💡 TL;DR - The 30 Seconds Version

🎭 Nvidia labels Congressional chip restriction supporters "AI doomers," importing Silicon Valley philosophical debates into national security policy as Senate votes Tuesday.

💰 Banks' "America First amendment" targets $50 billion Chinese market, requiring US companies get first rights to advanced AI chips before overseas sales.

🇨🇳 Chinese tech giants Alibaba, ByteDance, and Tencent still pursue Nvidia chips despite Beijing pressure, eyeing B30A models costing double H20's $10,000-$12,000 price.

🏭 Supply constraints delivered Nvidia's narrowest earnings beat in nine quarters, with systems requiring 600,000 components each and year-long build cycles limiting growth.

⚡ Energy infrastructure emerges as systemic bottleneck as utilities resist financing AI data center capacity on uncertain boom-bust timelines.

🤝 Microsoft's $17.4 billion five-year Nebius deal signals shift toward long-term capacity contracts as companies route around silicon scarcity through strategic partnerships.

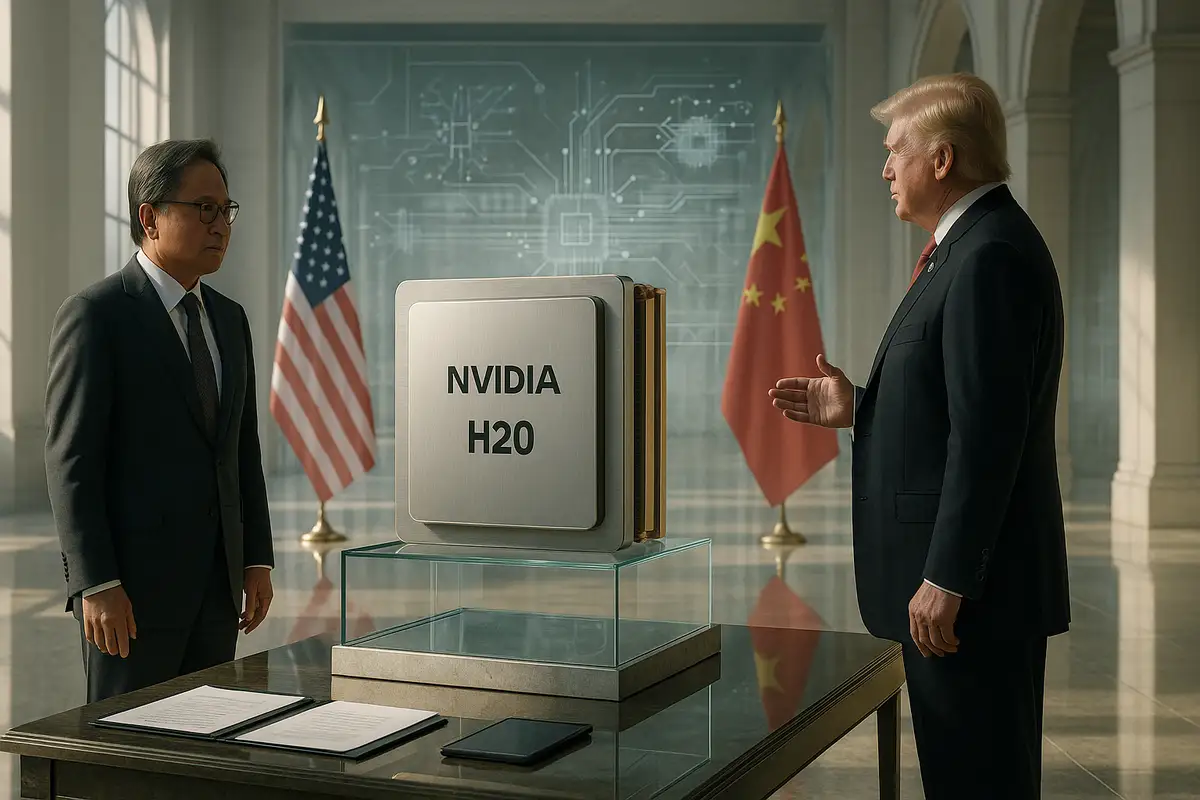

Nvidia has escalated its lobbying campaign against Congressional chip restrictions by weaponizing Silicon Valley's philosophical divide, labeling Republican national security hawks as "AI doomers" in what amounts to an unconventional political gambit that's shocked Washington insiders.

The strategy emerged as Senate leaders prepare to vote Tuesday on amendments requiring AI chips be offered to American companies before Chinese sales. Senator Jim Banks' "America First amendment" targets the $50 billion Chinese market that Nvidia stands to capture over the next year, yet the company's response has muddied traditional political alignments by importing tech industry factional disputes into national security policy.

The doomer designation—borrowed from effective altruism's philosophical debates about AI existential risk—represents a calculated attempt to reframe hawkish Republican export controls as left-wing paranoia. Tim Teter, Nvidia's general counsel, dismissed Senate staff concerns about Chinese sales as "AI doomerism" during a July call, while White House AI czar David Sacks amplified the attack by calling regulation supporters a "doomer cult" on his podcast.

The terminology warfare reveals deeper strategic tensions

The semantic battle obscures substantive disagreements about competitive strategy. Nvidia CEO Jensen Huang and Sacks argue that selling more US chips to China creates technological dependence, making Chinese companies reliant on American infrastructure. This "managed competition" model challenges years of government policy championing restrictions based on military and AI development concerns.

The approach has drawn pointed criticism from Republican veterans like David Feith, who led NSC technology policy through April. "It's misleading to suggest that US government support for semiconductor export controls originates with anything left-wing," Feith observed, noting the restrictions' origins in hawkish Republican national security doctrine rather than tech philosophy.

Nvidia's campaign has targeted specific individuals with effective altruist connections, including RAND Corporation CEO Jason Matheny, whose early 2000s research at Oxford's Future of Humanity Institute helped develop the movement's foundational ideas. The company's complaints contributed to dismissing at least one Commerce Department staff member partly funded by RAND, according to five sources familiar with personnel decisions.

Supply chain physics constrain exponential ambitions

Beneath the political theater, structural constraints are reshaping Nvidia's growth trajectory independent of policy outcomes. The company's latest quarter delivered its narrowest earnings beat since the AI boom began, with shares falling 6% as supply chain complexities limit manufacturing scale.

The numbers tell the constraint story precisely. Nvidia's current AI systems contain 600,000 components each, with future configurations targeting 2.5 million parts. TSMC produces nearly all chips, which then require packaging into elaborate configurations before integration into data center systems. The timeline stretches roughly one year from chip fabrication to customer delivery, creating bottlenecks that no amount of financial success can eliminate.

UBS analysts tracking Nvidia's supply commitments—inventory plus future obligations totaling $45 billion—concluded the company has "sufficient" capacity for steady growth but lacks resources for dramatic revenue acceleration. Annual revenue growth of 56% in the latest quarter marked the slowest pace in over two years, with analyst projections showing continued deceleration ahead.

Chinese demand persists despite Beijing pressure

The political complexity extends to demand dynamics, where Chinese tech giants maintain strong interest in Nvidia hardware despite government discouragement. Alibaba, ByteDance, and Tencent continue pursuing H20 chips and monitoring plans for the more powerful B30A model based on Blackwell architecture, according to four procurement sources.

Chinese firms view the B30A's projected pricing—roughly double the H20's $10,000-$12,000 cost—as attractive given its promised six-fold performance improvement. The calculation reflects constrained domestic alternatives from Huawei and Cambricon, which multiple engineering sources describe as underperforming compared to Nvidia's offerings.

Beijing's approach reveals the managed competition dynamic in practice. While authorities have summoned companies including Tencent and ByteDance over H20 purchases, expressing information security concerns, they haven't ordered cessation of Nvidia procurement. The pattern suggests tolerance for continued dependence while domestic capabilities develop.

Energy infrastructure emerges as systemic constraint

Beyond manufacturing bottlenecks, energy infrastructure presents a structural challenge that supply chain optimization cannot address. US utilities resist developing infrastructure for AI projects, questioning whether the boom will last long enough to justify massive investments that could burden other customers.

The timeline mismatch compounds the challenge. Energy generation and transmission expansion requires years to complete—far slower than AI demand growth rates. Huang's response focuses on efficiency improvements in newer chips, but greater efficiency typically invites greater usage rather than reducing total consumption.

The strategic realignment accelerates

The confluence of political pressure, supply constraints, and infrastructure limitations signals a shift from exponential to managed growth across the AI hardware sector. Nvidia's doomer campaign represents recognition that pure technological dominance may not sustain current trajectories without favorable policy frameworks.

The Nebius-Microsoft $17.4 billion infrastructure deal demonstrates how strategic partnerships are filling gaps in traditional supply chains. Nvidia's equity stakes in infrastructure providers—CoreWeave, Applied Digital, WeRide—reflect similar positioning for ecosystem control as raw manufacturing capacity becomes commoditized.

Why this matters:

• Market access increasingly requires navigating geopolitical frameworks rather than purely commercial considerations, transforming technology companies into instruments of statecraft

• Supply chain physics create natural limits on exponential growth that policy changes cannot overcome, forcing strategic pivots toward ecosystem control and partnership models

❓ Frequently Asked Questions

Q: What exactly are "AI doomers" and why is Nvidia using this label?

A: "AI doomers" originated in effective altruism philosophy, referring to people who believe AI could destroy humanity. Nvidia borrowed this Silicon Valley insult to paint Congressional Republicans pushing chip restrictions as paranoid rather than focused on national security. It's a rhetorical strategy to reframe serious export control debates.

Q: What would Banks' amendment actually require companies to do?

A: Companies would need to certify that US buyers had "right of first refusal" before shipping advanced AI chips to countries like China. If American companies want the chips and supply is limited, domestic buyers get priority. It's essentially a rationing system during scarcity periods.

Q: Why can't Chinese companies just use domestic chips instead of Nvidia's?

A: Chinese alternatives from Huawei and Cambricon significantly underperform Nvidia's chips, according to engineering sources. Even Nvidia's downgraded H20 model (designed for China) outpaces domestic options. Limited supply from Chinese manufacturers compounds the performance gap, keeping demand for US chips high.

Q: How does Nvidia's "managed dependence" strategy supposedly work?

A: Nvidia argues that selling compliant chips to China keeps Chinese companies locked into US software ecosystems and prevents them from developing independent alternatives. The theory: controlled access maintains technological dependence better than complete bans, which might accelerate domestic innovation efforts.

Q: Why does building an AI system take a full year from chip to delivery?

A: Current AI systems require 600,000 individual components that must be precisely assembled and integrated. TSMC fabricates the chips, then separate facilities package them into configurations, which get installed into complex cooling and power systems. Each step has lead times and quality controls that compound delays.