Moltbot Left the Door Open. Tesla Bet the Factory.

Moltbot exposed 1,862 servers without authentication. Tesla discontinues flagship cars for unproven robots. Airtable launches AI agents amid platform complaints.

China announced Nvidia violated antitrust law precisely as US-China trade talks resumed in Madrid. Beijing's regulatory timing exposes the impossible bind facing tech giants caught between competing sovereign demands over AI chip access.

💡 TL;DR - The 30 Seconds Version

👉 China announced Monday that Nvidia violated antitrust law, timing the ruling to coincide with US-China trade negotiations in Madrid.

📊 Beijing's case stems from Nvidia's 2020 Mellanox acquisition worth $7 billion, where China required guaranteed chip supplies to Chinese customers.

🏭 US export controls since 2022 forced Nvidia to halt advanced AI chip sales to China, creating irreconcilable legal obligations.

🌍 Sources told Financial Times that SAMR reached its conclusion weeks ago but waited for maximum negotiating leverage.

💰 Potential fines could reach $1.7 billion based on China's 13% share of Nvidia's $17 billion revenue from the country.

🚀 The regulatory pressure may force Nvidia to choose between markets, accelerating tech decoupling both governments claim to oppose.

Beijing’s preliminary ruling puts the world’s top AI-chip supplier squarely in the middle of U.S.–China bargaining over tariffs, TikTok, and access to advanced semiconductors.

China's market regulator dropped news Monday that Nvidia violated anti-monopoly law. The timing? Not subtle. US and Chinese officials were entering their second day of trade negotiations in Madrid when Beijing's State Administration for Market Regulation released its preliminary findings on Nvidia's 2020 Mellanox acquisition.

This wasn't about due process. Sources told the Financial Times that SAMR actually reached its conclusion weeks ago. They just waited for the Madrid talks to announce it. Classic leverage play—give Beijing a regulatory hammer against America's most valuable AI company right as Treasury Secretary Scott Bessent and Vice Premier He Lifeng hash out semiconductor access.

Nvidia shares dropped 2.1% in pre-market trading. The company declined to comment, which probably says enough.

Here's where it gets legally fascinating, if you're into impossible contradictions. When China approved Nvidia's $7 billion Mellanox deal in 2020, they demanded guarantees. Nvidia had to promise continued chip supplies to Chinese customers without discrimination. Seemed reasonable at the time.

Then US export controls kicked in during 2022. Washington basically forced Nvidia to stop selling its most advanced AI accelerators to China. So now you've got Nvidia caught between two sovereign demands that can't both be satisfied.

Beijing says Nvidia breached its commitments by letting US national security override Chinese market access. Washington says the company correctly followed American export compliance. Both sides are technically right under their own legal frameworks. Both create impossible positions for any multinational tech company.

It's like being ordered to drive straight through a brick wall, then getting tickets from two different traffic cops for the same collision.

Monday's announcement fits a pattern that's been building for weeks. Trump administration blacklisted 23 Chinese companies Friday. Beijing responded with both the Nvidia finding and weekend anti-dumping probes targeting US analog chip suppliers like Texas Instruments.

"Both sides appear to be building leverage to negotiate from a more favorable position, but they're doing this through very calculated moves because they understand the stakes," strategic advisory firm GreenPoint's Alfredo Montufar-Helu told Reuters. Translation: everyone's collecting regulatory ammunition before sitting down to bargain.

The SAMR timing particularly shows how sophisticated this leverage game has become. You announce an antitrust violation right as negotiators discuss the exact terms for Nvidia's modified AI chip sales to China. It's diplomatic signaling with legal consequences attached.

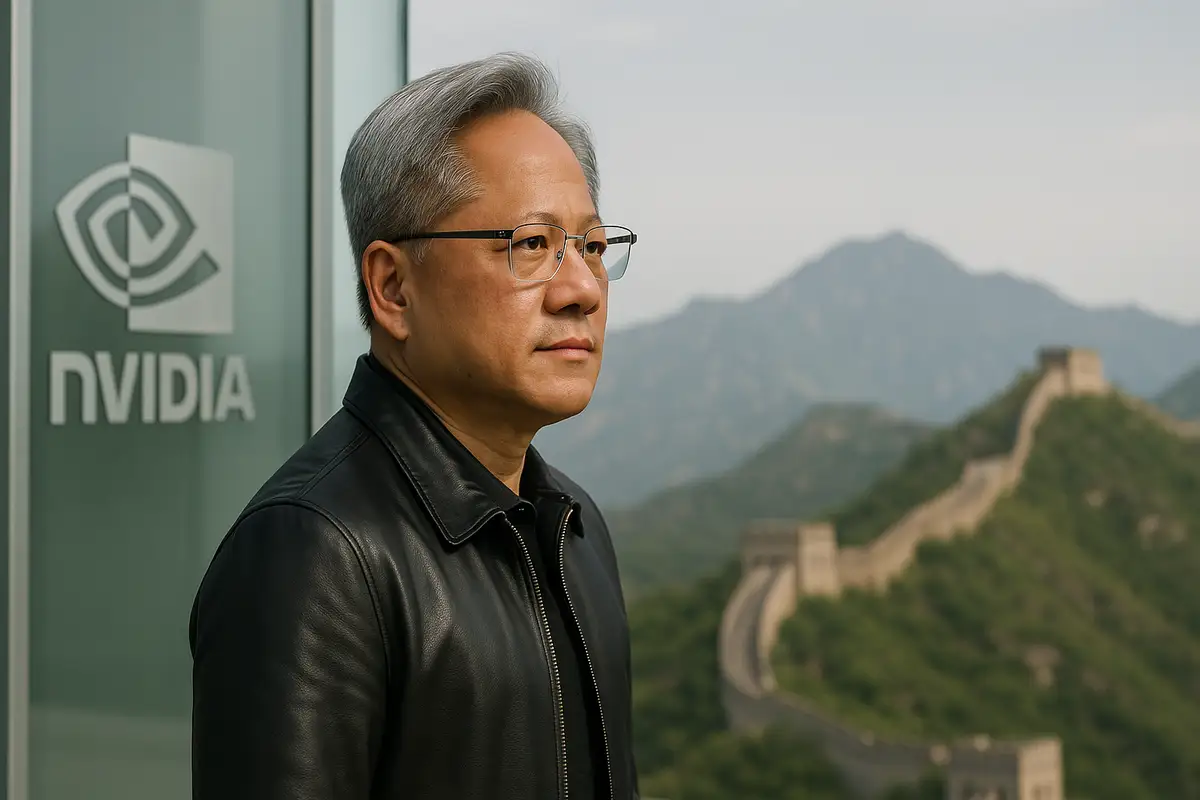

The company's been trying to thread an increasingly narrow needle. CEO Jensen Huang visited China three times this year, basically conducting a charm offensive in a market worth $17 billion in revenue—13% of Nvidia's total sales.

In July, Trump allowed limited sales of Nvidia's H20 chip. That's a modified accelerator designed specifically for Chinese compliance with US export rules. Seemed like progress, briefly.

Then Beijing raised cybersecurity concerns about the H20. They effectively halted purchases while demanding additional regulatory reviews. Chinese authorities also privately started urging domestic companies to avoid Nvidia chips entirely. Security risks, supply reliability concerns—pick your reason.

By the way, this regulatory whipsaw illustrates something broader about tech companies as geopolitical competition heats up. Nvidia's dominance in AI acceleration makes it indispensable to both American strategic interests and Chinese technological development. That's not a comfortable position when both sides want to control access.

Beyond immediate trade negotiations, the Nvidia case signals how nations assert control over critical technologies without completely cutting ties. China's antitrust approach represents something like a middle path—not outright bans, not unrestricted access either.

You use legal frameworks to extract concessions and demonstrate regulatory sovereignty while keeping technological relationships intact. Smart approach, actually. Complete Nvidia exclusion would handicap Chinese AI development. But unrestricted access undermines Beijing's push for domestic semiconductor alternatives.

Regulatory pressure creates space for managed dependence while fostering indigenous capabilities. It acknowledges economic realities while asserting political control.

For Washington, the Nvidia situation shows the limits of export controls when applied to companies with major foreign market exposure. Pure restrictions risk pushing allies toward alternative suppliers or domestic programs that ultimately reduce American technological influence.

The broader trade talks cover TikTok's future, tariff structures, and basically the fundamental terms of technological competition between the world's two largest economies. Officials reportedly discussed potential Trump-Xi meetings as early as October. Both sides seem to view current negotiations as preliminary to higher-level diplomatic engagement.

But the Nvidia finding complicates any near-term deals. China's antitrust law allows fines between 1% and 10% of annual sales. That could reach $1.7 billion based on Nvidia's Chinese revenue. More importantly, sustained regulatory pressure might force Nvidia to choose between markets entirely.

That would accelerate the technological decoupling both governments claim they want to avoid. Seems like the kind of outcome nobody actually benefits from, but here we are.

Why this matters:

• Tech companies are becoming primary battlegrounds for geopolitical competition, forced to navigate regulatory demands that make compliance with one jurisdiction violation in another

• China's antitrust enforcement shows how nations can leverage legal frameworks for strategic advantage without triggering outright trade war escalation

Q: What exactly is Mellanox and why did China care about this acquisition?

A: Mellanox Technologies designed high-speed networking equipment crucial for data centers and AI computing. China approved the $7 billion 2020 acquisition conditionally, requiring Nvidia to guarantee continued chip supplies to Chinese customers without discrimination—terms that now conflict with US export controls.

Q: How much could China actually fine Nvidia under antitrust law?

A: Chinese antitrust penalties range from 1% to 10% of annual sales. Based on Nvidia's $17 billion in Chinese revenue (13% of total sales), fines could reach $1.7 billion. The exact amount depends on violation severity and China's strategic calculations.

Q: What are H20 chips and why do they keep causing problems?

A: The H20 is Nvidia's modified AI accelerator designed specifically for Chinese compliance with US export controls—less powerful than the H100 but still useful for AI inference. Trump approved H20 sales in July, but Beijing subsequently raised cybersecurity concerns, effectively halting purchases.

Q: Why announce this during the Madrid trade talks specifically?

A: Sources told Financial Times that China's market regulator reached its conclusion weeks earlier but waited for maximum negotiating leverage. The announcement gives Beijing a regulatory weapon against America's most valuable AI company while Treasury Secretary Bessent and Vice Premier He Lifeng negotiate semiconductor access terms.

Q: Does this create similar risks for other US tech companies operating in China?

A: Yes. Any US company with Chinese acquisitions requiring ongoing commitments faces similar contradictions between Chinese market access guarantees and US export controls. The Nvidia case establishes precedent for using antitrust enforcement as geopolitical leverage against multinational technology firms.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.