San Francisco | February 11, 2026

Half of xAI's founding team is gone. Jimmy Ba and Tony Wu resigned within 48 hours, bringing departures to six of twelve. The company bleeding close to $1 billion a month just lost the people who built Grok.

Former GitHub CEO Thomas Dohmke raised $60 million to solve a problem that didn't exist two years ago. His startup Entire tracks why AI agents write the code they write. When machines produce most of the software, someone has to audit the machines.

Wall Street already priced in that shift. $285 billion vanished from software stocks after Anthropic proved agents can do what per-seat licenses charge humans for. The market isn't punishing bad quarters. It's repricing the seat.

Stay curious,

Marcus Schuler

xAI Loses Half Its Founding Team After Two Cofounders Resign in 48 Hours

Jimmy Ba and Tony Wu walked out of xAI within 48 hours. Six of twelve original cofounders are now gone from the AI company burning close to $1 billion per month.

Ba, a University of Toronto professor and student of Nobel laureate Geoffrey Hinton, led research, safety, and enterprise operations and reported directly to Elon Musk. His work shaped the Grok 4 models. Wu held significant technical authority before a restructuring stripped his portfolio. His Slack access was cut the same day he announced his resignation.

The departures follow a pattern. Kyle Kosic left for OpenAI in 2024. Christian Szegedy joined Morph Labs the same year. Igor Babuschkin resigned in August 2025 to launch an AI safety venture fund. Greg Yang stepped back last month after a Lyme disease diagnosis.

Inside the company, staff say leadership overpromised technical developments to Musk. MacroHard, xAI's coding and agents product, fell short of expectations. Cofounder Guodong Zhang has consolidated authority over both Ba's and Wu's teams, now overseeing all pre-training and post-training operations.

The financial picture compounds the talent drain. xAI lost $1.46 billion in Q3 2025 on $107 million in revenue. It burned $7.8 billion through the first nine months of the year. SpaceX absorbed xAI in an all-stock merger valuing the combined entity at $1.25 trillion. Without SpaceX's cash, xAI's reserves would have depleted within months.

Regulatory pressure mounts in parallel. Paris prosecutors raided X's French offices. The EU opened a formal Digital Services Act investigation. Musk and former X CEO Linda Yaccarino face April hearings on criminal allegations. SpaceX targets an IPO as early as June 2026 at a potential $1.5 trillion valuation, carrying xAI's burn rate as disclosed baggage.

Why This Matters:

- Half the founding team departing signals organizational dysfunction deeper than any single resignation explains

- SpaceX's planned IPO now carries xAI's roughly $1 billion monthly burn as public market baggage

✅ Reality Check

What's confirmed: Six of twelve cofounders have departed. xAI burned $7.8 billion in the first nine months of 2025 against $107 million in quarterly revenue. SpaceX absorbed xAI in an all-stock merger.

What's implied (not proven): Internal sources attribute departures to overpromised deliverables and organizational dysfunction, but Ba and Wu's public statements were gracious.

What could go wrong: Consolidating all technical authority under one remaining cofounder creates a single point of failure at a company running six product lines.

What to watch next: SpaceX IPO filing (targeted June 2026) and whether it discloses xAI's burn rate as a separate line item. Grok 4 ship date as a signal of research continuity.

The One Number

$20,000 — Total API cost for 16 Claude AI agents to write a 100,000-line C compiler from scratch. Anthropic set the agents loose as an experiment. The resulting compiler, written in Rust, compiles the Linux kernel and passes 99% of the GCC torture test suite. A human engineering team building the equivalent would bill seven figures. The cost gap between human and machine code just collapsed by two orders of magnitude.

Source: Anthropic Engineering Blog

Former GitHub CEO Thomas Dohmke Raises Record $60M Seed for AI Code Management Startup

Thomas Dohmke left GitHub after four years as CEO to build the management layer for AI-generated code. His startup Entire launched Monday with a record $60 million seed round at a $300 million valuation.

Felicis Ventures led the round. Microsoft's M12, Madrona, and Basis Set participated alongside angels including Yahoo co-founder Jerry Yang, Y Combinator CEO Garry Tan, and Datadog CEO Olivier Pomel.

Entire's first product, Checkpoints, is an open-source command-line tool that records the reasoning, prompts, and decisions behind AI-generated code. It supports Anthropic's Claude Code and Google's Gemini CLI. Where Git tracks what code does, Checkpoints tracks why it was built that way.

The thesis: AI agents produce code faster than humans can review it. Traditional pull requests become bottlenecks when machines generate thousands of lines per hour. Entire sits atop GitHub and GitLab as a management layer, not a replacement. Its three-layer architecture includes a Git-compatible database, a semantic reasoning layer for decision trails, and an AI-native interface for human-agent collaboration.

"We are not training models or building agents. We are integrating with them," Dohmke told implicator.ai. The 15-person team, drawn from GitHub and Atlassian, is fully remote across the US, Europe, and Australia.

Why This Matters:

- Entire bets that AI code management becomes as essential as version control, targeting the gap between agent output speed and human review capacity

- The record seed and $300M valuation signal investor conviction that developer infrastructure needs rebuilding for an AI-native era

AI Image of the Day

Prompt: A gritty, ethereal depiction of a "robot" graces the cover of this LP album, reminiscent of the iconic 1970s Hypgnosis style. In this dreamlike composition, a solitary figure is captured in a moment of toil and contemplation. The image, likely a photograph, is ultra realistic, conveying a sense of both mundane reality and transcendent beauty. Every detail is painstakingly rendered, from the worn hands and weathered face of the subject to the intricate textures of the environment. The overall effect is mesmerizing, inviting viewers to ponder the human experience within the context of labor and perseverance.

Anthropic's Claude Cowork Triggered $285 Billion Software Selloff, Exposing SaaS Pricing Flaw

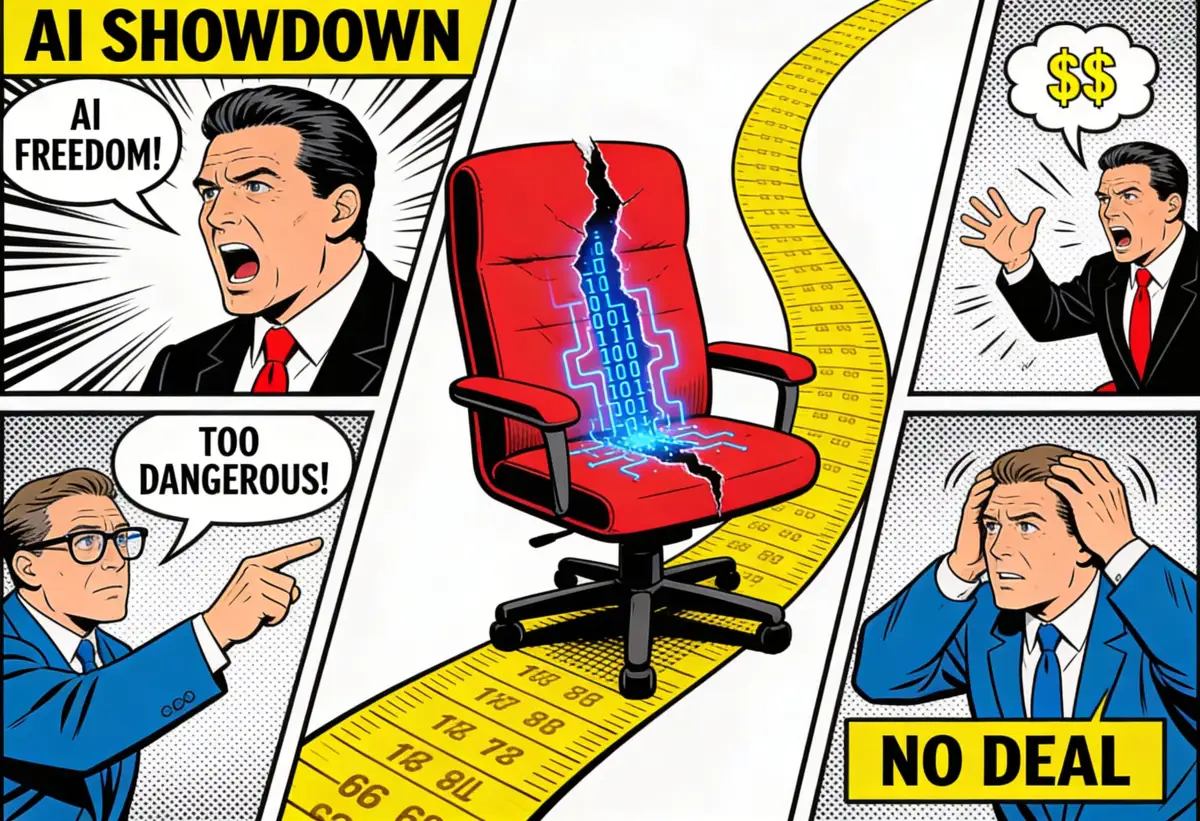

$285 billion evaporated from global software stocks in 48 hours after Anthropic demonstrated that AI agents can handle the workflow tasks for which per-seat licenses charge premium rates. The market repriced a $390 billion industry in real time.

Goldman Sachs' U.S. software basket fell 6% on February 3, its worst session since April's tariff selloff. Jefferies trader Jeffrey Favuzza coined the term SaaSpocalypse. The name stuck because the selling didn't stop.

Thomson Reuters posted its worst day ever, falling 17%. LegalZoom lost a fifth of its value. Monday.com dropped 50% year to date despite beating earnings expectations. Software underperformed semiconductors by 20 percentage points over 20 trading days, a gap last seen at the dot-com peak.

The trigger was specific. Anthropic shipped 11 open-source Cowork plugins covering legal, sales, finance, marketing, and support. Then Opus 4.6 arrived with coordinated agent teams and a million-token context window. Not a demo. A shipping product that reviews contracts, manages CRMs, and processes invoices for $100 to $200 per month.

Bain drew a useful distinction: "probabilistic" SaaS where approximate answers work got crushed. "Deterministic" SaaS where precision matters was spared. CrowdStrike rose during the worst of it. About 40% of SaaS companies still price by the seat. One customer killed a $350,000 Salesforce contract after rebuilding with AI tools. SaaS cost inflation hit 11.4% in 2025, four times G7 inflation. Buyers wanted out. Agents gave them the exit.

Why This Matters:

- The selloff separates workflow automation (vulnerable) from mission-critical precision software (defensible), creating a new investment framework

- SaaS cost inflation at 11.4% gave enterprise buyers the incentive to switch before agents gave them the ability

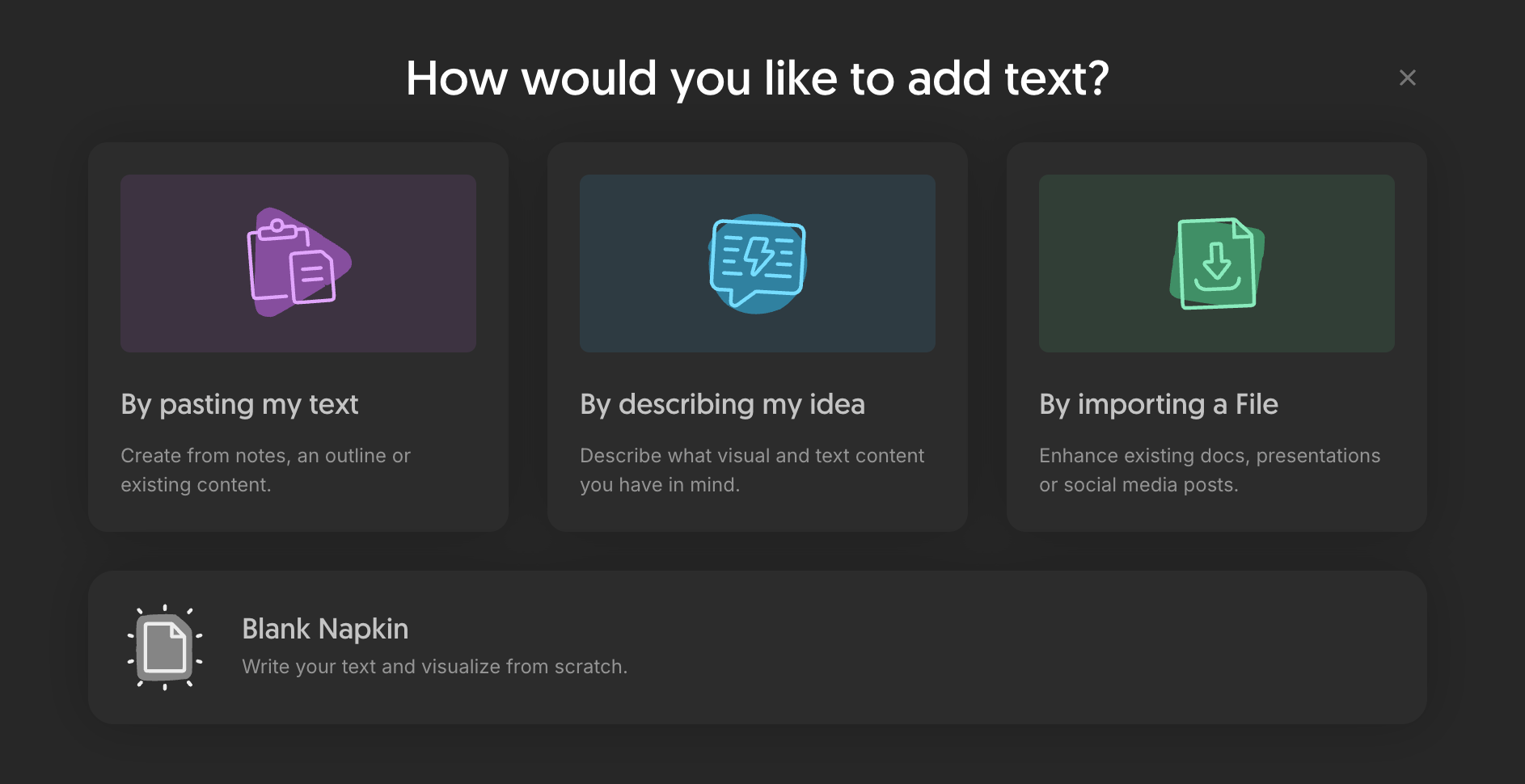

🧰 AI Toolbox

How to Turn Any Text Into Professional Visuals with Napkin AI

Napkin AI converts written text into diagrams, flowcharts, infographics, and charts without touching a design tool. Paste a paragraph from a strategy doc, a product spec, or meeting notes, and the AI generates visual options that match your content. Everything is editable, exportable, and works in 60+ languages.

Tutorial:

- Go to napkin.ai and create a free account (no credit card needed)

- Paste or type the text you want to visualize, anything from a bullet list to a full paragraph

- Click Generate and Napkin produces multiple visual options based on your content

- Pick the layout that fits: flowcharts, org charts, comparison tables, process diagrams, or infographics

- Customize colors, fonts, icons, and connectors using the built-in editor

- Invite teammates to co-edit or comment in real time using Teamspace

- Export as PNG, SVG, PDF, or PowerPoint, or paste directly into Google Slides, Notion, or LinkedIn

What To Watch Next (24-72 hours)

- AppLovin: Q4 earnings after market close today. The AI-powered ad optimization platform guided revenue of $1.57-1.60 billion. AppLovin has tripled in market cap over the past year on the strength of its machine-learning ad engine. Watch whether gross margins hold above 80%.

- Coinbase and Airbnb: Both report tomorrow after close. Coinbase rides crypto's post-election rally with Q4 revenue consensus near $2.1 billion. Airbnb tests whether AI-powered trip planning lifts average booking values or just generates prettier search results.

- OpenAI GPT-4o Retirement: The model goes dark Friday alongside GPT-4.1, GPT-4.1 mini, and o4-mini. Developers still building on these endpoints have 48 hours to migrate before the API calls stop returning.

🛠️ 5-Minute Skill: Turn a Competitor's Website Into a SWOT Analysis

Your boss just asked for a competitive review by end of week. You have four competitors to profile and no budget for a research firm. Their websites, job postings, and review sites are full of useful signals, but extracting strategy from marketing copy takes practice. Here's how to let AI do the pattern matching.

Your raw input:

Competitor: DataVault (datavault.io)

Homepage: "Enterprise-grade data protection for the AI era. Trusted by 3 of the Fortune 10."

- SOC 2 Type II certified, HIPAA compliant, FedRAMP authorized

- 99.999% uptime SLA

- "Starting at $50,000/year" on pricing page

- 340 employees on LinkedIn, founded 2019 in Austin TX

- Recent blog post: "Why we're doubling down on on-premise deployment"

- Glassdoor: 3.2 stars, reviews mention "fast growth but burnout"

- Press release: Series C, $180M at $1.2B valuation

- Job postings: 12 open roles, 8 are in sales

- G2 reviews: praised for security, criticized for "clunky UI" and "slow onboarding" (avg 14 weeks)

- No free tier, minimum annual contract

- Three tiers: Pro ($50K), Enterprise ($200K), Gov (custom)

The prompt:

You are a competitive intelligence analyst preparing a SWOT analysis from publicly available information. The audience is a product leadership team deciding where to invest.

From this research, produce:

1. STRENGTHS (3-4 bullets): What they do well, based on evidence not claims

2. WEAKNESSES (3-4 bullets): Where they struggle, based on reviews, job postings, or gaps

3. OPPORTUNITIES (2-3 bullets): Market shifts that could benefit them

4. THREATS (2-3 bullets): Risks to their position, including from us

Then add:

- STRATEGIC SIGNAL: One sentence on what their recent actions reveal about direction

- OUR PLAY: One sentence on the specific gap we could exploit

Research data:

[paste your notes here]

Rules:

- Only claim what the evidence supports. "3 of the Fortune 10" is their claim, not verified.

- Read between the lines. Job postings reveal strategy. Glassdoor reveals culture. Blog topics reveal anxiety.

- Separate what they say from what the data shows.

What you get back:

STRENGTHS

- Compliance moat: SOC 2 II, HIPAA, FedRAMP. Took years to earn, hard for competitors to replicate quickly.

- Enterprise credibility: Fortune 10 customers (if accurate) create reference-selling power.

- Cash position: $180M Series C at $1.2B gives runway to outspend smaller competitors.

- Uptime commitment: 99.999% SLA signals serious infrastructure investment.

WEAKNESSES

- Onboarding friction: 14-week average per G2. Enterprise buyers increasingly expect weeks, not quarters.

- UI gap: "Clunky" recurring in reviews. Engineering resources prioritize compliance over experience.

- Culture risk: 3.2 Glassdoor with burnout mentions at 340 employees. Scaling will strain retention.

- No self-serve motion: $50K minimum limits top-of-funnel. Mid-market competitors with freemium eat the segment below.

OPPORTUNITIES

- AI regulation: NIST AI framework and EU AI Act create demand for their security positioning.

- On-premise demand: Blog signals a bet on enterprises pulling data from cloud. If that trend accelerates, they're early.

THREATS

- Cloud-native competitors offering compliance as a feature. AWS and Azure adding SOC 2 by default erodes the moat.

- Price compression: $50K floor is vulnerable if smaller players achieve FedRAMP at lower cost.

STRATEGIC SIGNAL: 8 of 12 open roles are in sales, not engineering. They're prioritizing revenue growth over product. The on-premise blog confirms they're chasing defense or healthcare buyers.

OUR PLAY: Attack the onboarding gap. If we offer comparable compliance with 4-week onboarding, every buyer burned by a 14-week implementation is a warm lead.

Why this works

The prompt forces the model to triangulate three types of evidence: what the company says (marketing), what the users say (reviews), and what the company does (hiring, blogs, pricing). Most people only look at one source. The "read between the lines" rule catches signals like "8 sales roles = growth over product," exactly the kind of insight leadership teams need.

Where people get it wrong: Asking AI to "analyze this competitor." Without structure, you get a book report. The SWOT framework plus "strategic signal" and "our play" force actionable output that drives decisions, not just awareness.

What to use

Claude (Sonnet 4.5 via claude.ai): Best at the "read between the lines" analysis. Catches subtle signals in job postings and blog topics. Watch out for: Can over-qualify every claim. You may need to trim hedging language.

ChatGPT (GPT-4o): Cleanest SWOT formatting. Good at decisive "Our Play" recommendations. Watch out for: Sometimes invents competitive scenarios not supported by the input. Verify the threats section against your actual data.

AI & Tech News

Mistral AI Revenue Surges 20-Fold, Commits €1.2 Billion to Swedish Data Center

CEO Arthur Mensch says the French AI startup's annualized revenue run rate hit $400 million, up from $20 million a year ago. Mistral also announced a €1.2 billion data center investment in Sweden with EcoDataCenter, its first infrastructure commitment outside France, targeting a 2027 opening.

ByteDance Develops In-House AI Chip, Targets 100,000 Units in 2026

TikTok's parent company is building its own AI inference chip and negotiating with Samsung Electronics for manufacturing. The move signals ByteDance's push to reduce reliance on external chip suppliers amid growing geopolitical pressure on semiconductor access.

OpenAI's Fidji Simo Details Plans for ChatGPT Advertising

In a wide-ranging interview, OpenAI's Fidji Simo outlined how ads will be integrated into ChatGPT, discussed a new model push Sam Altman dubbed "Code Red," and addressed rivalry with Anthropic. Simo also provided updates on Sora, the Jony Ive collaboration, and OpenAI's strategy to maintain its lead.

Isomorphic Labs Unveils Drug Design Engine That Surpasses AlphaFold 3

The Google DeepMind spinoff launched IsoDDE, a next-generation AI system that outperforms AlphaFold 3 in predicting biomolecular structures. The engine marks a step toward AI-driven drug design that could compress the traditionally decade-long pharmaceutical development cycle.

London AI Chip Startup Olix Raises $220 Million at Unicorn Valuation

A 25-year-old British entrepreneur raised $220 million led by Hummingbird Ventures to build AI chips faster and cheaper than Nvidia's. Olix's founder James Dacombe also serves as CEO of brain monitoring startup CoMind.

Big Tech Companies Plan to Sidestep Trump's $100,000 H-1B Fee

Amazon, Google, and other major firms are shifting hiring toward exempt worker categories to avoid the new immigration surcharge on H-1B visa applications. Smaller companies with fewer options face a widening competitive disadvantage in recruiting skilled foreign workers.

SMIC CEO Warns Industry Is 'Panicked' Over Memory Chip Shortages

Zhao Haijun, chief executive of China's largest contract chip manufacturer, says new memory supply could take nine months to reach the market. Memory chip prices have surged more than 80% in 2026 as demand continues to outpace production capacity.

Anthropic CCO Says Company Prioritizes Revenue Over Headlines

Chief Commercial Officer Paul Smith told CNBC that Anthropic is focused on growing revenue and building its core business rather than chasing high-profile consumer initiatives. Smith dismissed the recent AI market selloff as "hyperbole," drawing a deliberate contrast with competitors.

T-Mobile Unveils AI-Powered Live Translation Running at the Network Level

T-Mobile announced a Live Translation feature that operates directly on its wireless infrastructure, supporting more than 50 languages across both 5G and 4G LTE connections. The beta launches this spring, embedding real-time translation into the network rather than relying on device-based apps.

SK Hynix Hits 58% Operating Margins as HBM Shortage Fuels $438 Billion Valuation

The South Korean chipmaker's transformation from underperformer to semiconductor powerhouse rides surging global demand for high-bandwidth memory chips powering AI infrastructure. SK Hynix now ranks among the most profitable technology companies in the world.

🚀 AI Profiles: The Companies Defining Tomorrow

Harvey

Harvey wants to do for lawyers what Excel did for accountants: make the grunt work disappear. The San Francisco startup builds custom large language models that handle legal research, contract drafting, and document review across every practice area and jurisdiction. ⚖️

Founders

Winston Weinberg quit Big Law after one year as a securities and antitrust litigator. Gabriel Pereyra left AI research positions at Meta and Google. They started Harvey as roommates in a San Francisco apartment in 2022 and secured early access to GPT-4, which let them build a prototype faster than competitors could hire. The founding story became a Harvard Business School case study.

Product

Harvey runs domain-specific LLMs trained on legal data. The AI handles research, drafting, due diligence, and contract analysis, functioning as an associate that reads faster than any human and bills nothing. Over 235 enterprise customers use it, including top global law firms. A recent feature lets firms and corporate clients collaborate in shared virtual workspaces with built-in data separation so confidential information stays walled.

Competition

Thomson Reuters and LexisNexis own the legacy research market and are bolting AI onto existing products. Sandstone, also Sequoia-backed, targets in-house counsel. Clio dominates small-firm practice management. Harvey's edge: purpose-built legal models, not general AI with a law plugin. The risk: OpenAI and Anthropic could ship "good enough" legal features inside their general platforms.

Financing 💰

In talks for $200M at an $11B valuation, per Forbes, up from $8B two months ago. The December 2025 round raised $160M. ARR hit $190M by year-end, up from $50M nine months earlier. Sequoia has led or participated in every major round. Total raised exceeds $300M.

Future ⭐⭐⭐⭐

Law firms spend $1 trillion globally per year, and most of that money pays humans to read and write. Harvey's growth curve, $50M to $190M ARR in nine months, suggests the market is ready. The risk: Big Law moves slowly on technology, and incumbents with existing distribution can ship AI faster than Harvey can land enterprise contracts. But Sequoia doesn't double down without conviction. ⚖️

🔥 Yeah, But...

Nvidia CEO Jensen Huang told Bloomberg last week that the company's $100 billion OpenAI investment, announced five months ago at a major tech conference, was "never a commitment." No contract was signed. No money changed hands. The figure on the table is now reportedly closer to $20 billion. Both Nvidia and OpenAI invested in each other's competitors during the intervening months.

Sources: Bloomberg, February 1, 2026 | CNBC, February 3, 2026

Our take: Corporate America used to have a name for this. It was called "forward-looking statements" and it came with a disclaimer, usually in footnote 6 on page 43. Silicon Valley skipped the disclaimer. Now "announcement" and "commitment" occupy different zip codes, connected by a press release nobody intended to honor. No retraction. No correction. Just a gentle recategorization of a hundred billion dollars from "happening" to "conceptual." If your landlord tried this with a lease agreement, you'd call a lawyer. When a CEO does it at a keynote, analysts nod and update their models.