💡 TL;DR - The 30 Seconds Version

👉 Over $1 billion in banned Nvidia AI chips reached China through black markets during three months of US export controls.

📊 Gate of the Era alone moved $400 million worth of restricted processors at 50% premiums of $489,000-570,000 per rack.

🏭 Smugglers advertise banned chips openly on Chinese social media with photos of Dell, Asus, and Supermicro packaging.

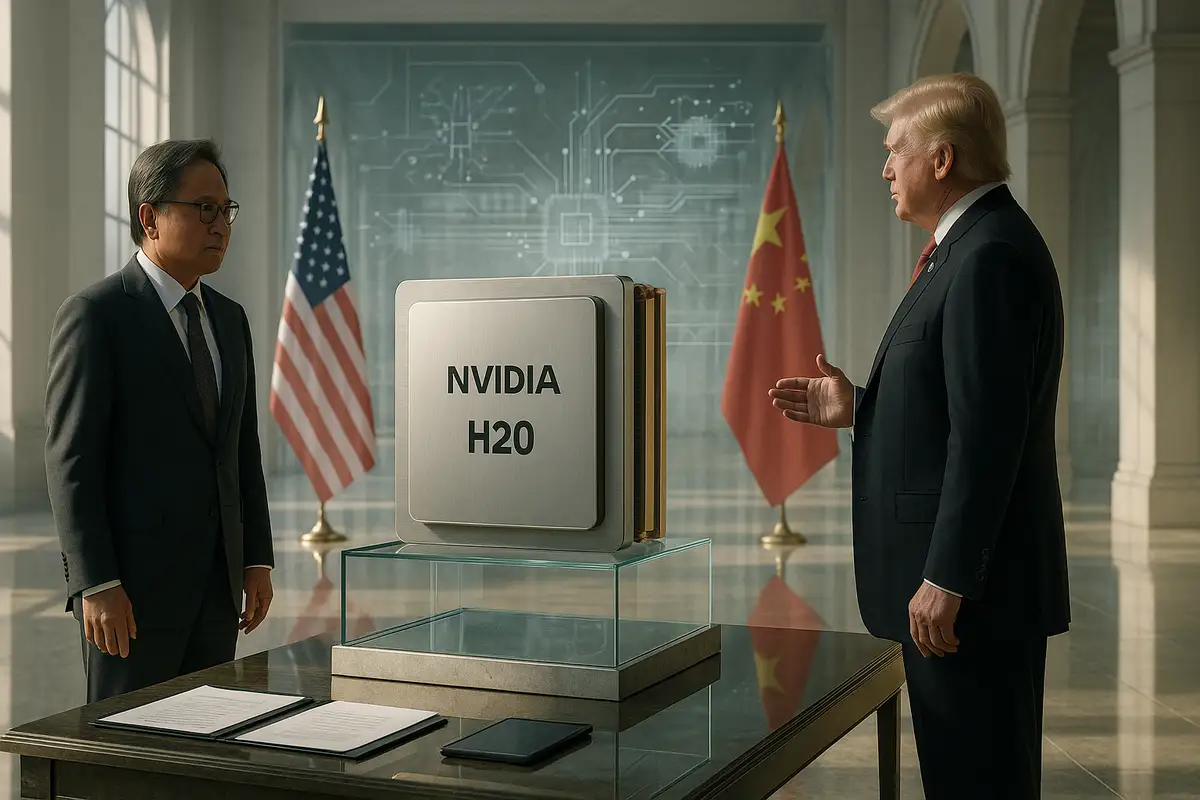

🔄 Trump blocked H20 chip sales in April for security reasons, then reversed the decision last week after Nvidia lobbying.

🌍 Export controls pushed Chinese firms toward domestic alternatives, with Qihoo 360 now choosing Huawei chips over US options.

🚀 Policy whiplash signals America's tech strategy lacks consistency, potentially undermining future cooperation on technology restrictions.

America's plan to strangle China's AI ambitions by restricting chip exports has produced an unexpected result: a thriving black market worth over $1 billion and potentially stronger Chinese competitors.

While Washington spent months crafting export controls to keep advanced processors out of Chinese hands, smugglers moved at least $1 billion worth of banned Nvidia chips into China during a three-month period this year. The forbidden semiconductors — including the coveted B200 processors used by OpenAI and Meta — flowed through elaborate networks of shell companies, social media marketplaces, and Southeast Asian middlemen.

The irony cuts deeper. Just as these underground channels proved export controls couldn't stop determined buyers, the Trump administration reversed course and allowed sales of Nvidia's H20 chip back to China. Critics say this one-two punch — failed restrictions followed by policy reversals — may have handed Beijing exactly what it wanted: access to advanced chips and motivation to build domestic alternatives.

The Underground Economy

The black market operates with surprising openness. Companies like "Gate of the Era," founded in February as Trump tightened restrictions, became major distributors of banned B200 processors. The Anhui-based firm sold chips in ready-built racks — each containing eight B200s in a suitcase-sized package weighing 150 kilograms.

Current prices range from $489,000 to $570,000 per rack, representing a 50% premium over US market rates. That's down from peak prices above $650,000 when supplies first hit Chinese markets in May. Gate of the Era alone moved an estimated $400 million worth of restricted hardware, according to Financial Times analysis of contracts and industry sources.

The company lists China Century as its largest shareholder — an AI solutions provider that claims partnerships with AliCloud, ByteDance, and Baidu Cloud. When reporters visited Gate of the Era's registered headquarters at a government-run cryptography park, no one was home. The company had never actually moved into the office.

Social Media Marketplaces

Chinese distributors don't hide their wares. Banned Nvidia processors appear openly on social platforms like Douyin and Xiaohongshu, complete with photos of Dell, Asus, and Supermicro packaging. Videos show testing procedures where buyers can verify chip authenticity before purchase.

"It's like a seafood market," one distributor told the Financial Times. "There's no shortage."

The social media groups connect hundreds of traders with data center suppliers. Transactions happen on the spot, with buyers collecting products after verification. Some vendors even advertise future inventory of B300 chips — Nvidia's next-generation processors expected later this year.

Even Nvidia's most advanced GB200 AI racks appear available, with distributors claiming sales at $5.6 million each. Marketing posts show consistent pricing and promise stock "available for pickup onshore."

Policy U-Turn

While smugglers built their networks, policy makers were having second thoughts. In May, the Trump administration blocked sales of Nvidia's H20 chip — a processor designed specifically for the Chinese market to comply with earlier restrictions. Officials cited "bipartisan and broad concern" about Chinese military applications.

The controls seemed to work. DeepSeek, China's most impressive AI company, reportedly couldn't follow through on breakthroughs after losing H20 access. The startup's CEO had called US chip restrictions his company's biggest obstacle.

But Nvidia CEO Jensen Huang lobbied hard for reversal, claiming Chinese competitor Huawei had developed equivalent chips. Last week, the Trump administration relented and allowed H20 sales to resume.

Ben Buchanan worked as Biden's White House AI adviser. He thinks Trump made a big mistake. In a New York Times piece, Buchanan says Huang is wrong about Huawei's chip-making abilities. The numbers don't lie: Huawei chips power just 3% of the world's supercomputers. The company makes about 200,000 advanced chips per year. That's enough for maybe one major data center.

The Backfire Effect

The export control experiment may have achieved the opposite of its stated goals. While American chips continued flowing through black markets, Chinese companies accelerated domestic development. Cybersecurity firm Qihoo 360 recently announced it was purchasing Huawei chips despite H20's return, with chairman Zhou Hongyi arguing domestic options needed support to improve.

"The more they are used, the more they will improve," Zhou said, calling domestic chip adoption "a must" despite technology gaps.

iFlytek, an AI company banned from buying US chips directly, now trains language models entirely on Huawei's Ascend computing solutions. The company claims it has boosted Ascend 910B efficiency from 20% of Nvidia's performance in 2024 to nearly 80% this year.

Meanwhile, smuggling networks adapted to policy changes. Black market B200 sales dropped after H20 restrictions lifted, but distributors simply found new routes through European countries not on restricted lists. Southeast Asian transit points face potential new controls, but industry insiders expect suppliers will adjust.

"History has proven many times before that given the huge profit, arbitrators will always find a way," one Chinese distributor observed.

Why this matters:

• Export controls created a contradiction that may have strengthened China's position — spurring domestic chip development while failing to prevent access to advanced US technology through black

markets.

• The policy whiplash of restricting then allowing chip sales signals to allies and competitors that America's tech strategy lacks consistency, potentially undermining future cooperation on technology restrictions.

❓ Frequently Asked Questions

Q: Is it illegal for Chinese companies to buy these smuggled chips?

A: No. Chinese law allows receiving and using restricted US chips as long as import duties are paid. The legal violation happens on the export side - US companies and middlemen who ship chips to China break American export control laws.

Q: How much do these chips normally cost in the US?

A: Nvidia's B200 racks typically sell for around $326,000 in the US market. The $489,000-570,000 prices in China represent a 50% premium. At peak demand in May, prices reached over $650,000 per rack.

Q: How do buyers actually get these banned chips once they're in China?

A: Most transactions happen through social media groups connecting sellers with data center operators. Buyers meet sellers in person, test chips for authenticity, then pay cash and take hardware immediately. It works like any commodity market.

Q: What's the performance difference between banned and allowed chips?

A: The banned B200 significantly outperforms China's allowed H20 chip for AI training. However, for AI inference (running completed models), the H20's large memory makes it competitive and more cost-effective than smuggled options.

Q: How big is this black market compared to legitimate sales?

A: The $1 billion in smuggled chips over three months represents a fraction of Nvidia's total sales. The company's revenue hit $60 billion in 2024, with most coming from legitimate US and international customers.

Q: Why did Jensen Huang push Trump to allow H20 sales again?

A: Huang argued that Chinese competitor Huawei was developing equivalent chips, so export controls only hurt Nvidia's profits. Critics say this is false - Huawei chips power just 3% of global supercomputing with limited production capacity.

Q: What happens if US companies get caught shipping banned chips?

A: Companies face severe penalties including hefty fines, criminal charges for executives, and being added to restricted entity lists that bar them from buying US technology. Commerce can also revoke export licenses.

Q: How do export controls actually work in practice?

A: US companies must get government licenses before shipping advanced chips to certain countries. Controls target specific performance thresholds - chips above certain speeds or capabilities need approval. Nvidia designed the H20 to stay below these limits.