Less than a year after incorporation, with a single fine-tuning tool in private beta, the OpenAI spin-out is testing how much investors will pay for pedigree alone.

Thinking Machines Lab wants to raise money at a $50 billion valuation. Maybe $55 billion. Possibly $60 billion, depending on which sources Bloomberg talked to in mid-November. The artificial intelligence startup founded by former OpenAI executive Mira Murati closed a $2 billion seed round at $12 billion just four months earlier, in July. If the new round closes anywhere near those whisper numbers, the company will have quadrupled its paper value in the time most startups take to ship a second product update.

What changed between July and November? Thinking Machines released Tinker in October. It's a Python API for fine-tuning open-source language models without managing GPU clusters. Academics at Princeton, Stanford and Berkeley report positive early results. The company has paying customers now, though it won't say how many or what they're paying. That's the product. One managed service, narrow audience, built on models other people trained.

The deal terms haven't been finalized and could still change or collapse entirely, but the number itself already tells a story. Not pricing what exists. Pricing who built it and the fear someone else gets the allocation instead.

The Breakdown

• Thinking Machines seeks $50-60B valuation just four months after raising $2B at $12B in July 2025

• Company's only product is Tinker, a fine-tuning API launched in October with undisclosed revenue from paying customers

• AI startups raised $73.1B in Q1 2025, with some ventures valued at $400M-$1.2B per employee

• Ilya Sutskever's competing SSI lab reached $32B with no product, setting precedent for talent-based valuations

$12 billion to $50 billion in sixteen weeks

The velocity matters more than the destination. Thinking Machines raised its initial $2 billion at a $12 billion valuation from Andreessen Horowitz, Nvidia, AMD, Cisco, Accel and Jane Street. That July round set records as one of the largest seed rounds in history, though "seed" had already lost any connection to dictionary definitions of early-stage funding.

Now the company is shopping a valuation more than four times higher. If terms hold, Thinking Machines would catapult into the upper ranks of the most valuable private companies less than a year after launch. Ilya Sutskever's Safe Superintelligence raised $2 billion at a $32 billion valuation in April 2025. SSI has no product. Approximately 20 employees. Thinking Machines would leapfrog SSI by nearly $20 billion in paper value with exactly one commercial offering.

The comparison to SSI is instructive. Both labs emerged from OpenAI's diaspora, hired from the same small pool of elite researchers, raised enormous sums before shipping products. SSI reached $30 billion valuation in March after starting at $5 billion in September 2024. Sixfold in six months. Thinking Machines is attempting a similar leap on a similar timeline, from a higher base, with marginally more to show.

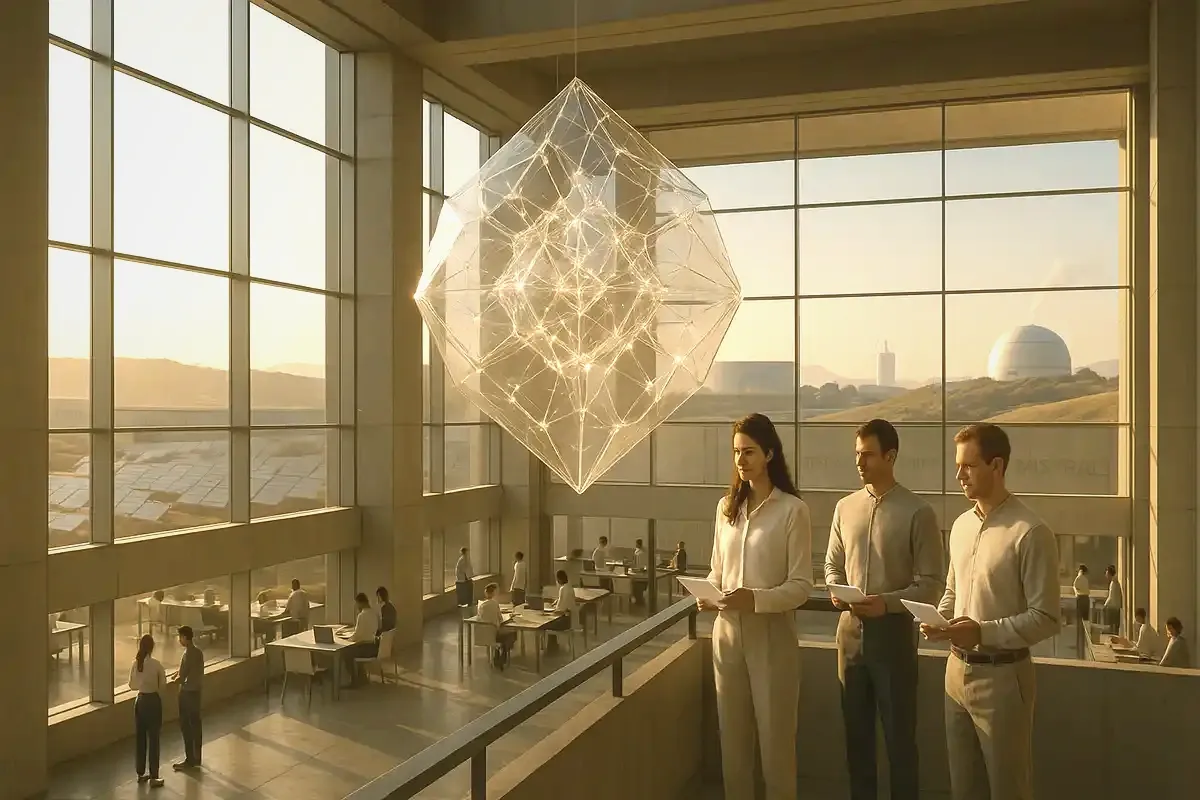

Murati assembled a team that reads like an OpenAI alumni directory. John Schulman, co-founder of OpenAI and architect of reinforcement learning from human feedback, joined as chief scientist. Barret Zoph, formerly OpenAI's vice president of research for post-training, signed on as co-founder. Lilian Weng, another senior OpenAI researcher, came too. In August the company leased 72,500 square feet in San Francisco's Mission District while most of the city's office space sits empty.

The team has started to fracture. Co-founder Andrew Tulloch left for Meta in October. Meta has been making unsuccessful bids to acquire entire labs and offering individual researchers multimillion-dollar packages. The talent war intensifies while the products remain hypothetical.

What $12 billion bought

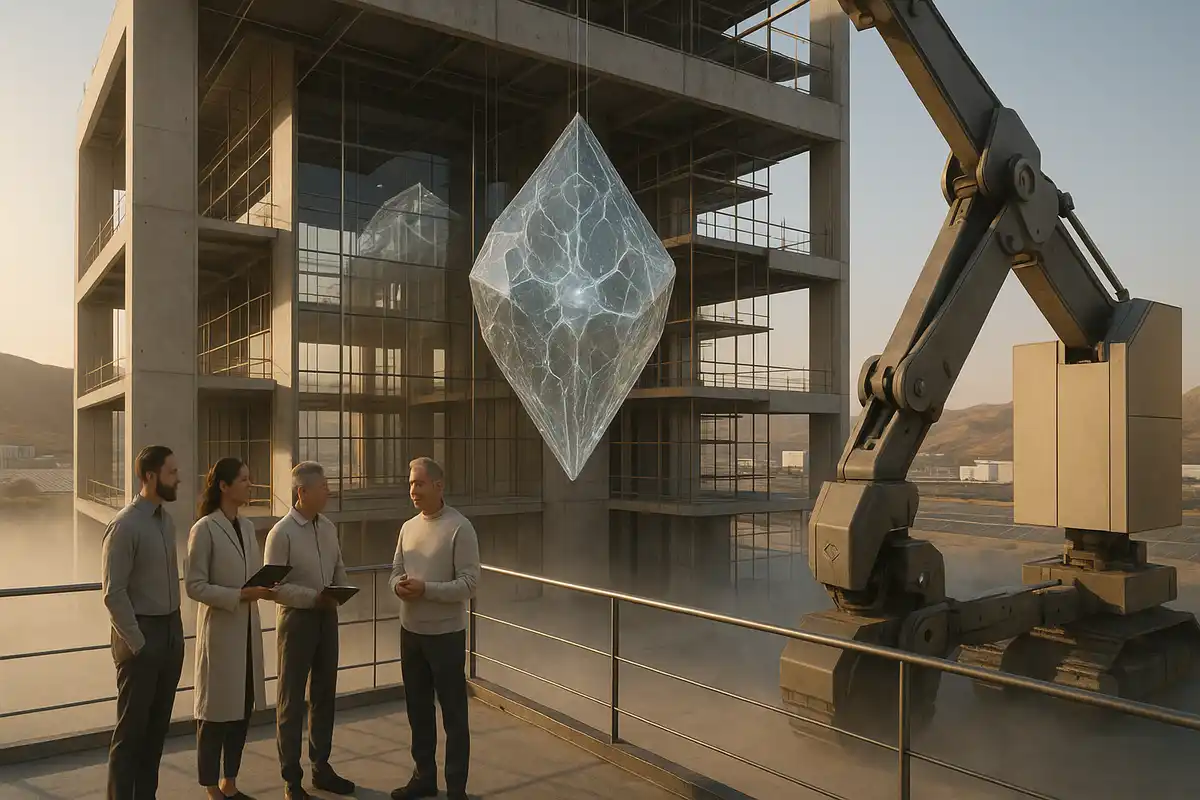

Tinker launched on October 1. Developers get low-level control over training loops. Thinking Machines handles GPU orchestration, scheduling, failure recovery. Users write Python code calling primitives like forward_backward for gradient computation, sample for token generation. The service supports open-weight models from Meta's Llama series to large mixture-of-experts architectures like Qwen3-235B.

The technical approach uses Low-Rank Adaptation. Fine-tune small adapter matrices rather than retraining entire models. Cuts compute costs, lets multiple training jobs share the same GPU pool. The company ships an open-source Tinker Cookbook with ready-made recipes for common post-training methods.

Early adopters have applied Tinker to specialized tasks: Princeton's Gödel Team trained mathematical theorem-proving models, Stanford's Rotskoff Lab improved a model's ability to convert chemical names into formulas, Berkeley's SkyRL group ran custom multi-agent reinforcement learning experiments. A Forbes review described the product as "useful, though not a big-time blockbuster". Value lies in reduced cost and complexity, not industry redefinition.

That assessment captures the gap. Tinker solves a problem. It sits between simple tune-for-you services and bare-metal frameworks demanding deep expertise. But it's a developer tool wrapping techniques available elsewhere. Better ergonomics, yes. Less operational friction, sure. Revolutionary? No.

The product doesn't explain a $50 billion valuation. Revenue remains early and modest. Tinker started in private beta with free access, only recently began usage-based pricing. Even with paying customers, the company is nowhere near revenue that would justify its paper value on traditional metrics.

The bubble everyone sees

Thinking Machines is not an outlier. It's the current exemplar. In the first quarter of 2025, AI startups raised $73.1 billion globally, accounting for 57.9% of all venture capital funding. Capital concentrated in mega-rounds. Thousands of non-AI startups can't raise modest Series A or B rounds.

Bryan Yeo, group chief investment officer at Singapore sovereign wealth fund GIC, warned in October of "a little bit of a hype bubble going on in the early-stage venture space." Any company with an AI label gets valued "right up there at huge multiples of whatever the small revenue is." Market expectations could be way ahead of what the technology delivers. The AI capital expenditure boom might mask weaknesses in the broader economy.

Some early-stage AI ventures command valuations at between $400 million and $1.2 billion per employee. Todd Sisitsky, president of alternative asset manager TPG, called that "breathtaking." Views remain divided on whether the sector has formed a true bubble. Some AI firms hit $100 million in revenue within months. Others raise hundreds of millions before generating their first dollar.

Thinking Machines falls into the latter category. More aggressive than most. The company structured itself as a public benefit corporation with governance terms giving Murati a deciding vote on board matters. Founding shareholders get votes weighted 100 times more than regular investors. The trade is explicit: investors accept weak control and uncertain near-term economics for exposure to scarce talent and the option value that one of these labs might produce the next dominant AI platform.

The trade made sense at $12 billion when Thinking Machines could claim to be assembling the strongest research team outside the major labs. At $50 billion? The product footprint remains narrow. The founding team has already started to erode. Competitors with similar pedigrees are raising at similar valuations.

What's being priced? Not revenue. Not technology that exists today. Not a clear path to defensible market position. The possibility that Murati's lab might build multimodal frontier models competing with OpenAI, Anthropic and Google. Her visibility. Her team's credentials. The fear of missing the next breakout AI company outweighs any concrete evidence this particular lab will be it.

A lab, a tool, a check

Thinking Machines has advantages. Murati combines technical credibility with high public visibility from her time as OpenAI's CTO and brief stint as interim CEO during the November 2023 governance crisis. Schulman and other co-founders command respect in the research community. The record seed round and prospective $50 billion valuation signal that investors still believe in the team's ability to execute.

The company has built infrastructure. It operates its own GPU clusters, secured long-term real estate, has relationships with GPU vendors and strategic investors including Nvidia and AMD. Tinker demonstrates the lab can ship working software and attract early users from top universities.

But the weaknesses are equally clear. Revenue is minimal compared to capital raised. The current product serves a narrow market. The governance structure concentrates power in ways that could create friction if strategy stumbles or if Murati's vision diverges from investor expectations about commercialization timelines. The company depends heavily on a small group of individuals who could be lured away by competitors with deeper pockets.

Most critically, Thinking Machines enters a market where incumbents already operate full platform stacks. Major cloud providers can cut prices or bundle fine-tuning services with broader cloud deals. Tinker gives customers more control and transparency than proprietary services. It also ties them to the long-term health of a single nascent lab whose business model remains speculative.

The $50 billion round will show something. Whether the AI funding bubble still has room or whether even star founders are hitting a ceiling. The deal closes near those whispered numbers? That's a new benchmark. Investors are willing to pay this much for potential over proven performance. It collapses or reprices down? Maybe the market finally wants more than pedigree and promises.

Murati's lab sits at the intersection of genuine technical capability and speculative excess. Tinker is real, solves real problems. The $50 billion valuation is a bet that someone in San Francisco can replicate what OpenAI built but with better governance and more collaborative AI. Whether those two facts connect in any economically rational way will determine if Thinking Machines becomes the exception that proves AI valuations make sense or the example future analysts cite when explaining what went wrong.

Why this matters:

• For AI investors: The Thinking Machines round tests whether billion-dollar valuations can keep inflating on team pedigree alone, or whether markets will start demanding revenue and product-market fit even from elite founders. A successful close at $50B extends the AI funding bubble. A collapse or repricing signals the correction has begun.

• For competing labs: If Murati's team raises at this valuation with one API product, it resets expectations for what OpenAI alumni can command. Pressure intensifies on SSI, Anthropic and others to show comparable valuations or superior products. The talent war accelerates regardless of outcome.

• For enterprises considering Tinker: Customers adopting fine-tuning infrastructure from Thinking Machines are betting on the lab's survival, not just its current technology. A $50B valuation doesn't guarantee staying power. It does mean the company won't run out of capital soon, even if proving the business model takes years.

❓ Frequently Asked Questions

Q: What exactly is a public benefit corporation and why did Thinking Machines choose this structure?

A: A public benefit corporation is a for-profit company legally required to pursue social good alongside shareholder returns. Thinking Machines chose this structure to enshrine its mission to "benefit humanity" in its corporate charter. The designation lets Murati justify decisions that prioritize research over rapid commercialization, though investors still expect eventual returns on their $2 billion.

Q: How do the 100-to-1 voting rights work at Thinking Machines?

A: Founding shareholders including Mira Murati hold shares carrying 100 votes each compared to one vote per share for regular investors. Murati also holds a deciding vote on board matters. This means founders maintain control over major decisions while holding a minority of total equity. Investors accepted these terms to gain exposure to elite AI talent.

Q: How much does Tinker actually cost to use?

A: Thinking Machines hasn't published detailed pricing. The company started with free beta access in October and only recently introduced usage-based pricing that charges for GPU compute time. Early materials mention costs "under $0.28 per million tokens" for API access, but exact pricing for paying customers remains undisclosed.

Q: Why did Mira Murati leave OpenAI to start Thinking Machines?

A: Murati left OpenAI in September 2024 after serving as CTO and briefly as interim CEO during Sam Altman's November 2023 ouster. She cited wanting "space for my own exploration." Several senior researchers followed her out, suggesting tension over OpenAI's direction and commercialization priorities during a period of internal upheaval over governance and safety.

Q: What other AI companies have similar valuations to Thinking Machines' proposed $50 billion?

A: At $50 billion, Thinking Machines would sit between Safe Superintelligence ($32 billion, no product) and Anthropic ($60 billion with revenue). OpenAI reached $157 billion in October 2024. Databricks hit $62 billion and Cohere $5.5 billion. The key difference: most have shipping products generating actual revenue, not a single API in private beta.