San Francisco | February 10, 2026

Alphabet is selling a 100-year bond in sterling. A 28-year-old company borrowing on the same terms as Oxford and sovereign wealth funds. Cash on hand: $127 billion. Planned capex: $185 billion. The message to regulators, competitors, and anyone watching is structural. We will be here longer than you.

OpenAI slipped ads into free ChatGPT less than 24 hours after Anthropic spent millions mocking the idea to 120 million Super Bowl viewers. Altman's response: more Texans use ChatGPT for free than total Americans use Claude.

Steve Yegge calls Anthropic the best engineering culture in tech. His own Golden Age theory says 4,000 employees is where it ends.

Stay curious,

Marcus Schuler.

Alphabet Sells 100-Year Sterling Bond as AI Capex Hits $185 Billion

A 28-year-old company now borrows on the same terms as Oxford University and sovereign wealth funds. Alphabet's century bond is not a financial instrument. It is a declaration of permanence.

Alphabet raised $20 billion in dollar-denominated bonds Monday, drawing over $100 billion in orders. The 3-year tranche priced at 0.27 percentage points above Treasuries, tightened from an initial 0.6 points. That spread is nearly sovereign.

The planned sterling tranche is a 100-year bond. Only three institutions have issued century bonds in sterling before: Oxford University, the Wellcome Trust, and EDF. IBM tried a century dollar bond in 1996. No other tech company has attempted one since.

Eighteen months ago, Alphabet carried less than $11 billion in long-term debt. After this offering, it passes $60 billion. The company plans $175 to $185 billion in capex for 2026, nearly double last year's $91 billion. About 40% goes to physical data centers. The rest buys servers and AI chips.

Alphabet can afford it. Net income hit $132 billion in 2025. Google Cloud grew 48%. But the century bond signals something beyond capacity. It locks in 20-year leases, custom facilities, long-duration supply contracts. Sundar Pichai told analysts his primary concern is "compute capacity," not margins.

Morgan Stanley projects hyperscalers will borrow $400 billion this year, up from $165 billion in 2025. Meta raised $30 billion in October. Amazon took $15 billion in November. The four largest plan $650 billion in combined capex. Meanwhile, bond spreads for traditional software companies widened 14 basis points. The infrastructure these bonds fund may disrupt the companies those investors also hold.

Why This Matters:

- Alphabet borrows at sovereign rates to build infrastructure that takes decades to depreciate, creating barriers no startup or regulator can easily reverse

- Bond investors treating a 28-year-old company as permanent reveals how deeply markets have priced in AI as critical infrastructure

✅ Reality Check

What's confirmed: Alphabet raised $20B with $100B+ in orders Monday. Capex guidance is $175-185B for 2026. Long-term debt passed $60B from under $11B eighteen months ago.

What's implied (not proven): That sustained AI demand justifies decade-long infrastructure commitments and sovereign-style borrowing by a company younger than most mortgages.

What could go wrong: Alphabet's own SEC filings warn generative AI could reduce search usage and ad revenue, the cash engine funding the entire bet.

What to watch next: Google Cloud growth rate in Q1 and whether hyperscaler bond spreads widen as total issuance approaches $400B.

The One Number

5% — The share of ChatGPT's 800 million weekly users who pay for a subscription. OpenAI generates roughly $13 billion in annual revenue against a $9 billion burn rate. When 95% of your user base contributes nothing to the bottom line, ads are not a strategy. They are arithmetic.

Source: Implicator.ai

OpenAI Puts Ads in ChatGPT Hours After Anthropic Mocks the Idea at the Super Bowl

OpenAI began testing sponsored products in free-tier ChatGPT on Monday, less than 24 hours after Anthropic aired four parody spots mocking ad-supported AI to roughly 120 million Super Bowl viewers.

Anthropic's campaign showed human stand-ins for chatbots interrupting personal moments with product pitches. A therapist recommending a dating site. A trainer pushing height-boosting insoles. Tagline: "Ads are coming to AI. But not to Claude." The most-viewed spot had 390,000 views before kickoff. OpenAI's competing Codex ad managed 26,000.

OpenAI's ads appear at the bottom of responses, labeled as sponsored and matched to conversation content. Users under 18 and paying subscribers are excluded. Health, mental health, and political discussions are off-limits.

The math forces the decision. ChatGPT has 800 million weekly users, but only about 5% pay. Revenue runs around $13 billion annually against a $9 billion burn rate. Advertising fills the gap that subscriptions alone cannot.

Altman called Anthropic's campaign "so clearly dishonest." Both companies released frontier coding models the same week and plan IPOs as early as this year. OpenAI sits at a $500 billion valuation, Anthropic at $350 billion. The revenue model each locks in now determines the pitch to public markets.

Why This Matters:

- The ad-versus-subscription split is now the defining brand distinction between the two largest AI labs, shaping how each monetizes hundreds of millions of users

- Claude Code hit $1 billion in annualized revenue six months after launch, giving Anthropic a subscription-first path OpenAI's free-tier economics cannot replicate

AI Image of the Day

Prompt: trzy pączki, turquoise solid background --ar 3:4 --raw

Yegge's Golden Age Framework Validates Anthropic's Culture, Then Predicts Its Decline

Steve Yegge says Anthropic runs the best engineering culture in tech. The framework he uses to make that argument contains its own expiration date.

Yegge's Golden Age theory: companies innovate fiercely when meaningful work exceeds available headcount. When the ratio flips, politics and empire-building replace genuine output. He validated the model against Google (Golden Age 2004-2011, ended when Larry Page cut projects while retaining engineers), Amazon (sustained through two-pizza teams), and Microsoft (stack ranking under Ballmer crushed internal approval to 46%).

Anthropic hits every positive indicator. Glassdoor rating: 4.4 out of 5. Revenue per employee: roughly $4 million, an order of magnitude above SaaS benchmarks. An 8-to-1 engineer migration ratio over OpenAI. Flat titles, 2-to-4 person teams, 90-day planning horizons. Claude Cowork shipped publicly ten days after conception.

The problem is scale. Anthropic tripled its workforce during 2025 to between 3,000 and 4,000 employees. It plans to double Labs within six months and triple international staff. The company crossed 150 (where trust networks fracture), passed 500 (where hallway conversations stop), and blew through 1,500 (where bureaucracy becomes inevitable).

A January reorganization split Labs from Product. External hires fill the C-suite: CTO from Stripe, CFO who ran the Airbnb IPO, a new Chief Commercial Officer. Anonymous reviews cite "chaotic, conflicting priorities." One departing employee: the company "will never be the place like the one that I started at."

Yegge's framework does not offer exemptions for good intentions.

Why This Matters:

- At $183 billion valuation and 4,000 employees, Anthropic is crossing every organizational threshold that predicted decline at Google, Microsoft, and every other Golden Age company

- OpenAI's 67% two-year retention rate versus Anthropic's 80% shows the clock runs at different speeds, but it runs for both

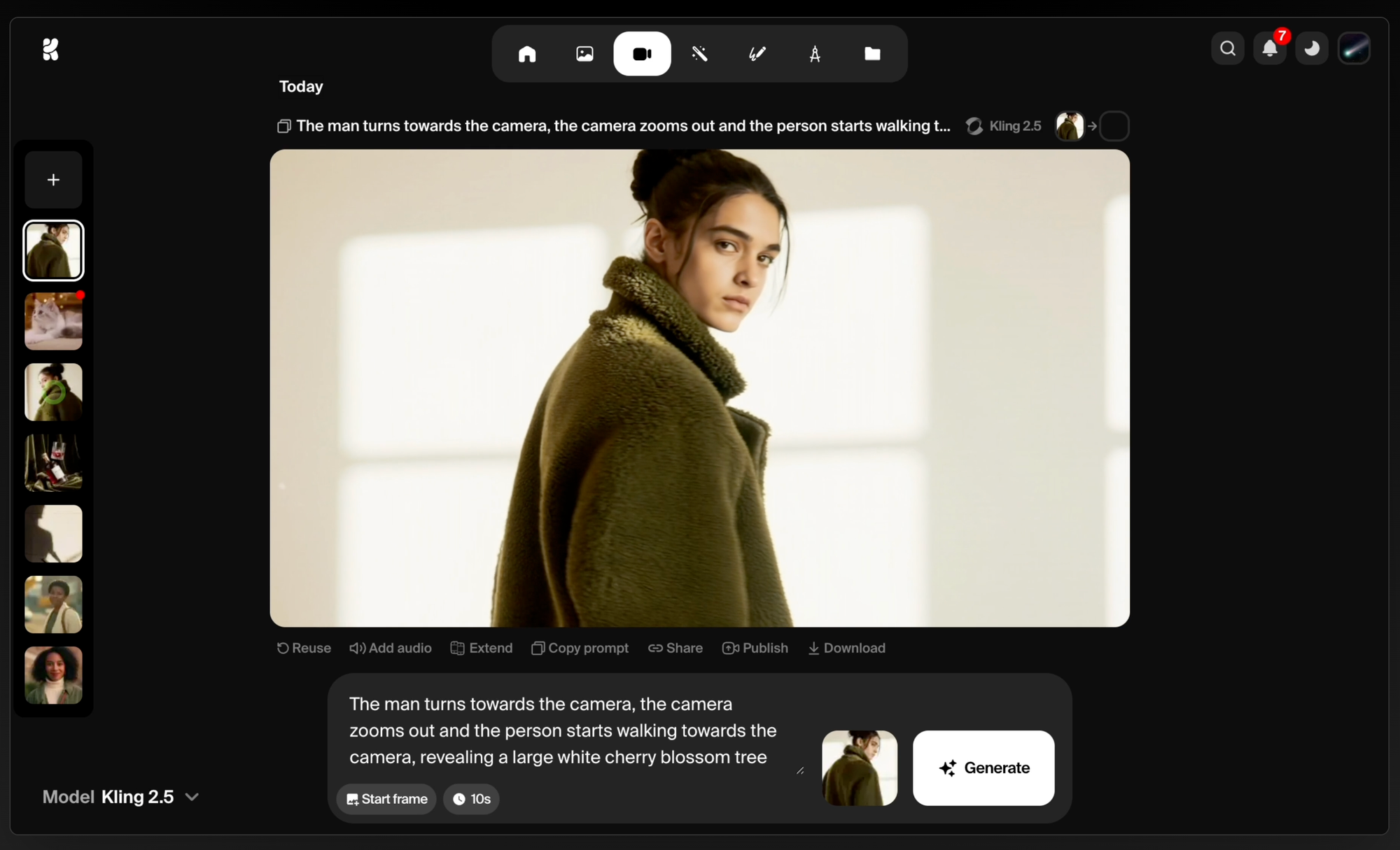

🧰 AI Toolbox

How to Generate and Refine Images in Real Time with Krea AI

Krea AI turns rough sketches and text prompts into polished images while you watch. Draw a shape, type a description, and the AI renders your vision in real time. No waiting for generation queues, no batch processing. Changes appear as you make them, powered by models including Flux, Google Imagen, and Nano Banana.

Tutorial:

- Visit krea.ai and create a free account (no credit card required)

- Open the Real-Time Canvas and start drawing a rough sketch of your concept

- Add a text prompt describing what you want ("minimalist product photo of a coffee mug on marble")

- Watch the AI render your image live as you adjust the sketch and prompt

- Use the Enhance tool to upscale the result to 4K or higher resolution

- Switch between Flux, Google Imagen, and Nano Banana models for different visual styles

- Download your final image or send it directly to Figma for design work

URL: https://www.krea.ai

What To Watch Next (24-72 hours)

- Cloudflare (NET): Reports after the close today. AI inference requests grew 340% last quarter. Watch whether edge compute workloads are displacing centralized hyperscaler demand.

- Shopify (SHOP): Reports tomorrow morning. AI commerce tools now embedded across the platform. Guidance reveals whether AI-driven conversion features move revenue or just demo well.

- AppLovin (APP): Reports tomorrow after close. The ad-tech AI play's growth rate shows whether AI-targeted advertising scales profitably, a question OpenAI just bet its free tier on.

🛠️ 5-Minute Skill: Extract What Matters From a 90-Minute Earnings Call

Earnings season means a dozen transcripts landing in your inbox every week, each one 8,000 words of prepared remarks, analyst Q&A, and legal hedging. You don't need all of it. You need the five things that changed, the one number management tried to bury, and a read on whether guidance went up or down.

Your raw input:

[Paste full earnings call transcript — for this example, ~8,000 words

from a cloud infrastructure company's Q4 call. Prepared remarks from

CEO and CFO, followed by 45 minutes of analyst Q&A.]

The prompt:

You are a senior equity analyst preparing a briefing for portfolio managers who have 2 minutes to read it. They don't want a summary. They want what changed.

From this earnings call transcript, produce:

1. VERDICT (1 sentence: beat/miss/in-line on revenue AND earnings, plus guidance direction)

2. THE 5 THINGS THAT CHANGED (numbered list, each item is one sentence stating what's different from last quarter or from consensus expectations — not background, not re-statements of known facts)

3. THE BURIED NUMBER (1 data point management mentioned once, quickly, or only when pressed by an analyst — something they didn't put in the headline)

4. GUIDANCE SHIFT (compare forward guidance to prior quarter's guidance AND to consensus: better, worse, or unchanged — with the specific numbers)

5. ANALYST MOOD (1 sentence: what were analysts pressing on? What question came up more than once?)

Transcript:

[paste transcript here]

Rules:

- Only include things that are NEW information from this call. Anything already public is noise.

- If management used vague language to avoid answering a direct question, note the question and what they said instead.

- Numbers must include units, time periods, and comparisons. "$4.2B" alone means nothing. "$4.2B revenue, up 28% YoY, vs. $4.1B consensus" means everything.

- No adjectives. No "impressive" or "strong" or "solid." Just the facts and the delta.

What you get back:

VERDICT

Beat on revenue ($591M vs. $590M consensus, +28% YoY) and earnings ($0.29 EPS vs. $0.27 consensus); full-year 2026 guidance raised by $40M at the midpoint.

THE 5 THINGS THAT CHANGEDWorkers AI inference requests grew 340% quarter over quarter, up from 85% growth last quarter, signaling production workloads are replacing experimentation.Net retention rate ticked up to 118% from 115%, the first sequential increase in five quarters.AI Gateway now processes 14 billion requests monthly, a metric the company disclosed for the first time.Free-to-paid conversion rate hit 7.2%, up from 6.1%, after the company added usage-based billing for AI features.Management said three hyperscaler partnerships are "in advanced commercial discussions," a new disclosure not mentioned in prior calls.

THE BURIED NUMBER

Operating cash flow margin dropped from 33% to 29% despite revenue growth. CFO mentioned it once during prepared remarks, attributed it to "timing of enterprise contract collections." No analyst followed up.

GUIDANCE SHIFT

Full-year 2026 revenue guidance raised to $2.56-2.58B (was $2.52-2.54B). Q1 guide: $608-612M vs. $601M consensus. Operating margin guide unchanged at 30-31%.

ANALYST MOOD

Three of eight analysts asked about AI cannibalization of existing CDN revenue. Management deflected each time with "we see AI as additive," without providing a breakdown.

Why this works

The prompt forces the model to filter for deltas, not summaries. Most people ask "summarize this earnings call" and get back a restatement of the press release. By specifying "only new information" and requiring comparisons (vs. last quarter, vs. consensus), you get a brief that tells you what moved.

Where people get it wrong: Asking for a "summary" or "key takeaways." That produces a book report. Analysts and PMs don't need to know what the company does. They need to know what changed in the last 90 days.

What to use

Claude (Opus 4.6): Handles long transcripts without losing detail from the Q&A section. Strong at identifying deflections and buried disclosures. Watch out for: may flag too many "buried numbers" if you don't specify you want exactly one.

Google Gemini (2.5 Pro): 1M-token context window means you can paste the full transcript plus the prior quarter's call for automatic comparison. Watch out for: tends to include background facts alongside new information unless your prompt explicitly prohibits it.

AI & Tech News

Trump Administration Plans to Exempt US Hyperscalers From Chip Tariffs

The White House will shield major US cloud companies from upcoming semiconductor tariffs, with exemptions tied to TSMC's commitment to expand manufacturing on American soil. The move uses tariff policy as leverage to pull chipmaking capacity onshore while protecting the AI buildout from cost spikes.

White House Drafts Voluntary Pact on Data Center Energy Costs

The Trump administration is preparing a voluntary agreement with tech companies to ensure data center expansion does not drive up electricity prices for consumers. The pact is expected to be unveiled at a White House event as officials work to secure commitments from firms facing growing scrutiny over AI's energy footprint.

NLRB Drops Case Against SpaceX Over Engineer Firings

The US labor board abandoned its case accusing SpaceX of illegally terminating eight engineers who circulated a letter critical of Elon Musk. The decision signals the NLRB will avoid future enforcement actions against the company, raising concerns about labor protections at firms tied to politically connected figures.

Oxide Computer Raises $200 Million for On-Premises Cloud Infrastructure

Oxide Computer, which builds hardware and software enabling enterprises to run their own cloud infrastructure, closed a $200 million round led by USIT. Total funding now sits at nearly $390 million as demand for on-prem alternatives to hyperscaler cloud grows.

Musk's Space Data Center Plan Deemed Feasible, Tied to $1.25 Trillion SpaceX-xAI Merger

Industry satellite executives and researchers consider Musk's goal of launching data centers into orbit by 2029 highly ambitious but feasible. The plan is a central component of the proposed $1.25 trillion merger between SpaceX and xAI, converging launch capacity with AI compute demand.

xAI Co-Founder Tony Wu Resigns From Musk's AI Company

Tony Wu, who led xAI's reasoning division and reported directly to Musk, has resigned from the company. His departure follows co-founder Igor Babuschkin's exit last August, making it the second high-profile co-founder to leave in six months.

Russia Moves to Restrict Telegram Access Starting Tuesday

Russia's communications regulator Roskomnadzor will begin limiting access to Telegram as the government pushes its domestically developed Max super app as a replacement. The move signals a broader tightening of control over foreign-linked communication platforms.

Fidelity-Backed Eight Roads Shelves Sale of 40 Chinese Tech Stakes

Eight Roads, the VC firm backed by the Johnson family behind Fidelity, halted plans to divest holdings in roughly 40 Chinese tech companies as US-China tensions show signs of easing. The reversal suggests institutional investors are recalibrating their China exposure rather than continuing the exit.

New Mexico Takes Meta to Trial Over Child Safety Failures

Opening statements began in New Mexico's lawsuit accusing Meta of misrepresenting platform safety for children and concealing known harms. The trial could set precedent for how social media companies are held accountable under consumer protection law.

Onsemi Posts 11% Revenue Decline as Power and Analog Units Struggle

Onsemi reported Q4 revenue of $1.53 billion, down 11% year over year and slightly below estimates. Shares fell more than 4% in after-hours trading as persistent weakness in the chipmaker's two largest business units showed no signs of recovery.

🚀 AI Profiles: The Companies Defining Tomorrow

Micro1

Micro1 finds, screens, and deploys human experts who train the AI models everyone else is racing to build. Revenue hit $200 million, up 50x in fourteen months. Founder Ali Ansari is 25. 🧠

Founders

Ali Ansari immigrated from Iran at ten, started reselling garage sale finds on eBay at twelve, and ran a six-figure textbook arbitrage business before he could drive. He built a software agency at UC Berkeley, discovered that hiring engineers took longer than the engineering, and turned the recruiting tool into Micro1 in 2022. He graduated the same year with a math and CS degree.

Product

Zara, an AI recruiting agent, screens candidates across 100 specialties and 60 languages. Over 130,000 people have sat through its coding challenges, domain quizzes, and behavioral tests. Those who pass enter a talent pool deployed to AI labs and Fortune 100 clients for reinforcement learning from human feedback. Microsoft is a confirmed customer. Most others hide behind NDAs. The company recently expanded into robotics training data, equipping 1,000 workers across 60 countries with Ray-Ban smart glasses to capture household tasks.

Competition

Mercor ($10 billion valuation, $450 million ARR) is the largest. Surge AI generated $1.4 billion in revenue bootstrapped with 121 employees. Scale AI dominated until Meta acquired 49% for $14.3 billion, sending Google and OpenAI scrambling for new suppliers. That scramble doubled Micro1's revenue in three months.

Financing 💰

$41.6 million across four rounds. 01 Advisors (Dick Costolo and Adam Bain, former Twitter CEO and COO) led the $35 million Series A at a $500 million valuation in September 2025. Forbes reports ongoing conversations value the company at $2.5 billion.

Future ⭐⭐⭐⭐

Growth is undeniable, and the Meta-Scale AI disruption handed Micro1 a once-in-a-decade opening. The existential question is synthetic data: if models learn to train themselves cheaply, the human feedback market contracts before Ansari's projected $1 trillion opportunity materializes. For now, model collapse keeps humans in the loop. That may not last forever. 🔬

🔥 Yeah, But...

Anthropic spent millions on four Super Bowl parody spots mocking AI companies that show ads. The tagline: "Ads are coming to AI. But not to Claude." OpenAI started testing ads in ChatGPT the next morning.

Sources: Implicator.ai, February 9, 2026

Our take: Choosing the one medium where you pay per second of attention to argue that paying for attention inside AI is dangerous is a decision that deserves its own Harvard Business School case. OpenAI's rebuttal was almost rude in its simplicity: a "sponsored" label at the bottom of a free chatbot, and Altman noting that more Texans use ChatGPT for free than total Americans use Claude. The anti-advertising movement has never had a bigger ad budget. CBS thanks them for the check.