San Francisco | February 5, 2026

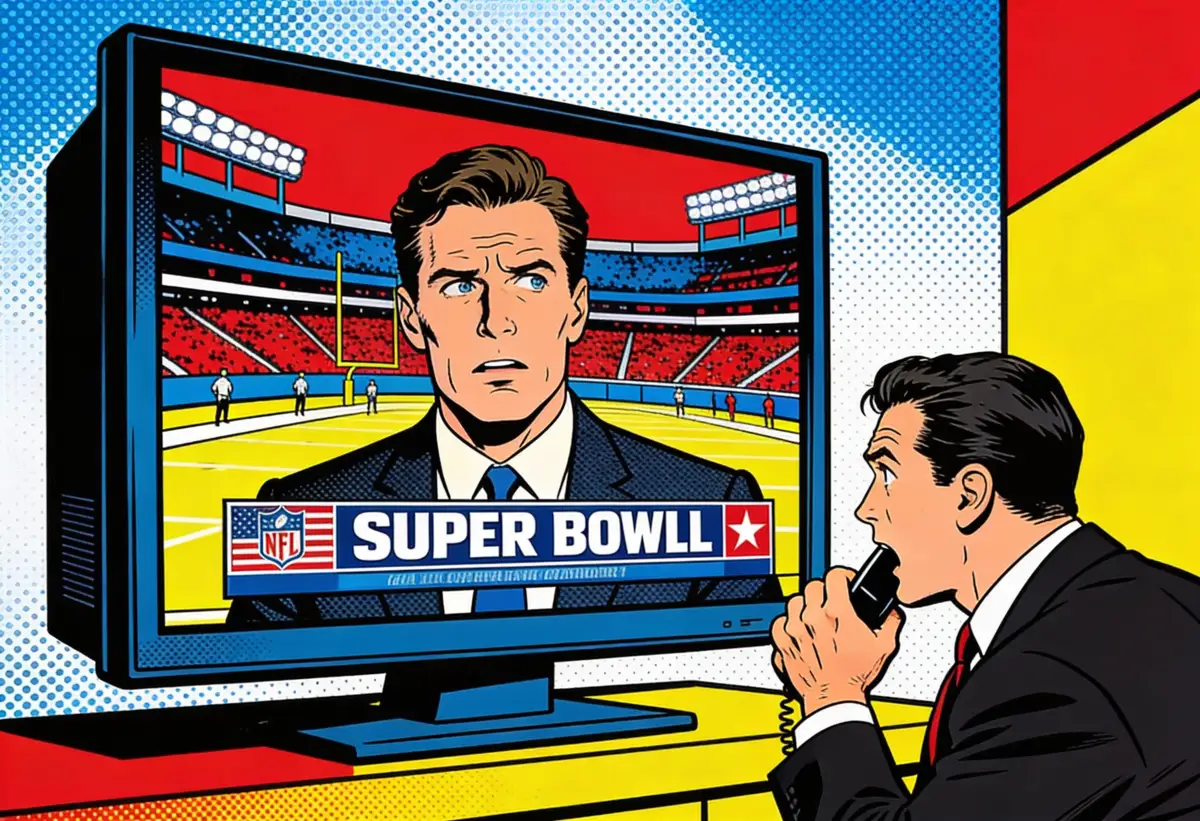

Anthropic is spending more than $8 million on Super Bowl airtime to tell 120 million viewers it doesn't believe in ads. The company that raised $10 billion on safety is now running influencer campaigns and pregame spots, all to make a point about ChatGPT putting banners in your therapy session. Sam Altman called it "dishonest." He wrote 400 words to prove it.

Arm posted its fourth straight record quarter. Data center royalties doubled. The stock dropped 8% because a licensing line item missed by $15 million. Wall Street sold the transition it asked for.

Stay curious,

Marcus Schuler

Anthropic Spends $8 Million on Super Bowl Ads Attacking ChatGPT's Ad Model

Anthropic bought its way into the Super Bowl to argue against buying your way into AI conversations. The company paid more than $8 million for a 30-second in-game spot and a 60-second pregame ad, both mocking the idea of ads inside chatbots.

The campaign targets OpenAI directly. ChatGPT began testing display ads at roughly $60 CPM earlier this year, and Microsoft's Copilot introduced ads in March 2025. Anthropic's pitch: users share medical questions, financial details, and personal struggles with AI assistants, making ad injection "exploitative," as co-founder Daniela Amodei put it.

The spots parody a fake product called "StepBoost Max" insoles. The broader campaign includes TV, digital, and influencer placements running through most of 2026. AI companies spent $333.6 million on U.S. broadcast TV ads last year, a 43% increase. Digital ad spending tripled to $426 million.

Sam Altman responded with a 400-word post calling Anthropic "dishonest" and "authoritarian." Anthropic left itself an escape clause: "Should we need to revisit this approach, we'll be transparent about our reasons."

Neither company has proven sustainable unit economics. Claude costs $0, $17, $100, or $200 a month. ChatGPT charges $0, $8, $20, or $200. eMarketer projects the U.S. AI search ad market will hit $2.08 billion in 2026 and balloon to $25.93 billion by 2029.

Why This Matters:

- Anthropic is positioning ad-free AI as an enterprise trust signal, betting that CISOs and compliance teams will pay premiums to keep corporate data out of ad-targeting pipelines.

- The AI ad market barely exists today but could reach $26 billion by 2029, meaning one company's moral stand is another's revenue roadmap.

✅ Reality Check

What's confirmed: Anthropic bought Super Bowl airtime and is running a multi-month ad campaign. OpenAI is testing ads at ~$60 CPM. Altman responded publicly.

What's implied (not proven): That ad-free AI is a durable business model, not a fundraising-stage luxury that disappears when burn rates catch up.

What could go wrong: Anthropic's own escape clause suggests the pledge expires when the balance sheet demands it.

What to watch next: Anthropic's next funding round terms and whether enterprise contracts include ad-free guarantees in writing.

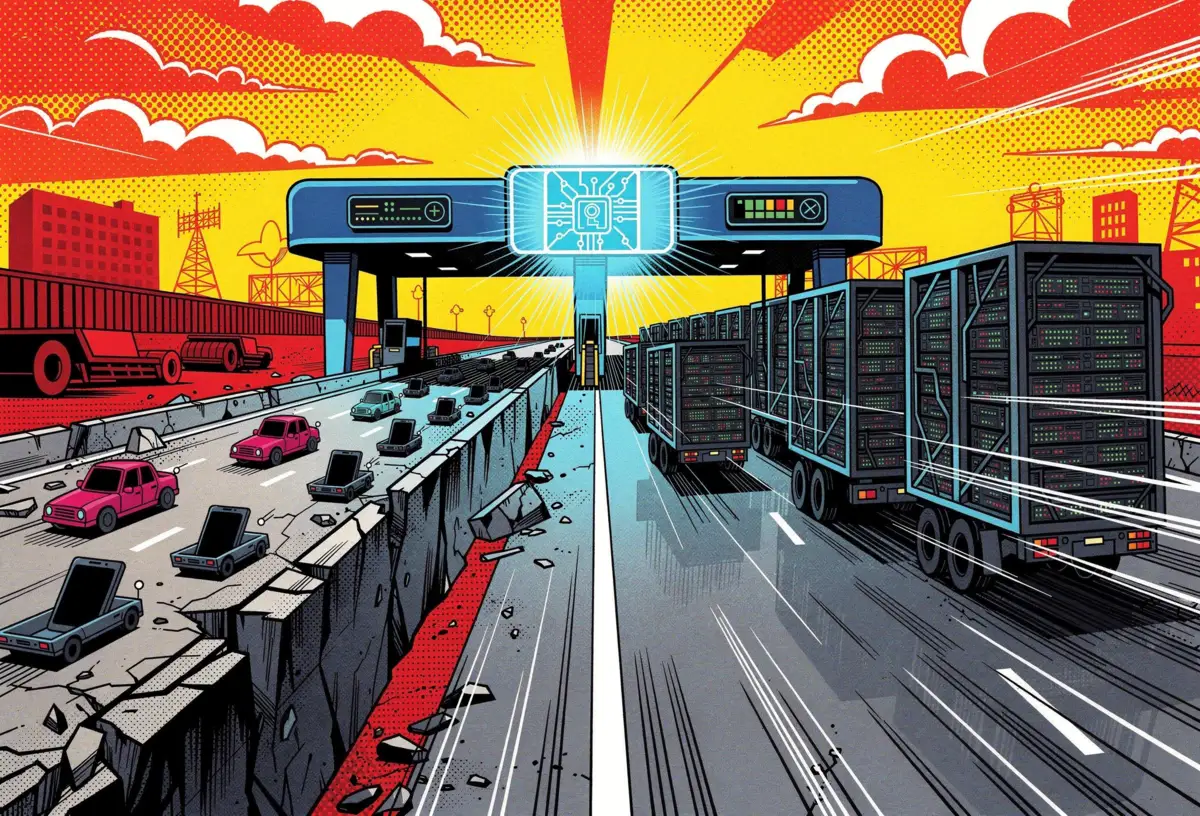

Arm Data Center Royalties Double as Wall Street Sells on $15 Million Licensing Miss

Arm posted $1.24 billion in record quarterly revenue. Data center royalties doubled year over year. The stock dropped 8% in after-hours trading because licensing revenue came in at $505 million instead of $520 million.

CEO Rene Haas called the reaction "micro-hysteria." The $15 million miss sits in a lumpy, timing-dependent revenue line that fluctuates quarter to quarter. Royalty revenue, the recurring business that tracks actual chip shipments, hit $737 million, up 27%.

The data center numbers tell a different story than the stock chart. Arm's Neoverse CPUs crossed 1 billion cores deployed. Market share among hyperscalers like AWS, Microsoft, and Google is approaching 50%, up from near zero five years ago. AWS now ships Graviton5 with 192 Arm cores. Nvidia's Vera CPU runs 88 Arm cores. Microsoft's Cobalt 200 packs 132.

Haas declared data center revenue will "overtake smartphones within a couple of years." That is a measurable claim against a business where smartphones still account for roughly half of revenue. Arm also disclosed plans last summer to build its own data center chips and hired an Amazon AI executive to lead the effort. A mysterious March 24 event is on the calendar.

Why This Matters:

- Arm collects royalties on nearly every AI inference chip shipping today, making it a toll booth on the AI infrastructure buildout regardless of which chipmaker wins.

- Wall Street punished a business model transition it has been demanding, selling the stock on a licensing timing blip while ignoring doubled data center revenue.

AI Image of the Day

Prompt: A dramatic digital shot of an astronaut standing on a barren, rocky planet surface with a massive glowing planet in the background. The astronaut wears a dark space suit with a white helmet and stands in silhouette against the cosmic scene. The main planet features dramatic ring systems in dark gray with bright red-orange glowing areas and cracks across its surface. The overall color palette consists of deep teals, blacks, grays, and bold red-orange highlights.

What To Watch Next (24-72 hours)

- Amazon: Q4 results land tonight at 5 PM ET. The number to watch: 23% AWS growth. Beat it, and the AI infrastructure spending narrative gets another year of runway.

- US Jobs Report: January nonfarm payrolls drop Friday morning. December was weak at 50,000 new jobs. Another soft print could accelerate rate-cut expectations and give tech valuations a lift.

- Cloudflare: Q4 earnings Monday after market close. Its network carries roughly 20% of global web traffic, making AI crawling and bot data a proxy for how fast AI companies are actually scaling.

The One Number

96% — Share of 401(k) plans that now offer a Roth option, up from a minority just a few years ago. The rush came because new tax rules took effect January 1: high earners over 50 must now put catch-up contributions into Roth accounts. No Roth option means no catch-up contributions at all. Employers scrambled. The deadline won.

🛠️ 5-Minute Skill: Turn a Research Paper Into an Executive Briefing

Your CEO just sent you a link to a 40-page research paper with the message "can you give me the headline on this by our 3 PM?" You read the abstract and your eyes glaze over. The paper has value, but it's buried under methodology sections, confidence intervals, and academic hedging. You need the core finding, the business implication, and the "so what" in one page.

Your raw input:

Paper: "Scaling Laws for Post-Training Optimization in Large Language Models"

Authors: Wei, Patel, Krishnamurthy et al. (Google DeepMind, 2026)

Pages: 38

Key bits I pulled out:

- post-training (RLHF, DPO) follows predictable scaling laws similar to pre-training

- they tested across 7 model sizes from 1B to 70B parameters

- the "alignment tax" (performance lost from RLHF) shrinks as models get larger

- at 70B+ parameters, alignment tax drops below 2% on most benchmarks

- implication: the trade-off between safety and capability is disappearing at scale

- they found diminishing returns on preference data after ~50K high-quality examples

- figure 4 shows the inflection point clearly

- the paper doesn't address multimodal models, only text

- competes with/extends Anthropic's earlier scaling laws work from 2023

The prompt:

You are a research analyst preparing a one-page executive briefing for a non-technical CEO. The CEO is smart, busy, and allergic to jargon.

From these notes on a research paper, produce:

BRIEFING: [Paper Title]

Source: [Authors, Institution, Year]

1. THE FINDING (2-3 sentences, plain English. What did they discover?)

2. WHY IT MATTERS FOR US (2-3 sentences. Connect the finding to business decisions. Be specific about what this changes.)

3. KEY DATA POINTS (3-4 bullets. The numbers that support the finding.)

4. LIMITATIONS (2 bullets. What the paper does NOT cover.)

5. RECOMMENDED ACTION (1-2 sentences. What should we do with this information?)

Notes on the paper:

[paste your notes here]

Rules:

- Zero jargon. If you must use a technical term, define it in parentheses on first use.

- The CEO should be able to read this in 90 seconds.

- Don't oversell. If the paper has caveats, include them.

- "Why it matters for us" should reference actual business decisions, not abstract trends.

What you get back:

BRIEFING: Scaling Laws for Post-Training Optimization in Large Language Models

Source: Wei, Patel, Krishnamurthy et al., Google DeepMind, 2026

THE FINDING

Making AI models safer and better-behaved used to cost you performance. This paper shows that cost is vanishing. Once models get large enough (70 billion parameters and up), the safety penalty drops below 2%, meaning companies no longer have to choose between a capable model and a well-behaved one.

WHY IT MATTERS FOR US

If we've been holding off on deploying AI in customer-facing roles because of safety trade-offs, that calculus just changed. The larger models we'd use in production are exactly the ones where safety alignment barely dents performance. This also means vendor claims about "safe AND capable" are becoming credible, not just marketing.

KEY DATA POINTS

- Tested across 7 model sizes (1B to 70B parameters). Results are consistent, not cherry-picked.

- Safety training performance penalty: <2% at 70B+ parameters, down from 8-12% at smaller scales

- Diminishing returns on training data after 50,000 high-quality examples, which means safety doesn't require unlimited data budgets

- Extends and validates earlier Anthropic research from 2023. Two independent labs reaching the same conclusion strengthens confidence.

LIMITATIONS

- Text-only. No findings on image, audio, or video models. Our multimodal use cases aren't covered.

- All testing done by Google DeepMind on their own models. Independent replication on other architectures pending.

RECOMMENDED ACTION

Revisit our risk assessment for the customer support AI pilot. The safety concerns that paused the project in Q4 may no longer apply at the model sizes we'd deploy. Request an updated vendor benchmark by end of month.

Why this works

The five-section structure answers every question an executive asks in sequence: What happened? Should I care? Prove it. What's the catch? What do I do? The "no jargon" rule forces the model to translate, not summarize. Academics write for peer reviewers. Executives need the translated version.

Where people get it wrong: Pasting the abstract and asking for "a summary." Abstracts are already summaries, just written for other researchers. Executives need a different summary built around business impact, not scientific contribution.

What to use

Claude (Claude Opus 4.5 via claude.ai): Best at maintaining appropriate caveats. Won't oversell the findings. Handles long input well. Watch out for: Briefings can run long. You may need to enforce the one-page constraint manually.

ChatGPT (GPT-4o): Strongest at producing tight, punchy executive language. Good compression. Watch out for: Tends to drop limitations or soften them. Check the "Limitations" section against the original.

Gemini (Gemini 2.5 Pro via Google AI Studio): If you upload the full PDF, it can work from the source instead of your notes. Saves the note-taking step. Watch out for: "Why it matters" section tends toward generic industry observations rather than company-specific actions.

Bottom line: Claude for faithfulness to what the paper actually says. ChatGPT for concision. Gemini if you want to skip taking notes and just upload the PDF.

AI & Tech News

State-Backed Hackers Breach Critical Infrastructure Across 37 Countries

A state-aligned Asian cyber-espionage group infiltrated 70 organizations across government agencies and critical infrastructure in more than 37 countries, according to Palo Alto Networks. The campaign is one of the most extensive state-sponsored intrusions reported this year.

Bitcoin Crashes Below $70,000 for First Time Since November 2024

Bitcoin plunged below $70,000, marking a 44% decline from its October 2025 peak as a broad risk-off wave swept global markets. The drop puts the cryptocurrency at its lowest point since Trump's election victory 15 months ago.

Software Stocks Bleed as AI Extinction Fears Grip Investors

Wall Street's fear that AI will trigger an extinction event for traditional software is largely overblown, the Wall Street Journal reports. The damage to valuations is real regardless, with a $285 billion rout hitting the sector this week.

Amazon Fined €59 Million in Germany, Ordered to Stop Policing Marketplace Prices

Germany's Federal Cartel Office ordered Amazon to cease price controls on third-party sellers and seized €59 million from the company. Amazon can appeal, but the ruling targets practices regulators called anticompetitive in Europe's largest economy.

SiTime Acquires Renesas Timing Unit in $2.9 Billion Semiconductor Deal

Analog chipmaker SiTime agreed to buy Renesas Electronics' timing division for $1.5 billion in cash and 4.13 million shares. The deal, expected to close by year-end, expands SiTime's position in semiconductor timing solutions.

Google, Amazon Lead Billions in India AI Data Center Investment

Google and other American tech companies are pledging tens of billions in data center investments in India as the country positions itself as a major AI services provider. India's large, tech-savvy population offers both consumer scale and a skilled AI workforce.

UK Partners With Microsoft to Build National Deepfake Detection System

Britain announced a partnership with Microsoft and academic institutions to develop a system for identifying AI-generated deepfake content online. The initiative creates a detection evaluation framework to combat growing synthetic media threats.

AI Accounting Startup Accrual Exits Stealth With $75 Million

Accrual, an AI accounting startup incubated by General Catalyst, emerged from stealth with $75 million in funding. The company is part of General Catalyst's $1.5 billion Creation fund, which builds startups internally.

Substack Data Breach Exposes Nearly 700,000 User Records

Substack notified users of a breach that occurred in October 2025, exposing email addresses and phone numbers from approximately 697,000 records. The company discovered the intrusion on February 3 after a threat actor leaked the stolen database publicly.

AI Law Firm Lawhive Raises $60 Million Series B, Hits $100 Million Total

London-based Lawhive closed a $60 million Series B, following a $40 million Series A in December 2024. The startup pairs human lawyers with AI tools to automate routine legal work for individuals and small businesses.

🧰 AI Toolbox

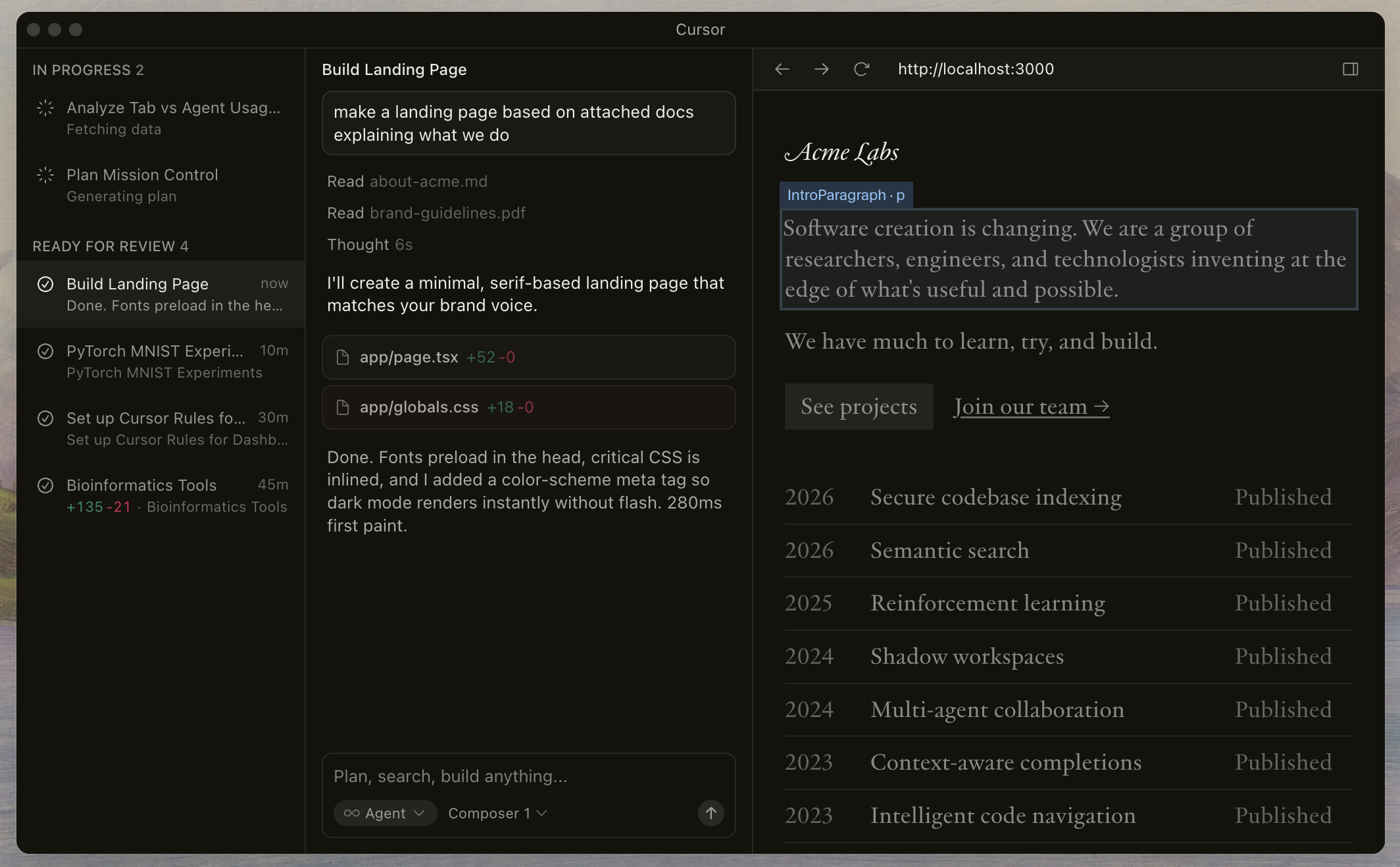

How to Design Software Interfaces Inside Your Code Editor with Cursor

Cursor's new Visual Editor brings design tools directly into the AI coding environment. Designers can create UI layouts that developers see as code, bridging the design-to-development gap.

Tutorial:

- Download Cursor from the Cursor website

- Open the Visual Editor panel alongside your code

- Design components visually by dragging and arranging elements

- Watch as Cursor generates corresponding React/HTML code in real-time

- Switch between visual and code views to refine details

- Use AI chat to request design changes ("Make the header sticky")

- Export designs or commit the generated code directly

URL: https://cursor.com

🚀 AI Profiles: The Companies Defining Tomorrow

Shield Technology Partners

Shield buys small IT companies and injects them with AI. The national platform, backed by Joshua Kushner's Thrive Holdings and OpenAI, acquires managed service providers and automates their operations from the inside out. 🛡️

Founders

Thrive Holdings and ZBS Partners formed Shield in mid-2025. Jim Siders runs the company as CEO. Anuj Mehndiratta from the Thrive Holdings founding team oversees strategy. The Thrive connection matters: OpenAI took an ownership stake in Thrive Holdings in December 2025, embedding research and engineering teams directly inside portfolio companies.

Product

Shield acquires stakes in small and mid-sized IT service businesses, then deploys AI agents to automate the tedious work: restarting computers, resetting passwords, triaging support tickets. The model turns fragmented local IT shops into a national platform with consistent AI-powered operations. Nine partner companies across the US now serve over 1,500 customers in construction, energy, and healthcare. Future plans extend AI into sales and marketing for the acquired firms.

Competition

Kaseya and ConnectWise dominate managed service provider tooling. Datto (now Kaseya-owned) provides backup and remote management. Private equity firms like Insight Partners roll up MSPs without the AI layer. Shield's differentiator: the OpenAI pipeline. Having AI researchers embedded in your parent company is an advantage incumbents cannot replicate easily.

Financing 💰

$100M from Thrive Holdings in February 2026. Shield hit over $100M in annual revenue within its first year. Thrive Holdings operates a $1B war chest funded in part by OpenAI's strategic investment. No external valuation disclosed.

Future ⭐⭐⭐⭐

Shield is a bet that AI transforms services businesses, not just software. The playbook: buy cheap, automate hard, scale fast. The risk is integration. Merging company cultures is difficult even without adding AI to the mix. But if the model works for IT, it works for accounting, legal, and every other service vertical drowning in tickets. 🔧

🔥 Yeah, But...

Anthropic will air its first Super Bowl ad on Sunday, a 30-second spot parodying intrusive advertising inside AI chatbots. The ad targets OpenAI, which recently announced it would bring ads to ChatGPT. Thirty seconds of Super Bowl airtime costs more than $8 million this year.

Source: Wall Street Journal, February 4, 2026

Our take: Anthropic is spending north of $8 million on a Super Bowl ad to tell you it doesn't believe in putting ads in AI conversations. The company chose the most expensive 30 seconds in advertising to argue against advertising. Their head of brand marketing said, "We thought there was something fun about that." He's not wrong. A startup valued at $60 billion positioning itself as the humble alternative to big tech does take a certain commitment to the bit. The spot mocks a fake product called "StepBoost Max" insoles for short kings. Claude Pro costs $20 a month. One promises an extra inch. The other promises moral high ground. Both are selling something on Super Bowl Sunday.