Moltbot Left the Door Open. Tesla Bet the Factory.

Moltbot exposed 1,862 servers without authentication. Tesla discontinues flagship cars for unproven robots. Airtable launches AI agents amid platform complaints.

OpenAI spends half its projected revenue on stock comp to stop engineers from walking to xAI. Jensen Huang gets a meeting with Trump and China export controls disappear. Two very different power plays revealing the same fragile economics.

San Francisco | December 15

OpenAI just eliminated its six-month vesting cliff. Fidji Simo calls it "encouraging risk-taking." The real translation: $6 billion in annual stock comp, half of projected revenue, and no one can afford to lose a single engineer to xAI or Anthropic.

In Washington, Jensen Huang secured something money can't buy. Direct access. The executive order Trump signed Thursday directing DOJ to sue states over AI laws?

Nvidia lobbied for it in November. Same week, the H200 export to China sailed through with no interagency review. Commerce Secretary Lutnick called it a deal between "the great American technologist" and "the great businessman president."

OpenAI employees are betting their equity on a 2030 IPO. Jensen isn't betting.

Stay curious,

Marcus Schuler

OpenAI eliminated its six-month vesting cliff entirely, a move applications chief Fidji Simo framed as encouraging "risk-taking."

The company now spends $6 billion annually on stock compensation, nearly half its projected revenue, while expecting to burn $115 billion through 2029 before turning profitable. xAI made identical changes in Q3 2025 after hemorrhaging executives and facing recruiting problems tied to Grok's antisemitic posts and Musk's political activities.

Meta, Google, and Anthropic now offer $100 million packages for top researchers, forcing competitors to abandon the retention safeguards that vesting cliffs provide.

The math is brutal: employees receive equity in a company planning $1.4 trillion in spending, funded by circular financing where Nvidia's investment dollars flow to cloud providers who hand them right back for chips. Employee stock only becomes real money at IPO. That's 2030 at the earliest.

Why This Matters:

Strategic AI news from San Francisco. Clear reporting on power, money, and policy. Delivered daily at 6am PST.

No spam. Unsubscribe anytime.

Prompt:

A digital art piece in the distinctive style of Eyvind

Earle featuring a colossal ice cream cone topped with Santa Claus's jovial head, his rosy cheeks glowing with warmth and his eyes twinkling with holiday cheer. His flowing white beard and hair are sculpted from soft, swirled vanilla ice cream with delicate peaks and curves, crowned by a traditional red Santa hat with a fluffy white pom-pom. The massive waffle cone beneath gleams with silver glitter that catches the light, while gentle cascades of shimmering silver sparkles drift down through the air around the magical creation. The serene background reveals a tranquil seaside vista with calm turquoise waters reflecting silver light, pale golden sand stretching toward distant cliffs, and silver text at the bottom reading "Happy Christmas everyone" in an elegant, festive font.

The executive order Trump signed Thursday directing the DOJ to sue states over AI laws admits in its own text that it "must act with the Congress" to preempt state authority.

It then proceeds to ignore that admission entirely. Nvidia CEO Jensen Huang, who never visited the Oval Office before January 2025, lobbied for this order in a November meeting with White House AI czar David Sacks. The same week, Trump approved Nvidia's H200 chip exports to China with no interagency review. Commerce Secretary Lutnick called it a deal between "the great American technologist" and "the great businessman president."

GOP populists including DeSantis and Bannon fought the draft order for weeks, warning it traded millions of working-class votes for Silicon Valley donors.

Sacks added carve-outs for child safety and data centers. The revolt quieted. But the legal strategy may backfire: dormant commerce clause arguments could accidentally invalidate every state tech law, including Republican anti-censorship measures.

Why This Matters:

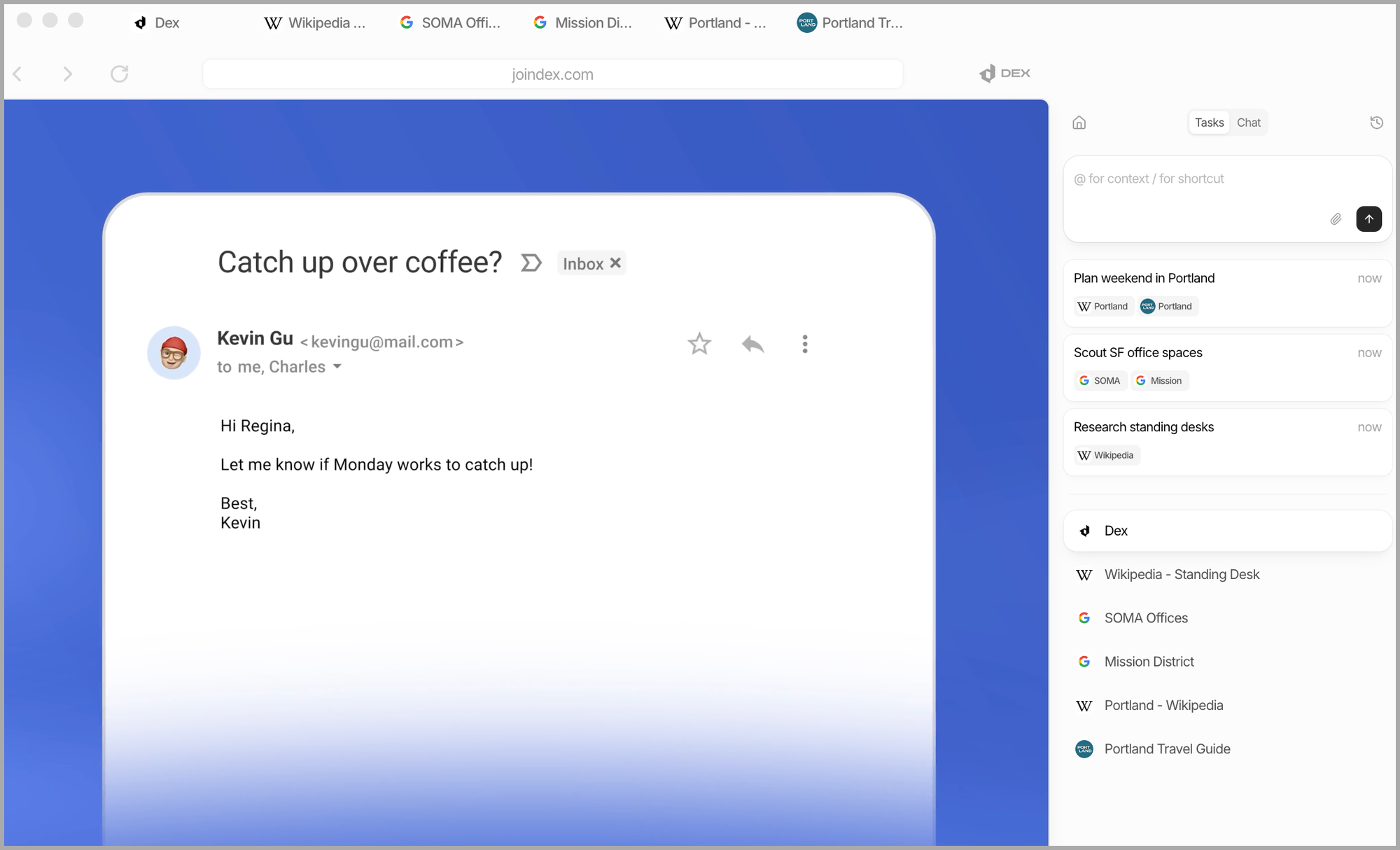

Dex is an AI copilot Chrome extension that transforms your browser into a context-aware workspace. It learns from your interactions, remembers your preferences, and automates tasks across platforms like Gmail, LinkedIn, Google Sheets, and Slack. Think Cursor for knowledge work, embedded directly where you browse.

Tutorial:

A new survey of 350 public-company CEOs by consulting firm Teneo reveals that 68% of chief executives plan to increase their artificial intelligence spending in 2026 compared to 2025, despite disappointing results from current investments. The survey found that fewer than half of AI projects have generated returns exceeding their costs, yet business leaders remain committed to expanding their AI initiatives.

Trading in credit default swaps linked to major US technology companies has surged 90% since early September, according to data from the DTCC, as investors increasingly seek protection against potential defaults in the sector. The spike in demand for these insurance-like financial products reflects growing market concerns about the sustainability of debt levels accumulated by tech firms during the artificial intelligence investment boom.

AI image generation technology has made significant strides in producing realistic images by adopting the visual characteristics of smartphone cameras, including specific traits in contrast, exposure, and sharpening. Tools like Nano Banana represent a new approach that moves beyond the early era of AI-generated images—once notorious for producing obvious errors like extra fingers—by deliberately mimicking the imperfections and processing styles that make phone photos appear authentic to human viewers.

A new investigative report from Brian Merchant's Blood in the Machine newsletter documents the widespread damage generative AI has inflicted on copywriters, including mass layoffs, dramatically falling wages and rates, freelancers losing clients, and the use of their original work to train the very AI systems replacing them. The interviews, conducted three years into what Merchant calls "the AI era," reveal copywriters were among the first professional groups specifically targeted by AI companies seeking to automate creative work.

A Bloomberg analysis reveals that Indian IT giants Tata, Infosys, and Cognizant will bear the heaviest burden from the Trump administration's proposed $100,000 H-1B worker fee, with Infosys particularly vulnerable as 93% of its H-1B hires between 2020 and 2024 would have been subject to the increased fee. The policy change threatens to significantly raise operational costs for major IT outsourcing firms that rely heavily on the visa program to staff their U.S. operations with skilled workers from abroad.

Reddit has filed a lawsuit challenging Australia's new social media ban, arguing that the platform should not be classified as a traditional social media service. In court documents, the company contends that it functions as "a collection of public fora" and that social interaction is not its "sole purpose," potentially exempting it from the legislation that bars children under 16 from creating or maintaining social media accounts.

The UK government is calling on major technology companies including Apple and Google to implement default blocking of explicit images at the operating system level as a child protection measure. According to Financial Times sources, the Home Office is expected to encourage tech firms to introduce these controls, which would require adult users to verify their ages to access such content.

Netflix co-CEOs Greg Peters and Ted Sarandos have issued an internal memo outlining the company's rationale for acquiring Warner Bros. Discovery, seeking to address employee concerns about potential job losses and the future of theatrical releases. The memo comes as Netflix positions its bid against a competing offer from Paramount, with leadership working to reassure stakeholders that the acquisition would preserve key aspects of WBD's operations.

The competition among America's three largest wireless carriers—AT&T, T-Mobile, and Verizon—has intensified beyond traditional advertising into direct customer acquisition efforts and legal disputes. AT&T has twice blocked T-Mobile's Easy Switch tool, which is designed to help customers transfer their service, while T-Mobile and Verizon actively pursue strategies to attract subscribers from competing networks, prompting AT&T to respond with legal action.

Tech whistleblowers who have exposed harms at major technology companies say coming forward has unexpectedly derailed their lives and careers, with many facing diminished job prospects and professional exile in Silicon Valley. Former employees including Yaël Eisenstat have spoken about the personal costs of whistleblowing, while Meta is currently engaged in litigation with another former employee, Sarah Wynn-Williams.

London-based PolyAI, a company specializing in artificial intelligence voice assistants for call centers, has raised $86 million in Series D funding led by Georgian, Hedosophia, and Khosla Ventures. The company, which secured $50 million in 2024, plans to use the new capital to enhance its AI technology and expand its enterprise customer base.

Berlin-based artificial intelligence startup Mirelo has raised $41 million in seed funding led by Index Ventures and Andreessen Horowitz (a16z), following an earlier $3 million pre-seed round. The company has developed AI models capable of interpreting video content and automatically generating matching sound effects and soundtracks, addressing a significant gap in current AI video creation tools that often produce silent output.

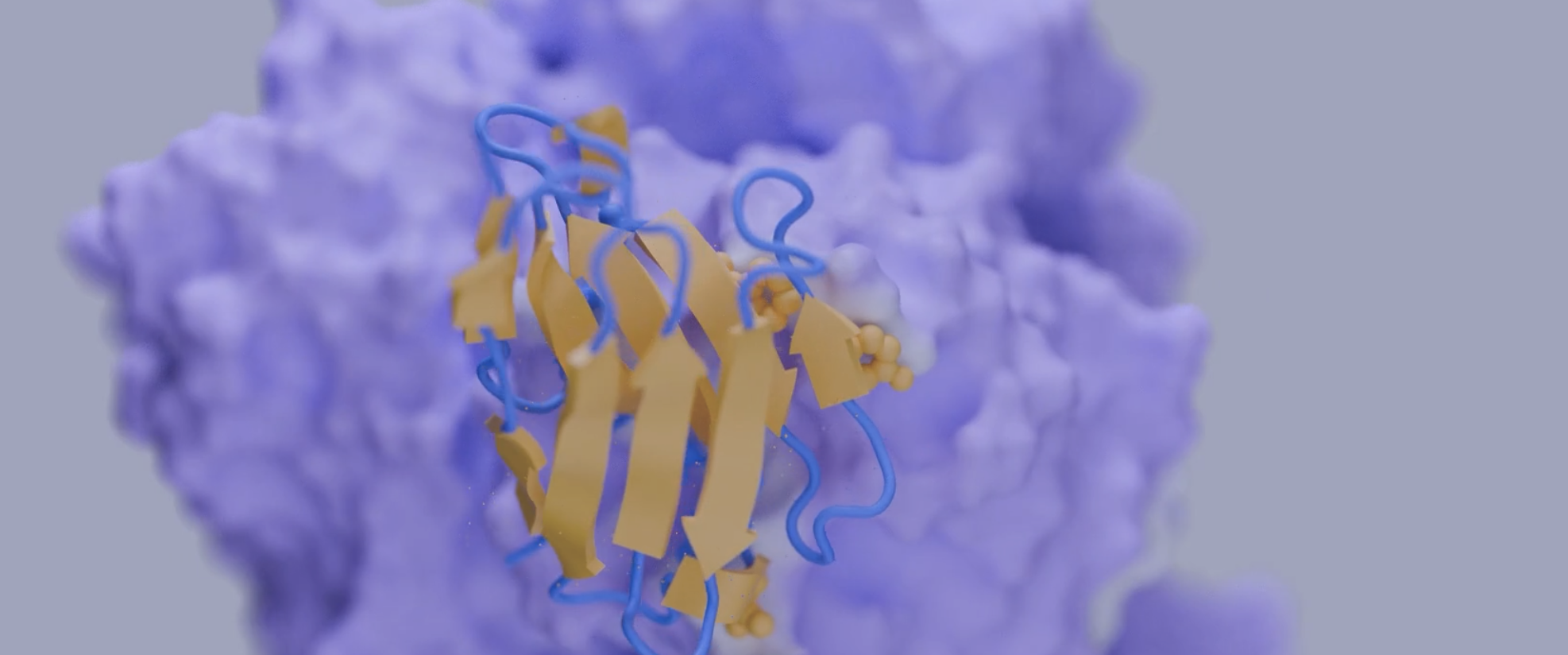

Chai Discovery, an artificial intelligence drug discovery company backed by OpenAI, has raised $130 million in a Series B funding round led by Oak HC/FT and General Catalyst, valuing the startup at $1.3 billion. The investment brings the company's total funding to $225 million and will support the development of its computer-aided design platform for creating new molecules in pharmaceutical research.

Chai Discovery wants to turn drug discovery into a design problem. It builds AI models that predict molecular structures and generate antibodies from scratch, promising to slash the time and cost of early-stage R&D. 🧬

Founders

Joshua Meier (CEO, ex-OpenAI/Meta), Jack Dent (President, ex-Stripe), Matthew McPartlon, and Jacques Boitreaud launched Chai in 2024. San Francisco HQ. The team shipped open-source models before raising serious money. Scientists first, pitch deck second.

Product

Chai 1 predicts molecular structures across proteins, DNA, RNA, and small molecules. Chai 2 designs antibodies de novo. Feed it a target and epitope, get binder candidates in under two weeks. The company claims a ~20% hit rate across 50+ targets. If that holds, it replaces months of high-throughput screening with software iteration. Users set constraints, specify formats, iterate like engineers. 💻

Competition

Crowded field. Isomorphic Labs (DeepMind's $600M-backed spinoff) looms large. Generate Biomedicines plays in generative protein therapeutics. Insilico Medicine already has clinical programs. Then there's pharma's internal teams, quietly building their own models. Chai's edge: productized antibody design with claimed superior hit rates.

Financing

Seed to unicorn in twelve months. OpenAI and Thrive backed a $30M seed at $150M valuation (late 2024). Menlo led a $70M Series A at ~$550M (August 2025). Oak HC/FT and General Catalyst co-led a $130M Series B at $1.3B (December 2025). Total raised: $225M. Pfizer's former CSO joined the board. 🦄

Future ⭐⭐⭐⭐

Chai rides perfect timing. Pharma faces patent cliffs and cost pressure, while FDA warms to AI in drug development. The unicorn valuation prices in platform ambitions, not just science projects. Execution matters now. Biology always grades on a curve, and it doesn't accept late submissions.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.