Beijing locked the supply. The Hague locked the board.

Three European executives at Nexperia petitioned an Amsterdam court on October 1 for an investigation into their Chinese parent. That same day, the Dutch government issued a formal invocation under the Goods Availability Act—a Cold War-era emergency law—targeting Nexperia’s governance, not its factory lines. Hours later, the court suspended Wingtech chairman Zhang Xuezheng from Nexperia’s boards. Wingtech still owns the company. It lost command of it.

What’s actually new

The Netherlands didn’t nationalize Nexperia or halt production. It used the company’s own senior management—Dutch chief legal officer Ruben Lichtenberg, German CFO Stefan Tilger, and German COO Achim Kempe—as the trigger for state intervention. All three petitioned together. The coordination was immediate. This isn’t a classic takeover. It’s a boardroom mutiny with state backing.

The Breakdown

• Three European executives at Nexperia petitioned Amsterdam court October 1; same day Dutch government invoked emergency law, court suspended Chinese chairman.

• Wingtech retains 99% ownership and economic rights but lost all governance control to court-appointed independent director with decisive voting power.

• One-year freeze blocks changes to strategy, assets, IP, or personnel while chip production continues uninterrupted for European automotive clients.

• Template separates ownership from control—sharper than nationalization, requires internal corporate rebellion meeting state power at court speed.

Wingtech retains economic rights to Nexperia’s profits. Governance is the part that moved. An independent, foreign director now holds a deciding vote. For up to a year, Nexperia can manufacture chips but cannot change strategy, assets, intellectual property, operations, or personnel. The economic minister can block or reverse decisions deemed harmful to Nexperia’s future as a European enterprise. Production runs. Strategy stops. Bloomberg called it the law’s first use; the government calls it “highly exceptional.” Both can be true.

The dual-leverage template

Beijing locked the supply. The Hague locked the board.

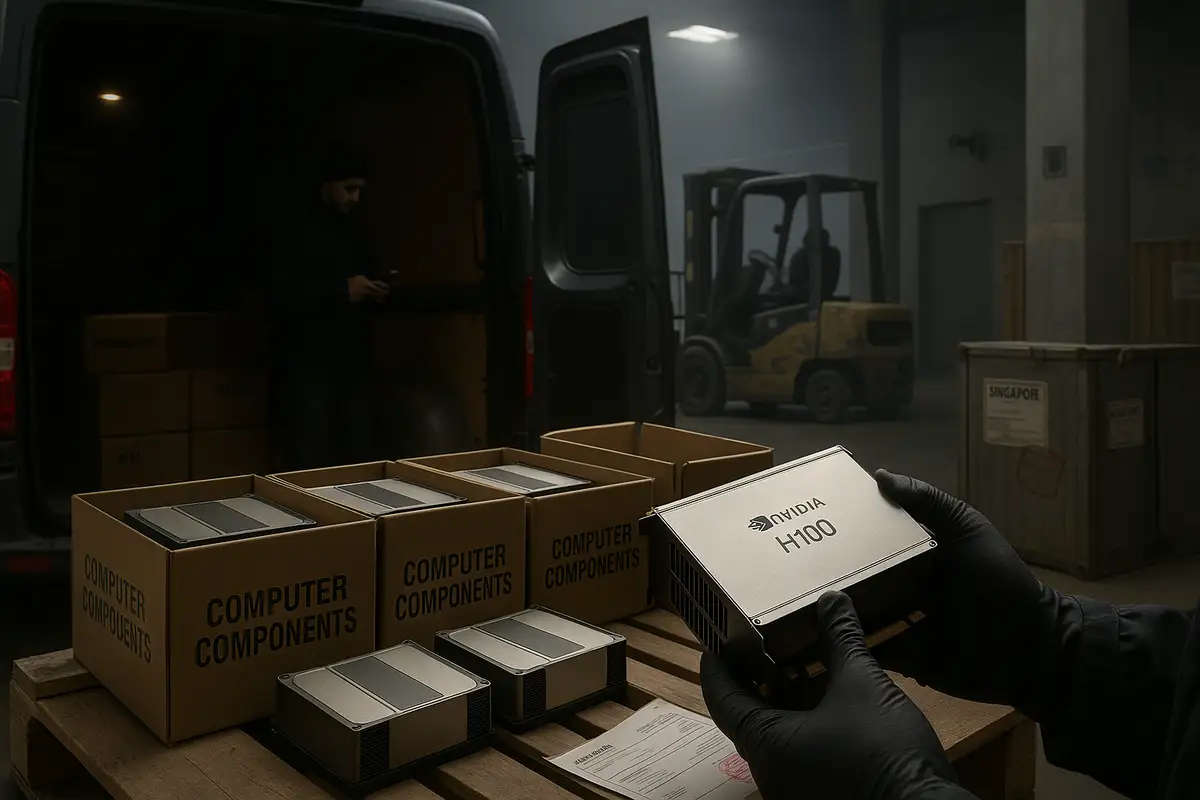

China’s new rare-earth export controls—announced Thursday—tighten licensing on materials and even certain magnet products, asserting reach beyond China’s borders. The 90% bottleneck in refined rare earths and magnets cannot be quickly replicated. The Netherlands’ move tightens control through courts: suspend directors, appoint an independent with decisive voting rights, and put shares under custodial management. Both are leverage plays, executed through different pipes. One via chemistry. One via procedure. It’s an uncomfortable symmetry.

Wingtech sees conspiracy, not symmetry. In a WeChat statement later deleted, the company accused Nexperia’s European executives of colluding with Dutch authorities to “forcibly alter the company’s ownership structure” and “usurp shareholder rights under the guise of compliance.” On Monday in Shanghai, Wingtech’s shares hit their 10% down limit. Markets read the message.

Evidence and sequence

The dates tell the story. The government invoked the Goods Availability Act on September 30. On October 1, Nexperia’s CLO, backed by the COO and CFO, petitioned the Enterprise Chamber. The court immediately suspended Zhang and, after an October 7 hearing, installed an independent, non-Chinese director with independent representation rights and a deciding vote. According to Chinese filings summarized by multiple outlets, all Nexperia shares—except one—were placed under court-appointed custodial management for governance purposes. Wingtech keeps economics. It loses control.

Official statements cite only “serious governance shortcomings” that threatened “crucial technological knowledge and capabilities” on European soil. That vagueness created space for local reporting: NRC sources said the trigger was concern that Nexperia planned to “leak chip knowledge to China.” The government declined to confirm specifics. The gap between the broad risk language and the granular leak allegation is the tell.

The ownership-control split

Traditional nationalization takes ownership. Investment screening blocks deals before they close. This template separates them. Wingtech keeps the asset but can’t run it. That’s a sharper instrument for open economies that want to avoid outright expropriation. It also requires two ingredients: an internal corporate rebellion and a government willing to move at court speed. The Netherlands had both—and used them on the same day.

Note the 12-day disclosure lag. The state acted on September 30; public confirmation came October 12. That’s not a crisis fire drill. That’s a legal choreography: state order, emergency court measures, second hearing, then announcement. By the time Wingtech’s stock filing landed in Shanghai, the governance structure was locked. The factory lines, by design, were not.

Market and policy implications

Three indicators will show if this model spreads. First, whether other European governments identify Chinese-owned firms where local management might cooperate with similar petitions. Second, whether Wingtech’s legal challenge weakens the seizure; if the Enterprise Chamber’s rulings hold, the tool hardens. Third, whether Beijing retaliates against Dutch interests specifically or treats this as a wider European escalation.

Timing will fuel both sides’ narratives. China announced rare-earth curbs on October 10. The Netherlands disclosed the Nexperia move October 12. But the Dutch action actually happened September 30. Either The Hague delayed disclosure and looks retaliatory, or coincidence now reads like choreography. Both interpretations raise the temperature.

The broader context is constricting. Wingtech landed on the U.S. Entity List in December 2024, and new U.S. rules automatically sweep in majority-owned subsidiaries. The UK forced Nexperia to sell Newport Wafer Fab in 2022. Now the Netherlands has frozen Nexperia’s governance at the source. Different jurisdictions, different levers, same direction of travel.

Limits and caveats

This is a governance freeze, not an industrial shutdown. Nexperia’s lines keep serving Europe’s carmakers and electronics clients—precisely the supply the Dutch say they must protect in an emergency. The risk is drift: a yearlong strategy freeze can bleed competitiveness if competitors invest while Nexperia waits for court calendars. Wingtech’s legal and diplomatic pushback will be fierce. China’s response could make it costlier.

Why this matters:

- Governance seizure without nationalization gives Europe a new, court-driven tool to control strategic assets while keeping factories running.

- Chinese-owned firms with European leadership now face a novel risk: internal executives can become the fuse for state action.

❓ Frequently Asked Questions

Q: What is the Goods Availability Act and why hasn't it been used before?

A: It's a Cold War-era law (enacted 1940s-50s) allowing the Dutch government to control companies producing critical goods during emergencies. Never invoked until September 30, 2025. It was designed for wartime supply disruptions—food, fuel, medicines. Using it for semiconductor governance control marks a major expansion of what qualifies as "emergency" in modern economic security thinking.

Q: Who are the three executives who triggered this intervention?

A: Ruben Lichtenberg (Dutch chief legal officer), Stefan Tilger (German chief financial officer), and Achim Kempe (German chief operating officer). All senior management at Nexperia's Nijmegen headquarters. They jointly petitioned the Amsterdam Enterprise Court on October 1 for an investigation into governance—essentially rebelling against their Chinese parent company Wingtech. Their nationalities matter: European executives challenging Chinese ownership.

Q: What happens when the one-year freeze ends?

A: Unclear. The order blocks changes to assets, IP, operations, or personnel through roughly September 2026. After that, either the government lifts restrictions and returns control to Wingtech, extends the freeze, or forces a permanent restructuring. Wingtech's legal challenges and China's diplomatic pressure will shape the outcome. The court-appointed independent director could remain indefinitely if the government views risks as ongoing.

Q: What does "decisive voting power" actually mean in practice?

A: The court-appointed independent director can override Wingtech's decisions despite the Chinese company owning 99% of shares. On strategic matters—hiring executives, IP transfers, asset sales, operational changes—this director's vote wins. Wingtech can still collect dividends and profits (economic rights intact) but can't steer the company. It's control without ownership, the reverse of normal corporate structure.

Q: What happened with Nexperia's UK facility that the article mentions?

A: Nexperia bought Newport Wafer Fab in Wales for £63 million in July 2021. In November 2022, the UK government forced Nexperia to sell it over national security concerns about Chinese ownership—this was more than a year after the deal closed. Vishay Intertechnology (Pennsylvania-based) bought it for $177 million in early 2024. Nexperia still operates a facility in Stockport, England.