💡 TL;DR - The 30 Seconds Version

🔒 Nvidia published a forceful denial Tuesday in English and Chinese: no backdoors, kill switches, or spyware exist in their chips—days after China summoned staff over H20 security concerns.

🎯 China's regulators cited US proposals for location-tracking in advanced chips like the H100 and B200, asking Nvidia to prove the H20 doesn't contain remote shutdown capabilities.

💰 H20 chips generate billions quarterly for Nvidia despite being years-old tech; Trump's administration banned them in April, then reversed course in July after trade talks.

🏭 Beijing imposed 125% tariffs on US semiconductors and demands full chip traceability while Chinese chipmakers SMIC and Cambricon saw stock rises after the Nvidia confrontation.

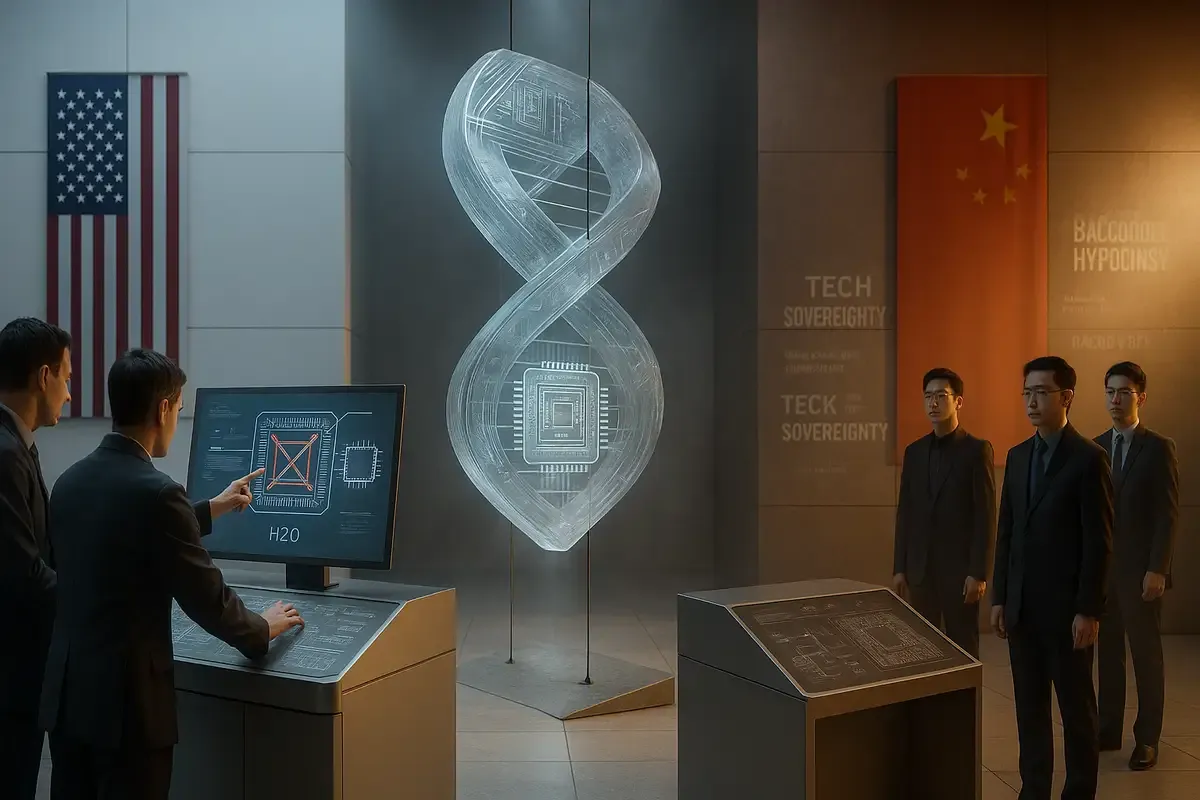

🌏 The backdoor debate exposes US policy contradiction—attacking Huawei for hidden vulnerabilities while proposing mandatory tracking in American chips threatens to derail trade negotiations.

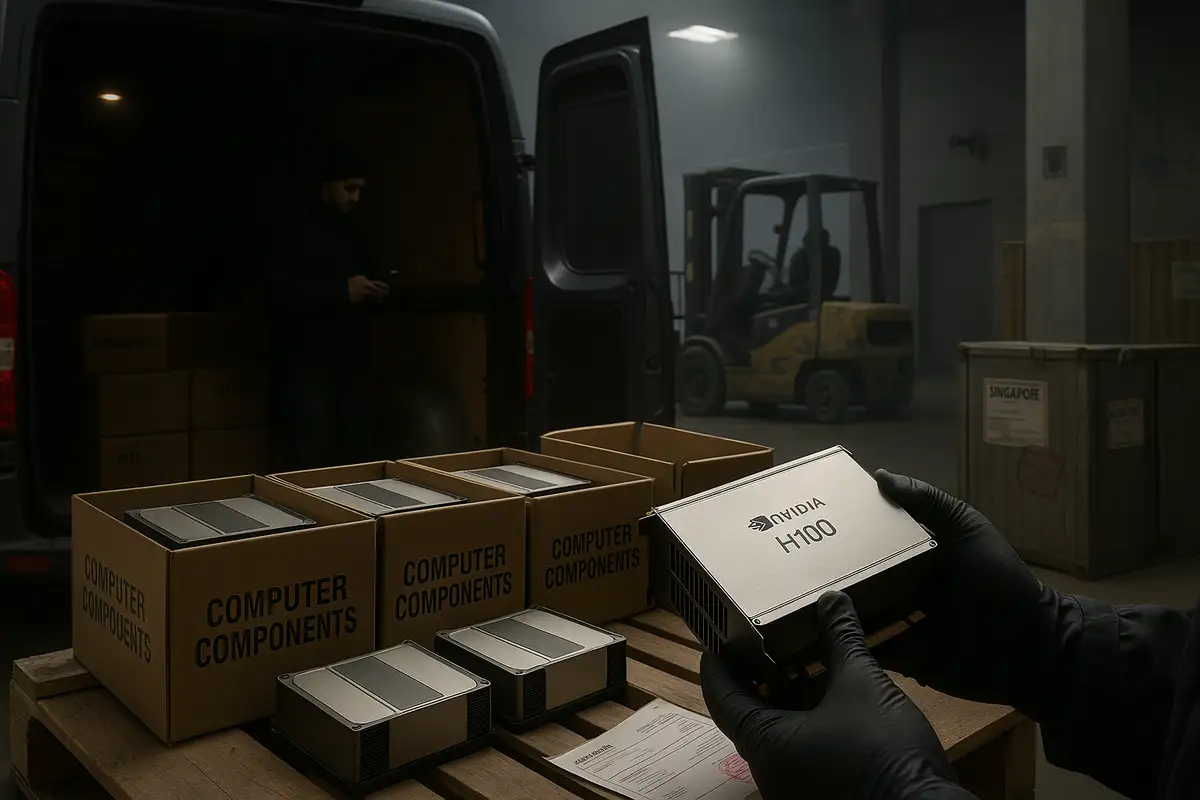

Nvidia came out swinging Tuesday. No backdoors, no kill switches, no spyware—the company said it straight up in both English and Chinese. This happened just days after Chinese regulators called in Nvidia staff to ask about security concerns with the H20 chip. The timing tells you everything.

China's Cyberspace Administration summoned Nvidia last week with a pointed question: do your chips contain hidden tracking and remote shutdown capabilities? The regulator cited US lawmakers who've been pushing for exactly those features in advanced semiconductors. Beijing wanted documents. They wanted answers. And they wanted them now.

The confrontation reveals a deeper irony that Chinese officials aren't shy about highlighting. For years, Washington warned allies against Huawei equipment, claiming hidden backdoors threatened national security. Now US policymakers want to mandate those same backdoors in American chips. As one Chinese analyst put it: "the thief shouting to catch the thief."

The H20 Saga

The H20 chip sits at the center of this mess. It's Nvidia's watered-down processor designed specifically for the Chinese market—what state media dismisses as "castrated" technology. Yet these chips still generate billions quarterly for Nvidia, even though they're years behind the company's cutting-edge offerings.

Trump's administration has played ping-pong with H20 exports. First approved, then banned in April, then approved again in July after trade talks. Commerce Secretary Howard Lutnick defended the flip-flopping, saying America wants Chinese developers "addicted to the American technology stack."

China's Commerce Ministry disputes this version of events. They claim the US "proactively" approved H20 sales and the chips weren't part of any trade-off for rare-earth magnets. Either way, Chinese tech giants like ByteDance and Tencent snapped them up before the brief ban hit.

Trust Issues Run Deep

David Reber, Nvidia's chief security officer, didn't mince words in his blog post. Building kill switches into chips would be "a gift to hackers and hostile actors." He compared it to buying a car where the dealership keeps a remote control for your parking brake—just in case they decide you shouldn't drive.

The comparison hits harder given history. Reber pointed to the NSA's Clipper Chip debacle of the 1990s, when the government tried embedding backdoor access in encryption systems. Security researchers quickly found flaws that malicious actors could exploit. The initiative collapsed, teaching the tech world that there's no such thing as a "good" backdoor.

Chinese commentary has been even sharper. Shen Yi from Fudan University called reliance on American technology "strategically perilous." A trending Weibo hashtag frames the H20 sales resumption as a deliberate attempt to delay China's chip development. One widely-shared post claims Washington only lifted the ban because Chinese firms were approaching breakthroughs—flooding the market with cheaper alternatives to undermine local innovation.

The Tracking Proposal

What triggered this confrontation? The proposed Chip Security Act, introduced to Congress in May, would require location-verification mechanisms on advanced chips like Nvidia's H100 and B200. Not the H20, interestingly. The technology would use "delay-based" verification, measuring signal travel time between trusted servers and target equipment.

Michael Kratsios, an architect of the White House AI action plan, told Bloomberg officials are discussing software or physical changes to track restricted chips better. He claims he hasn't personally talked to Nvidia or AMD about it.

But the damage is done. Chinese internet regulators now view any American semiconductor with suspicion. People's Daily called devices with location tracking "infected." Online discussions have shifted from technical specs to fundamental mistrust.

Beijing's Countermoves

China isn't just complaining. They've slapped 125% tariffs on US semiconductors. They're demanding full traceability for imported chips. And they're accelerating domestic chip development with renewed urgency.

The summons to Nvidia serves multiple purposes. It warns domestic firms to be cautious. It signals to global buyers that American chips might carry hidden vulnerabilities. And it pressures Jensen Huang, Nvidia's CEO who visited Beijing last month praising Chinese innovation, to influence Washington.

Chinese chipmakers like SMIC and Cambricon saw their stocks rise immediately after the Nvidia meeting became public. Investors are betting on homegrown alternatives, even if they can't yet match Nvidia's capabilities.

The Bigger Picture

Trump says the US and China are "getting very close to a deal." Treasury Secretary Scott Bessent confirms tariff truce talks. Trade Representative Jamieson Greer says they're "about halfway there" on easing China's rare-earth export controls.

Yet the chip tracking issue threatens to poison these negotiations. As Tom Nunlist from Beijing consultancy Trivium notes: "We started attacking Huawei because of secret backdoors, and now the US is openly suggesting we should legally mandate backdoors. What government would accept this?"

Nvidia finds itself trapped between Washington's export controls and Beijing's market leverage. China remains vital for revenue, but proving trustworthiness while following US law becomes increasingly impossible. The company can declare "no backdoors" all it wants. In this environment, technical truth matters less than geopolitical perception.

Ni Guangnan from the Chinese Academy of Sciences warns that unless China controls the entire semiconductor chain, foreign concessions mean nothing. Hu Xijin, former Global Times editor, sees H20 sales resumption not as generosity but as American weakness facing Huawei's progress.

Why this matters:

• The backdoor debate exposes a fundamental contradiction in US tech policy—demanding transparency from others while proposing surveillance capabilities in its own products undermines American credibility globally

• China's response shows how quickly technical dependencies become leverage points—what starts as export controls evolves into broader questions about technological sovereignty that other nations, including US allies, are watching closely

❓ Frequently Asked Questions

Q: What exactly is the H20 chip and how does it differ from Nvidia's regular chips?

A: The H20 is a stripped-down version of Nvidia's older AI processors, designed to comply with US export restrictions. It has about 20% of the computing power of Nvidia's top H100 chip. Despite being years behind current technology, it still generates billions in quarterly revenue from Chinese buyers who need any AI computing they can get.

Q: What was the Clipper Chip incident from the 1990s?

A: The NSA's Clipper Chip (1993) was an encryption device with a built-in government backdoor through a key escrow system. Security researchers found flaws that hackers could exploit. The program failed completely, proving that intentional backdoors create vulnerabilities that bad actors can use. It became the textbook example of why backdoors don't work.

Q: How would the proposed chip tracking technology actually work?

A: The proposed system uses "delay-based" location verification. It measures how long signals take to travel between trusted servers and the chip. Based on these millisecond differences, the system calculates the chip's location. The Chip Security Act would require this on advanced chips like the H100 and B200, but notably not the H20.

Q: Who specifically is pushing for chip tracking in the US government?

A: The Chip Security Act was introduced to Congress in May 2025. Michael Kratsios, an architect of the White House AI action plan, confirmed officials are discussing tracking features. Both houses of Congress have proposed similar ideas. However, no formal rule exists yet, and technical requirements haven't been established.

Q: What's the timeline of the H20 export ban and reversal?

A: The H20 was initially approved for export to China. Trump's administration banned it in April 2025, costing Nvidia up to $5.5 billion that quarter. After trade talks in July, the ban was lifted. Commerce Secretary Lutnick said the goal was getting Chinese developers "addicted to the American technology stack."

Q: Can Chinese chips actually compete with Nvidia's technology?

A: Not yet at the high end. Chinese firms like SMIC and Cambricon are years behind Nvidia's best chips. However, they're catching up on mid-range processors. Chinese companies still bought H20s because domestic production can't meet demand. Beijing claims their progress scared the US into resuming H20 sales.

Q: How do other countries view the US chip tracking proposal?

A: The proposal raises concerns beyond China. Tom Nunlist from Trivium consultancy notes the irony: the US attacked Huawei for potential backdoors, now proposes mandating them. He asks, "What government would accept this?" Even US allies might hesitate to buy chips with built-in surveillance, seeing it as a sovereignty risk.