San Francisco | February 4, 2026

Anthropic released a legal plugin on Friday. By Tuesday, Thomson Reuters had lost 16%, PayPal shed a fifth of its value, and Goldman Sachs's software basket posted its worst day since the tariff panic. Combined damage: $300 billion. The real trigger wasn't the plugin but years of price hikes with no meaningful product improvement. AI just made the bill come due.

Pactum's CEO says Moltbook agents create themselves and can't be shut down. He expects regulators to freeze the whole space within months.

ChatGPT's U.S. mobile share fell from 69% to 45% in a year. The chatbot market grew 152%. OpenAI is winning less of a much bigger game.

Stay curious,

Marcus Schuler

Software Stocks Lose $300 Billion as Anthropic Plugin Sparks Sector Selloff

Anthropic named specific job functions. The market heard a death sentence for pricing power. $300 billion vanished in a single session.

Goldman Sachs's software basket dropped 6% on Tuesday. Thomson Reuters fell 16%. Relx, which owns LexisNexis, shed £6 billion. The selling spread to Salesforce, Intuit, Adobe, and CrowdStrike, then jumped continents: Tata Consultancy lost 6% in Mumbai, Xero cratered 16% in Sydney, its worst session since 2013.

The deeper story is margin compression that started building in 2024. Only 71% of software companies beat revenue expectations this earnings season, compared with 85% for broader tech. Vendors had leaned on annual price increases for years without matching product improvement. Anthropic's legal plugin didn't cause the correction. It gave investors a reason to act on what they already suspected.

Private equity took collateral damage. Software now makes up 20% of business development company investments, double the share from 2016. Blue Owl Capital fell for its ninth straight session. Ares, KKR, and TPG each dropped roughly 10%.

J.P. Morgan analyst Toby Ogg summed up the mood: the sector "is now being sentenced before trial." Nvidia CEO Jensen Huang pushed back at Cisco's AI Summit, calling the decline narrative "the most illogical thing in the world." Markets weren't predicting software's death. They were repricing what it gets to charge.

Why This Matters:

- Enterprise software vendors face margin compression from AI alternatives that perform specific tasks at a fraction of the cost, threatening the annual price-hike model

- Private equity's heavy software exposure creates systemic risk if repricing continues through earnings season

✅ Reality Check

What's confirmed: $300 billion in combined losses across software and financial-data stocks. Goldman Sachs basket down 6%, Thomson Reuters down 16%.

What's implied (not proven): That AI tools will replace incumbent software revenue at scale. Current plugins handle narrow tasks, not full workflows.

What could go wrong: Panic selling overshoots and creates buying opportunities that reward the same incumbents. Enterprise switching costs remain high.

What to watch next: Q4 earnings from Salesforce and ServiceNow. If renewal rates hold, the selloff was sentiment, not substance.

Pactum CEO Warns Moltbook Agents Create Themselves and Cannot Be Shut Down

The CEO whose AI agents negotiate for Walmart and Rolls-Royce says a competitor has crossed a line that can't be uncrossed.

Kaspar Korjus built Pactum's negotiation agents over six years and $100 million in investment. His bots handle procurement for Walmart, Nestlé, Honeywell, and Maersk, pulling an average of $42,000 in net value per million dollars of negotiated spend. Ninety percent of suppliers prefer dealing with Pactum's AI over human counterparts.

Now Korjus is raising alarms about Moltbook: "These glorified chatbots have become authoritative entities with minds and goals of their own," he said. The specific concern: These agents can create themselves without oversight, and no one has visibility into who created whom, what they do, or what their motivations are.

Korjus draws a hard line between Pactum's narrowly scoped, guardrailed agents and what Moltbook has built. His recommendation is blunt: don't install OpenClaw on home systems, limit agent access, authority, and budgets until safety is proven. He expects regulators to force a "full stop" within five months.

The warning carries weight because Korjus isn't an AI skeptic. He previously built Estonia's e-Residency program and now advises the Estonian Prime Minister on AI. Skype co-founder Jaan Tallinn, an early DeepMind investor, backs Pactum as an angel.

Why This Matters:

- An enterprise AI insider calling for a pause on autonomous agents signals the gap between controlled and uncontrolled deployment is widening fast

- If regulators act on the timeline Korjus predicts, companies deploying unscoped agents face compliance risk before mid-2026

AI Image of the Day

Prompt: A cute penguin with soft, fluffy feathers, big round eyes, and a small beak, standing on a snowy surface with a serene expression, surrounded by gentle, warm lighting, and a color palette of whites, grays, and blues, with intricate details on its feathers and a sense of innocence and charm, the penguin's facial features are delicate, with a slight smile, and its skin is a pale yellow, the overall atmosphere is peaceful and heartwarming, with the penguin being the main focus of the image, set against a simple, muted background that accentuates its cuteness.

ChatGPT U.S. Mobile Share Falls Below 50% as Gemini and Grok Gain Ground

ChatGPT owned 69% of the U.S. chatbot market a year ago. Now it holds 45%. The market didn't shrink. It grew 152%.

Apptopia data shows ChatGPT's daily user share on U.S. mobile dropped from 69.1% to 45.3% in twelve months. On the web, it fell from 86.6% to 64.6%. Gemini climbed to 25.1% on mobile, up from 14.7%. Grok surged from 1.6% to 15.2%.

The numbers tell a distribution story. Google's advantage is structural: Gemini ships embedded in Android, Workspace, and Chrome, reaching 650 million monthly active users without a separate download. Code found in Gemini's Android app reveals an "Import AI chats" feature that lets users migrate ChatGPT or Claude conversation histories, with imported data feeding Gemini's training.

OpenAI is responding with product proliferation. ChatGPT Go, an $8 monthly tier with ads and GPT-5.2 Instant, targets price-sensitive users. The standalone Codex app for Mac drew over a million developers in its first month. The company projects $20 billion in 2026 revenue, triple last year.

Twenty percent of chatbot users now run multiple apps, up from 5% two years earlier. Claude shows the highest engagement per user, with daily sessions tripling from ten to thirty minutes since June 2025.

Why This Matters:

- Distribution is overtaking model quality as the primary competitive advantage, favoring Google's platform integration over standalone apps

- Multi-app usage at 20% suggests the market is fragmenting by use case rather than converging on a single winner

What To Watch Next (24-72 hours)

- Alphabet Earnings: Reports today at 1:30 PM PT. Revenue expected near $111 billion, with Cloud margin at 24%. The real question is whether Gemini monetization gets a breakout number or stays folded into search revenue.

- Amazon Earnings: Thursday at 2 PM PT. AWS backlog hit $200 billion, but 2026 capex could climb past $150 billion. Investors want proof the AI infrastructure binge converts to margin, not just revenue.

- EU AI Act Article 6 Guidelines: Commission deadline hit Sunday for high-risk AI classification guidance. Watch for the published framework this week, as it defines which AI systems face the strictest compliance rules before August enforcement kicks in.

The One Number

125 million — Global on-demand streams earned by Xania Monet, an AI-generated artist, in 2025. That's not a novelty act number. It's enough to chart. Monet became the first AI act to debut on a Billboard radio chart, hitting No. 3 on Hot Gospel Songs. The music industry's "AI won't replace artists" talking point is getting harder to defend.

🛠️ 5-Minute Skill: Turn a Slack Thread Into a Decision Document

It's 4 PM and your team just spent 90 messages debating a product decision in Slack. Your VP wants "a one-pager on what we decided" by end of day. The thread is a disaster of emoji reactions, side conversations, and at least two people who changed their minds halfway through.

Your raw input:

#product-decisions channel, 2:15 PM - 3:45 PM

@rachel: do we build the API integration in-house or use Merge.dev? we need to decide today

@daniel: merge is $2,400/mo at our scale. that's $29k/year

@priya: but building in-house means 3 engineers for ~6 weeks

@daniel: more like 8 weeks, last integration project ran over by 40%

@rachel: what about maintenance after? merge handles that

@priya: true but we're locked into their schema mapping. had issues with that at my last company

@daniel: can we do a hybrid? use merge for the first 5 connectors, build custom for salesforce

@rachel: actually that's not bad. salesforce is 60% of our volume anyway

@priya: I could live with that. but who owns the merge relationship?

@rachel: @daniel can you own vendor? priya owns the salesforce build?

@daniel: 👍

@priya: works for me. timeline?

@rachel: merge can be live in 2 weeks. salesforce build starts march 1, target april 15

@daniel: we need security review for merge. @infosec any flags?

@alex (infosec): checking. will have answer by tomorrow noon

@rachel: ok let's go with hybrid pending security clearance. if infosec flags something we revisit friday

The prompt:

You are a product manager writing a decision document from a Slack thread. The audience is a VP who was not in the conversation and needs to understand what was decided, why, and what happens next.

From this Slack thread, produce:

1. DECISION (1 sentence: what the team decided)

2. OPTIONS CONSIDERED (3-4 bullets: what was on the table, with the key trade-off for each)

3. RATIONALE (2-3 sentences: why this option won)

4. OWNERS & TIMELINE (table: WHO | WHAT | BY WHEN)

5. OPEN RISKS (bullets: what could change this decision)

6. NEXT CHECKPOINT (when and how the team will confirm this is working)

Slack thread:

[paste thread here]

Rules:

- Write for someone who has zero context on this discussion.

- Use names from the thread. Don't anonymize.

- If something was unresolved, say so explicitly. Don't paper over gaps.

- Under 250 words total.

What you get back:

DECISION: Hybrid approach — use Merge.dev for initial API connectors, build Salesforce integration in-house.

OPTIONS CONSIDERED:

- Merge.dev (full): Fast deployment, $29K/year, but locks us into their schema mapping

- In-house (full): Full control, but 6-8 weeks of engineering time with overrun risk

- Hybrid (selected): Merge for 5 connectors + custom Salesforce build. Balances speed with control where volume is highest

RATIONALE: Salesforce represents 60% of integration volume, making it the one connector worth owning. Merge handles the long tail at predictable cost. Daniel flagged that past in-house projects ran 40% over estimates, so limiting custom work to one integration reduces schedule risk.

OWNERS & TIMELINE:

OPEN RISKS:

- Security review could flag Merge.dev (revisit decision Friday if so)

- Salesforce build estimate hasn't been validated against actual scope

- No fallback plan if Merge.dev's schema mapping causes issues post-launch

NEXT CHECKPOINT: Friday — confirm infosec clearance. If cleared, proceed. If flagged, team reconvenes to reassess full in-house option.

Why this works

The six-section structure mirrors how executives actually read decisions: What did you decide? What else did you consider? Why? Who owns it? What could go wrong? When do we check back? Slack threads bury this information across dozens of messages. The prompt extracts the architecture of the decision, not just the conclusion.

Where people get it wrong: Asking for "a summary of this Slack thread." Summaries preserve the chronological mess. Decisions need to be restructured by function, not by timestamp.

What to use

Claude (Claude Sonnet 4.5 via claude.ai): Best at identifying unresolved items and calling out gaps honestly. Won't smooth over missing information. Watch out for: Can over-qualify risks. You may need to trim hedging.

ChatGPT (GPT-4o with "Reasoning" toggled on): Cleanest table formatting. Good at compressing long threads into tight summaries. Watch out for: Sometimes drops names or attributes decisions to the wrong person. Verify owners.

Gemini (Gemini 2.5 Pro via Google AI Studio): If you export the Slack thread as text, handles long input well. Watch out for: Weaker on the "open risks" section. Tends to list generic risks instead of thread-specific ones.

Bottom line: Claude for accuracy and honesty about gaps. ChatGPT for clean formatting. Always verify the names and timelines against the original thread.

AI & Tech News

Anthropic Takes Aim at ChatGPT With Super Bowl Ad Debut

Anthropic will air its first Super Bowl advertisement, a 30-second spot that parodies intrusive advertising inside AI chatbots. A separate 60-second pre-game ad rounds out the push as the Claude maker escalates its consumer rivalry with OpenAI.

Anthropic Pledges Claude Will Never Run Ads

In a separate move, Anthropic committed to keeping Claude ad-free, promising conversations will never feature sponsored links or advertiser-influenced responses. The pledge draws a clear line against monetization strategies competitors may pursue.

Major Cloud Providers Add OpenClaw Support Despite Gartner Security Warnings

Tencent Cloud, DigitalOcean, and Alibaba Cloud have rolled out OpenClaw support, making the AI agent service available beyond the Mac mini setups many users run today. Gartner has declared OpenClaw an unacceptable cybersecurity risk and is urging administrators to remove it from their systems.

Positron Raises $230 Million to Challenge Nvidia in AI Chips

Reno-based semiconductor startup Positron closed a $230 million Series B led by the Qatar Investment Authority, bringing total funding past $300 million. The company is developing high-speed memory chips aimed at the AI accelerator market Nvidia dominates.

Texas Instruments Strikes $7.5 Billion Deal to Buy Silicon Labs

Texas Instruments agreed to acquire Silicon Laboratories for $231 per share in an all-cash deal, a steep premium over Silicon Labs' $4.5 billion market cap. The transaction is expected to close in the first half of 2027.

Uber Launches Robotaxis in Hong Kong, Madrid, Houston, and Zurich

Uber announced robotaxi expansions to four cities in 2026, investing hundreds of millions of dollars in autonomous operations. Hong Kong becomes the company's first autonomous ride-hailing market in Asia.

Bedrock Raises $270 Million to Automate Construction Equipment

The one-year-old robotics startup founded by former Waymo executives secured $270 million led by CapitalG and Valor Atreides AI Fund, reaching a $1.75 billion valuation. Bedrock is building autonomous technology for excavators and heavy machinery.

Resolve AI Hits Unicorn Status With $125 Million Round

Resolve AI, which builds agents that monitor source code and fix outages autonomously, raised $125 million led by Lightspeed at a $1 billion valuation. The startup detects and resolves live software problems without human intervention.

Uber Revenue Jumps 20% But Profit Misses, Stock Falls 8%

Uber posted Q4 revenue of $14.4 billion with trips up 22% to 3.8 billion and gross bookings hitting $54.1 billion. Profit of $296 million missed expectations, sending shares down more than 8% after hours.

🧰 AI Toolbox

How to Build Professional Websites with AI Using Framer

Framer combines visual design with AI generation to create production-ready websites. Describe a page, generate layouts, then refine with drag-and-drop editing and publish instantly.

Tutorial:

- Sign up at framer.com and start a new project

- Use "Generate Page" and describe what you need ("A landing page for a SaaS product")

- Review the AI-generated layout with placeholder content

- Edit text, swap images, and adjust components visually

- Add interactions, animations, and responsive breakpoints

- Connect your domain and configure SEO settings

- Publish with one click and iterate based on analytics

URL: https://framer.com

🚀 AI Profiles: The Companies Defining Tomorrow

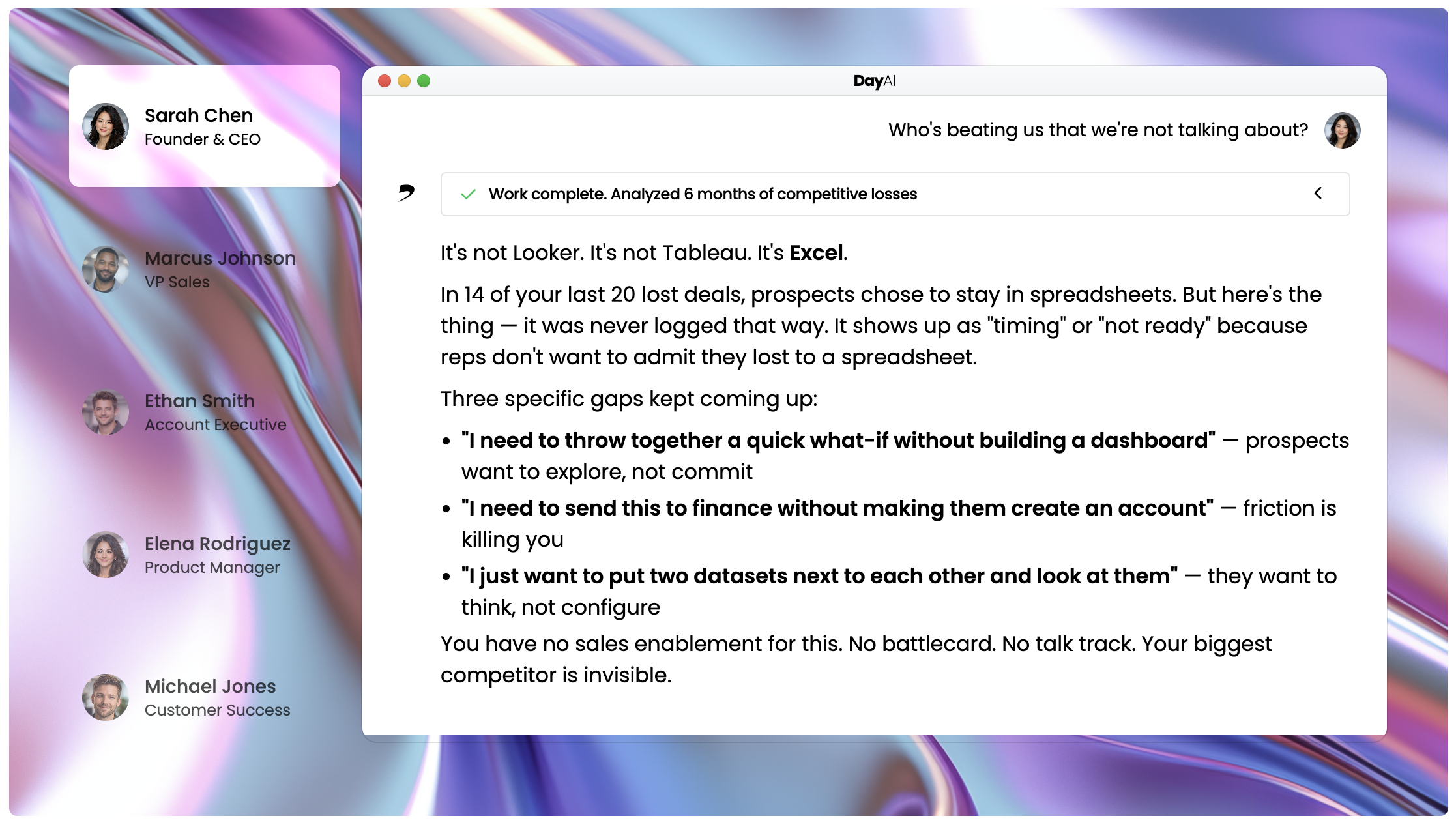

Day.ai (CRMx)

Day.ai thinks your CRM should work for you, not the other way around. The Boston company builds what it calls the first "CRMx" platform, an AI chief of staff that automates meeting prep, note-taking, and pipeline building. 🤖

Founders

Christopher O'Donnell (CEO) and Michael Pici met at HubSpot, where O'Donnell helped scale the product that defined modern CRM. They left to build what they think comes next: a CRM that fills itself. Pat Grady from Sequoia joined the board, a signal the firm sees Day.ai as a category bet, not a feature.

Product

Day.ai onboards a business in 15 minutes, ingests data from email and Slack, and starts automating the busywork sales teams hate. It prepares meeting briefs, takes notes, builds prospect pipelines, and tracks relationships without manual entry. O'Donnell calls it "the Cursor for CRM," software that handles the work humans wouldn't do full-time anyway. After a year in private beta, the platform hit general availability with roughly 120 customers.

Competition

Salesforce still owns enterprise CRM with a $200B market cap. HubSpot dominates mid-market. Newer AI-native players crowd the space: Attio ($100M+ raised), Reevo ($80M), and Clarify ($15M). Day.ai differentiates on automation depth, not just a prettier interface. The question: can a 120-customer startup compete with platforms that already have distribution?

Financing 💰

$20M Series A led by Sequoia with Greenoaks, Conviction, Sound Ventures, and Permanent Capital. Previous $4M seed also led by Sequoia. Total raised: $24M. Sequoia leading both rounds signals high conviction.

Future ⭐⭐⭐

Day.ai has pedigree and a thesis. The risk is timing. CRM incumbents are bolting AI onto existing products as fast as they can. Day.ai must prove that native AI beats retrofitted AI before Salesforce and HubSpot close the gap. 120 customers is a start, not a moat. 📈

🔥 Yeah, But...

TikTok's U.S. service went down for days after a winter storm knocked out a primary data center operated by Oracle, its new infrastructure partner. The outage hit just days after TikTok officially transferred to U.S. ownership, citing data security as the main reason for the deal.

Sources: The Hollywood Reporter, February 1, 2026

Our take: Congress spent a year arguing that TikTok needed American ownership to protect U.S. data. Oracle got the keys. Days later, a cold snap in Texas knocked tens of thousands of Oracle servers offline and took the whole platform with it. The app built to survive a geopolitical standoff couldn't survive winter. Users thought the new owners were tampering with the algorithm. Turns out it was just a power outage. The $20 billion data security deal, and the first real test was a space heater.