💡 TL;DR - The 30 Seconds Version

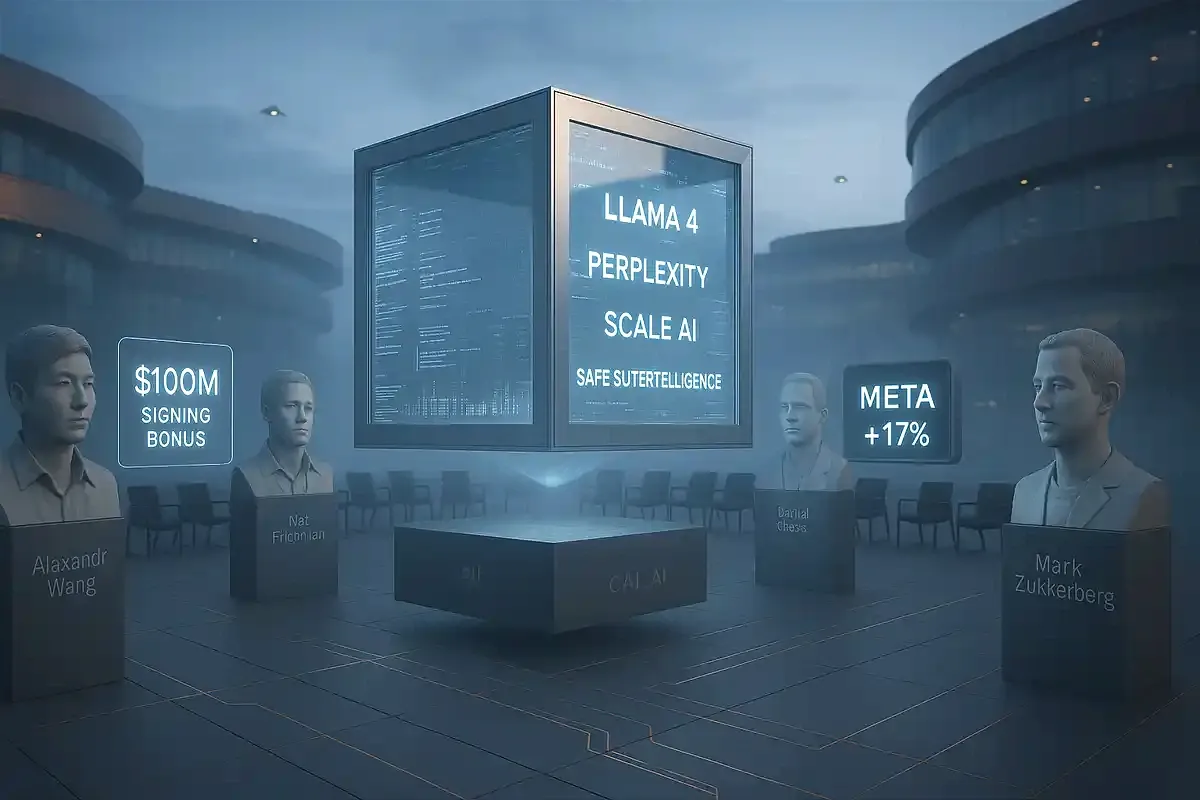

💰 Meta paid $14.3 billion to hire Scale AI's 28-year-old founder Alexandr Wang after its own Llama 4 models flopped with developers.

🎯 Wang knows every major AI company's strategy because they all used Scale's data-labeling services to train their models.

🏃 Meta tried buying Perplexity ($14B), Safe Superintelligence ($32B), and other AI startups but deals fell through over price disagreements.

💸 The company now offers OpenAI employees $100 million signing bonuses as talent wars reach unprecedented levels across Silicon Valley.

⚖️ Competitors face a tough choice: keep using Scale and enrich Meta, or find new data providers and slow their progress.

🚀 Meta's total AI spending could hit $80 billion this year, with Llama 5's success determining whether the strategy pays off.

Mark Zuckerberg is writing checks like never before. The Meta CEO just dropped $14.3 billion on Scale AI, not for the company itself, but to hire its 28-year-old founder Alexandr Wang. This deal caps off a months-long shopping spree that reads like a Silicon Valley anxiety attack.

The numbers tell the story. Meta tried to buy Perplexity AI, valued at $14 billion. It pursued Safe Superintelligence, worth $32 billion. When those deals fell through, Zuckerberg pivoted to poaching talent directly, offering OpenAI employees signing bonuses up to $100 million. The message is clear: Meta will pay any price to catch up in artificial intelligence.

The panic stems from a simple reality. Meta's Llama 4 models, released in April, flopped with developers. While OpenAI and Google advanced their AI capabilities, Meta's open-source approach stumbled. Zuckerberg publicly admitted the failure, and Wall Street took notice.

The Alexandr Wang Factor

Wang brings something money usually can't buy: knowledge of what everyone else is doing. As Scale AI's founder, he has worked with OpenAI, Google, and most major AI companies. They all used Scale's data-labeling services to train their models. Wang knows their strengths, weaknesses, and strategies.

The 28-year-old MIT dropout has spent years building relationships across the industry. His former roommate is OpenAI CEO Sam Altman. He regularly visits Zuckerberg's houses in Tahoe and Palo Alto, discussing AI strategy over dinner. Wang's network extends beyond tech into government contracts worth hundreds of millions.

Meta's investment gives it a 49% stake in Scale, creating an awkward situation for competitors. Companies like OpenAI and Google must decide whether to keep using Scale's services, knowing they're enriching Zuckerberg, or find alternatives that might slow their progress. OpenAI plans to stick with Scale. Google reportedly wants out.

Building the Dream Team

Wang won't work alone. Meta has recruited Daniel Gross, CEO of Safe Superintelligence, and Nat Friedman, former GitHub CEO. Both will report to Wang and help lead Meta's AI assistant development. The company also gained a stake in their venture firm, NFDG.

This hiring spree follows a pattern. When Zuckerberg feels threatened, he spends big. In 2012, facing the mobile revolution, he bought Instagram for $1 billion. Two years later, he acquired WhatsApp for $19 billion. Both deals looked expensive at the time but proved prescient.

The current AI race feels similar. Zuckerberg recognizes that falling behind in AI could doom Meta's future. The company's core advertising business depends on algorithms that recommend content and target ads. Better AI improves both functions while reducing costs.

The Talent War Heats Up

Meta's aggressive recruiting has sparked a bidding war for AI talent. Signing bonuses that once topped out at a few million dollars now reach nine figures. Annual compensation packages climb even higher. The market for top AI researchers resembles the NBA free agency, with astronomical numbers and fierce competition.

OpenAI's Altman confirmed that Meta offered his employees $100 million signing bonuses. He also noted that his company counters these offers, driving prices higher across the industry. Meta's technology chief Andrew Bosworth called the spending "unprecedented" in his 20-year career.

The strategy reflects broader industry dynamics. Major tech companies recognize that AI talent is finite and valuable. Missing out on key researchers could mean losing the next breakthrough. For Meta, the stakes feel particularly high given its recent AI failures.

Political Connections Add Value

Wang brings another asset: political influence. He has cultivated relationships with Republican lawmakers and right-wing influencers, positioning Scale as essential to America's AI competitiveness against China. The company has secured government contracts worth hundreds of millions.

Recent moves show Wang aligning with conservative politics. He attended Trump's inauguration, appeared on right-wing podcasts, and adopted "merit, excellence, and intelligence" as Scale's hiring philosophy, rejecting diversity initiatives. These connections mirror Zuckerberg's own rightward shift as he courts the Trump administration.

Meta has rolled back diversity programs and weakened hate speech policies. Both CEOs now sport similar fashion choices and appear on conservative podcasts. Their alignment extends beyond politics to strategy, suggesting Wang's hiring reflects broader changes at Meta.

The Open Source Gamble

Meta's AI strategy differs from competitors through its open-source approach. While OpenAI and Google keep their best models proprietary, Meta releases Llama models for free use. This strategy aims to build developer loyalty and prevent competitors from creating AI monopolies.

The approach has mixed results. Developers appreciate free access to capable models, but Meta's latest releases lagged behind closed-source alternatives. The company needs to prove that open-source development can match or exceed proprietary research. Wang's team must deliver this proof.

Success would vindicate Zuckerberg's philosophy while providing competitive advantages. Developers building on Llama models create value that Meta can capture through its platforms. Failure would force a strategic rethink and potentially billions in wasted investment.

Wall Street's Patience

Investors have mostly supported Zuckerberg's AI spending, but patience has limits. Meta shares rose 17% this year, outpacing major competitors. Analysts maintain buy ratings while raising price targets. The market believes in Zuckerberg's track record of successful pivots.

However, the spending scale dwarfs previous investments. Meta's capital expenditures could reach $72 billion this year, up from $65 billion previously planned. The company must show that AI investments translate into revenue growth and competitive advantages.

The next test comes with Llama 5, expected later this year. Meta promises a larger, more capable "Behemoth" model that could restore developer confidence. Wang's team will help deliver this model, making their success crucial for justifying recent spending.

Why this matters:

- Zuckerberg's spending spree reveals how far behind Meta fell in AI, forcing desperate measures to catch up with OpenAI and Google.

- The talent war shows AI development depends on people more than technology, making recruitment the key battleground for the next decade.

❓ Frequently Asked Questions

Q: What exactly does Scale AI do that made it worth $14.3 billion to Meta?

A: Scale provides data labeling services for AI training. Humans review images, text, and videos to teach AI models what they're looking at. Scale has worked with OpenAI, Google, and most major AI companies, giving Wang inside knowledge of their strategies and weaknesses.

Q: How much control does Meta actually get for its $14.3 billion investment?

A: Meta gets 49% ownership of Scale but zero voting power. The real value is hiring Wang and a few key employees. Meta essentially paid $14.3 billion for talent acquisition, not corporate control. Wang started at Meta the Monday after saying goodbye to Scale on Friday.

Q: What makes Alexandr Wang so valuable compared to other AI executives?

A: Wang knows what every major AI company is working on because they all used Scale's services. He's also unusually well-connected, befriending everyone from OpenAI's Sam Altman (his former roommate) to right-wing podcasters. At 28, he's worth over $5 billion and has government contracts worth $250 million.

Q: Why did Meta's talks with Perplexity and other AI startups fail?

A: The deals fell apart over price disagreements and strategic differences. Perplexity was valued at $14 billion, Safe Superintelligence at $32 billion. Rather than meet these prices, Meta decided to poach talent directly with massive signing bonuses up to $100 million.

Q: How bad was Meta's Llama 4 failure compared to competitors?

A: Llama 4 launched in April with only two smaller models, disappointing developers who expected more capable versions. Meta promised a larger "Behemoth" model later but hasn't delivered. Meanwhile, OpenAI and Google continued advancing their models, leaving Meta visibly behind in the AI race.

Q: Will OpenAI and Google stop using Scale now that Meta owns part of it?

A: OpenAI plans to keep using Scale despite Meta's investment. Google reportedly wants to cut ties and find alternatives. This creates a dilemma: competitors must choose between enriching Meta or slowing their progress by switching data providers mid-development.

Q: How much is Meta actually spending on AI this year?

A: Meta raised its capital spending range to $64-72 billion for 2025, up from $60-65 billion previously. The $14.3 billion Scale deal sits outside this range. Add recruitment bonuses up to $100 million per person, and Meta's total AI spending could exceed $80 billion this year.

Q: What happens if Meta's new AI team fails to deliver results?

A: Meta's stock has risen 17% this year on investor confidence, but patience has limits. The next test comes with Llama 5's "Behemoth" model later this year. If Wang's team can't match OpenAI and Google's capabilities, Meta may need to abandon its open-source strategy entirely.