💡 TL;DR - The 30 Seconds Version

👉 Nvidia invests $5 billion in Intel at $23.28 per share to jointly develop PC and data center chips, sending Intel stock up 33%.

📊 Intel will design custom x86 processors for Nvidia's AI infrastructure using NVLink technology, delivering 14x more bandwidth than standard PCIe connections.

🏭 The partnership excludes Intel's foundry business—Nvidia won't manufacture chips at Intel facilities, suggesting continued TSMC reliance.

🌍 AMD faces competitive pressure in both data centers and gaming laptops as Intel gains access to Nvidia's proprietary NVLink ecosystem.

💰 Combined with recent $9B government and $2B SoftBank investments, Intel secures $16B in fresh capital for manufacturing revival.

🚀 The deal formalizes Nvidia's role as industry kingmaker—even Intel now needs partnership for AI-adjacent market relevance.

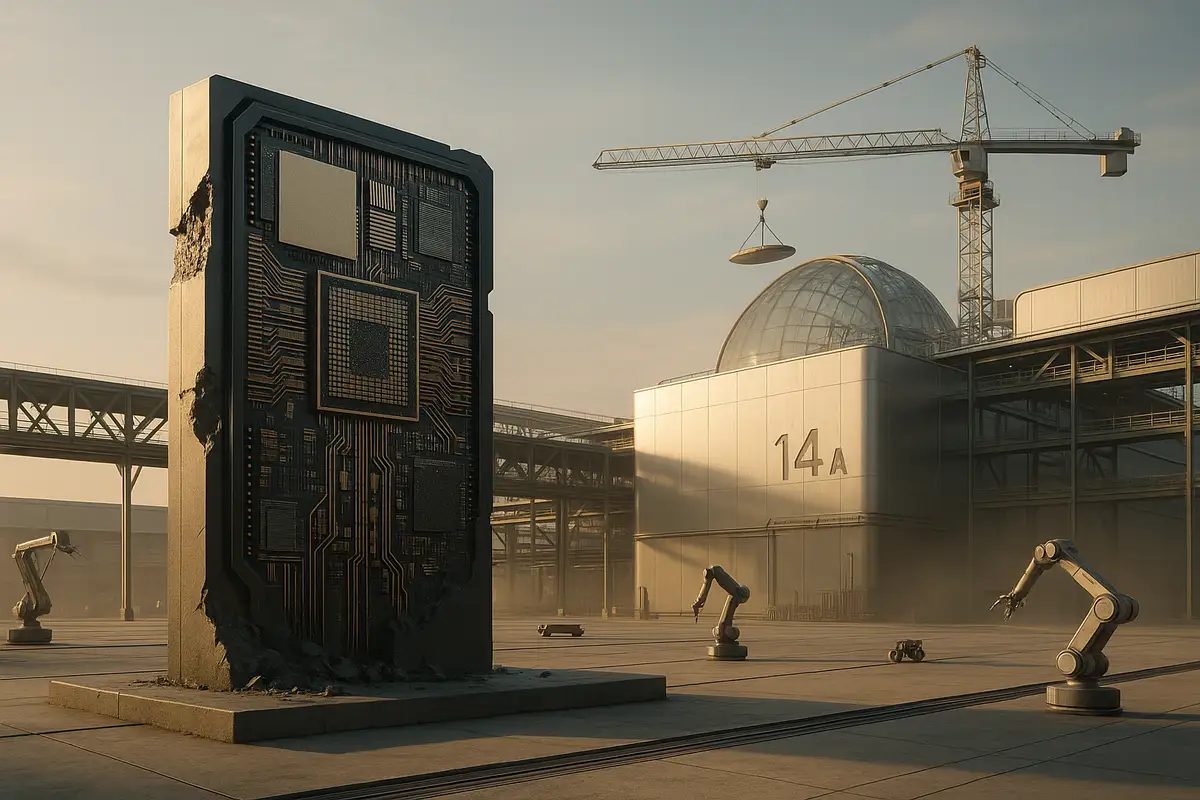

Nvidia bets $5 billion on Intel partnership. Silicon Valley rivals forge an unlikely alliance

Nvidia will invest $5 billion in Intel at $23.28 per share while the companies jointly develop new PC and data-center chips, according to the NVIDIA–Intel collaboration announcement. Intel’s stock jumped more than 30% in premarket trading—an inversion of power that would have seemed impossible when Intel dominated semiconductors just three years ago.

What’s actually new

Intel will design custom x86 processors for Nvidia’s AI infrastructure and create “x86 RTX SoCs” that fuse Intel CPU cores with Nvidia RTX GPU chiplets for consumer PCs. Both product families are slated to use Nvidia’s NVLink for CPU-to-GPU communication, a tighter coupling than today’s PCIe-based designs. If it works as promised, throughput and latency improve substantially. That’s the bet.

Crucially, Nvidia stopped short of committing any chip manufacturing to Intel. Design together, yes. Build together, not yet. That caveat matters.

Money and control

The cap table tells a story. Nvidia’s buy-in at $23.28 follows August’s U.S. government stake at $20.47 and SoftBank’s $23 purchase. Together those three checks represent roughly $16 billion in fresh capital for Intel—breathing room for multi-year process technology and packaging investments without piling on more debt. It’s a lifeline.

For Nvidia, $5 billion is about 2% of its market cap. The return is strategic optionality: access to custom x86 silicon tuned for NVLink systems and client PCs, without assuming foundry risk or schedule slips. Cheap insurance.

Why Nvidia, why Intel

Nvidia’s calculation. Custom Intel CPUs socketed into NVLink-centric systems could reduce bottlenecks and differentiate GPU clusters against rivals. The x86 RTX SoCs also broaden Nvidia’s reach into thin-and-light gaming laptops where discrete GPUs fight power and thermal limits. Minimal downside, real upside.

Intel’s rationale. Beyond the cash, this is validation from the industry’s kingmaker. Intel’s historic edge was tailoring Xeons for big buyers; turning that muscle toward Nvidia makes sense. It also signals to customers and Washington that Intel remains central—on design, packaging, and advanced interconnects—even as it rebuilds manufacturing credibility.

Short version: each side gets something it needs.

The competitive fallout

AMD takes a direct hit. In data centers, an Intel-Nvidia CPU with NVLink tightens the moat around Nvidia’s accelerator empire, blunting AMD’s pitch for fully integrated CPU-GPU platforms. In PCs, an Intel x86 package with RTX graphics squeezes AMD’s APU beachhead in gaming laptops. Pressure rises on two fronts.

TSMC, meanwhile, faces a long-term risk, not an immediate one. If Intel’s process nodes and advanced packaging catch up, some Nvidia-related volume could shift to Intel. That’s a big if. For now, manufacturing remains TSMC’s to lose.

A precedent—and a lesson

This isn’t the first fused-silicon experiment. Intel’s 2017 Kaby Lake-G paired Intel CPUs with AMD Radeon graphics in one package. The concept was sound; the execution wasn’t. Driver responsibilities blurred, updates lagged, and the product line died early.

Two things are different now. Nvidia will own its GPU drivers, and NVLink provides tighter, lower-latency coupling than the PCIe link used then. The architecture should be cleaner. The incentives are, too.

Geopolitics in the background

Washington’s 9.9% stake in Intel wasn’t charity. The U.S. wants resilient, domestic capacity for leading-edge compute, and it wants Intel in the game. Nvidia’s partnership aligns with those objectives while protecting its own supply chain flexibility. Politics and business rarely mesh this neatly. Here, they do.

Still, the deal notably sidesteps Intel Foundry as a near-term destination for Nvidia silicon. That restraint keeps pressure on Intel to prove it can deliver 18A and beyond at scale. Results, not press releases.

Execution remains the wildcard

Tight CPU-GPU coupling demands custom silicon, coherent memory semantics, coordinated firmware, and relentless thermal engineering. Failure modes are many. Past industry attempts promised desktop-class performance in laptop-class envelopes, only to be throttled by heat, bandwidth, or driver fragility. Reality bites.

Nvidia’s own CPU roadmap complicates the picture. Grace and its successors pursue ARM for certain workloads, suggesting Nvidia sees heterogeneous paths by use case. The Intel tie-up reads as additive: an x86 branch for markets where ecosystem and software inertia matter most.

Manufacturing is the deliberate blank space. Intel builds some parts in-house and outsources others to TSMC; Nvidia leans on TSMC today. The custom Nvidia-branded x86 CPUs could land on either side of that fence, dictated by timing and yield rather than strategy alone. We’ll know when product dates appear. Not before.

The bigger shift

This deal codifies an industry trend: general-purpose CPUs yielding ground to tightly integrated, accelerator-centric systems. Value accrues to the company orchestrating the stack—silicon, interconnects, software, and systems. Nvidia sits atop that pyramid. Even Intel now needs its blessing to reenter certain rooms.

For customers, the pitch is simple: more performance per rack unit, less glue logic, fewer bottlenecks. The lock-in risk is equally clear. NVLink isn’t an open standard. Once you buy the stack, switching costs rise.

Why this matters:

- Nvidia just formalized its kingmaker role: Even Intel, once the industry’s sun, now seeks Nvidia’s ecosystem to stay competitive in AI-adjacent markets.

- System architecture is tilting for good: NVLink-centric CPU-GPU packages signal a durable move toward tightly coupled, accelerator-first designs—and away from commodity, PCIe-glued boxes.

❓ Frequently Asked Questions

Q: What exactly is NVLink and why is it better than PCIe?

A: NVLink is Nvidia's proprietary chip-to-chip interconnect technology that provides up to 14 times more bandwidth than standard PCIe connections. It also offers lower latency communication between CPUs and GPUs, which is crucial for AI workloads that require massive data movement between processors.

Q: Why didn't Nvidia commit to manufacturing chips at Intel's foundries?

A: Nvidia remains skeptical about Intel's ability to match TSMC's advanced manufacturing capabilities. Intel's foundry business has struggled with delays and yield issues, while TSMC consistently delivers leading-edge nodes. The partnership focuses on design collaboration, keeping manufacturing options open.

Q: What happened with Intel's previous CPU-GPU integration attempt?

A: Intel's 2017 Kaby Lake-G combined Intel CPUs with AMD graphics but failed within two years due to driver support problems and internal conflicts. Unlike that effort, Nvidia will handle its own GPU drivers while NVLink provides superior chip-to-chip communication compared to Kaby Lake-G's PCIe connection.

Q: When will we actually see these Nvidia-Intel products hit the market?

A: Neither company provided specific timelines, only committing to "multiple generations" of products. Given typical processor development cycles of 2-4 years, expect the first x86 RTX SOCs and custom data center chips sometime in 2027-2028 at the earliest.

Q: How does this affect Intel's existing partnerships with AMD and other competitors?

A: Intel maintains separate business relationships across different market segments. However, the Nvidia partnership could create tension since AMD competes directly with Nvidia in graphics. Intel will need to carefully manage overlapping partnerships to avoid conflicts, particularly in gaming and data center markets.