium tier, then shipped a model at one-fifth the price that matches it on almost everything. Enterprise customers are migrating before the first invoice arrives. The CTO of Hex said "at Sonnet pricing, it's an easy call." It's always nice when your customers explain your product strategy back to you. The $15 model isn't obsolete exactly. It's just the one you buy to prove you're serious before switching to the one that does the same thing for less. Anthropic is competing with the hardest rival in the market: last month's Anthropic.