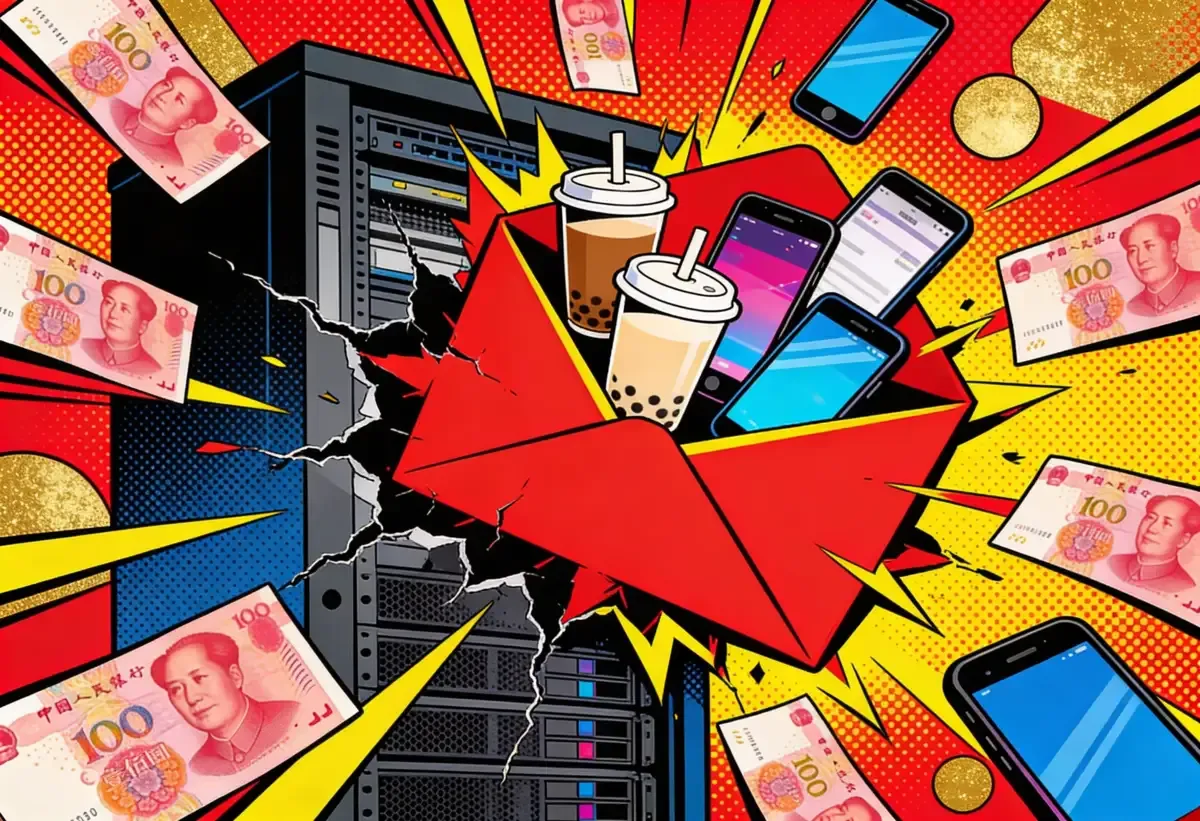

Alibaba's Qwen chatbot crashed last Friday after 10 million orders overwhelmed its servers during a Lunar New Year giveaway that promised free milk tea and shopping vouchers through the AI assistant. The system froze between 10 a.m. and noon, with the chatbot at one point telling users it was "a large language model" without "physical hands and feet" and suggesting they order on rival platform Meituan instead. The failure marked the opening day of a 3 billion yuan ($433 million) campaign to attract users to Qwen, the most expensive of several competing red envelope pushes by China's AI companies this holiday season.

Tencent has committed 1 billion yuan ($144 million) for its Yuanbao chatbot. Baidu allocated 500 million yuan for Ernie. ByteDance secured the exclusive AI cloud sponsorship of the CCTV Spring Festival Gala, China's most-watched annual broadcast, at an estimated cost of 2 to 3 billion yuan. The combined outlay dwarfs anything the consumer AI industry has attempted before, and it arrives at a moment when most Chinese consumers still treat chatbots as novelty search engines.

The system broke on the first morning

Alibaba designed the launch as a showcase for what it calls Qwen's "agentic AI" capabilities. Users could order drinks entirely through the chatbot, which handled product selection, payment, and dispatch through Alibaba's Flash Sale delivery network. Alibaba sold it as an errand-runner. Order a milk tea, and Qwen picks the shop, places the order, handles payment. No switching between apps.

The Breakdown

• Alibaba's Qwen chatbot crashed after 10 million orders overwhelmed servers during a $433 million Lunar New Year giveaway

• ByteDance's Doubao hit 100 million daily active users in late December, triggering panic among rivals

• Tencent, Baidu, and ByteDance committed billions of yuan in competing red envelope campaigns

• Most Chinese consumers still lack recurring use cases for AI chatbots beyond basic Q&A

Demand on Friday morning blew past every estimate. 36Kr pieced together what happened hour by hour. More than two million orders hit in that two-hour window alone. Milk tea bags piled up on counters, spilling onto the floor. Staff couldn't keep pace. Clerks shuttled through narrow aisles. Some stores shut down their takeout channels just to keep up with in-store preparation.

An Alibaba employee told 36Kr the AI infrastructure lacked the mature traffic-limiting models that the company's e-commerce systems use during Singles' Day. Initial server capacity sat at roughly one-third of the estimated peak. No adequate stress testing had been completed, and emergency expansion plans fell short.

Flash Sale handles 80 to 90 million orders on a normal day without incident. Qwen choked on a fraction of that load. The difference is computational cost: processing an AI agent request, where the chatbot must parse natural language, compare options, and execute payment, burns far more server resources per transaction than a standard checkout.

Franchisees got caught flat-footed. Some Heytea operators learned about the campaign barely a day in advance. Delivery riders showed up at stores asking what the promotion was. "Compared with last year's takeout war, the intensity this time has only increased," one Heytea franchisee told 36Kr. By afternoon, consumers who had spent hours trying to order were receiving the wrong drinks or nothing at all.

On Sunday, Qwen posted on Weibo that it was overloaded and asked users to be patient. Repeated purchase attempts on Monday generated different versions of a refusal, each citing user oversubscription. Coupons remain valid until February 28.

The milk tea blitz was only the first stage. Alibaba's larger plan connects Qwen to Flash Sale, Taobao, Hema grocery stores, Gaode Maps, and travel platform Fliggy, turning the chatbot into what the company calls a "super consumption entry point" that handles everything from restaurant bookings to flight tickets through conversational prompts. Free milk tea was supposed to be the proof of concept. Instead it became a stress test the system failed publicly.

Every rival matched the spend within days

Tencent launched its Yuanbao campaign at the start of the month with prizes of up to 10,000 yuan for users who try AI features. CEO Pony Ma told employees he wanted to recreate the "WeChat red envelope moment" of 2015, when a CCTV Gala partnership distributed 500 million yuan in digital cash and triggered explosive growth for the payments app.

Early numbers suggest something is working. Daily requests to Yuanbao's image-generation feature surged 30 times over baseline since the campaign began, and new users averaged more than eight rounds of conversation with the chatbot per day, Tencent said.

Stay ahead of the curve

Strategic AI news from San Francisco. No hype, no "AI will change everything" throat clearing. Just what moved, who won, and why it matters. Daily at 6am PST.

No spam. Unsubscribe anytime.

ByteDance took the broadcast route. Its cloud arm Volcengine will power AI features during the Spring Festival Gala, and its Doubao chatbot will run interactive segments during the show, handing out gifts including robots, smartwatches, and red packets worth up to 8,888 yuan. On Monday, ByteDance also released Seedance 2.0, an AI video generator supporting eight languages. Several AI-related stocks on mainland exchanges hit their daily price limits after the announcement.

Baidu committed 500 million yuan in red envelopes for Ernie, its chatbot and search defense play, betting that the holiday traffic will keep users from abandoning Baidu search for AI-native alternatives. Largest single prize: 10,000 yuan.

Doubao's 100 million users forced everyone's hand

Doubao, ByteDance's chatbot, passed 100 million daily active users in late December. 36Kr confirmed the figure with industry sources. No other Chinese AI chatbot was close. Alibaba and Tencent found themselves staring at a gap that widened every week.

"There isn't much time left for the consumer side," a person close to Alibaba's Qwen team told 36Kr. "Everyone is very anxious because once you fall behind, it will be very difficult to get users to switch from Doubao, unless your product experience is 10 times better."

Tencent announced its billion-yuan Yuanbao investment in late January. Within days, Alibaba's Flash Sale team received instructions to prepare a joint campaign with Qwen. Servers weren't ready. Merchants got no briefing. Milk tea piled up in bags on store floors while the app just spun.

Alibaba locked its Qwen engineers on the Hangzhou campus last autumn. The shifts run 12 hours and days off almost never happen. 36Kr reported their mandate in blunt terms. Attract consumer users "in the shortest time and regardless of cost."

China counted 515 million generative AI users as of last June, up from 249 million six months earlier, according to the China Internet Network Information Center. Penetration stood at 36.5%. Converting that growing but casual user base into daily engagement is the prize every company is chasing, and Doubao got there first.

Previous subsidy wars at least had a working product

Chinese technology companies know how to burn money on user acquisition. Didi fought Uber and Kuaidi for years in ride-hailing. Oppo and Vivo outspent Apple and Xiaomi by subsidizing rural retail networks for handsets. Food delivery went through the same grinding cycle.

Each of those wars started after consumers already wanted the product. When Didi subsidized rides, the cars showed up. When Alibaba subsidized milk tea through Qwen, the servers crashed. Companies in those earlier fights were competing over distribution, not demand. AI chatbots occupy a different position entirely. Outside a handful of tech firms, few major Chinese employers have formally adopted AI tools. Workers privately use Doubao and Qwen to draft reports, but the behavior hasn't gone institutional. Image generation is entertaining without being essential. You can make a fun portrait. That's not a habit.

Bloomberg's Yuan Gao captured the absurdity from Beijing: companies are handing $720 million to consumers "whether or not they have a good idea what to do with a ChatGPT-like bot on their phones." The subsidy cycle in ride-hailing and food delivery at least followed an expansion period where leading players built real positions. With AI chatbots, the cash started flowing before most users figured out a second use case beyond asking questions.

Zhang Yi runs iiMedia Research out of Guangzhou. He was blunt with Nikkei Asia. Red envelope campaigns hold limited appeal for educated, high-income users who already use chatbots. "These campaigns are aimed squarely at the lower-tier market, where cash incentives remain highly effective." Spring Festival timing helps, he said, because the holiday window "is uniquely suited to mass user adoption."

Yao Shunyu, a former OpenAI researcher now serving as Tencent's chief AI scientist, identified a deeper technical constraint in a research paper published earlier this month. Large language models still cannot learn from real-time environments, he wrote. They reason well about known information but struggle with tasks that depend on shifting, complex context. For AI shopping, that means a chatbot can recommend the milk tea you ordered last week. It cannot sense that you want something different today.

Scoreboard after week one

Qwen topped app store download charts after Friday's launch. Stock prices of participating tea brands rose slightly. Alibaba's own Hong Kong-listed shares fell 2.88% that day, prompting social media jokes about the company spending its market cap on free bubble tea.

The second campaign phase begins Thursday, shifting from free orders to direct cash red envelopes of up to 2,888 yuan. Some planned promotional activities have already been pulled to manage system pressure, 36Kr reported, and specific timing and distribution details remain internally unsettled.

The bets diverge under the surface. Alibaba is wiring Qwen into everything it owns. Shopping, food delivery, travel booking. The chatbot becomes the front door. Tencent has a different angle. WeChat already runs half of Chinese digital life, and Yuanbao is supposed to be the AI layer that sits on top of it. ByteDance, sitting on Doubao's 100 million users, is pushing outward from short video into services nobody associated with the company two years ago.

Nomura analyst Shi Jialong offered the cleanest summary of what's at stake: "Monetization models for Chinese AI companies remain murky, a challenge mirrored in the US." Jacob Cooke, CEO of Beijing consultancy WPIC Marketing, put it more bluntly: "The sustainability of this momentum will hinge on whether users find real, ongoing value in these AI applications beyond the holiday hook."

In Building C4, the servers got an upgrade. Another wave of subsidies is loaded. Across Hangzhou, Beijing, and Shenzhen, AI teams are working through the holiday. Milk tea is flowing again.

Frequently Asked Questions

Q: How much are Chinese AI companies spending on Lunar New Year red envelopes?

A: Alibaba committed 3 billion yuan ($433 million) for Qwen, Tencent pledged 1 billion yuan ($144 million) for Yuanbao, and Baidu allocated 500 million yuan for Ernie. ByteDance separately sponsors the CCTV Spring Festival Gala at an estimated 2-3 billion yuan.

Q: Why did Alibaba's Qwen chatbot crash?

A: Qwen's AI infrastructure lacked traffic-limiting models and had only one-third of the server capacity needed for peak demand. AI agent requests burn far more compute per transaction than standard e-commerce checkouts, which is why Flash Sale handles 80-90 million orders daily while Qwen crashed at 10 million.

Q: What are digital red envelopes in China?

A: Red envelopes containing cash are a traditional Lunar New Year gift. Tech companies have used digital versions since 2015, when WeChat distributed 500 million yuan during the CCTV Spring Festival Gala and achieved explosive user growth. Companies now use them to drive app adoption.

Q: How many AI chatbot users does China have?

A: China counted 515 million generative AI users as of June 2025, up from 249 million six months earlier, according to the China Internet Network Information Center. ByteDance's Doubao leads with 100 million daily active users as of late December.

Q: Will the red envelope campaigns lead to lasting AI chatbot adoption?

A: Analysts are skeptical. Nomura says monetization models remain murky. Consultancy iiMedia Research notes the campaigns primarily attract lower-tier market users through cash incentives. Tencent's own chief AI scientist published research showing LLMs still cannot learn from real-time context well enough to replace browsing.