💡 TL;DR - The 30 Seconds Version

👉 Nvidia invests $5 billion in Intel stock while announcing joint development of PC and data center chips, sending Intel shares up 33%.

📊 Intel dominated computing for decades through x86 processors, but missed mobile (2007) and AI shifts, losing relevance to GPU-focused Nvidia.

🏭 The partnership focuses on chip design only—Nvidia avoids committing to Intel's struggling foundry business, keeping manufacturing options open.

🌍 AMD faces pressure in both CPU and GPU markets as Intel gains access to Nvidia's superior graphics technology and ecosystem.

⚡ Joint products will use NVLink technology for faster chip-to-chip communication, but previous Intel attempts at CPU-GPU fusion failed in 2017.

🚀 The deal cements Nvidia's role as industry kingmaker—even Intel now needs partnership to compete in AI-adjacent computing markets.

The x86 architects of the PC era and the GPU builders of the AI boom find strategic alignment.

Nvidia just dropped $5 billion on Intel stock and announced they're co-developing chips. Rivals for decades, now partners. Intel's stock jumped 33% because investors get what this means—the company that gave Silicon Valley its name needs help from a graphics specialist it used to ignore.

This isn't about money. It's about where computing power actually moved.

When Intel ruled everything

Intel started in 1968. Two guys left Fairchild to make better memory chips. Then in 1971, they created the 4004—basically put an entire computer on a piece of silicon the size of a fingernail. Revolutionary doesn't cover it.

IBM picked Intel's 8088 processor for its first PC in 1981. That decision locked in x86 as the standard everyone else had to follow. Intel kept building on that foundation—each new chip ran the same software as the last one, just faster. The "Intel Inside" stickers made a hidden component into something consumers actually cared about.

Servers became Intel's second gold mine. Xeon processors dominated corporate data centers through the 90s and early 2000s. Intel's manufacturing stayed ahead of everyone else's. They had discipline, they had process leadership, they had momentum.

When Apple switched Macs to Intel chips in 2005, that felt like total victory. Even the company that built its identity around being different chose Intel. "Wintel"—Windows plus Intel—wasn't just about two companies anymore. It described how computing worked.

Where it went wrong

Intel said no to making the first iPhone chip. Seemed like a small market at the time. Smartphones exploded anyway, and Intel couldn't catch up. ARM processors owned mobile, and Intel got locked out of the biggest computing platform shift in decades.

Manufacturing started slipping too. Intel's fabs used to be automatically ahead of everyone else's. That advantage eroded. AMD came back with Zen processors that actually competed. Worse than competed—they started winning.

But the real killer was AI. When machine learning took off, it turned out GPUs were way better than CPUs for training neural networks. Intel had spent decades optimizing for sequential processing. AI workloads wanted massive parallelism. Nvidia had that. Intel didn't.

How Nvidia went from niche to kingmaker

Nvidia started in 1993 betting that computing would become visual. Graphics cards for gamers seemed like a narrow market, but Jensen Huang figured 3D would matter everywhere eventually.

They had early struggles, then caught a break with graphics accelerators that actually worked. The GeForce 256 in 1999 was the first chip they called a "GPU"—graphics processing unit. Marketing, but it stuck.

The breakthrough came in 2006 with CUDA. Instead of just drawing pixels, those same parallel processors could crunch numbers for scientists and researchers. Matrix math, simulations, anything that needed lots of calculations done simultaneously.

Deep learning hit in 2012. Suddenly everyone needed the exact kind of parallel processing power Nvidia had spent years perfecting. Not just games—actual artificial intelligence. Training neural networks required massive computational throughput, and GPUs delivered it better than anything else.

Nvidia built an ecosystem around that advantage. CUDA software, DGX systems, enterprise tools—they didn't just sell chips, they sold complete AI infrastructure. By the time competitors caught on, developers were already locked into Nvidia's platform.

Why this partnership makes sense

Intel brings things Nvidia needs. Manufacturing capability, even if it's not quite cutting-edge anymore. Advanced packaging technology. Most importantly, x86 processors that still run the vast majority of installed systems.

Nvidia offers what Intel desperately needs—relevance in AI. Also NVLink interconnect technology that can move data between processors much faster than standard connections. And credibility with the developers who actually build AI applications.

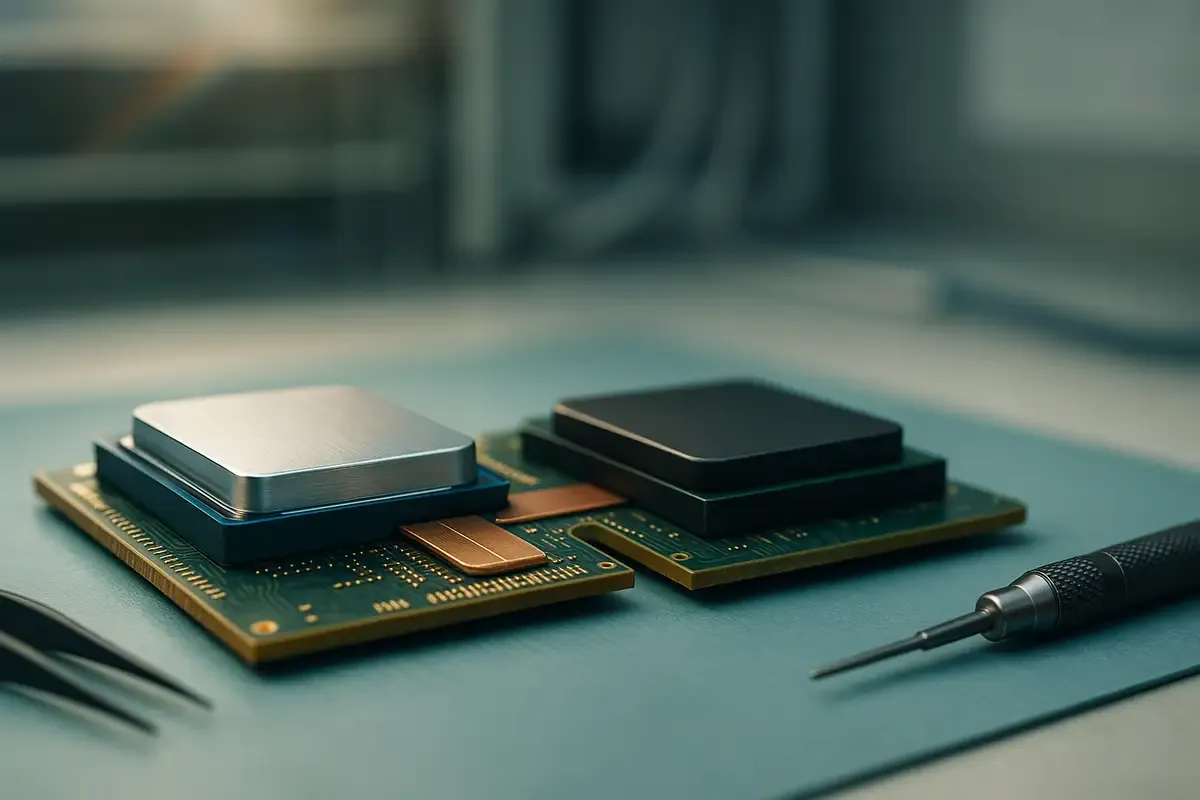

The plan is joint development, not just investment. Intel will design custom x86 processors for Nvidia's data center products. They'll also build consumer chips that combine Intel CPU cores with Nvidia graphics in a single package—basically gaming laptops that don't need separate graphics cards.

Here's what's interesting: Nvidia didn't commit to manufacturing anything at Intel's fabs. They'll design together, but Nvidia keeps its options open on where chips actually get made. That tells you something about Intel's foundry credibility.

The competitive fallout

AMD takes a hit in two directions. They've been gaining share against Intel in processors while building decent graphics capabilities. Now Intel gets access to much better graphics technology, and Nvidia gets custom CPU designs. That's AMD's integrated approach under pressure from both sides.

TSMC might eventually lose some Nvidia business if Intel's manufacturing recovers. But that's a big if, and probably years away.

For the broader industry, this consolidates power around Nvidia's ecosystem even more. Even Intel—which used to set the rules—now needs partnership with the GPU company to stay relevant in AI markets.

Where this could go wrong

Tight integration between different chip architectures is technically hard. Intel tried something similar with AMD graphics back in 2017—Kaby Lake-G processors that combined Intel CPUs with AMD GPUs. It didn't work well. Driver problems, thermal issues, the whole thing got cancelled after two years.

This attempt might be different. Both companies will handle their own software, which should eliminate the finger-pointing that killed the AMD project. NVLink provides much better chip-to-chip communication than the PCIe connections they used before.

Still, there's a reason most attempts at CPU-GPU fusion fail. Different architectures, different optimization requirements, different thermal profiles. Making them work together seamlessly is harder than marketing makes it sound.

The bigger picture

Performance improvements increasingly require system-level design rather than just faster individual components. That favors companies that can optimize across the entire stack—processors, interconnects, memory, software, everything.

Intel used to control that stack through x86 dominance. Now Nvidia controls it through CUDA and AI ecosystem lock-in. This partnership lets Intel participate in Nvidia's platform while giving Nvidia more hardware flexibility.

The trend challenges traditional industry boundaries. Pure hardware companies need software expertise. Software platforms need hardware optimization. The companies that succeed will be the ones that integrate everything effectively.

Why this matters:

• The kingmaker dynamic is real: Even Intel now requires Nvidia's partnership to stay competitive in AI-adjacent markets, cementing the graphics company's role as industry power broker.

• System architecture trumps individual components: Performance gains come from optimizing entire platforms rather than just making faster processors, rewarding companies that control multiple pieces of the puzzle.

❓ Frequently Asked Questions

Q: What exactly is NVLink and why is it better than standard connections?

A: NVLink is Nvidia's proprietary chip-to-chip communication technology that moves data much faster than PCIe connections—the current standard. It also provides lower latency, which is crucial for AI workloads that need massive data movement between processors. Think of it as a wider, faster highway between chips.

Q: Why didn't Nvidia commit to using Intel's foundry services to make chips?

A: Intel's foundry business has struggled with delays and yield issues compared to TSMC, which currently makes most of Nvidia's chips. By focusing only on design collaboration, Nvidia keeps its manufacturing options open while Intel tries to prove its foundries can deliver competitive results at scale.

Q: What went wrong with Intel's previous attempt at CPU-GPU integration?

A: Intel's 2017 Kaby Lake-G combined Intel CPUs with AMD graphics but failed after two years due to driver support problems and internal conflicts. The partnership fell apart when responsibilities weren't clear, leaving customers with products that didn't get proper software updates.

Q: When will we actually see these new Intel-Nvidia products hit the market?

A: Neither company provided specific timelines, only promising "multiple generations" of products. Given typical processor development cycles of 2-4 years, expect the first consumer chips combining Intel CPUs with Nvidia graphics sometime in 2027-2028 at the earliest.

Q: How much of Intel's stock does Nvidia actually own after this investment?

A: Nvidia's $5 billion investment likely gives them around 4-5% ownership of Intel, making them one of the largest shareholders. For comparison, the U.S. government owns 9.9% after its recent investment, while SoftBank holds a smaller stake from its $2 billion purchase in August.