💡 TL;DR - The 30 Seconds Version

💰 Mistral AI talks with Abu Dhabi's MGX fund and others to raise up to $1 billion in equity funding plus hundreds of millions in debt.

📊 Europe's largest AI startup already raised €1+ billion since 2023, reaching €5.8 billion valuation but struggles to match OpenAI's pace.

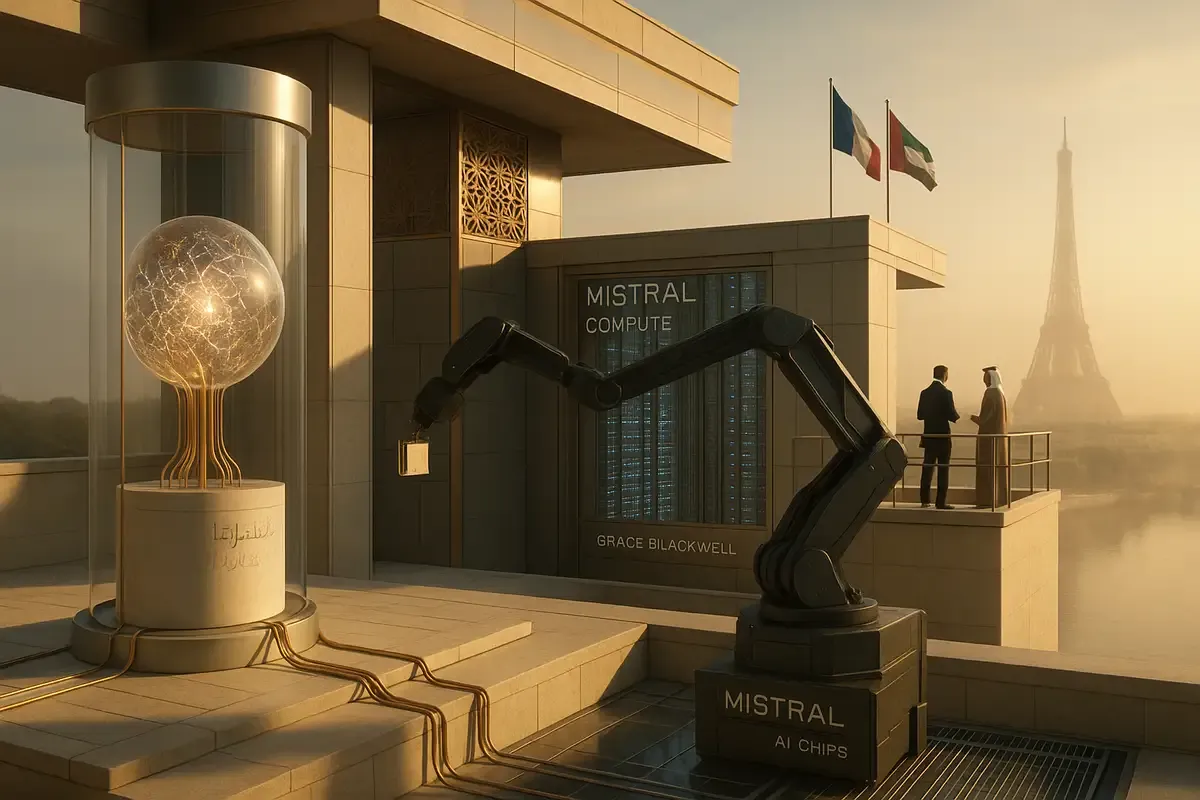

🏭 The debt financing would fund Mistral Compute, a new AI cloud service using 18,000 Nvidia Grace Blackwell chips near Paris.

🤝 UAE committed €50 billion to French AI projects as both countries partner to break US-China tech dominance and build AI sovereignty.

🌍 MGX already backs OpenAI and xAI, making this deal part of a broader Middle East strategy to invest in global AI leaders.

🚀 The funding shows how expensive competing with Silicon Valley has become, forcing European AI companies to seek massive international backing.

French AI startup Mistral is hunting for up to $1 billion in new funding. The company talks with several investors, including Abu Dhabi's MGX fund, about equity financing that could reshape Europe's AI landscape.

The funding discussions extend beyond equity. Mistral also negotiates hundreds of millions of euros in debt financing from French lenders, including existing investor Bpifrance. The talks remain early and could change, with no clear valuation target yet set.

Mistral represents Europe's biggest AI bet. Founded in 2023, the company has already raised more than €1 billion, reaching a €5.8 billion valuation after last year's funding round. But it faces stiff competition from American rivals like OpenAI and has been shifting toward specialized services rather than broad consumer products.

The France-UAE AI Alliance

This funding push deepens an unusual partnership between France and the United Arab Emirates. Both countries want to break the AI duopoly held by America and China. The collaboration goes beyond money.

Mistral already works with MGX and Nvidia to build Europe's largest AI data center campus. The UAE has committed €50 billion to AI projects in France, part of President Emmanuel Macron's push for "AI sovereignty." The partnership reflects how smaller players team up to compete with tech superpowers.

MGX brings serious firepower to the table. The government-backed fund manages $100 billion and invests aggressively in AI companies. It has backed OpenAI and Elon Musk's xAI, and partners in OpenAI's Stargate project alongside Nvidia and Microsoft.

Europe's AI Reality Check

Mistral's funding hunt exposes Europe's AI dilemma. The continent wants technological independence but lacks the capital and computing power of American competitors. European AI companies often end up dependent on American cloud services and chips.

The company makes Le Chat, a chatbot that competes with ChatGPT. But Mistral has struggled to match OpenAI's pace and market penetration. The shift toward custom enterprise services suggests the company recognizes it cannot win the consumer AI race.

Arthur Mensch, Mistral's CEO, said earlier this year that his company would spend several billion euros on computing facilities. The plans include a new facility near Paris loaded with high-end chips. In June, Nvidia announced plans for an "AI cloud" service in France called Mistral Compute using 18,000 of its latest Grace Blackwell chips.

Following the Money Trail

The debt financing Mistral seeks would fund the Mistral Compute project. This represents a bet that European companies will pay for local AI computing power rather than rely on American clouds. Whether European businesses will switch remains unclear.

Mistral's investor list reads like a who's who of tech funding. Microsoft, Lightspeed Venture Partners, General Catalyst, and Andreessen Horowitz have all backed the company. The mix of American VCs and European strategic investors reflects Mistral's position bridging two markets.

The company's valuation has grown quickly but faces pressure. PitchBook puts Mistral's current value at $6.51 billion post-money, based on its June 2024 Series B. That makes it one of Europe's most valuable startups, but AI valuations have become volatile as the market matures.

Bpifrance's involvement as both equity investor and potential debt provider shows French government support. The state-backed investment bank has made AI a priority, viewing it as crucial for France's economic future. The debt structure would provide cheaper capital for infrastructure investments while preserving equity for founders and investors.

The Sovereignty Question

France's AI ambitions face practical challenges. Building independent AI capabilities requires massive investment in chips, data centers, and talent. European companies often find American solutions cheaper and more advanced.

The MGX partnership offers a workaround. UAE money can fund European AI development without creating dependence on American or Chinese investors. But it raises questions about where true sovereignty lies when foreign funds drive domestic technology.

Mistral's open-weight approach to AI models differentiates it from closed competitors like OpenAI. The company releases model weights publicly, allowing others to modify and improve the technology. This strategy appeals to enterprises wanting control over their AI systems.

The timing of Mistral's funding talks reflects broader AI market dynamics. Investment has poured into AI companies, but returns remain uncertain. Many startups burn cash quickly while searching for sustainable business models. The current AI boom could prove short-lived if companies fail to generate profits.

Regional AI champions like Mistral face a difficult balance. They need scale to compete globally but must serve local markets first. The result often means smaller addressable markets and higher customer acquisition costs than American rivals.

Why this matters:

• Europe's biggest AI startup needs massive funding to stay competitive, showing how expensive it has become to challenge American AI dominance

• The France-UAE partnership creates a new model for countries seeking AI independence without relying on Silicon Valley or Chinese tech giants

❓ Frequently Asked Questions

Q: What exactly is MGX and why does it matter?

A: MGX is Abu Dhabi's government-backed investment fund with $100 billion in assets. It focuses heavily on AI investments and already backs major players like OpenAI and Elon Musk's xAI. The fund serves as the UAE's main vehicle for global tech investments.

Q: How big is Mistral compared to OpenAI?

A: Much smaller. While Mistral reached a €5.8 billion valuation, OpenAI was valued at $157 billion in its latest funding round. Mistral has raised €1+ billion total, while OpenAI has raised over $11 billion from investors.

Q: What does "AI sovereignty" actually mean?

A: AI sovereignty means countries controlling their own AI infrastructure rather than depending on foreign tech companies. France wants European alternatives to American AI services like ChatGPT and Google's cloud computing. It's about data security and economic independence.

Q: What products does Mistral actually make?

A: Mistral makes Le Chat, a ChatGPT competitor, and sells AI models to businesses. Unlike OpenAI's closed approach, Mistral releases "open-weight" models that companies can modify and control. The company focuses more on enterprise services than consumer products.

Q: Why is the UAE investing €50 billion in French AI?

A: The UAE wants to diversify its economy beyond oil and become a global tech hub. France offers advanced AI talent and technology while the UAE provides capital and market access. The partnership helps both countries compete with US and Chinese dominance.

Q: What exactly is Mistral Compute?

A: Mistral Compute is a planned "AI cloud" service that will rent computing power to European companies. It will use 18,000 of Nvidia's latest Grace Blackwell chips in data centers near Paris. Think of it as Europe's answer to Amazon Web Services.

Q: How risky is this investment for Abu Dhabi?

A: Moderate to high risk. AI startups burn cash quickly and many fail to find profitable business models. However, MGX spreads risk by investing in multiple AI companies including OpenAI and xAI. The UAE can afford losses given its massive sovereign wealth.

Q: What happens if Mistral can't compete with US rivals?

A: Mistral could pivot further toward specialized enterprise services or potentially be acquired. The French government would likely step in to prevent foreign acquisition given AI sovereignty goals. The UAE investment provides runway to find a sustainable business model.