Anthropic announced Thursday it has raised thirty billion dollars in Series G funding at a $380 billion post-money valuation, more than doubling what the company was worth five months ago and closing the second-largest private technology fundraise in history. Only OpenAI's $40 billion-plus round led by SoftBank last year was bigger. Before that, the record belonged to Ant Group's $14 billion raise in 2018, a figure that now looks quaint by comparison.

GIC, Singapore's sovereign wealth fund, led the deal alongside Coatue Management. Peter Thiel's Founders Fund co-led. So did D.E. Shaw Ventures, Dragoneer, ICONIQ, and Abu Dhabi-backed MGX. From there the cap table gets absurd: Sequoia, Lightspeed, Blackstone, BlackRock, Fidelity, Goldman Sachs, Jane Street, JPMorgan, Morgan Stanley, Temasek, Qatar's sovereign wealth fund. You run out of marquee names before Anthropic runs out of investors.

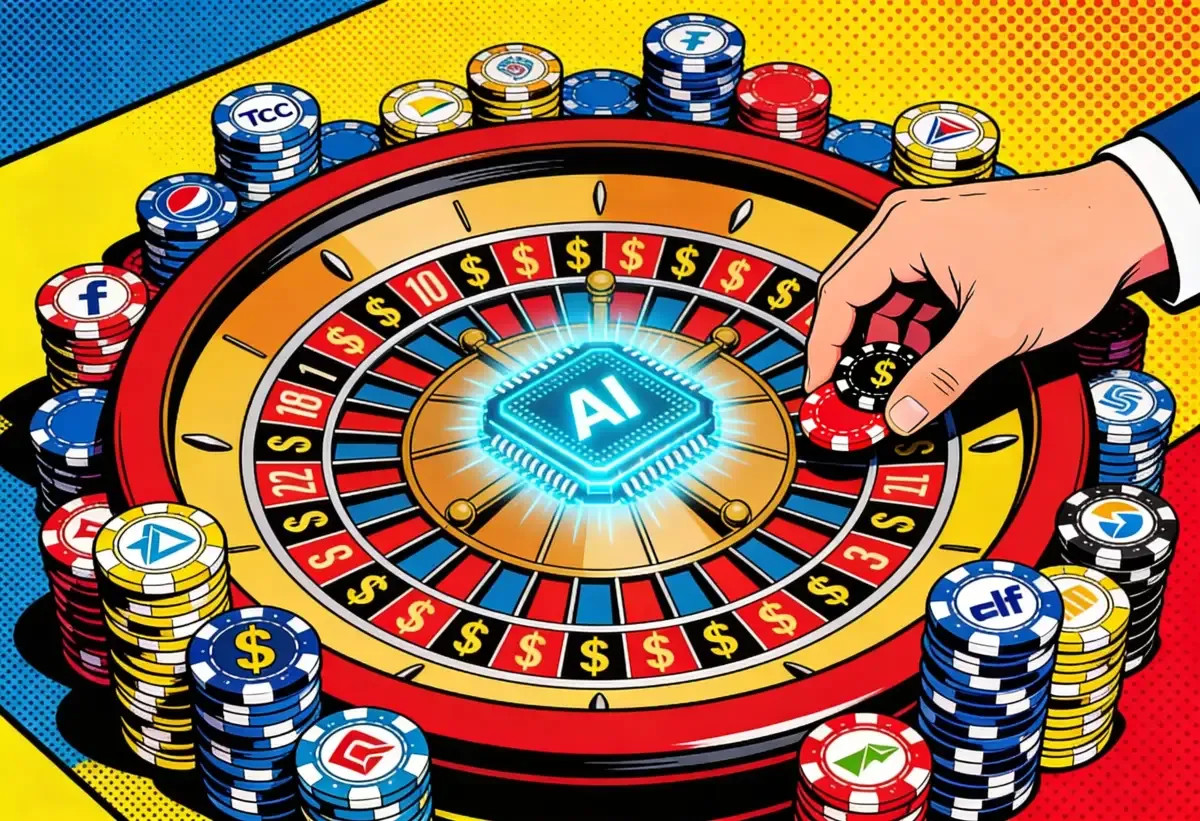

The round also includes "a portion" of the up-to $15 billion that Microsoft and Nvidia committed to Anthropic in November. Both companies are putting money into OpenAI at the same time. Microsoft is one of OpenAI's largest backers, and Nvidia is expected to commit $20 billion to OpenAI's upcoming round, Bloomberg reported.

If you're keeping score, Microsoft and Nvidia are now the house in an AI wager, bankrolling both sides of the table while selling chips and cloud services to each player.

The revenue engine

Less than three years have passed since Anthropic earned its first dollar. The company said Thursday its annualized revenue run rate has hit $14 billion, a figure that has grown more than tenfold in each of the last three years. Last year's full-year revenue was roughly $10 billion, CEO Dario Amodei told CNBC last month.

The Breakdown

• Anthropic raised $30 billion in Series G at a $380 billion valuation, the second-largest private tech fundraise in history.

• Annualized revenue hit $14 billion. Claude Code alone crossed $2.5 billion and now writes 4% of public GitHub commits.

• Software stocks have lost roughly $2 trillion from peak market cap as AI automation reprices the sector.

• Major VCs including Sequoia and Blackstone now back both Anthropic and OpenAI, abandoning competitive exclusivity norms.

Claude Code, the AI coding agent Anthropic opened to the public in May 2025, is the product driving most of that growth. Its annualized revenue has crossed $2.5 billion and more than doubled since the start of this year. Business subscriptions to the tool quadrupled over the same stretch. Enterprise customers now account for more than half of Claude Code revenue.

How fast is Claude Code spreading? A SemiAnalysis estimate published this month pegged the tool's share of all public GitHub commits at 4 percent, double what it was a month earlier. One in every 25 pieces of code pushed to the world's largest repository was not reviewed by the tool, or suggested by it. Written by it.

Eight of the Fortune 10 are now Claude customers. More than 500 companies spend over $1 million a year on the platform, up from about a dozen two years ago. Customers spending over $100,000 annually have grown sevenfold in the past year. Eighty percent of revenue comes from enterprise buyers, Amodei said.

"Whether it is entrepreneurs, startups, or the world's largest enterprises, the message from our customers is the same: Claude is increasingly becoming more critical to how businesses work," CFO Krishna Rao said Thursday.

OpenAI is scrambling to keep pace. The company launched GPT-5.3-Codex last week alongside a standalone desktop app, pushing its own coding agent into direct competition with Claude Code. But Anthropic got there first, and the enterprise adoption numbers reflect that lead.

The $2 trillion wreckage

Anthropic's growth has a cost, and the software sector is paying it.

Software stocks have lost roughly $2 trillion in market capitalization from their peak. Investors are repricing an entire industry around the likelihood that AI coding agents and automation tools will eat into traditional software revenue. Anthropic's products keep giving them reasons to sell.

Earlier this month, the company released a Claude Cowork plugin for legal work. Legal software stocks cratered the same day, Bloomberg reported. When Anthropic unveiled Opus 4.6, its latest model built for financial research, shares in financial services firms dropped too.

Stay ahead of the curve

Strategic AI news from San Francisco. No hype, no "AI will change everything" throat clearing. Just what moved, who won, and why it matters. Daily at 6am PST.

No spam. Unsubscribe anytime.

In January alone, Anthropic shipped more than 30 products and features, including Cowork itself, which extends Claude Code's capabilities to sales, legal, and finance teams through 11 open-source plugins. Claude for Enterprise is now available to organizations operating under HIPAA, pushing into healthcare. The product roadmap looks less like incremental improvement and more like a company working its way through an org chart, automating one department at a time.

Microsoft AI chief Mustafa Suleyman said last month that most tasks performed by white-collar workers "will be fully automated by an AI within the next 12 to 18 months." Anthropic's product cadence suggests it agrees with the timeline but has no interest in waiting for permission.

"Since our initial investment in 2025, Anthropic's focus on agentic coding and enterprise-grade AI systems has accelerated its progress toward large-scale adoption," Coatue founder Philippe Laffont said. The word "adoption" does a lot of lifting in that sentence. What he's describing is replacement.

Barron's summed it up in five words. "It's software vs. AI. And software is losing."

The death of VC monogamy

Venture capitalists used to follow a simple code. You picked one company in a category, backed it, and stayed away from the competition. The AI fundraising boom killed that norm.

Sequoia Capital, which has been investing in OpenAI since 2021, is now putting money into Anthropic. Altimeter Capital called OpenAI its "biggest bet ever," then committed more than $200 million to this round, Bloomberg reported. MGX, an Abu Dhabi fund that partnered with OpenAI on the Stargate data center project, is also writing a check to Anthropic. That gives MGX positions in three of the four largest model makers, including xAI.

Blackstone increased its Anthropic stake to about $1 billion this week. It holds OpenAI stock too. JPMorgan's growth equity arm sits on both cap tables. Andreessen Horowitz has bets on both xAI and OpenAI.

"When you talk about OpenAI and Anthropic, these are generational companies, the likes of which we may not see again in our lifetimes," said Ethan Choi, a partner at OpenAI-backer Khosla Ventures. "In the face of that, some VC firms have lowered the bar for conflicts."

Not everyone is comfortable with that logic. Josh Kushner, founder of OpenAI investor Thrive Capital, responded to a chart showing overlapping investments by posting on X, "Call us old school. But we are serial monogamists."

The discomfort makes sense. Overlapping investors create information leakage risk between competing firms. OpenAI limits financial data access to backers above a certain investment threshold, according to people familiar with the matter. Some startups have started discussing non-disclosure agreements as a safeguard. Founders get nervous when the firm sitting across the table from them also sits across the table from their rival.

But the capital demands of frontier AI have grown so enormous that neither company may have the luxury of rejecting dual-backer checks. OpenAI is trying to raise $100 billion for its next round. The pool of investors capable of writing nine-figure checks is not infinite.

The money loop

Buried in the investor list is a structural tension that nobody in AI financing wants to discuss at length.

Microsoft and Nvidia invest billions in Anthropic, then sell the company the chips and cloud infrastructure that consume much of those billions. Anthropic trains and runs Claude on AWS Trainium chips, Google TPUs, and Nvidia GPUs. It sells Claude through Amazon Bedrock, Google Vertex AI, and Microsoft Azure Foundry. The company has committed $50 billion to building data centers in the U.S. Some of that spending will flow right back to the companies writing the investment checks.

OpenAI's version of this loop is even larger. The company has committed over $1.4 trillion in infrastructure deals. Bloomberg has documented concerns about "circular deals" propping up AI industry valuations, where cloud providers invest in startups that immediately spend the money on cloud services from those same providers.

Nobody is calling it a problem publicly. Not yet. But investor, customer, and vendor have collapsed into the same entity for several of the largest names in AI financing. When those roles merge, the incentives get tangled. A dollar invested in Anthropic that returns to Nvidia as chip revenue that funds Nvidia's investment in OpenAI is not a straightforward capital allocation story. It is a loop. Loops need a correction eventually, or they need a public market to absorb the risk. Which brings us to the exit.

Where this leaves Anthropic

The round was oversubscribed "several times," the Financial Times reported. Anthropic raised its fundraising target by $10 billion during the process because investors kept pushing to get in. Wilson Sonsini, the law firm, has already been hired to begin IPO preparations, the FT reported. A listing could come as early as this year. Anthropic also confirmed plans for an employee tender offer at the current valuation, letting staff sell shares ahead of a potential debut.

Five years old, $380 billion in private market value, $14 billion in annualized revenue, one coding tool writing 4 percent of the world's public code. Claude remains the only frontier AI model available on all three major cloud platforms. Opus 4.6, released last week, leads the GDPval-AA benchmark for economically valuable knowledge work. Cowork is turning Claude from a chatbot into an automation layer that spans an entire enterprise.

For the software sector, every new Anthropic product launch feels like a fire alarm. Two trillion dollars in lost market cap says the fear is not abstract. For the VCs stacking bets on both sides, the old rules about competitive conflict have given way to something blunter: the cost of missing a generational company outweighs the awkwardness of backing its rival.

Anthropic doesn't need a public listing to prove what it has built. It needs one to let its early investors cash out before the next round makes thirty billion dollars look like a down payment.

Frequently Asked Questions

Q: Who led Anthropic's $30 billion Series G round?

A: GIC, Singapore's sovereign wealth fund, led alongside Coatue Management. Founders Fund, D.E. Shaw Ventures, Dragoneer, ICONIQ, and Abu Dhabi-backed MGX co-led. Dozens of institutional investors participated, including Sequoia, Blackstone, BlackRock, Fidelity, and Goldman Sachs.

Q: How does Anthropic's $380 billion valuation compare to OpenAI?

A: Anthropic more than doubled its valuation in five months. OpenAI raised over $40 billion at a higher valuation last year, but Anthropic's round is the second-largest private tech fundraise ever, behind only OpenAI's SoftBank-led deal.

Q: What share of GitHub code does Claude Code write?

A: SemiAnalysis estimated in February 2026 that Claude Code accounts for 4 percent of all public GitHub commits, double the figure from one month earlier. That means one in every 25 pieces of code pushed to GitHub was written by the tool.

Q: Why are software stocks losing market value?

A: Investors are repricing the software sector around the likelihood that AI coding agents and automation tools will replace traditional software revenue. Anthropic product launches in legal, finance, and healthcare have triggered sell-offs in each vertical.

Q: Is Anthropic planning to go public?

A: Wilson Sonsini has been hired to begin IPO preparations, and a listing could come as early as this year. Anthropic also confirmed plans for an employee tender offer at the $380 billion valuation ahead of any potential debut.