💡 TL;DR - The 30 Seconds Version

💰 ASML commits €1.3 billion to Mistral AI's €2 billion Series C round, becoming the largest shareholder and securing a board seat.

📊 The deal values Mistral at €10 billion pre-money, making it Europe's most valuable AI company by private valuation.

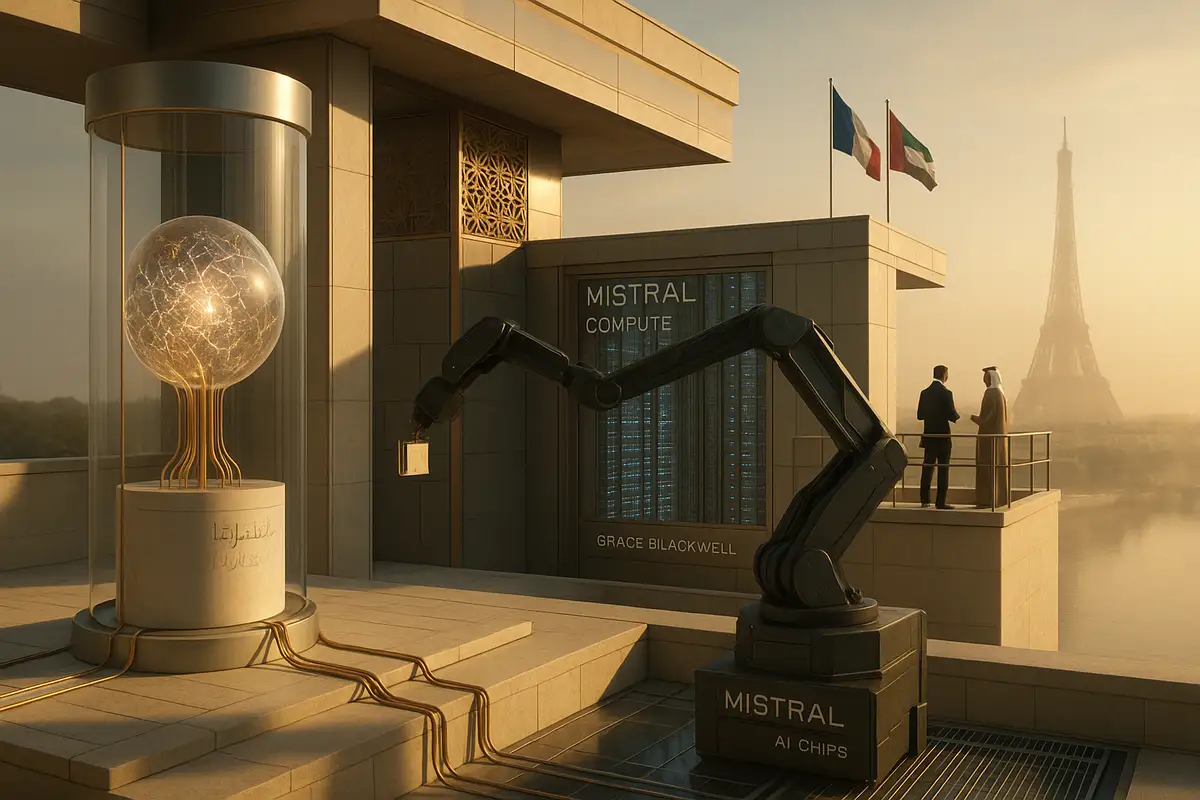

🔧 ASML's $180 million EUV lithography machines make the chips that power AI workloads, while Mistral builds the AI models that need those chips.

🇪🇺 This represents Europe's bet on vertical integration and stack control rather than trying to match US venture capital scale competition.

🌍 The partnership creates a template for European tech sovereignty through managed dependencies rather than complete independence from US and Chinese technology.

🚀 Success could establish a new model where European companies compete through deep technical integration rather than pure market dominance.

A rare cross-stack alliance is taking shape in Europe. ASML plans to invest €1.3 billion in Mistral AI’s roughly €2 billion Series C, becoming the French startup’s largest shareholder and taking a board seat, according to Reuters’ exclusive on the ASML–Mistral deal.

What’s new

If completed, the round would value Mistral at €10 billion pre-money, making it Europe’s most valuable AI company by private valuation. Other outlets have floated a higher, post-money figure around $14 billion. The gap reflects timing and deal construction rather than a sharp change in fundamentals. Private rounds are fluid until the ink dries.

No one is confirming on the record yet. ASML and Mistral declined comment; Bank of America, said to advise ASML, also kept quiet. That silence suggests the talks encompass more than a simple cap table update. Think IP access, joint development, and governance.

Why ASML would do this

ASML sits at the most irreplaceable chokepoint in advanced computing: extreme-ultraviolet lithography. Its systems—priced in the hundreds of millions—enable the smallest features on the fastest chips. The company already uses AI to squeeze more throughput and yield from those machines.

Owning a meaningful slice of a frontier-model builder brings two dividends. First, privileged access to model talent and tooling that can automate calibration, anomaly detection, and predictive maintenance across fabs. Second, strategic visibility into the AI workload roadmap that ultimately drives chip demand. That’s not full vertical integration, but it is vertical adjacency with teeth. And it’s smart hedging in an era when software choices reshape hardware economics.

The move also signals a broader ambition. Rather than treating AI as a customer segment, ASML is positioning AI as a core capability inside its product cycle. That shortens loops between advances in models and advances in manufacturing.

What Mistral gains

Capital, obviously. But also something more valuable in Europe: an industrial patron with unmatched leverage. Mistral can tell customers and regulators it is anchored by a firm that already works with every leading chipmaker. That matters for procurement, sovereign contracts, and credibility outside the startup echo chamber.

Strategically, Mistral has differentiated with open-weight releases, strong multilingual performance, and pragmatic model sizes. Its pitch is not “we out-scale San Francisco,” but “we tune for real-world efficiency and European needs.” A board-level tie to ASML amplifies that story. It also helps with compute access and applied research—areas where European companies often lag purely on budget.

The sovereignty math

Europe talks about “technological sovereignty,” but supply chains remain interlocked with U.S. rules and Asian manufacturing. ASML itself is subject to export controls, while Europe’s largest cloud footprints are American. The right realism, therefore, is not autarky. It’s managed dependency—securing control points while diversifying everything else.

Seen that way, ASML-Mistral is a blueprint rather than a one-off. Tie a crown-jewel hardware incumbent to a credible AI lab; exchange cash for compute-driven productivity and influence over the model agenda; keep IP on the continent where possible. It won’t cut the cord to U.S. chips or clouds, but it shifts the center of gravity a few degrees toward Eindhoven and Paris.

Competitive context

The U.S. giants are now priced like public megacaps in private markets. Anthropic’s recent $13 billion raise at a $183 billion valuation underlines how far the ceiling has moved. OpenAI’s reported valuations keep inflating on secondary sales and fresh rounds. Against that backdrop, Mistral’s number looks modest. But it’s not playing the same game.

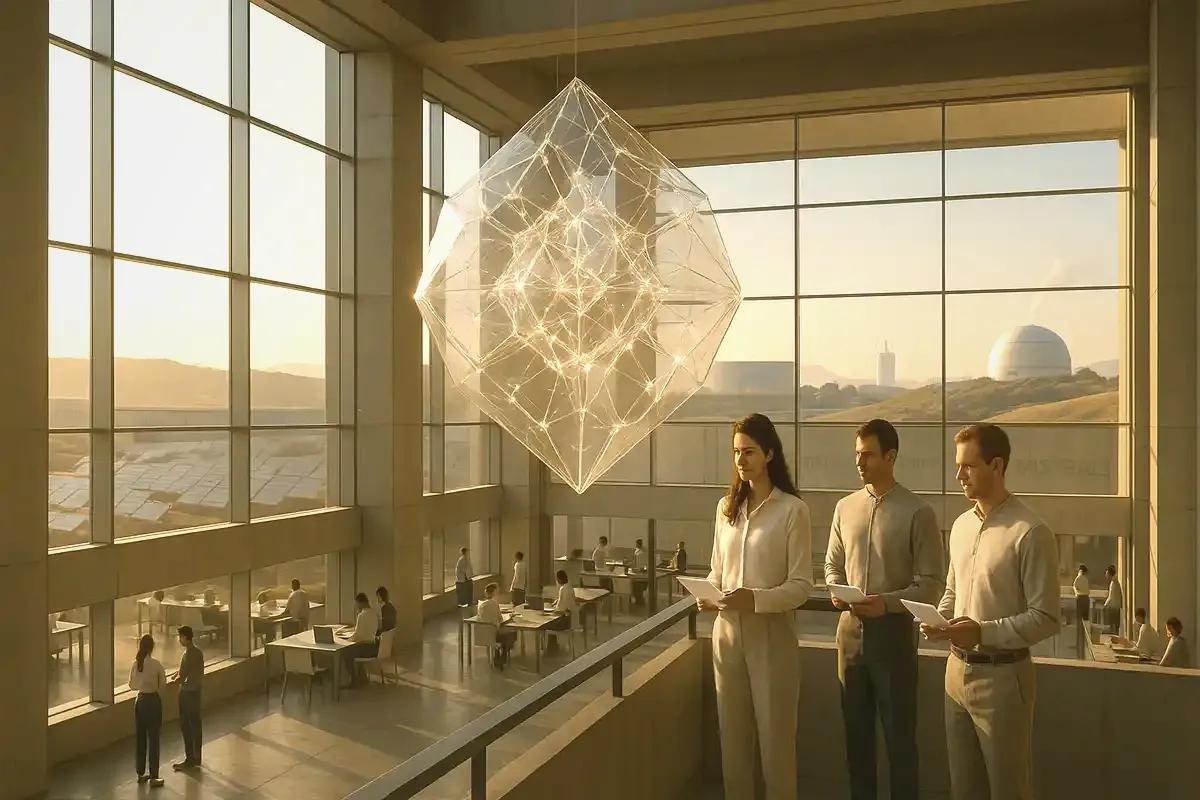

Europe lacks the venture fuel for “scale at any price.” Its plausible path is stack control, interoperability, and targeted excellence: models that integrate cleanly with enterprise systems, privacy-forward defaults, and region-specific strengths. This deal leans into that logic. It turns “we can’t outspend them” into “we can out-integrate them.”

What to watch next

Governance and scope. A board seat gives ASML influence, not command. The questions are where it points that influence—applied AI for manufacturing, joint labs, or productized tools sold back into the fab ecosystem. Watch for technical working groups and co-authored papers before you see revenue.

Regulatory optics. Europe is friendlier to industrial policy than Silicon Valley’s laissez-faire, but scrutiny will follow if the partnership begins to privilege certain downstream partners or tie access to preferred vendors. Expect polite letters before hard remedies.

Execution. AI’s promise in manufacturing is well-known; the bottleneck is deployment. To change yields and cycle times, models must be reliable, interpretable, and integrated with safety-critical control software. Demos are easy. Plant-wide rollouts are not. This is where the partnership will either compound or stall.

The bottom line

This is a sovereignty play wrapped in an operations thesis. ASML buys a seat at the AI table to improve its machines and steer the workloads that justify them. Mistral gains funding, legitimacy, and a path to differentiated enterprise deals. Europe tests an alternative to the U.S. model of sheer scale. It’s not a revolution. It’s a re-wiring.

Why this matters:

- Stack control over raw scale: Europe is betting that deep integration between chip tools and models can beat bigger budgets and parameter counts.

- From independence to resilience: The goal shifts from full autonomy to strategically managed dependencies that keep critical capabilities at home.

❓ Frequently Asked Questions

Q: What exactly is ASML and why is it so powerful in the chip industry?

A: ASML is the world's only manufacturer of extreme ultraviolet (EUV) lithography machines, which cost $180-400 million each and are essential for making the most advanced chips. Every leading chipmaker—TSMC, Intel, Samsung—depends on ASML's machines. This monopoly gives ASML unique leverage in global tech supply chains.

Q: How does Mistral's €10 billion valuation compare to US AI giants?

A: Mistral's valuation is roughly 5% of OpenAI's $300 billion and 6% of Anthropic's $183 billion. However, Mistral burns far less cash—US companies lose billions annually while scaling, whereas Mistral focuses on efficient, open-source models that work well at smaller sizes with less computational power.

Q: What does "technological sovereignty" actually mean in practice for Europe?

A: It means reducing dependence on any single external power, not achieving complete independence. Europe currently relies on US companies for 69% of its cloud infrastructure and Asian manufacturers for most chip production. Sovereignty means diversifying these dependencies while securing control over critical technologies like ASML's lithography.

Q: Why can't Europe just copy Silicon Valley's venture capital approach to AI?

A: Europe lacks the venture capital scale—US firms raised over $200 billion for AI in 2024 versus Europe's roughly $15 billion. European companies also face stricter regulations and smaller domestic markets. Instead, Europe is betting on technical integration and efficiency rather than pure scaling through massive funding rounds.

Q: What are the main risks of ASML's investment in Mistral?

A: Integration challenges top the list—AI deployment in manufacturing requires reliable, interpretable models that work with safety-critical systems. Regulatory scrutiny could emerge if the partnership favors certain customers. ASML also faces the risk that AI advances don't translate into measurable improvements in chip manufacturing efficiency or yields.