💡 TL;DR - The 30 Seconds Version

👉 Canada killed its digital services tax Sunday night after Trump ended trade talks, saving Google, Meta, and Amazon $2-3 billion due Monday.

📊 The tax would have charged tech firms 3% on Canadian revenue above $14.6 million, applied retroactively to 2022.

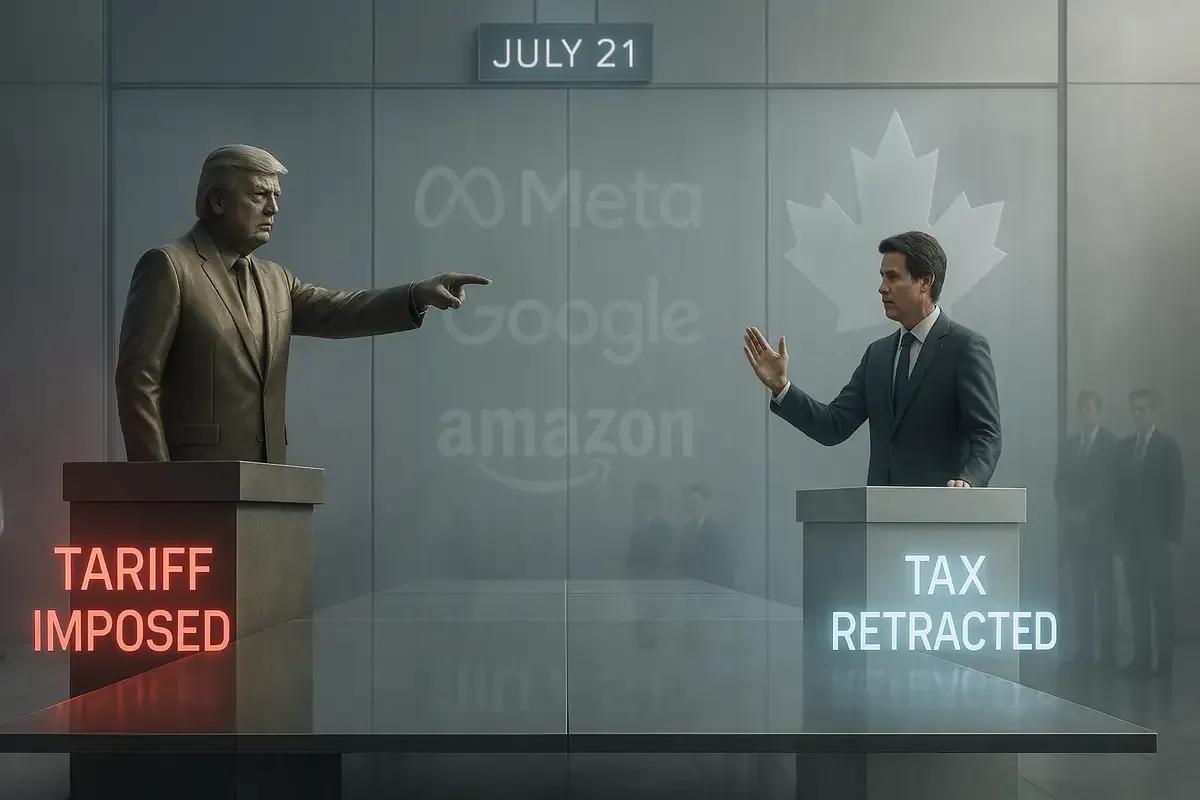

🗓️ Both countries agreed to restart negotiations with a July 21 deadline after Trump and Carney spoke Sunday.

🏭 Canada depends heavily on US trade with $762 billion in annual commerce and 75% of exports going south.

🎯 Trump already hit Canada with 50% steel tariffs, 25% auto tariffs, and 10% on most other goods.

🌍 The quick surrender signals other countries may face similar pressure to drop taxes targeting US tech companies.

Canada pulled its digital services tax Sunday night, just hours before payments were due from American tech companies. The move came after President Trump canceled trade talks Friday, calling the tax "a direct and blatant attack on our country."

The tax would have hit Google, Meta, Amazon, and other tech firms with a 3% levy on revenue from Canadian users. The bill was retroactive to 2022, meaning companies faced roughly $2-3 billion in payments due Monday.

Trump's threat worked. Prime Minister Mark Carney called the president Sunday, and both sides agreed to restart negotiations with a July 21 deadline for a deal.

Trump's trade war gets personal

This latest spat shows how Trump uses trade talks as leverage. He's already slapped Canada with 50% tariffs on steel and aluminum, 25% on cars, and 10% on most other imports. Now he threatened even more tariffs within a week if Canada didn't back down.

The digital tax became a flashpoint because it targeted American companies specifically. While other countries have similar taxes, Canada's version applied retroactively—something that particularly annoyed Trump's treasury secretary, who called it discriminatory.

Canada's awkward position

Canada finds itself in a tough spot. It's America's second-largest trading partner, with $762 billion in trade last year. About three-quarters of Canadian exports go to the US, making it heavily dependent on American markets.

The digital tax was supposed to address a real problem—tech companies making billions from Canadian users while paying minimal taxes in Canada. The tax was expected to bring in $4.2 billion over five years.

But facing Trump's ultimatum, Canada chose trade relations over tax revenue. Finance Minister François-Philippe Champagne will introduce legislation to formally scrap the tax.

Winners and losers

Trump scored a clear win. He forced Canada to abandon a policy it had defended for months, just by threatening to walk away from talks. Tech companies also benefit, avoiding billions in retroactive payments.

Daniel Béland, a political science professor at McGill University, called it "a clear victory for both the White House and big tech." He noted that Trump "forced PM Carney to do exactly what big tech wanted."

Canada's retreat makes Carney look vulnerable to Trump's pressure tactics. The prime minister had been "polite but firm" during a White House visit in May, but this episode shows the limits of that approach.

The bigger picture

This dispute fits Trump's broader trade strategy. He's using tariffs and threats to force concessions from trading partners, often targeting specific policies he dislikes.

The digital tax fight also reflects tensions over how to tax multinational tech companies. Many countries want these firms to pay more, but Trump sees such taxes as unfair to American businesses.

Canada's capitulation may encourage other countries to resist similar taxes. The European Union faces its own deadline to avoid 50% US tariffs, and digital taxes are likely to be part of those discussions.

What's next

Canada and the US now have three weeks to hammer out a deal. That's not much time for complex trade negotiations, especially given the stakes involved.

Trump has shown he's willing to use aggressive tactics to get what he wants. Canada's quick surrender on the digital tax suggests it will face pressure to make other concessions too.

The July 21 deadline coincides with Trump's broader trade strategy. He's set similar deadlines for dozens of other countries to avoid "reciprocal" tariffs, creating multiple pressure points for negotiations.

Why this matters:

- Trump's threat-based diplomacy works—at least with close allies who can't afford to lose access to US markets

- The digital tax retreat shows how economic dependence limits smaller countries' policy options, even on domestic issues

❓ Frequently Asked Questions

Q: What exactly is a digital services tax?

A: A tax on revenue from online services like search, social media, and digital advertising. Canada's version charged 3% on revenue above $14.6 million annually from Canadian users. Unlike regular corporate taxes on profits, this tax hits gross revenue.

Q: How much would the tech companies have actually paid?

A: Between $2-3 billion total, with payments retroactive to 2022. The first installment was due Monday, June 30. Google, Meta, Amazon, Apple, and other major platforms would have split the bill based on their Canadian revenue since 2022.

Q: Why did Canada create this tax in the first place?

A: Tech companies earn billions from Canadian users but often pay minimal Canadian taxes by routing profits through other countries. The tax was expected to generate $4.2 billion over five years to address this gap.

Q: Do other countries have similar digital taxes?

A: Yes, including the UK, France, and several EU countries. But Canada's tax was unusual because it applied retroactively to 2022. Most other digital taxes only apply to future revenue, not past earnings.

Q: What other tariffs has Trump put on Canada?

A: Trump imposed 50% tariffs on Canadian steel and aluminum, 25% on automobiles, and 10% on most other imports. He also threatened separate 25% tariffs on all Canadian goods under anti-fentanyl measures, though some products remain protected.

Q: How important is Canada to US trade?

A: Canada is America's largest customer, buying $349 billion in US goods last year. It's also the second-largest trading partner overall at $762 billion in total trade. About 75% of Canadian exports go to the US.

Q: What happens if they don't reach a deal by July 21?

A: Trump could impose the new tariff rates he threatened, potentially making Canadian goods much more expensive in the US. The July 21 deadline also coincides with Trump's broader trade strategy targeting dozens of other countries.

Q: Will Canada bring back the digital tax later?

A: Unlikely in the near term. Canada's finance minister will introduce legislation to formally repeal the Digital Services Tax Act. Bringing it back would risk another confrontation with Trump and potentially other trading partners.