Moltbot Left the Door Open. Tesla Bet the Factory.

Moltbot exposed 1,862 servers without authentication. Tesla discontinues flagship cars for unproven robots. Airtable launches AI agents amid platform complaints.

Good Morning from San Francisco,

Elon Musk ditched Washington last week. Now he's raising billions across his empire. 🚀

The star act: $5 billion debt for xAI at 12% interest rates. Morgan Stanley is shopping the deal. Demand already tops $3.5 billion. 📈

The timing screams strategy. Musk fled politics after clashing with Trump's cabinet. Tesla stock dropped 20% since inauguration. "Back to sleeping in conference rooms," he tweeted. 😴

Beyond xAI, he's raising $300 million more for the xAI-X combo (valued at $113 billion) plus $650 million for Neuralink. 🧠

X crashed from $44 billion to $33 billion after advertisers fled. But AI hype makes that look like pocket change. Microsoft now offers xAI models. Telegram will distribute Grok to a billion users. 🤖

Musk's political retreat wasn't retreat. It was repositioning. Why fight in Washington when you can command Wall Street? 💪

Stay curious,

Marcus Schuler

Elon Musk has launched a fundraising blitz across his business empire, raising billions just days after stepping back from his role in the Trump administration.

The centerpiece is a $5 billion debt package for his AI startup xAI. Morgan Stanley is shopping the debt with double-digit interest rates around 12%. Early demand has already topped $3.5 billion, suggesting investors remain hungry for Musk-backed ventures despite recent turbulence.

The timing is telling. Musk announced his political exit last week after clashing with Trump cabinet members and criticizing administration policies. Tesla shares have dropped 20% since the inauguration, reflecting what Musk called "blowback" from his Washington stint.

"Back to spending 24/7 at work and sleeping in conference/server/factory rooms," Musk wrote on X. He said he must focus on "critical technologies rolling out" at his companies.

The fundraising extends beyond xAI. A separate $300 million share sale values the combined xAI-X group at $113 billion. This secondary offering lets staff sell shares to new investors and will precede a larger funding round.

The March merger that created this combined entity priced xAI at $80 billion and X at $33 billion. That marks a steep decline for X, which Musk bought for $44 billion in 2022. The social media platform lost advertisers after Musk relaxed content moderation policies.

Musk is also raising $650 million for Neuralink, his brain-computer interface company that recently received FDA breakthrough designation.

The xAI debt will help fund the company's Memphis data center called Colossus. The facility already houses 200,000 graphics processing units for AI training, with plans to add another million nearby. Musk launched xAI in 2023 to compete with OpenAI and other tech companies in the AI race.

Recent partnerships show xAI gaining traction. Microsoft now offers xAI models to cloud customers, while Telegram will distribute the Grok chatbot to its billion users.

Morgan Stanley has deep ties to Musk's dealmaking. The bank advised on his Twitter acquisition and provided $13 billion in debt financing. That debt initially looked problematic as X struggled, leaving banks stuck with risky loans for over two years. But Morgan Stanley eventually sold the debt at or near face value and profited handsomely from fees and interest.

The fundraising spree reflects Musk's strategy of combining his companies. xAI benefits from X's data for training AI models, while X leverages xAI's rising valuation. Twitter investors received 25% of xAI shares as part of this integration.

Musk's political retreat appears calculated. His time leading the Department of Government Efficiency ended after conflicts with administration officials. The cost-cutting initiative faced criticism, and Musk's public disagreements with Trump policies created friction.

The business refocus comes as competition intensifies in AI. OpenAI, Google, and Microsoft are pouring billions into the technology. Musk's combined approach across social media, AI, and other ventures offers a different path in this high-stakes race.

Why this matters:

• Musk's rapid pivot from politics to fundraising shows where his real power lies - not in government roles but in commanding investor attention and capital markets.

• The $113 billion valuation for xAI-X reveals how AI hype can paper over social media struggles, turning X's advertiser exodus into a rounding error on a much larger bet.

Read on, my dear:

Prompt:

A Black woman with short hair stands next to the logo of "PRADA" in an elegant dark green coat. She is accompanied by her pet panther that lies on its side and looks at her lovingly. The background features a gray wall with light reflections. In the style inspired by a Vogue photoshoot for the Dior brand. Minimalistic luxury aesthetic. High-resolution photography, taken using a Canon EOS R6 Mark II camera with a high-quality telephoto lens.

TSMC expects record profits this year despite Donald Trump's tariff threats. The world's biggest contract chipmaker has a simple calculation: tariffs hit importers, not exporters like itself.

CEO C.C. Wei delivered this message at the company's annual shareholder meeting Tuesday. He's more worried about a global economic slowdown than trade wars. "I am not afraid of anything. I am only afraid of the global economy slowing down," Wei said.

The math works in TSMC's favor. Tariffs could raise prices and dampen demand, but AI chip orders keep flooding in faster than the company can fill them. Wei confirmed the company started receiving orders for humanoid robot chips now, not in 2026 or 2027 as expected.

TSMC has been talking with the U.S. Commerce Department about tariffs, warning that levies could increase production costs for its $165 billion U.S. investment. The department called the discussion "open," though timing remains unclear.

Currency swings pose a bigger immediate threat. The Taiwan dollar's 8% appreciation against the U.S. dollar sliced more than 3 percentage points off gross margins. That's real money when you're working with a NT$3 trillion revenue base.

Wei's $100 billion U.S. investment announcement wasn't accidental either. He admitted the number needed to be big enough to get Trump's attention. "President Trump wouldn't even open his eyes" to a smaller figure, Wei explained.

When Wei told Trump the timeline would be challenging, the president's response was characteristically direct: "Do your best!"

The company has no plans for Middle East factories, citing lack of customers in the region. Meanwhile, traffic jams are delaying TSMC's second Japan plant. Routes that once took 10-15 minutes now stretch to 1.5 hours thanks to the first plant's operations.

Why this matters:

Read on, my dear:

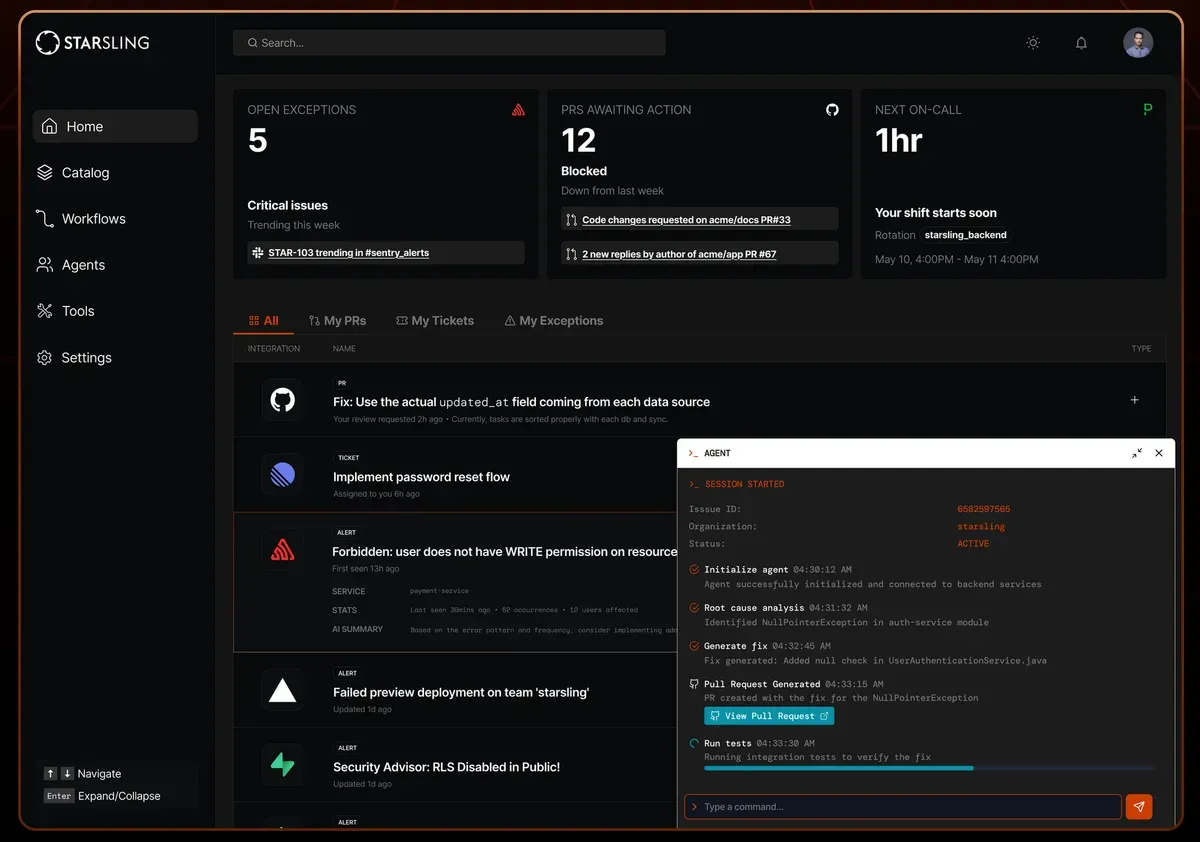

What is StarSling

Who built it?

How does autofix work?

Which tools does it support?

What you see on the homepage

What StarSling automates

How to get started

Benefits

Limitations and status

Tip: StarSling works best for teams already using GitHub, Sentry, and similar tools who want to improve their developer experience through AI automation.

Smart developers are avoiding AI coding tools. This makes no sense. Thomas Ptacek, a respected security expert, calls out his "AI skeptic friends" for dismissing tools that already work. These aren't random programmers—they're some of the smartest people in tech. Yet they're writing tedious code that AI handles better.

The resistance stems from outdated assumptions. Critics think AI means copy-pasting broken ChatGPT output. Modern AI agents actually navigate codebases, run tests, and fix their own mistakes. They don't just generate code—they debug it.

Common objections fall apart under scrutiny. "AI hallucinates"? So do tired developers on deadlines. "The code quality is poor"? Most code is mediocre anyway. "I don't know what the AI wrote"? Reading other people's code is part of the job.

The real issue isn't technical—it's emotional. Developers pride themselves on craft. Using AI feels like cheating. But software development isn't fine woodworking. It's problem-solving for people who need working applications.

Meanwhile, academics debate whether AI coding leads to artificial general intelligence. That misses the point. Current tools already eliminate grunt work and speed up debugging. They free developers to focus on architecture and design—the parts that actually matter.

Why this matters:

Read on, my dear:

Meta signed a 20-year contract to buy nuclear power from Constellation Energy's Illinois plant, securing 1,121 megawatts starting in 2027 when state subsidies expire. The deal reflects how AI has turned tech companies into power-hungry giants scrambling for reliable electricity sources that won't kill the planet.

Hisayuki Idekoba returned as Indeed's CEO after a six-year break, replacing Chris Hyams who stepped down from the job site. Idekoba says he'll use AI to speed up hiring, apparently believing technology can solve what humans have struggled with for decades.

Trump posted over 2,200 times on Truth Social since January, tripling his early Twitter pace from 2017 with help from aides and late-night typing sessions. The 78-year-old president now treats social media like a full-time job, surprising staff with 3 a.m. posts about everything from Putin to Taylor Swift's declining hotness.

The US banned electronic design automation software exports to China, hitting companies like Xiaomi that design their own chips for manufacturing in Taiwan. Xiaomi's new 3-nanometer processor and similar chips from Lenovo and Bitmain face cuts to future software updates and technical support, though Chinese firms are already turning to hacked US software and local alternatives.

The Federal Trade Commission is investigating about a dozen advertising and advocacy groups for allegedly coordinating boycotts against platforms like X over hateful content concerns. FTC Chairman Andrew Ferguson, who calls advertiser pullbacks illegal boycotts that threaten free speech, sent letters demanding information about business practices and communications between watchdog groups.

Google will spend $500 million over 10 years rebuilding its compliance structure to settle a shareholder lawsuit over antitrust violations. The deal creates a new board committee to oversee regulatory issues and requires senior executives to report directly to CEO Sundar Pichai after courts found Google monopolized search, advertising, and app markets while judges criticized the company for deleting evidence.

Vodafone faces a record €45 million fine in German after third-party sales agents created fake contracts and unauthorized people accessed customer eSIM profiles. The penalty splits between €15 million for poor agent oversight and €30 million for security failures that let strangers into customer accounts.

Israeli cybersecurity company Zero Networks raised $55 million in funding, tripling its customer base since 2023 while keeping its revenue growth at a modest 300%. The company prevents ransomware attacks, which apparently remains a growth industry.

Microsoft, CrowdStrike, Palo Alto Networks, and Google announced plans to create a public glossary of hacker group nicknames after years of confusion over names like "Cozy Bear" and "Kryptonite Panda." The move comes after a 2016 government report listed 48 different aliases for Russian hackers, proving that creative naming conventions can backfire spectacularly.

Former FBI cyber official Cynthia Kaiser joined cybersecurity firm Halcyon after two decades of government service, where she'll run their new ransomware research center. Kaiser says ransomware gangs have splintered into smaller groups that now harass victims' customers directly, proving criminals will always find new lows to sink to.

Walmart added $150 billion in revenue over five years while employing 70,000 fewer people, using robots and AI to handle tasks from unloading pallets to building shipping boxes. The company now runs warehouses where one worker covers 1,200 square feet and machines decide box sizes, proving that America's largest private employer has mastered the art of profitable job elimination.

Netic builds AI agents that answer phones for plumbers, electricians, and HVAC techs. The startup turns every missed call into booked appointments while contractors sleep. 💤

Founded in 2024 by Melisa Tokmak, a Stanford computer scientist who cut her teeth at Scale AI, Instagram, and Facebook. Born in rural Turkey, now commanding Silicon Valley respect. San Francisco HQ, stealth team size undisclosed.

Core strength: Full-stack AI receptionist that never sleeps

Powers: Handles calls, texts, web chat across all channels 24/7

Smart moves: Triages emergencies, schedules appointments, generates outbound leads

Integration game: Plugs into ServiceTitan, Jobber, Housecall Pro seamlessly

Track record: 50K+ jobs booked autonomously during private beta

Crowded field of wannabes and giants. Broccoli AI (YC-backed) targets same vertical. Conju uses SMS angles. ServiceTitan ($9.5B valuation) could crush everyone by adding AI features. Traditional call centers still dominate. Netic's edge: Nexstar Network partnership gives industry credibility.

War chest: $20M seed + Series A (June 2025)

Lead investors: Greylock Partners, Founders Fund

Notable angels: Dylan Field (Figma), Alexandr Wang (Scale AI)

Valuation: Undisclosed, likely nine figures

Burn rate: Funding targets engineering hires and customer acquisition

Strong prospects in massive market ($700B home services). Early wins with major contractors prove concept works. Risk: Only 20% of calls fully automated at best clients. Contractors remain skeptical of robots handling panicked homeowners. Success depends on perfecting human-like AI that doesn't creep people out.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.