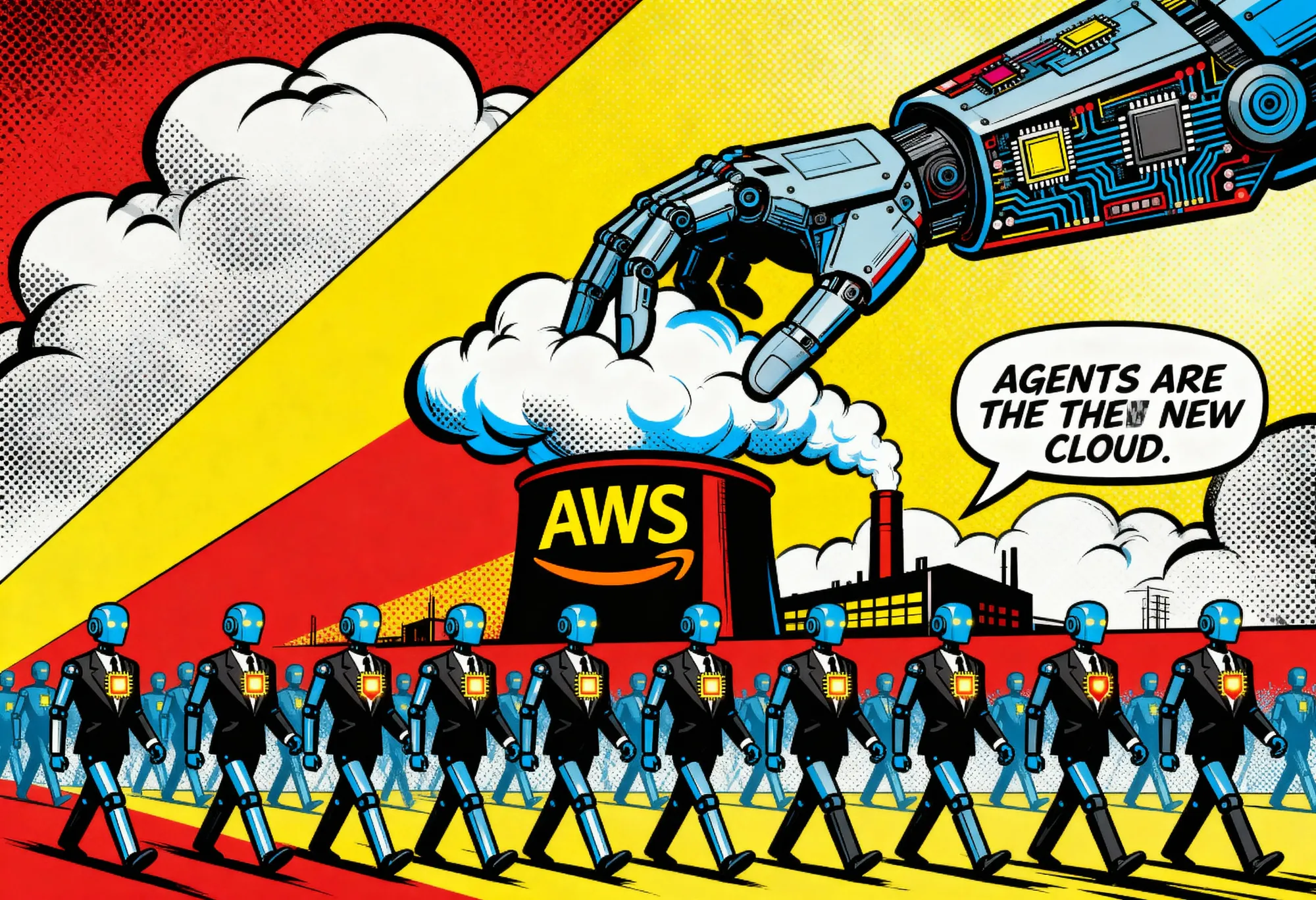

At AWS re:Invent 2025, Matt Garman made a declaration that would have sounded absurd five years ago. "Agents are the new cloud," the AWS CEO announced during his keynote. Not chatbots. Not copilots. Autonomous digital workers that operate for days, learn organizational preferences, and collaborate in swarms.

Behind the keynote theater, a more consequential story was unfolding. AWS unveiled a full-stack AI architecture spanning custom silicon, frontier models, enterprise training pipelines, and agent runtimes, all designed to capture the entire AI value chain before competitors can carve it up. The company has deployed more than one million Trainium chips in what Garman called "record speed," building a multi-billion-dollar business in custom AI silicon while simultaneously announcing compatibility with Nvidia's interconnect technology.

This is not a company hedging its bets. This is a company executing a vertical integration strategy that makes Apple's hardware-software playbook look modest by comparison.

The Breakdown

• AWS launched Trainium3 UltraServers with 4.4x performance gains and previewed Trainium4 with Nvidia NVLink Fusion compatibility for GPU interoperability

• Nova Forge offers custom frontier model training for $100,000 annually, a fraction of the cost of building in-house AI research capabilities

• Three frontier agents operate autonomously for weeks, learning organizational patterns and creating compounding switching costs

• Despite its $8 billion Anthropic investment, Nova holds less than 5% market share while over 50% of Bedrock tokens run on Trainium

The Silicon Gambit

AWS formally launched Trainium3 UltraServers this week, each housing 144 of the company's 3-nanometer AI chips. The performance claims are substantial: 4.4 times more compute than the previous generation, four times the memory bandwidth, and 40 percent better energy efficiency. Thousands of these servers can link together to provide applications with up to one million Trainium3 chips, roughly ten times the previous generation's ceiling.

More than 50 percent of Bedrock tokens already run on Trainium. That statistic, buried in Garman's remarks to SiliconANGLE, reveals the real competitive moat AWS is building. Cost and performance advantages compound when you control the silicon.

But AWS also previewed Trainium4, and here's where the strategy gets interesting. The fourth-generation chip will support Nvidia's NVLink Fusion high-speed interconnect technology. Trainium4 systems will interoperate with Nvidia GPUs while using Amazon's homegrown, lower-cost server rack technology.

The conventional reading: AWS is waving the white flag, acknowledging Nvidia's CUDA dominance. The sharper reading: AWS is making it easier for enterprises locked into Nvidia-dependent workloads to migrate incrementally onto Trainium infrastructure. Accept the GPU you have today, capture the training jobs you'll run tomorrow.

Rohit Prasad, Amazon's head scientist for artificial general intelligence, positioned Nova Forge, the company's new custom training platform, as complementary to this silicon strategy. Organizations can inject proprietary data early in the training process, at checkpoints inside Nova, performing co-training alongside Amazon's curated datasets. The output is a private, frontier-grade model that never leaves the customer's boundary.

Here's the math that matters. Training a large language model from scratch runs somewhere between $50 million and several hundred million, depending on scale and how many failed runs you're willing to admit. Nova Forge? $100,000 annually. That buys access to the training pipeline, not the compute or data, those cost extra. Still. For companies that were never going to build their own AI research divisions anyway, the gap between "theoretically possible" and "practically achievable" just collapsed.

Agents as Lock-In

Garman's "80 to 90 percent of enterprise AI value will come from agents" prediction deserves scrutiny. AWS is not making a neutral forecast about technology trends. The company is declaring where it intends to extract margin.

Consider the three frontier agents announced this week. Kiro handles autonomous software development, maintaining persistent context across sessions and continuously learning from pull requests and human feedback. AWS Security Agent proactively reviews design documents, scans pull requests, and performs penetration testing on demand. AWS DevOps Agent monitors microservices and cloud dependencies around the clock, diagnosing root causes and recommending remediations.

Each agent is designed to operate for weeks with minimal supervision. Each learns customer preferences over time. "Three to six months in," Garman said, "these agents behave like part of your team. They know your naming conventions, your repos, your patterns."

That's the stickiness play. Agents that understand your codebase, your security policies, your infrastructure topology. Agents that improve the longer you use them. Migration costs that compound monthly.

AgentCore, the runtime layer beneath these frontier agents, addresses the operational friction that has stalled enterprise AI adoption. AWS claims teams were spending months reinventing repetitive foundational systems, identity, policy, security, memory, observability, drift detection, just to make early agents safe and deployable. AgentCore abstracts that complexity. Teams can mix and match secure compute, memory, and observability while pairing them with models from Nova, Anthropic, OpenAI, Meta's Llama, or open source alternatives.

The platform play is obvious. Once your agents run on AgentCore, switching costs multiply across every layer of the stack.

Nova's Market Reality

AWS's model strategy faces a credibility problem. A July survey from Menlo Ventures found Amazon Nova commanding less than 5 percent of the enterprise LLM market. Anthropic, in which Amazon has invested $8 billion, controlled 32 percent. OpenAI held 25 percent, Google 20 percent, Meta 9 percent.

Nova is the second-most popular model family in Bedrock. The top group remains Anthropic's Claude models. AWS is simultaneously the largest investor in its most successful model partner and the developer of its least successful in-house alternative.

The Nova 2 announcements attempt to close this gap. Nova 2 Pro, a reasoning model, allegedly matches or exceeds Anthropic's Claude Sonnet 4.5, OpenAI's GPT-5 and GPT-5.1, and Google's Gemini 3.0 Pro Preview across various benchmarks. Nova 2 Omni processes images, speech, text, and video, generating multimodal output with simulated reasoning capabilities. Prasad claims no other AI company has released a fully multimodal model of this kind.

Benchmark claims require skepticism. But Nova Forge may matter more than Nova's raw capabilities. Reddit used Nova Forge to create a custom model for content moderation that, according to CTO Chris Slowe, developed a "social intuition" generic systems miss. The model reads context, reduces false positives, flags real threats, and scales to millions of communities without scaling engineering complexity.

"Other LLMs understand Reddit as a concept, and how Reddit works, but they're not down in the weeds," Slowe said. "We really built a Reddit expert model."

Booking.com, Sony, and Nimbus Therapeutics are testing similar approaches. The thesis: domain-specific frontier models built through Nova Forge will outperform general-purpose alternatives on specialized tasks, even if Nova's base capabilities trail OpenAI or Anthropic.

The Infrastructure Bet

Garman is skeptical of AI bubble talk, at least when applied to infrastructure spending. "When people talk about a bubble, I think those are the deals that are most at risk," he told WIRED, referring to AI startups raising billion-dollar seed rounds with no lines of code. "Where it's a $3 billion valuation for a startup with no lines of code. Maybe, but maybe not."

AWS's own spending tells a different story. The company brought on 3.8 gigawatts of new data center power in the past 12 months. It recently announced an up to $50 billion investment in AI data centers for the US government. AI Factories, sovereign-scale infrastructure deployments inside customer data centers, represent the next frontier.

These are not edge appliances. Garman described AI Factories as "highly opinionated AWS-managed AI systems" that operate like private AWS Regions. The model originated with Project Rainier, the 500,000-Trainium2 build with Anthropic, and now extends to partnerships like the one with Humain in Saudi Arabia, which will deploy around 150,000 AI chips including Nvidia GB300s and Trainium processors.

"99.999% of customers will never purchase an AI factory," Garman acknowledged. Sovereign nations, defense agencies, and hyperscale enterprises represent the addressable market. Everyone else consumes the same architecture through AWS regions.

The capital intensity is deliberate. AI Factories require years of planning, billions in upfront investment, and operational expertise that only a handful of companies possess. The barriers to entry compound over time.

The Efficiency Narrative

October brought 14,000 layoffs at Amazon. The company framed the cuts as part of its AI investment push. Andy Jassy had telegraphed this months earlier, telling employees that certain roles would shrink as the technology matured. Nobody should have been surprised.

Garman offered a specific example during re:Invent: one AWS team expected a major codebase rewrite to require 30 people working roughly 18 months. With AI, six people completed the task in 71 days.

More than 1,000 anonymous Amazon employees signed a petition in November warning that the company's "aggressive" AI rollout could come at a cost to the environment. Garman's response focused on agent management, not environmental impact. "Agents are most effective when you ask them to do things that you actually know how to do yourself," he said. "So these are not replacements for people. They are ways to make people more effective at their jobs."

The distinction matters less than the trajectory. If six people can do what 30 did before, the organizational implications are straightforward regardless of whether you call it replacement or effectiveness.

Why This Matters

AWS is not chasing the AI trend. The company is attempting to industrialize it, from silicon fabrication to agent deployment, with each layer reinforcing the others. The strategic implications vary by stakeholder:

For Nvidia: Trainium4's NVLink Fusion compatibility signals coexistence, not capitulation. AWS wants to capture GPU-dependent workloads gradually, offering a migration path that preserves existing investments while shifting future training to Trainium. Jensen Huang should watch the Bedrock token mix more closely than the partnership announcements.

For enterprise buyers: The lock-in calculus has shifted. Agents that learn organizational patterns over months create switching costs that compound far beyond traditional infrastructure dependencies. The 12-month evaluation window for new platforms has become inadequate.

For AI startups: Garman's bubble skepticism targets you directly. "A $3 billion valuation for a startup with no lines of code" faces a platform player spending $50 billion on infrastructure and offering frontier model training for $100,000 annually. The capability gap between funded and deployed is about to matter.

For Anthropic: The relationship with AWS grows more complex. Amazon's $8 billion investment makes Anthropic the dominant model provider in Bedrock while Nova struggles for market share. How long does that arrangement remain stable if Nova 2's capabilities approach Claude's performance?

The cloud era abstracted infrastructure. The agent era, if Garman's vision holds, abstracts work itself. AWS is building the factory floor for that transition. Whether the agents perform as advertised matters less than whether enterprises believe they might.

❓ Frequently Asked Questions

Q: What is Trainium and how does it differ from Nvidia GPUs?

A: Trainium is AWS's custom AI chip designed specifically for training and running large language models. Unlike Nvidia's general-purpose GPUs, Trainium is optimized for AWS's cloud infrastructure and Bedrock platform. AWS claims it can reduce training and inference costs by up to 50% compared to equivalent GPU systems. Over 50% of Bedrock tokens already run on Trainium chips.

Q: What does NVLink Fusion compatibility mean for Trainium4?

A: NVLink Fusion is Nvidia's high-speed chip interconnect technology that lets different processors communicate rapidly. By building this into Trainium4, AWS allows customers to run Nvidia GPUs and Trainium chips in the same server racks. This creates a migration path: companies can keep existing Nvidia workloads while gradually shifting new training jobs to cheaper Trainium infrastructure.

Q: What's included in Nova Forge's $100,000 annual fee?

A: The fee covers access to Nova models at various training checkpoints, letting customers inject proprietary data during pre-training rather than just fine-tuning afterward. Training data and compute infrastructure cost extra. Amazon engineering assistance is also not included. The resulting custom model runs serverlessly on Bedrock and never leaves the customer's boundary.

Q: How do "frontier agents" differ from current AI coding assistants?

A: Current AI assistants like Copilot respond to individual prompts and require constant human oversight. Frontier agents operate autonomously for days or weeks, maintaining context across sessions, learning organizational preferences over time, and handling multiple tasks across repositories without supervision. AWS says after three to six months, these agents learn naming conventions, repo structures, and team patterns.

Q: What are AWS AI Factories and who are they for?

A: AI Factories are sovereign-scale AI infrastructure deployments inside customer data centers, operated exclusively for that customer. They function like private AWS Regions with access to managed services and foundation models. Garman said "99.999% of customers will never purchase" one. The target market is sovereign nations, defense agencies, and hyperscale enterprises with strict data residency requirements.