Apple Called Google's AI Nonsense. Then Apple Bought It.

Apple signed a multiyear deal with Google to power Siri using Gemini AI after failed talks with Anthropic and OpenAI. Two major updates coming in 2026.

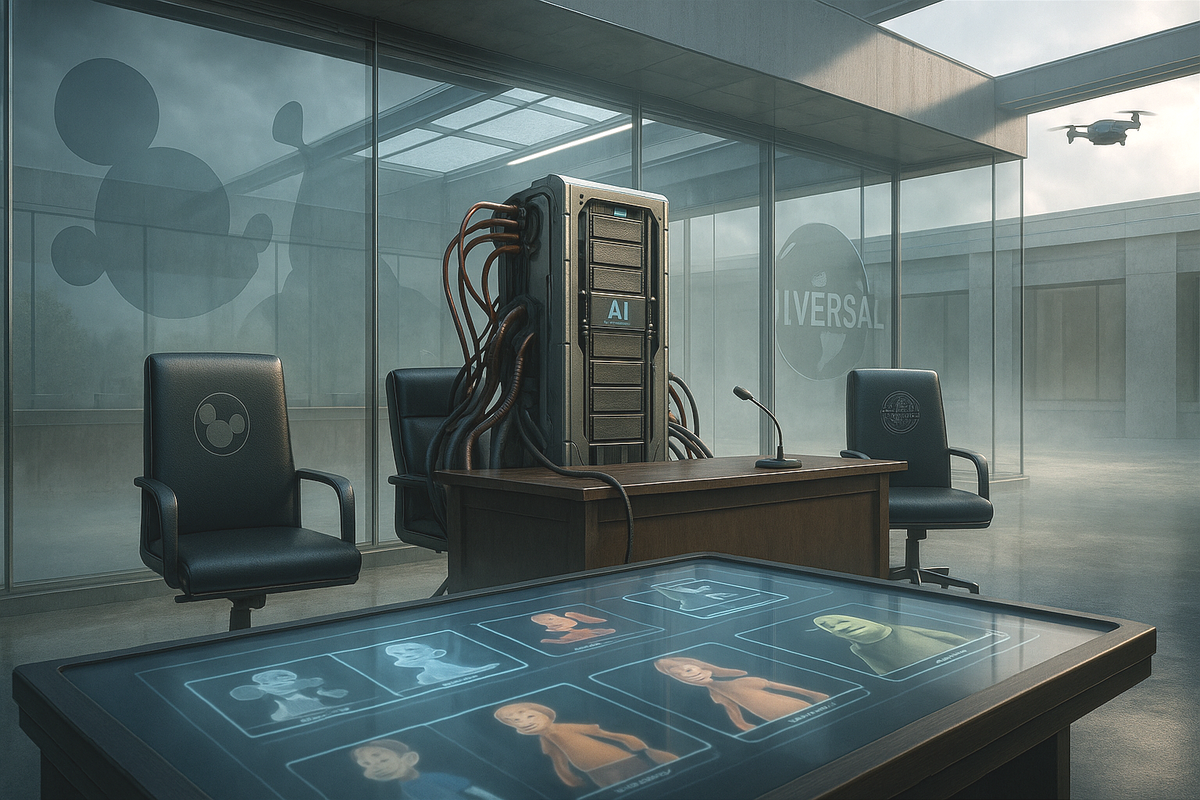

Disney sent Google a cease-and-desist for AI copyright infringement on Wednesday. On Thursday, it handed 200 characters to OpenAI's Sora and wrote a billion-dollar check. The logic reveals how Hollywood plans to survive the flood.

Bob Iger faced a choice familiar to media executives watching their empires erode: fight the technology threatening to turn your gold into gravel, or find a way to cash out before it does. On Thursday, Disney announced a $1 billion investment in OpenAI and a three-year licensing deal that hands more than 200 iconic characters to Sora, the generative video platform that sparked industry outrage just two months ago.

In October, Sora launched with an opt-out policy that let users generate videos of any character, any celebrity, any copyrighted property until rights holders demanded removal. Hollywood's talent agencies condemned it. SAG-AFTRA scrambled to respond. The Motion Picture Association called for "immediate and decisive action" against infringement.

Disney opted in anyway, enthusiastically enough to write a billion-dollar check.

The Breakdown

• Disney invests $1 billion in OpenAI for 0.6% equity stake, licensing 200 characters to Sora while keeping actor likenesses off the table

• Hours before the OpenAI deal, Disney sent Google a cease-and-desist for AI copyright infringement, setting a market floor through litigation

• User-generated character videos will appear on Sora and Disney+ starting early 2026 under the three-year licensing agreement

• Other studios now face pressure to match Disney's terms or watch competitors monetize AI shifts while bearing the same disruption costs

Strip away the press release language about "responsible AI" and "protecting creators," and the deal structure tells a cleaner story. Disney gets a minority equity stake in a company valued at $157 billion while OpenAI gets the most valuable character library in entertainment history, plus the legitimacy that comes with a Disney partnership.

A billion dollars buys roughly 0.6% of OpenAI at current valuation. Disney's market cap hovers around $200 billion, meaning this investment represents 0.5% of Disney's enterprise value for access to IP that generates tens of billions annually through merchandise, parks, and media licensing. The warrants for additional equity sweeten the pot, but the basic exchange rate favors OpenAI.

What Disney receives in return: the ability to filter fan-generated Sora videos for Disney+, API access to build unspecified "new experiences," and ChatGPT for employees. The streaming feature Iger hinted at during November's earnings call turns out to be user-generated content featuring Disney characters. A cost center wearing a product label.

The 200-character roster includes Mickey Mouse, Darth Vader, and the Frozen princesses. But notice who's missing. No actor likenesses. No voices. Disney gave OpenAI the cartoon characters and kept anything that might trigger a SAG-AFTRA grievance locked in a vault.

On Wednesday evening, hours before the OpenAI announcement, Disney's attorneys sent Google a cease-and-desist letter alleging copyright infringement "on a massive scale." The accusation: Google copied Disney's works without approval to train AI models, then used those models to exploit and distribute protected content.

Disney is suing one AI company for training on its IP while investing in another AI company to generate content from that same IP. The split comes down to who signs the check.

The strategy makes sense once you see it clearly. By partnering with OpenAI, Disney sets a market rate for character licensing in generative AI. Future talks with Google, Midjourney, and whoever else emerges will reference this deal as the baseline. The lawsuits continue not despite the partnership but because of it. Lawsuits set the floor while licensing captures the upside.

The Midjourney lawsuit Disney filed alongside Universal in July called that platform a "bottomless pit of plagiarism." Sora's October launch exhibited identical behavior, generating unauthorized character content until rights holders complained. The difference now is a wire transfer and a press release.

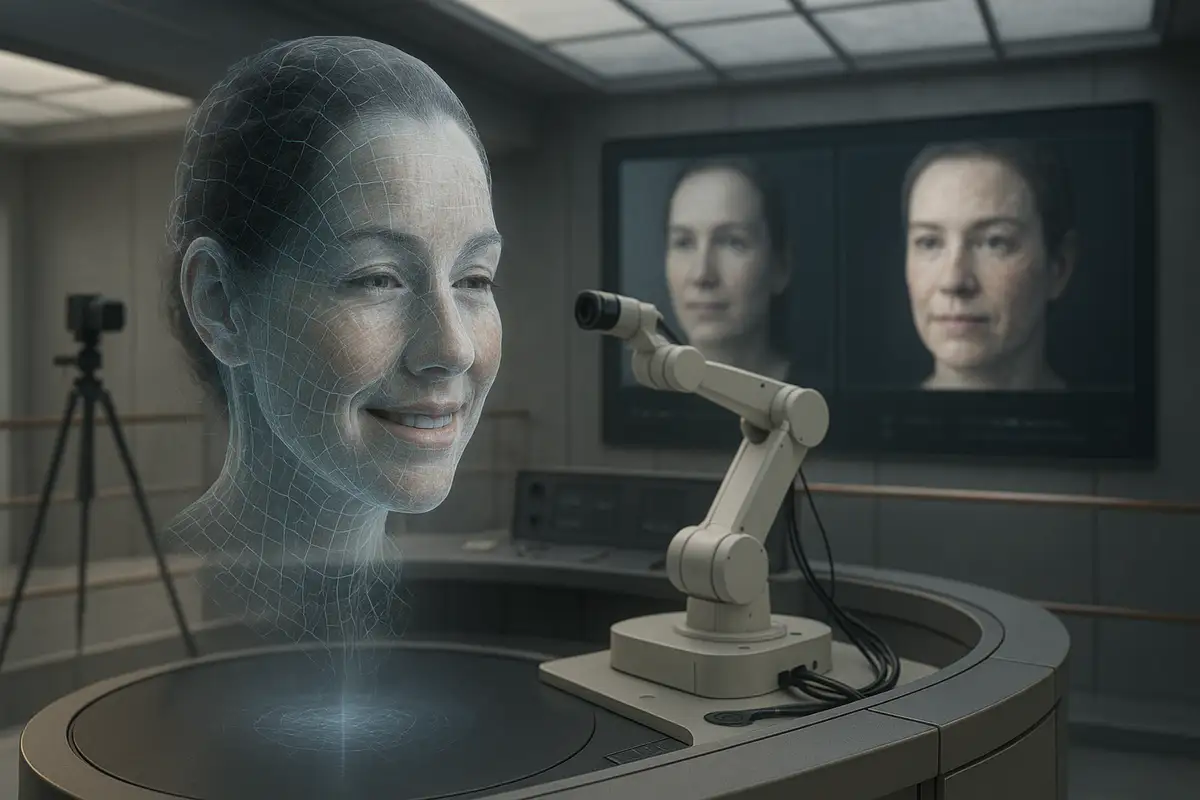

Consider what Disney has actually agreed to distribute. Starting in early 2026, Sora users will generate short videos featuring Disney characters based on text prompts. Whatever constraints OpenAI implements, the output volume will be enormous, millions of riffs on Darth Vader, Elsa, and Iron Man flooding social platforms and, remarkably, Disney+ itself.

The streaming piece reveals more than Disney probably intended. The company will host "curated" fan-generated Sora content alongside its professionally produced library. The company that built its brand on quality control and narrative consistency will now showcase algorithmically generated character content of wildly variable quality right next to Pixar features. The filtering language suggests human oversight, but at scale, nobody's watching every video. They're building a fence around a garbage dump.

Here's what nobody's discussing. Every AI-generated Mickey Mouse video trains users to expect Disney characters as raw material for personal expression rather than carefully guarded narrative properties. Think about the plastic gleam of a Mickey action figure on a Target shelf, the one that costs $24.99 because Disney's brand management ensures Mickey means something specific. That figure competes against whatever a twelve-year-old generates on their iPad in thirty seconds. The scarcity that underpins licensing value, the reason Disney can charge theme parks, merchandise partners, and media companies premium rates, depends on controlled access. Sora blows the doors off.

Disney's old licensing model charged partners for the privilege of using its characters. When anyone can generate Mickey doing anything, the brand falls apart. Not immediately. But a parent scrolling past AI-generated Mickey content on Disney+ doesn't distinguish between official and user-generated the way a licensing executive does. The brand bleeds at the edges.

The entertainment industry has been waiting to see who would break ranks first on AI licensing. Lionsgate's September 2024 deal with Runway allowed training on its 20,000-title library but stopped short of consumer-facing character work. Disney went further, setting both investment terms and licensing scope that will shape every deal that follows.

Other studios face an ugly choice. Match Disney's terms and speed up the flood of AI-generated content from professional IP. Refuse and watch competitors cash in while the wave hits you anyway. Remember what happened to the music labels. They spent years suing Napster, suing LimeWire, suing individual teenagers, and by the time they cut deals with iTunes and Spotify they'd already lost control of the economics. The studios watched that collapse. Now they're racing to sign term sheets before they become the next cautionary tale, and the race itself is shredding their leverage.

What the agencies said in October hasn't changed. WME opted out all clients from Sora over genuine concern about talent exploitation. CAA called it misuse of emerging technology. UTA demanded exploitation protections. Disney's deal excludes actor likenesses precisely because those concerns remain unresolved. But character licensing creates pressure downstream. If Disney characters are fair game for generative video, the concept artist in Burbank who spent fifteen years learning to draw Elsa should probably start updating her resume now. The animator whose hand brought Baymax to life watches a teenager replicate that work with a text prompt.

Sam Altman telegraphed this path in his October mea culpa, when he promised "more granular control over generation of characters" and noted that "a lot of rightsholders" were "very excited for this new kind of interactive fan fiction." The framing tells you everything. Fan fiction has historically existed in legal gray zones, tolerated because enforcement costs exceeded damages. Sora makes fan fiction commercial, scalable, and worth money, which raises the question of who pockets the cash when a million users generate a million Groots.

Both companies' statements emphasize commitment to responsible use, creator protection, and user safety. This language serves a specific function: a shield against lawmakers and bad press.

OpenAI has committed to "maintaining robust controls to prevent the generation of illegal or harmful content." What counts as harmful remains undefined. Character misuse that damages brand value? Probably not covered. Content that competes with official Disney work? Almost certainly not addressed. The controls will prevent pornographic Mickey Mouse content. Beyond that, OpenAI decides.

Disney's "shared commitment to respecting the creative industries" comes from a company that has spent decades extending copyright terms, aggressively enforcing trademark rights, and crushing derivative works through lawsuits. The same legal apparatus that sued daycares for painting characters on walls will now coexist with a platform generating millions of unauthorized character riffs daily. The tension resolves simply: paid infringement becomes licensing, appropriation becomes partnership. The ethical framework bends to fit the check.

When this licensing agreement expires, Disney will have normalized AI-generated character content across its platform and social media. OpenAI will have established Disney-level partnerships as the industry standard. The talent likeness and voice exclusions will have faced pressure from competitive deals, user demand, and the steady improvement of synthetic media.

The content creators that Hollywood unions fought to protect during 2023's strikes will compete against AI-augmented amateur content that studios can distribute without production costs. Disney+ hosting Sora-generated shorts alongside Pixar features doesn't complement the catalog. It A/B tests whether audiences care about the difference.

For OpenAI, Disney serves as proof and marketing. The most brand-conscious company in entertainment has blessed generative AI for character content. Every objection from smaller rights holders now faces a simple response: Disney agreed. Every regulatory concern about creative industry harm meets the same counter: Disney invested a billion dollars.

Iger called this an "important moment for our industry." He's right, though perhaps not in the way he intended. Disney has shown that even the most aggressive IP defender will trade long-term brand control for short-term cash when the alternative is watching the flood come without getting paid.

The mouse made its choice. Somewhere in Burbank, a concept artist is scrolling job listings. The flood of AI-generated Elsas and Groots hasn't started yet, but she can hear the water rising.

For content creators and Hollywood talent: Disney's exclusion of actor likenesses provides temporary cover, but character licensing sets the template. Expect pressure on performer rights as studios seek competitive parity with AI-generated content economics. The three-year deal window suggests renegotiation will coincide with significant advances in synthetic media capability.

For competing studios and rights holders: The $1 billion investment and 200-character scope sets market expectations for AI licensing deals. Refusing similar arrangements means watching competitors cash in on technology shifts while bearing the same disruption costs. The panic that broke the music industry is back, wearing a different mask.

For investors tracking media and AI convergence: Disney's equity stake signals that major entertainment companies view AI platforms as hedges rather than threats. Watch for acquisition activity as studios seek to own rather than license generative capability. The real question: can Disney maintain character value as AI-generated content floods its own distribution channels?

Q: What can users actually create with Disney characters on Sora?

A: Users can generate short, text-prompted videos featuring more than 200 animated characters from Disney, Marvel, Pixar, and Star Wars. This includes costumes, props, vehicles, and iconic environments. ChatGPT Images will also create still images using the same IP. The feature launches in early 2026. Think fan-made clips of Darth Vader dancing or Elsa in custom scenarios, not full episodes or films.

Q: Why did Disney exclude actor likenesses from the deal?

A: SAG-AFTRA fought hard during the 2023 strikes to protect performers from AI exploitation. When Sora launched in October 2024, talent agencies including WME, CAA, and UTA condemned its use of celebrity likenesses. By limiting the deal to animated and masked characters, Disney avoids union grievances and potential contract violations with actors who played Marvel and Star Wars roles.

Q: Can OpenAI train its AI models on Disney's film library?

A: No. The deal explicitly does not allow OpenAI to train its machine learning models on Disney IP. This is a licensing agreement for output generation, not a training data agreement. Compare this to Lionsgate's September 2024 deal with Runway, which did grant access to 20,000 titles for model training. Disney kept training rights off the table entirely.

Q: What do the warrants in the deal mean for Disney?

A: Beyond the $1 billion equity investment, Disney received warrants to purchase additional OpenAI shares at a set price. If OpenAI's valuation rises above $157 billion before the warrants expire, Disney can buy more equity at a discount. It's a hedge: if generative AI takes off, Disney profits from the upside rather than just suffering the disruption.

Q: Will the AI-generated videos on Disney+ be labeled as user content?

A: The press release says Disney will show "curated selections" of Sora-generated fan videos but doesn't specify labeling requirements. How Disney distinguishes AI-generated content from professionally produced Pixar and Marvel shorts remains unclear. The filtering process, quality standards, and presentation format haven't been disclosed. Expect more details closer to the early 2026 launch.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.