Two subsidy races are reshaping the AI contest.

A six-figure electricity bill just became China’s newest industrial-policy lever. Provinces like Gansu, Guizhou, and Inner Mongolia are slashing data-center power costs by up to 50%—but only for facilities running domestic chips from Huawei and Cambricon. Centers using Nvidia hardware are excluded. The message is blunt: cheaper electrons if you choose Chinese silicon.

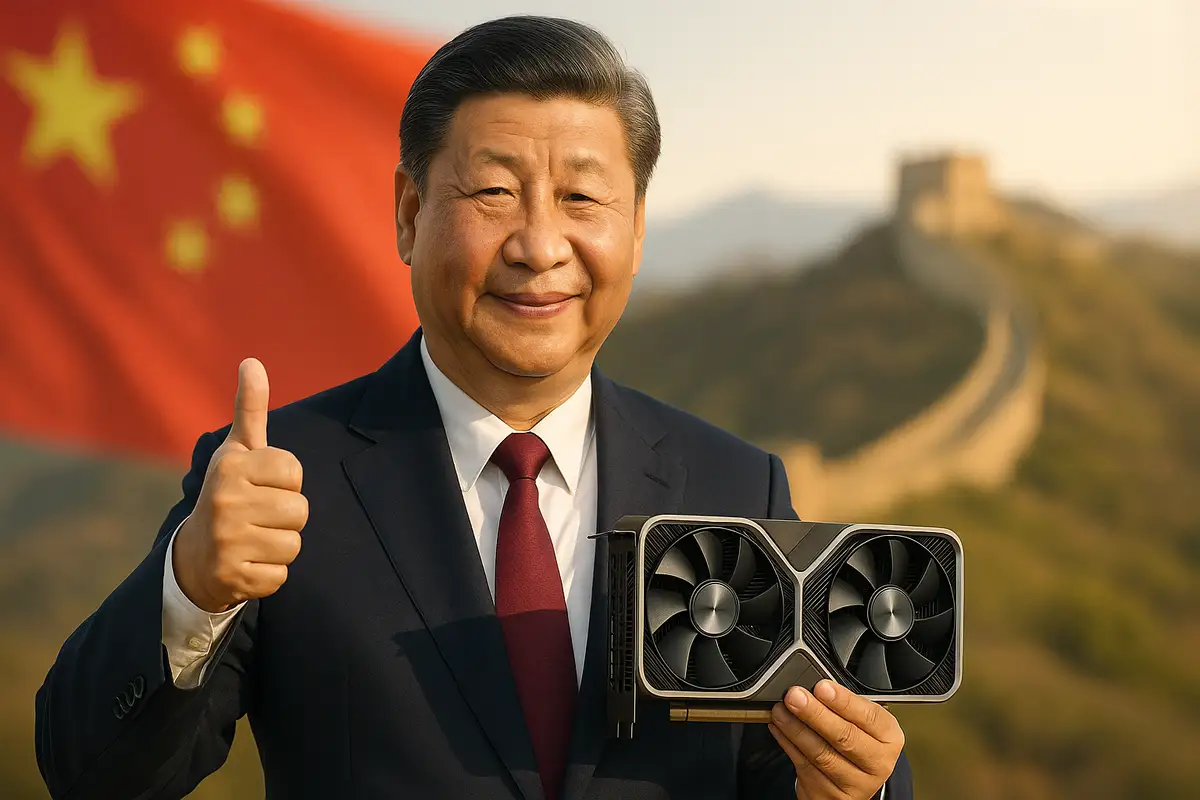

Days before President Trump met Xi Jinping in Busan on October 30, Nvidia CEO Jensen Huang pushed for permission to export the company’s Blackwell chips to China. Top advisers—including Secretary of State Marco Rubio—argued the move would erode U.S. security. Trump didn’t raise the issue with Xi, then told “60 Minutes” that America wouldn’t give its most advanced AI chips “to other people.” That door now looks shut.

The Breakdown

• China cuts data center electricity bills up to 50% in Gansu, Guizhou, Inner Mongolia—only for facilities using Huawei and Cambricon chips

• Trump blocked Nvidia's Blackwell export push before Oct 30 Xi meeting after unified opposition from Rubio, Lutnick, and Greer

• Chinese chips consume 30-50% more power than Nvidia H20 for same output; subsidies mask efficiency gap while domestic capability scales

• Post-subsidy power drops to 5.6 cents per kWh versus 9.1 cent US average; some packages cover entire year of operating costs

The efficiency tax

China’s subsidies are designed to mask a performance gap. Experts say generating the same output on current Chinese accelerators consumes roughly 30%–50% more electricity than Nvidia’s H20. Huawei’s 910c Ascend compensates by clustering more chips together, which compounds the power draw. Beijing is effectively paying to narrow that gap fast.

For ByteDance, Alibaba, and Tencent, the economics are immediate. Coastal power is pricier; inland provinces are cheaper and awash in capacity. With new grants, bills can fall to roughly 0.4 yuan (about 5.6¢) per kWh—below the U.S. industrial average—and some packages can cover a year of operating costs, according to people familiar. China’s centralized grid is cheaper, greener, and not capacity-constrained in the near term. It’s a bridge to sovereignty.

The Busan calculus

Huang’s argument is straightforward: abandon China now and Nvidia risks irrelevance there when local chips approach parity. He has called the market “irreplaceable” and highlighted China’s share of AI researchers. But the Busan deliberations cut against him. Advisers warned that exporting Blackwell would accelerate China’s data-center capabilities and undermine U.S. leverage just as Washington negotiates over other strategic inputs, from rare-earth magnets to cloud access. The president sided with the hawks. That choice sets the pace of decoupling.

The near-term business hit is real. Nvidia hasn’t sold any H20 chips in China since April, after local authorities told companies not to buy them following a contentious U.S. revenue-sharing condition. Meanwhile, the next-gen B200 promises a step-change in capability—about three times H100’s training performance and roughly 15 times for inference—so closing off China could mean ceding tens of billions in potential sales. Even a down-clocked “for China” Blackwell would be formidable.

Subsidy math vs. sovereignty timeline

Beijing’s playbook is familiar: subsidize through a capability trough, then taper as domestic champions catch up—think solar and EVs. What’s new is the precision. Target the operating line—electricity—where Chinese chips are weakest, and make the adoption decision easy for platform companies. It’s not forever. It just needs to last until the silicon improves.

Washington’s move is equally targeted. Don’t try to block everything; tighten on the frontier. Keeping Blackwell at home raises China’s cost of progress and forces more indigenous design rather than incremental adaptation of Nvidia’s stack. It slows, but doesn’t stop.

The risks are different on each side. China’s incentive math breaks if the efficiency gap persists for too long; provincial budgets can’t underwrite 30%–50% more power per token at hyperscale indefinitely. The bet is that Huawei, Cambricon, and others converge within a few product cycles, before subsidies become fiscally painful.

For the U.S., the risk is locking Nvidia out of an ecosystem that will re-architect around its absence. Every quarter outside China incentivizes alternatives in software, networking, and training regimes that make re-entry harder later. Markets route around missing parts.

The next inning

Expect tiered policies. Beijing will refine who gets what discount—and for which chips. Washington will iterate export rules as quickly as Nvidia iterates SKUs. Both sides know the window. Neither wants to blink.

This is what industrial policy looks like in the AI era. It runs on semiconductors and electricity.

Why this matters:

- Industrial policy now runs through power bills and export licenses. Subsidies and controls—not just product specs—will decide where the next trillion dollars of AI infrastructure lands.

- Market access increasingly requires technical compromise. Nvidia’s path back into China likely involves architecture constraints or revenue-sharing that turn private roadmaps into instruments of statecraft.

❓ Frequently Asked Questions

Q: Why did Nvidia stop selling H20 chips in China in April?

A: In August 2024, the White House reversed an export ban but required Nvidia to share 15% of China revenue with the US government. Some lawyers called this an unconstitutional export tax. Chinese authorities then told companies not to buy the chips, effectively killing the market. Nvidia hasn't sold any H20s in China since.

Q: What makes Blackwell chips so much more powerful than previous generations?

A: Nvidia's B200 GPU delivers roughly three times the performance of the H100 chip for training AI models and about 15 times the capability for inference (running AI models). Even a 30-to-50 percent downgraded version designed for China would represent a major upgrade over what Chinese companies can currently access.

Q: How can China offer cheaper electricity than the US?

A: China's centralized grid provides more uniform pricing. Energy-rich provinces like Gansu and Inner Mongolia offer industrial rates around 5.1 cents per kWh before subsidies, versus a 9.1-cent US average. The new subsidies push costs down to roughly 5.6 cents. US rates vary widely by state due to fragmented regional grids.

Q: What's China's long-term strategy with these subsidies?

A: Beijing is using the same playbook it applied to solar panels and electric vehicles: subsidize domestic producers through the capability gap until they reach competitive parity with foreign technology. The subsidies buy time for companies like Huawei and Cambricon to improve chip efficiency before the costs become fiscally unsustainable at scale.

Q: Could Nvidia still get permission to export Blackwell chips to China?

A: Trump mentioned in August he'd consider approving a Blackwell with 30-to-50 percent reduced capabilities. Huang continues lobbying, especially ahead of Trump's planned April visit to China. However, any approval would likely require architecture constraints or revenue-sharing arrangements that make Nvidia's roadmap serve US strategic interests.