💡 TL;DR - The 30 Seconds Version

👉 Sam Altman co-founds Merge Labs with OpenAI's ventures team leading a $250 million funding round to directly compete with Elon Musk's Neuralink.

💰 The brain-computer interface startup targets an $850 million valuation, with Altman partnering with World's Alex Blania but avoiding personal investment.

📊 Neuralink raised $650 million at a $9 billion valuation this year and has five paralyzed patients already controlling devices with their thoughts.

🧠 AI advances in signal decoding and miniaturized electronics are making brain implants more practically useful after decades of limited medical applications.

🏭 Multiple companies including Precision Neuroscience and Synchron are racing to bring brain-computer interfaces to market in a fragmented but growing field.

🚀 Control over brain-to-AI interfaces could determine who owns the gateway to human-machine interaction as traditional input methods become obsolete.

OpenAI’s ventures arm is expected to lead a $250 million round for Merge Labs as Altman and Musk take their rivalry inside the brain.

Sam Altman is co-founding a brain–computer interface startup designed to compete with Elon Musk’s Neuralink, with OpenAI’s ventures team expected to lead a $250 million raise for Merge Labs, a move first detailed in a report on Merge Labs’ funding plan, according to the Financial Times. The bid escalates a long-running feud into a hardware-plus-AI contest over how humans will interact with machines. Talks are early. But the stakes are clear.

Merge is targeting an ~$850 million valuation. Altman will help launch the company alongside Alex Blania, who runs World (the eyeball-scanning digital ID project), yet he won’t invest personally or run day-to-day operations. That signals an institutional bet by OpenAI rather than a side project by its CEO. It also keeps governance simpler. For now.

A new front in a familiar fight

Altman and Musk co-founded OpenAI in 2015. Musk left in 2018 after clashing over direction and has since launched xAI while attacking OpenAI’s nonprofit conversion in court. Their public sparring on X keeps the drama alive. The business logic runs deeper. Each wants influence over the chokepoints of an AI economy. Interfaces are chokepoints. So are models, chips, and data. This is about control.

Neuralink has the head start: years of R&D, regulatory engagement, and early human trials. The company raised roughly $650 million this year at a ~$9 billion valuation and says multiple people with severe paralysis are already using its implant to control devices. Those numbers won’t be easy to chase. But they set a bar.

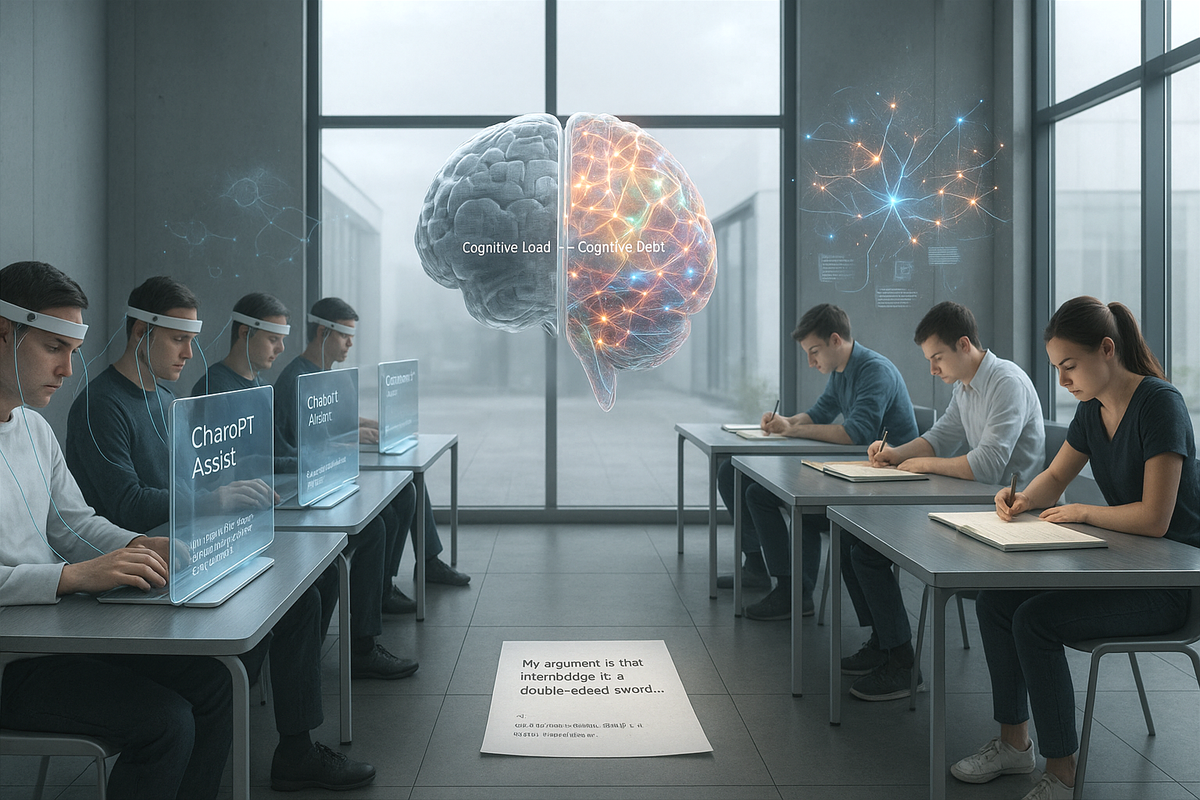

Why now: AI makes BCIs more useful

Brain implants are not new. Deep brain stimulation has treated Parkinson’s and epilepsy for decades. What changed is the software. Modern AI improves signal decoding, reduces latency, and enables higher-level intent recognition. Meanwhile, sensors and electronics have gotten smaller and more power efficient. Put together, the utility curve bends upward. Timing is not accidental.

Altman has been public about “the merge” for years, arguing that high-bandwidth interfaces would eventually narrow the gap between human intent and machine action. He sees BCIs as both assistive tech and, eventually, an augmentation layer for knowledge work. That’s the bet Merge aims to operationalize. It’s ambitious. It’s also crowded.

The field Merge enters

Beyond Neuralink, rivals like Precision Neuroscience and Synchron are pursuing different surgical and regulatory paths. Some approaches prioritize minimally invasive hardware; others chase bandwidth even if it requires more aggressive implantation. The market itself is bifurcating: medical restoration first, consumer enhancement later. Revenue today is small; long-term estimates run big. Forecasts of a future multihundred-billion market mask a near-term reality of clinical milestones and burn rates. Hardware is hard.

Regulation looms over everything. FDA approvals, human-subject protections, and post-market surveillance will define pace more than venture dollars alone. Neuralink’s progress clarifies the pathway, but it doesn’t simplify it. Safety events, device reliability, and explant procedures will shape public trust. One mishap can set the entire category back. That risk is real.

OpenAI’s stack strategy

Viewed from OpenAI’s seat, Merge fits a broader portfolio logic. Altman has backed energy (Oklo, Helion) to power compute, identity (World) to govern access, and now interfaces to capture intent. Each investment targets a bottleneck around AI scale: energy, trust, and I/O. A ventures-led deal keeps optionality: OpenAI gets a seat near the interface layer without absorbing hardware execution risk. If BCIs become the next default input, OpenAI wants influence over that surface. If not, the exposure remains limited. It’s a hedge and a probe.

The partnership could also create technical leverage. OpenAI’s models improve with richer, cleaner input signals; BCI vendors benefit from better decoding and intent prediction. Joint work on privacy, edge inference, and latency could matter more than cap tables. Throughput wins here. So does reliability. The user will not tolerate misfires.

What could go wrong

Plenty. The science may advance slower than the hype. Surgical risk, cost, and ethics could bottle up consumer use for years. Data governance will be under a microscope: who owns neural data, how it’s secured, and whether it becomes adtech’s next frontier. Even in medicine, reimbursement and clinician adoption decide outcomes as much as engineering does. Merge must pick a first market carefully. Start narrow. Prove value. Then expand.

And the deal itself is not done. Early-stage talks can shift, shrink, or fall apart. Valuation, control rights, and technical milestones will all be negotiated. The rivalry makes headlines, but execution will decide the scoreboard. No one gets a pass on hardware.

Why this matters

- Interfaces decide who controls access to AI. If BCIs mature, today’s platform power could shift to whoever owns the brain-to-model gateway.

- A credible challenger to Neuralink speeds the field and tests governance models for neural data, safety, and commercialization.

❓ Frequently Asked Questions

Q: How do brain-computer interfaces actually work?

A: Tiny electrodes detect electrical signals from neurons and translate them into digital commands. AI software decodes these signals to understand intent—like wanting to move a cursor or type text. Modern AI has dramatically improved signal interpretation accuracy compared to earlier systems.

Q: Who is Alex Blania and why is he involved?

A: Blania runs World (formerly Worldcoin), Altman's eyeball-scanning digital identity project that aims to verify human identity in an AI world. His experience with biometric technology and identity verification complements brain-interface development, particularly around data privacy and user authentication.

Q: How long does FDA approval take for brain implants?

A: Traditional brain implants took 10-15 years from development to approval. Neuralink's pathway suggests 5-7 years is possible with breakthrough device designation. The company expects FDA approval by 2029, having started human trials in 2024.

Q: What other companies compete with Neuralink and Merge Labs?

A: Precision Neuroscience received FDA clearance for its Layer 7 interface in April 2025. Synchron focuses on less invasive approaches through blood vessels. Paradromics, Science Corporation, and InBrain Neuroelectronics are also advancing clinical trials with different technical approaches.

Q: What are the main safety risks of brain implants?

A: Surgical risks include infection, bleeding, and tissue damage. Long-term concerns involve device degradation, immune responses, and potential neural scarring. Cybersecurity poses new risks—protecting neural data from hacking or unauthorized access remains a critical challenge for all manufacturers.

Q: When might healthy people get brain-computer interfaces?

A: Current trials focus on medical restoration for paralyzed patients. Consumer enhancement applications likely remain 5-10 years away, pending safety data, cost reduction, and ethical frameworks. Regulatory approval for healthy individuals will require extensive long-term safety studies.

Q: What is "the merge" that Altman wrote about in 2017?

A: Altman's concept describes humans merging with AI through high-bandwidth brain interfaces. He predicted this could happen by 2025, enabling direct thought-to-computer communication and potentially cognitive enhancement. The idea builds on transhumanist concepts of human-machine convergence.

Q: How does brain-interface investment fit OpenAI's strategy?

A: OpenAI is building an AI infrastructure portfolio: energy (Oklo, Helion), identity (World), and now interfaces (Merge). Each targets potential bottlenecks in AI adoption. Brain interfaces could become the primary input method for AI systems, making early influence strategically valuable.