Insurers keep promising AI-powered efficiency; their staff still drown in PDFs and spreadsheets. Into that gap, San-Francisco-based FurtherAI just closed a $25 million Series A led by Andreessen Horowitz, six months after its seed, to build an insurance-native AI workspace that automates submissions, underwriting checks, claims intake, and compliance.

The Breakdown

• FurtherAI closed $25M Series A from Andreessen Horowitz six months after seed, hitting seven-figure revenue on insurance workflow automation

• Forward-deployed engineers pair with carrier ops teams to deliver measurable ROI: 15% better quote ratios, 95% accuracy, 10x faster proposals

• Competitive window is six to eight months according to founder, as point solutions and incumbents rush to add AI layers

• Integration tax is the real moat: each carrier's core stack requires adapters, data contracts, and compliance validation at scale

What’s actually new

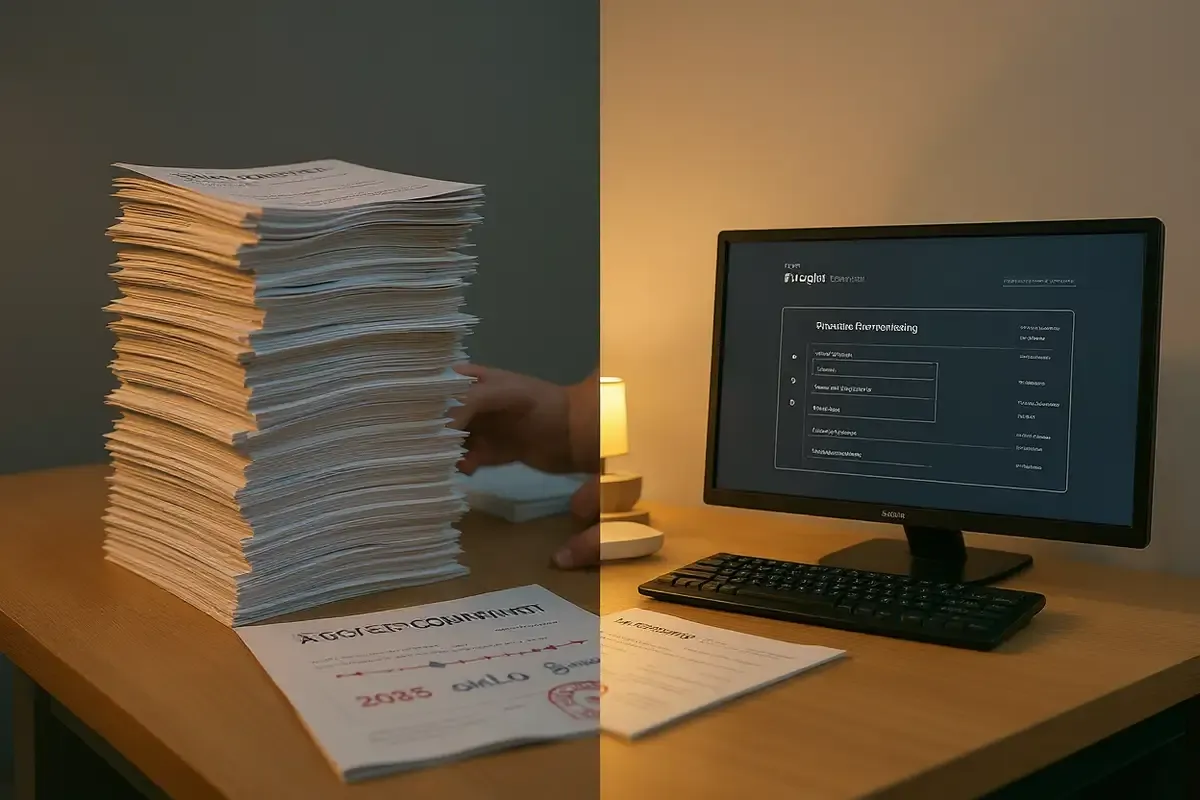

The round is big by insurtech-AI standards and unusually fast. FurtherAI’s pitch isn’t generic copilots. It’s prebuilt, auditable workflows tuned to the documents that run commercial P&C—ACORD forms, broker letters, property schedules, and loss histories—plus integrations into carrier and broker systems. Teams can start with one use case and expand later. That lowers adoption friction.

The go-to-market model also stands out. Instead of tossing a toolkit over the wall, FurtherAI pairs “forward-deployed” engineers with ops leads inside a carrier or brokerage. The goal is hard ROI on live workflows, not pilot purgatory. It’s a pragmatic stance for a regulated industry that measures value in loss ratios and cycle times.

The early evidence

Customers named publicly include Accelerant, MSI, and Leavitt Group. Reported outcomes are the kind executives can defend in a budget review: turnaround times cut from hours to minutes, 10x-faster proposal generation, policy comparisons above 95% measured accuracy, and improved submission-to-quote ratios by roughly 15%. Revenue is already in seven figures, according to founder interviews, and the platform processes “billions” in premiums annually via automated intake and normalization. Those are traction markers, not proofs of market dominance. Still, they beat slideware.

The funding use is clear: expand the library of insurance-specific workflows, deepen integrations with core systems, and scale implementation teams to keep cycle-time promises as demand rises. This is where many insurtechs stall. If FurtherAI sustains the on-site engineering model while broadening coverage, the Series A buys time to turn bespoke deployments into repeatable playbooks.

Why insurance, why now

Insurance is a $7 trillion-ish market by premium volume, with talent scarcity, climate-driven volatility, and rising regulatory transparency pushing carriers to modernize. The work is document-heavy and sequence-bound: clear a submission, normalize fields, reconcile schedules, run appetite triage, and assemble a quote. Miss a step and the unit economics wobble. AI is most credible when it tackles that assembly line with guardrails, not when it pretends to “replace underwriters.”

Generic chatbots fail here because nuance matters. Coverage forms differ by line and jurisdiction. Small field errors cascade into rework. The opportunity is in stitched-together, domain-aware flows with built-in audit trails. That is the bet FurtherAI—and a growing class of competitors—are making.

Competitive picture

Competition is active and bifurcating. On one side are focused AI vendors targeting specific links in the chain: fraud detection in claims, subrogation recovery, or underwriting triage. On the other are full-stack workflow players that promise cradle-to-quote coverage and deep system integrations. Incumbent platforms (think policy admin and broker management software) are adding their own AI layers and buying point solutions. M&A is accelerating. In short, carriers will be offered overlapping “AI automation” from startups and incumbents alike. Procurement will favor proof over promise.

FurtherAI’s differentiation claim is breadth of insurance-native workflows plus measurable accuracy and latency at production scale. That’s testable. If they keep shipping new workflows that plug into core systems without months of custom plumbing, they’ll hold an edge. If not, the market will treat them as yet another point solution wearing a platform hat.

The risks and the grind

Two realities could slow momentum. First, systems integration is the real moat—and the real tax. Each carrier’s core stack is a snowflake. Scaling from a dozen happy deployments to hundreds requires adapters, data contracts, and change management muscle. Second, regulators. Auditability, data lineage, and human-in-the-loop controls aren’t nice-to-haves. They’re table stakes for models that ingest sensitive policyholder data and generate decisions that touch pricing or denials. Accuracy claims will need independent validation and ongoing monitoring, not just demo-day stats.

Then there’s the model layer. Vendors must prevent hallucinations, enforce schema consistency, and keep latency predictable under load. Cost control matters too. If inference costs spike with volume, unit economics will fray exactly when adoption scales. The winners will pair domain expertise with ruthless engineering on throughput, caching, and deterministic extraction.

Bottom line

FurtherAI’s raise signals a shift from AI experiments to line-of-business rewiring in insurance. The story is less about clever prompts and more about cycle times, quote rates, and loss-ratio discipline. If the company can keep turning messy documents into reliable, auditable data across more workflows—without drowning customers in custom projects—it will have earned this step up the ladder. Execution, not exuberance, decides the rest.

Why this matters

- Insurance is moving from chatbot pilots to production AI that shortens cycles and improves submission quality—where dollars, not demos, prove value.

- A platform that ships auditable, domain-specific workflows could set the template for other regulated, document-heavy sectors.

❓ Frequently Asked Questions

Q: What does FurtherAI's "forward-deployed engineer" model actually mean?

A: FurtherAI embeds its engineers on-site with insurance carrier operations teams rather than selling self-service software. Engineers work directly with underwriters and claims staff to customize workflows, validate accuracy, and deliver measurable ROI on live data. It's closer to consulting than SaaS—expensive to scale but reduces adoption friction in regulated industries.

Q: How much did FurtherAI raise in its seed round?

A: FurtherAI raised $5 million in its seed round, led by Y Combinator and Nexus Venture Partners, with participation from insurance-focused funds Xceedance and BTV. The Series A came six months later, bringing total funding to $30 million. That velocity—seed to substantial Series A in half a year—is unusually fast for enterprise software.

Q: What are ACORD forms and why do they matter?

A: ACORD forms are standardized insurance documents used across the industry for applications, certificates, and policy changes. Created by the Association for Cooperative Operations Research and Development, they're ubiquitous in commercial insurance but still handled manually by most carriers. Automating ACORD parsing removes a major bottleneck in underwriting workflows.

Q: Who are FurtherAI's main competitors?

A: The competitive landscape splits between point solutions targeting specific tasks—fraud detection, subrogation, underwriting triage—and full-stack workflow platforms. Incumbent policy administration and broker management software providers are also adding AI layers or acquiring startups. Gour admits competition is intense: "It's an arms race right now in building AI for insurance."

Q: How long does typical insurance AI implementation take?

A: Traditional enterprise software pilots in insurance can drag 12-18 months before production deployment. FurtherAI's model aims to compress that by embedding engineers who work directly on live workflows. The company reports turnaround times cut from hours to minutes and 10x faster proposal generation, but scaling that across hundreds of carriers requires solving custom integration challenges for each snowflake tech stack.