Apple Pays $2 Billion to Read Your Face

Apple acquired Israeli startup Q.AI for close to $2 billion, gaining facial micro-movement technology that decodes silent speech for future wearables.

Anthropic's $7B revenue run rate trails OpenAI's $13B, but the gap narrows when accounting for customer mix. New Excel integration and financial connectors target Wall Street as Microsoft embeds both AI providers—hedging infrastructure bets in an uncertain market.

Anthropic launched Excel integration and seven financial data connectors this week, sharpening its enterprise focus as the company reaches $7 billion in annual revenue—just as rival OpenAI's consumer-first strategy faces monetization questions at $13 billion.

The timing connects two narratives. Anthropic's Claude can now pull real-time data from platforms like Moody's, the London Stock Exchange Group, and financial research firm Aiera while sitting inside Microsoft Excel spreadsheets. Meanwhile, OpenAI continues chasing 800 million weekly users through mass-market chatbot conversations, still searching for an advertising model that works beyond $20-per-month subscriptions.

The revenue gap looks smaller when you account for strategy. Anthropic expects to hit $9 billion by year-end with 80% coming from corporate customers—roughly 300,000 of them. OpenAI pulls just 30% from business users despite its larger top line. Revenue per user favors Anthropic substantially.

The Breakdown

• Anthropic reaches $7B annual revenue (targeting $9B by year-end) with 80% from 300,000 corporate customers versus OpenAI's $13B with 70% consumer base

• Claude launched Excel integration plus seven financial data connectors (Moody's, LSEG, Aiera) and six automation Skills for enterprise finance teams

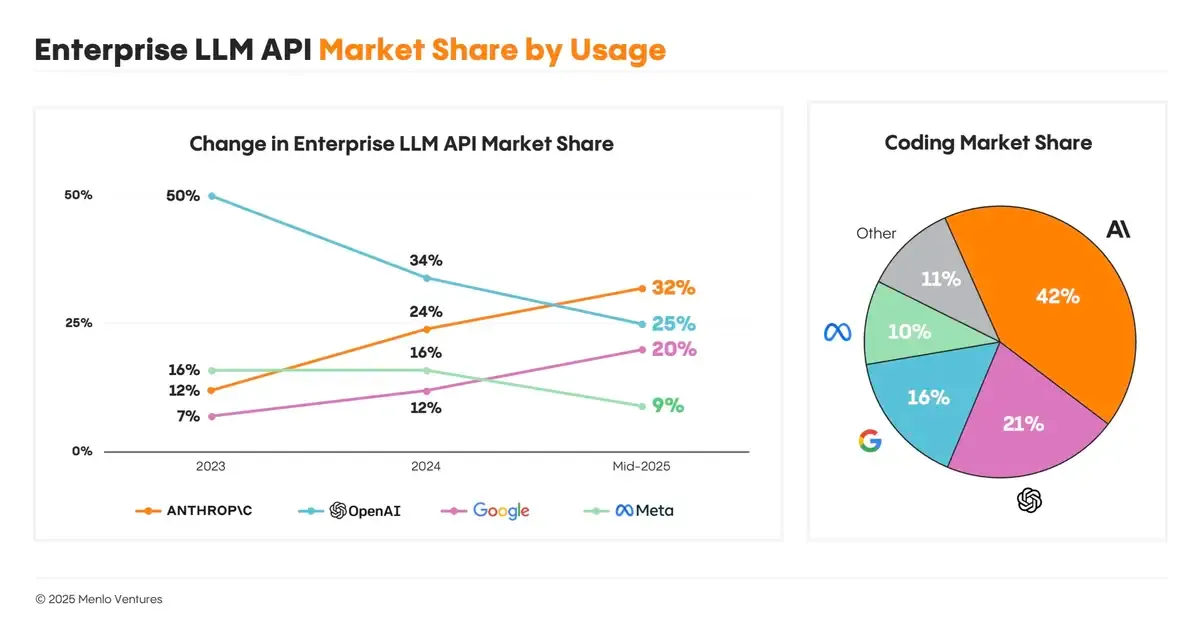

• Anthropic leads enterprise AI market share at 32% versus OpenAI's 25%, and dominates coding tasks 42% to 21%, per Menlo Ventures survey

• Microsoft embedded Claude in Copilot despite heavy OpenAI investment, treating model diversity as infrastructure risk management rather than competitive confusion

The Excel integration arrived Monday as a preview for paid Max, Enterprise, and Teams subscribers. Users get a sidebar—think Clippy with Claude's reasoning engine—that can answer questions about spreadsheet data, modify structures, or generate new financial models entirely.

The seven connectors link Claude directly to financial infrastructure: Aiera for earnings transcripts, MT Newswires for market updates, LSEG for exchange data, Egnyte for secure document access, Chronograph for portfolio monitoring, Third Bridge for investment research, and Moody's for credit analysis. All pull data in real time. All launched to the full user base immediately.

Six new Agent Skills followed—customizable instruction sets that shape Claude's output for specific financial tasks. One analyzes quarterly earnings and packages executive statements into digestible reports. Others model discounted cash flow, process data room documents, generate company profiles for pitchbooks, and build comparable company analyses. These also hit Max, Enterprise, and Teams tiers.

The release builds on September's Microsoft partnership announcement, when Claude became available inside Microsoft's Copilot suite despite Microsoft's heavy investment in OpenAI. That decision signaled something: Microsoft sees value in hedging its AI infrastructure bets, even between competing model developers it funds.

Corporate customers care about return on investment in ways consumer users don't. A July survey from Menlo Ventures—an Anthropic investor, disclosure noted—estimated Claude holds 42% market share for coding tasks against OpenAI's 21%. For overall corporate AI use, Anthropic leads 32% to 25%.

Those numbers reflect product design decisions made years ago. Anthropic built for "boring and useful" from the start, per one industry assessment. OpenAI recently announced it would allow adults to have erotic conversations with ChatGPT and advocates for lighter AI regulation. Both stances play well with consumer audiences. Both create friction with corporate compliance teams.

The reputational divergence matters more as AI moves from experimental budgets into core operations. Finance teams modeling cash flows don't want the same tool their teenagers use for homework help. Legal departments drafting contracts don't want brand risk from a provider known for pushing content boundaries. The use cases demand different positioning.

Microsoft's September move crystallizes the dynamic. The company maintains its OpenAI partnership—providing compute infrastructure, embedding models in products—while simultaneously offering Claude inside Copilot. That's not competitive confusion. That's portfolio management. Different enterprise customers want different risk profiles, and Microsoft sells to all of them.

The monetization path matters because infrastructure costs remain brutal. Both companies burn capital on compute, talent, and model training. OpenAI raised billions specifically to build data centers. Anthropic has backing from Amazon and Google for similar infrastructure needs.

But revenue predictability differs sharply. Corporate customers deploy AI for measurable cost reduction: faster coding cuts development time, automated legal drafting reduces billable hours, expedited billing improves cash flow. Each use case connects to a budget line item. Each improvement can be calculated as saved headcount or accelerated revenue.

Consumer chatbot monetization lacks that clarity. Subscription fees don't offset training costs for frontier models. The obvious path—advertising—presents technical and strategic problems. Users won't welcome brand placement in bot conversations. And OpenAI would compete directly with Google, which has deeper advertising infrastructure and its own AI suite. The economics get harder, not easier.

Vals AI, a startup evaluating AI models, ranks Claude's latest version as top performer in a business-focused benchmark covering finance, legal, and coding tasks. "Anthropic is laser-focused on these agentic enterprise use cases and they're playing a very competitive game with OpenAI right now," said Rayan Krishnan, Vals co-founder.

The finance sector offers particularly fertile ground. Algorithms have analyzed market data for decades, but large language models bring pattern recognition across text-heavy tasks: earnings call analysis, contract review, research synthesis. A study last month found leading AI models passing the Chartered Financial Analyst Level III exam—the industry's hardest aptitude test—suggesting routine portfolio management work may shift to software.

Anthropic's Excel integration and financial connectors don't just add features. They demonstrate thesis execution. The company bet that enterprise customers would pay premium prices for AI that integrates into existing workflows with measurable output. Wall Street uses Excel universally. Financial professionals need real-time market data. Both requirements are now bundled with Claude's reasoning capabilities.

OpenAI isn't abandoning business customers—it pursues them through Microsoft and directly. And its massive consumer base exposes models to more varied queries, which could improve performance. But the revenue model remains speculative while Anthropic's grows more concrete each quarter.

The competitive landscape will clarify as both companies scale. But Anthropic's focus on corporate customers with quantifiable ROI—and Microsoft's decision to embed both AI providers in its enterprise stack—suggests the market sees room for different strategies to succeed simultaneously.

Q: Why is Microsoft paying for both Anthropic and OpenAI?

A: Microsoft treats AI providers as infrastructure hedges, not winner-take-all bets. The company invested heavily in OpenAI for consumer products but embedded Claude in Copilot for enterprise customers who want different risk profiles. Different compliance teams prefer different content policies, so Microsoft sells access to both rather than picking one model.

Q: What exactly are Claude's Agent Skills?

A: Skills are customizable instruction folders that shape Claude's output for specific tasks. The six new finance Skills automate earnings analysis, discounted cash flow modeling, comparable company research, and pitchbook generation. They're designed to make Claude behave less like a general chatbot and more like a trained employee who understands company-specific workflows and policies.

Q: How much do enterprise Claude subscriptions cost?

A: Anthropic hasn't disclosed exact pricing for Max, Enterprise, and Teams tiers publicly. However, the company's $9 billion annual revenue target with roughly 300,000 corporate customers suggests average spend around $30,000 per customer annually—though actual pricing likely varies significantly based on usage volume, team size, and specific feature access.

Q: Why can't OpenAI just add ads to ChatGPT like Google does with search?

A: Chatbot conversations lack natural ad placement points. Search results show ads alongside organic links—users understand the format. But injecting brand messages into conversational AI responses creates user experience problems. Plus OpenAI would compete directly against Google, which has deeper advertising infrastructure and relationships with brands built over two decades.

Q: Do the financial data connectors work with all Claude accounts?

A: Yes. The seven connectors linking Claude to Moody's, LSEG, Aiera, MT Newswires, Egnyte, Chronograph, and Third Bridge launched to all Claude users immediately. However, the Excel integration and six finance Skills are currently limited to paid Max, Enterprise, and Teams subscribers as a preview feature before wider release.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.