Nvidia's $100 Billion OpenAI Deal Is Dead. The Relationship Isn't.

Nvidia's $100 billion OpenAI infrastructure deal never progressed past preliminary talks. Jensen Huang says he'll still invest, but the terms have changed.

San Francisco | December 17

Amazon is negotiating a $10 billion stake in OpenAI that would push the valuation past $500 billion. The catch: OpenAI must adopt Trainium chips and rent additional AWS capacity. The money flows in, then flows right back out. Add that to the $38 billion OpenAI already committed to AWS for Nvidia servers. Amazon also holds $8 billion in Anthropic. The house always wins.

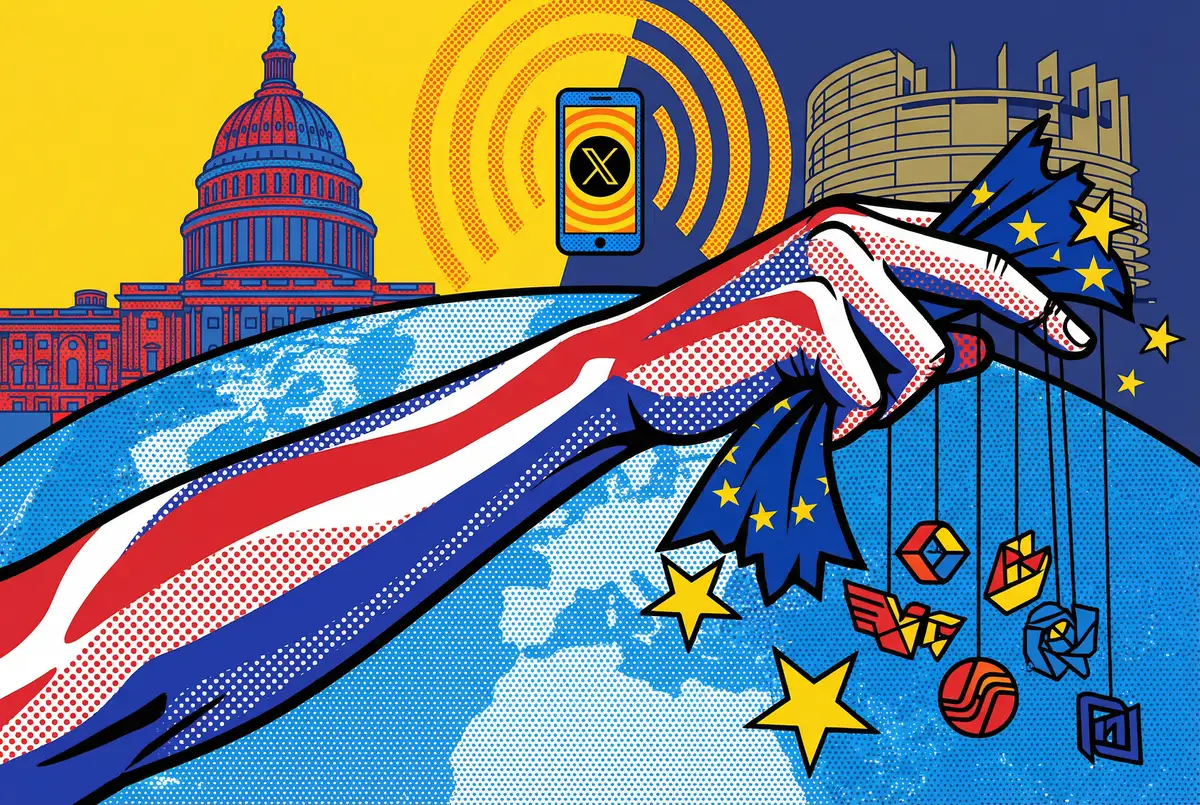

Across the Atlantic, a different game. The Trump administration named nine European companies, from Mistral to Siemens, as potential retaliation targets. Their crime? None. The trigger was a €120 million fine against Musk's X. The message: enforce your laws, lose access to ours.

This is the last issue before Christmas. The Implicator returns January 5th, 2026 with the stories that actually mattered and what to watch for the year ahead.

Stay curious,

Marcus Schuler

Amazon is negotiating a $10 billion investment in OpenAI that would push the company's valuation above $500 billion.

The catch: OpenAI must adopt Amazon's Trainium chips and rent additional AWS capacity, routing invested capital back to the investor. This arrangement layers onto the $38 billion OpenAI already committed to AWS in November 2024 for Nvidia-based servers.

Amazon is hedging across the AI landscape. The company holds $8 billion in Anthropic while pursuing this OpenAI stake, positioning to collect infrastructure fees regardless of which model builder wins. Microsoft retains exclusive rights to sell OpenAI's advanced models until the early 2030s, meaning Amazon gets chip adoption and cloud revenue but not model distribution.

OpenAI has locked in $1.4 trillion in infrastructure commitments against roughly $3 billion in 2024 revenue. The first AWS payment comes due Q2 2025.

Why This Matters:

Prompt:

a miniature bedroom with a bed, night lamp, and a sleeping person inside the "home" key on an old beige computer keyboard. the word "home" is written in bold letters above it. there's also a desk next to that, and there should be no other keys visible except for the ones featuring the letters p, g, or h. this scene captures the simplicity of home life within the minimalistic space created by a single white space bar.

The Trump administration crossed a line on Tuesday that trade experts will be parsing for years.

USTR Jamieson Greer posted a threat on X naming nine European companies, from tiny AI startup Mistral to industrial giant Siemens, as potential targets for fees or restrictions. The condition for their safety: Europe must stop enforcing its own laws against American tech firms. This isn't tariff negotiation. It's sovereignty extraction.

The trigger was a €120 million fine against Musk's X for DSA violations. The response targeted companies with zero connection to the dispute.

Days earlier, Washington froze Britain's £31 billion Tech Prosperity Deal over digital taxes and food standards never mentioned in the original agreement.

Macron's same-day Financial Times op-ed defending "EU regulatory sovereignty" suggests Brussels won't fold. Bloomberg reports a Section 301 investigation is being prepared, which would authorize formal trade remedies within 18 months.

Why This Matters:

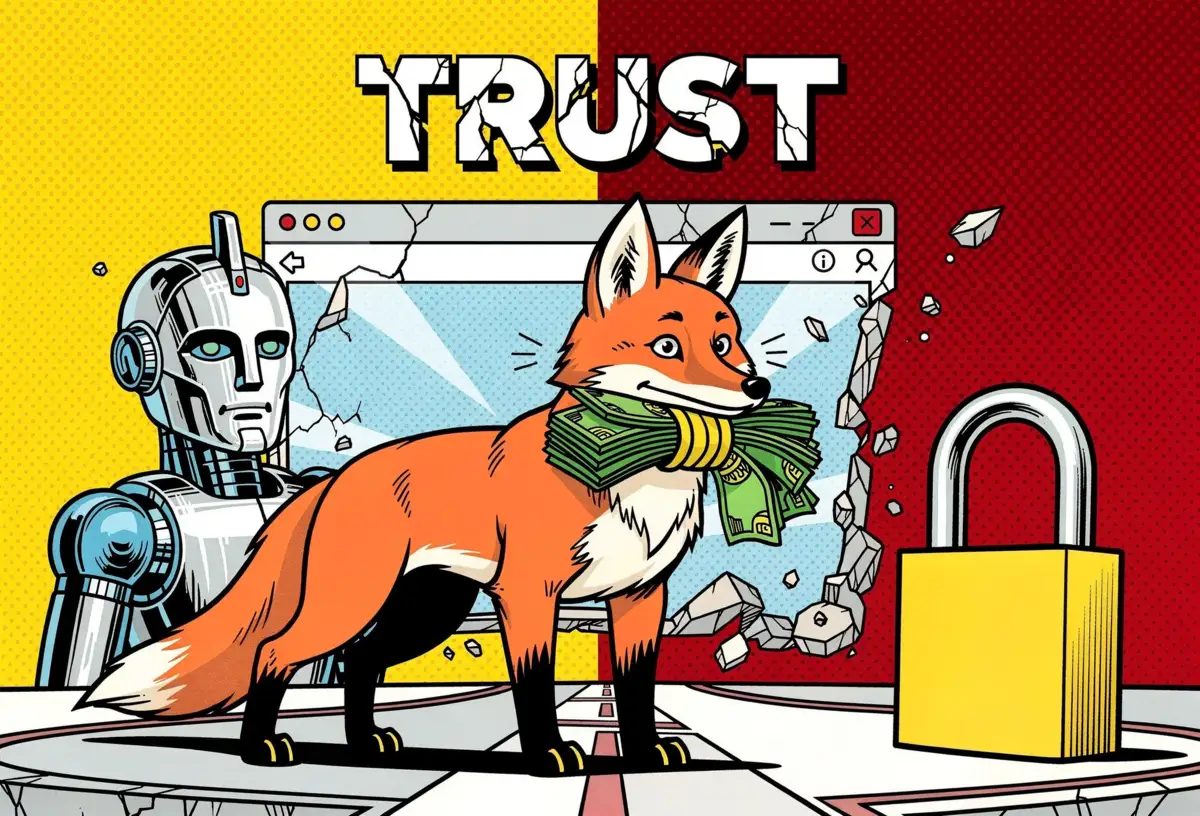

Anthony Enzor-DeMeo took over Mozilla Tuesday with a contradiction embedded in his opening statement. Users can "easily turn off" AI features, he wrote, then five sentences later committed Firefox to becoming a "modern AI browser."

The tension reflects a decade of strategic drift at an organization that once commanded 30% browser market share and now holds 2.3% according to November Statcounter data.

Mozilla's finances sharpen the stakes: $653 million in 2023 revenue, 85% flowing from Google's search licensing deal, $1.3 billion in reserves covering roughly 34 months of operations if that payment stops. The Google contract likely comes up for renewal in 2025, with ongoing antitrust litigation determining Mozilla's negotiating leverage.

Enzor-DeMeo brings consumer growth experience from Roofstock, Better.com, and Wayfair. His stated priorities, mobile growth, revenue diversification, market stabilization, incentivize shipping features over exercising restraint.

Firefox's remaining users chose the browser specifically because it wasn't Chrome. Making it more Chrome-like accelerates their departure.

Why This Matters:

• Google's next contract renewal determines whether Mozilla can sustain Firefox development past 2028

• Users who actively rejected Chrome may abandon Firefox if AI features become central, not optional

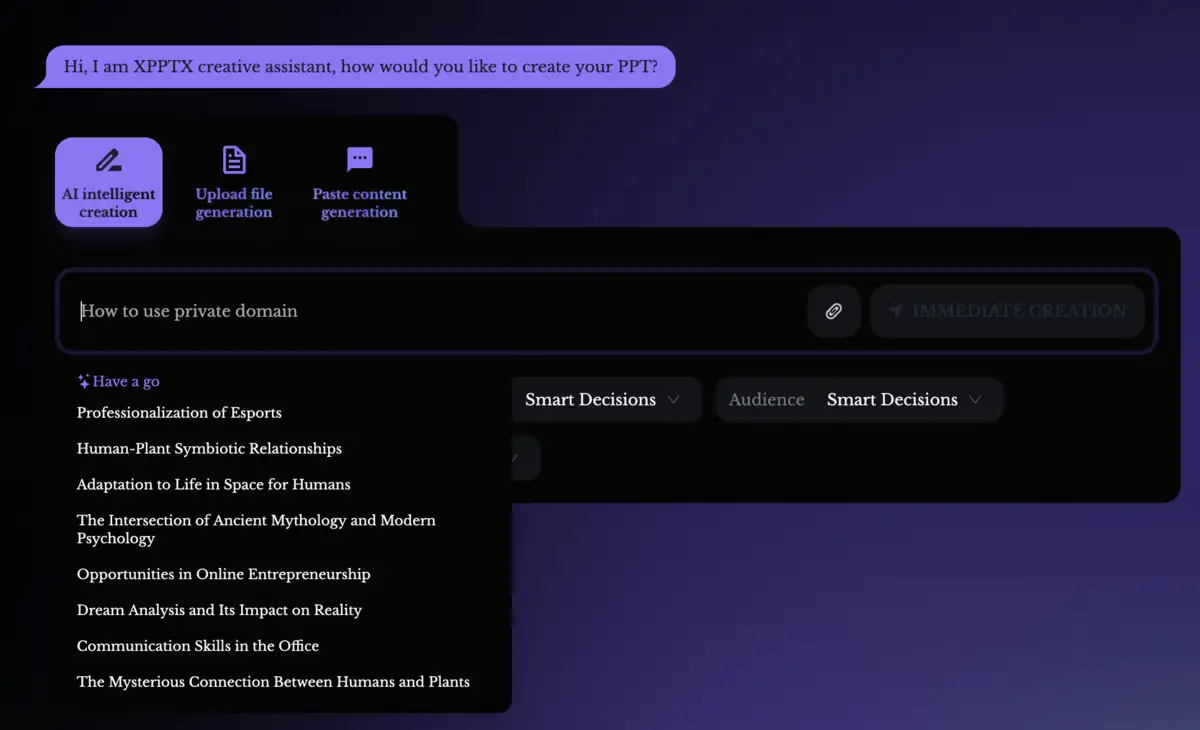

Xpptx is an AI-driven presentation tool that transforms text descriptions or uploaded documents into polished PowerPoint slides instantly. Import PDFs, Word files, mind maps, or website links, and the AI generates structured outlines with professional layouts and copywriting. Choose from templates designed for business, finance, education, and more.

Tutorial:

URL: https://xpptx.com/en

Hut 8 has announced a landmark $7 billion, 15-year lease agreement to build an AI data center in Louisiana in partnership with Fluidstack, with the facility set to serve artificial intelligence company Anthropic. The data center will initially provide 245 megawatts of computing capacity, marking a significant expansion in AI infrastructure and a strategic shift for the former cryptocurrency mining company into the rapidly growing AI sector.

Prediction markets have experienced explosive growth, with monthly betting volumes skyrocketing from under $100 million in early 2024 to $13 billion by November, according to data from Dune and Keyrock reported by the Financial Times. The 130-fold expansion over approximately two years has been driven by intense competition between leading platforms Polymarket and Kalshi, signaling a dramatic mainstream shift in how people wager on future events.

AI chip startup Mythic Inc. has raised $125 million in a funding round led by venture capital firm DCVC, positioning the company to compete against industry giant Nvidia with its innovative "analog processing units" that perform AI computations directly within memory. The company, led by a former Nvidia executive, is developing technology that represents an alternative approach to traditional AI chip architecture as demand for artificial intelligence hardware continues to surge.

Blue Owl Capital has decided not to invest in Oracle's planned $10 billion, 1-gigawatt data center in Michigan after funding negotiations broke down. The investment firm reportedly grew concerned about tougher debt terms and potential delays affecting the massive infrastructure project, which would have been Oracle's largest data center.

Tencent Holdings has promoted Yao Shunyu, a former OpenAI researcher who joined the company in September, to the position of chief AI scientist, according to an internal announcement reported by The Information. Yao will report directly to Tencent President Martin Lau, signaling the Chinese tech giant's commitment to strengthening its artificial intelligence capabilities amid intensifying global competition in the AI sector.

Warner Bros. Discovery has formally recommended that its shareholders reject Paramount's unsolicited cash bid, characterizing the hostile offer as "illusory" and questioning its credibility, particularly regarding backing from the Ellison family. The media company maintains that a competing proposal from Netflix remains the superior option for shareholders, signaling its intent to pursue that deal instead of Paramount's approach.

Berlin-based fintech company Trade Republic has announced a €1.2 billion secondary share sale that values the company at €12.5 billion, making it Germany's most valuable startup. Early investors are selling their stakes to new backers including Sequoia and Singapore's sovereign wealth fund, marking a significant milestone for the European fintech sector.

London-based digital bank Monzo has obtained an Irish banking license, enabling the fintech lender to offer current and savings accounts to customers across the European Union. The move marks a significant expansion strategy for the UK challenger bank as it seeks to grow its presence in European markets following Britain's departure from the EU.

The Marshall Islands has announced a national Universal Basic Income scheme that will provide approximately $200 in quarterly payments to every resident citizen, with recipients able to choose between receiving funds via stablecoin cryptocurrency or traditional currency. The program, described as a world first for its cryptocurrency option, is designed to help ease cost of living pressures facing residents of the Pacific island nation.

ChatGPT has reached 73 million daily active users in India as of last week, marking a 607% year-over-year surge that now makes its Indian user base more than double that of the United States, according to data from Sensor Tower. OpenAI's aggressive free-tier strategy has proven remarkably effective against competitors, with Google's Gemini trailing significantly at just 17 million daily active users as tech giants battle for dominance in one of the world's largest digital markets.

Ankar, a startup founded by Palantir alumni that develops artificial intelligence tools powered by large language models to streamline patent application drafting for attorneys, has raised $20 million in Series A funding led by European venture capital firm Atomico. The company aims to simplify and accelerate the traditionally complex and time-consuming process of obtaining patents by leveraging AI technology to assist patent attorneys in preparing applications.

Ankar wants to make patents move at the speed of R&D. The London startup sells AI software that turns inventions into filed, defended, and monitored intellectual property. 🛡️

Founders Tamar Gomez and Wiem Gharbi met at Palantir, where they discovered a bottleneck: patents. Incorporated October 2023, launched 2024. Around 20 employees, planning to double. The name comes from an omniscient knight in pre-Islamic poetry. Modest branding goals.

Product Ankar pitches itself as an "operating system" for patents, not a writing bot bolted onto Word. The platform searches 150M+ patent applications and 250M scientific publications using semantic matching. It handles invention discovery, novelty testing, drafting, prosecution responses, and infringement detection. Customers include L'Oréal and Vorys. The company claims 40% productivity gains and 96% recommendation rates. Key strength: keeping humans in control while compressing weeks into hours.

Competition Crowded space. DeepIP raised $15M, Solve Intelligence grabbed $40M, Patlytics pulled $14M. All AI-native challengers. Then there's the incumbent army: Clarivate, Questel, LexisNexis, PatSnap. They have procurement familiarity and institutional inertia. Ankar differentiates on lifecycle breadth. One platform, no fragmentation.

Financing Index Ventures led a £3M seed in May 2025. Atomico led a $20M Series A in December 2025. Total raised: $24M. Other backers include Daphni, Norrsken VC, and Motier Ventures. No valuation disclosed. Discipline or discretion. Either works.

Future ⭐⭐⭐⭐ Ankar picked a rare corner where "moving fast" and "being careful" describe the same job. Patent offices love their forms. Engineers hate filling them out. If Ankar makes both sides feel like winners, it wins. The risk? Best ideas get absorbed into legacy platforms as features. Category-defining or quietly commoditized. The next 18 months will tell.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.