Good Morning from Las Vegas,

Sam Altman called a Code Red. The New York Times called David Sacks a conflict. Both accusations reveal the same uncomfortable truth about this industry: building in AI means getting your hands dirty.

OpenAI paused its advertising push to fix ChatGPT's declining quality. Meanwhile, Google's Gemini quietly added 200 million users in three months. The company that triggered the modern AI race now scrambles to stay in it.

Sacks faces a different court. Critics demand an AI czar with deep technical expertise but zero economic exposure to the industry he regulates. That mythical figure exists only in editorial boards and think tank fantasies. The real choice is far messier.

Stay curious,

Marcus Schuler

OpenAI Declares Code Red, Delays Ads as Gemini Surges Ahead

Sam Altman told employees Monday that OpenAI had reached its highest internal alert level, pausing advertising development, AI shopping agents, and the Pulse assistant to fix ChatGPT's deteriorating quality.

The timing reflects Google's momentum: Gemini grew from 450 million to 650 million monthly users between July and October, with engagement data showing users now spend more time in Gemini sessions than ChatGPT ones despite OpenAI's claimed 800 million weekly users.

The delay creates a financial bind. OpenAI needs roughly $200 billion in annual revenue by 2030 to break even while honoring $1.4 trillion in compute commitments to Oracle and SoftBank. Advertising was supposed to help close that gap. Beta code already contains references to "ads feature" and "search ad" infrastructure. But monetizing frustrated users accelerates churn rather than generating sustainable revenue.

Google's structural advantages run deeper than any single model. Custom Tensor chips eliminate GPU rental costs. Ecosystem integration across Android, Gmail, and Search creates compounding data flywheels. OpenAI rents compute through Azure and ships Mac apps before Windows ones. Three years after Google panicked over ChatGPT's launch, the positions have inverted.

Why This Matters:

- OpenAI's delayed monetization extends its cash burn while compute obligations to Oracle and SoftBank remain fixed

- Enterprise customers face uncertainty as resources shift from API reliability toward consumer product fixes

AI Image of the Day

Prompt:

illustration of a christmas tree in the center, surrounded by a busy christmas market and a red double-decker bus on the street with people walking around. the cityscape includes st. paul's cathedral and big ben visible in the background. a crowd is gathered to watch children riding colorful snowmen in mid-air, all depicted against a backdrop of a winter sky with falling snowflakes. the overall mood captures the festive spirit with twinkling lights, decorations, and bustling activity. in the style of a vintage illustration.

David Sacks's 708 Investments Aren't a Scandal. They're the Point.

The New York Times frames David Sacks as Silicon Valley's man corrupting Washington, citing 708 tech investments and 449 AI-related holdings as evidence of conflict.

The framing misses something fundamental. Expertise in AI and crypto cannot exist without economic exposure. Sacks's critics want an impossible figure: a czar who understands transformers like Nvidia's engineers yet owns nothing and has never taken a risk. That person doesn't exist.

History offers a counterpoint. In 1940, FDR pulled William Knudsen from General Motors to organize war production. Critics called it a sellout. Two years later, America became the arsenal of democracy. When nations face industrial races, they draft builders, not bystanders.

Sacks's portfolio spreads across hundreds of firms rather than one monopoly. His fortune rises with American innovation broadly, not a single favored champion. He has accepted waivers, sold large positions, and exposed his finances to scrutiny. The alternative, regulators who've never shipped a model while China sprints toward dominance, isn't virtuous. It's reckless.

Why This Matters:

- Tech policy debates will increasingly pit expertise-with-exposure against the fiction of neutral oversight

- Future AI czars face the same test: alignment of interest may matter more than absence of interest

🧰 AI Toolbox

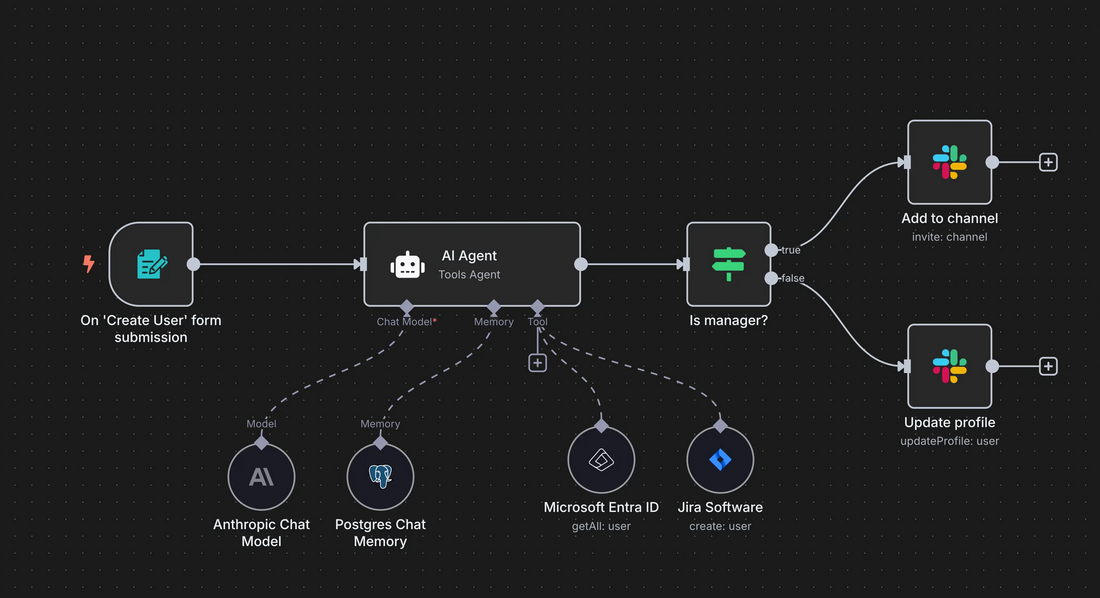

How to Build Powerful Workflow Automations with AI

n8n is an AI-native workflow automation platform that connects your apps and services through a visual drag-and-drop interface. With 400+ integrations and native AI capabilities, you can create everything from simple automations to complex multi-step AI agents. Self-host for full data control or use their cloud solution.

Tutorial:

- Go to the n8n website

- Choose cloud hosting or self-host via Docker for complete data control

- Use the visual editor to drag and drop nodes that connect your apps

- Browse 900+ ready-made workflow templates to get started quickly

- Add AI capabilities like chatbots and document summarization using built-in LangChain nodes

- Write custom JavaScript or Python code when you need advanced logic

- Automate complex business processes 10x faster than traditional coding

URL: https://n8n.io/

AI & Tech News

AI Coding Startup Cursor Faces Questions About Long-Term Viability

Cursor, the AI-powered coding tool founded by 25-year-old CEO Michael Truell in 2023, has emerged as one of the fastest-growing AI applications in Silicon Valley, attracting millions of developers to its platform. However, the startup now finds itself at the center of industry debate over its sustainability, with critics questioning whether its dependence on third-party AI models creates a fundamental vulnerability in its business model.

AI Models Discover $4.6 Million in Smart Contract Vulnerabilities

A new study published by Anthropic reveals that advanced AI models successfully identified and developed exploits in blockchain smart contracts worth a collective $4.6 million. Using the SCONE-bench benchmark, which tests AI against 405 smart contracts, researchers evaluated Claude Opus 4.5, Claude Sonnet 4.5, and GPT-5, demonstrating the significant and growing economic implications of AI capabilities in cybersecurity tasks.

SoftBank's Son Admits to "Crying" Over Nvidia Sale, Says OpenAI Investment Took Priority

SoftBank Group founder Masayoshi Son acknowledged at a Tokyo forum on Monday that selling the company's entire $5.83 billion Nvidia stake was an emotionally difficult decision, stating he "was crying" over the move. However, Son explained that the sale was necessary to fund SoftBank's investment in OpenAI, indicating the conglomerate's strategic pivot toward backing the artificial intelligence company took precedence over maintaining its position in the chipmaker.

French AI Voice Startup Gradium Secures $70M in Major Funding Round

Paris-based artificial intelligence voice startup Gradium has raised $70 million in funding led by FirstMark and Eurazeo, following its launch in September after spinning out of nonprofit AI research lab Kyutai. The funding round has attracted notable backers including former Google CEO Eric Schmidt and French tech billionaire Xavier Niel, signaling strong investor confidence in the European AI voice technology sector.

Discord Launches In-Platform Store for Video Game Cosmetics

Discord has introduced a new feature allowing users to purchase, wishlist, and gift in-game cosmetic items directly within its platform without leaving the app. The feature debuts with a dedicated store inside the Marvel Rivals Discord server, marking the chat platform's expansion into direct video game commerce.

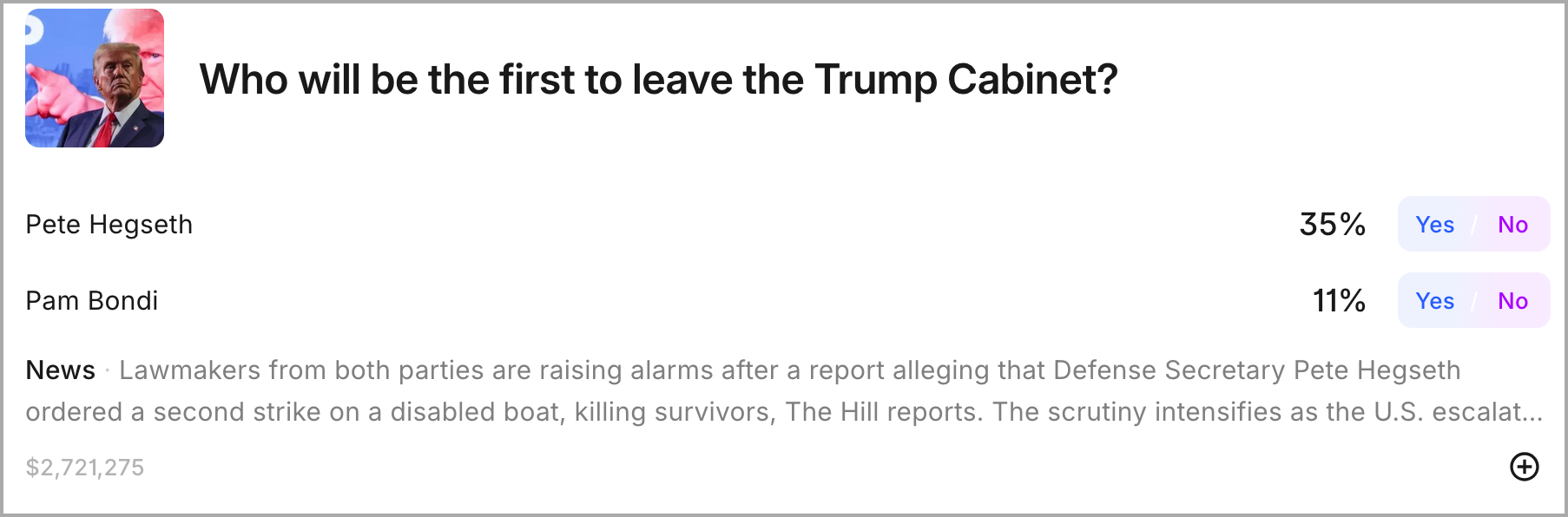

Unauthorized Map Edit Triggers $1M+ Polymarket Bet Resolution on Ukraine War

A prediction market bet on Polymarket asking "Will Russia capture Myrnohrad?" generated over $1 million in trading volume before being resolved based on an unauthorized edit to the Institute for the Study of War's live frontline tracking map. The fraudulent map change on November 15 falsely showed a Russian advance on the Ukrainian city of Myrnohrad, raising serious questions about the vulnerability of prediction markets that rely on third-party data sources for bet resolution.

Kalshi: Co-Founders Become Billionaires as Company Raises $1 Billion Led by Paradigm

Prediction market platform Kalshi has raised $1 billion in new funding led by Paradigm, more than doubling its valuation to $11 billion from the $5 billion valuation it achieved just two months ago when it raised $300 million in October 2025. The funding round, the company's third this year, has elevated its co-founders to billionaire status amid intensifying competition in the rapidly growing prediction market industry.

🚀 AI Profiles: The Companies Defining Tomorrow

Kalshi lets you bet on reality. The New York startup turned prediction markets into a regulated asset class, making "Will inflation spike?" as tradable as Apple stock.

👥 Founders

Tarek Mansour (ex-Goldman, Citadel) and Luana Lopes Lara (ex-Bridgewater, Citadel) met at MIT studying math and economics. Founded 2018, they got tired of stitching together derivatives when they just wanted to trade events directly. Spent years in regulatory purgatory. Won CFTC approval in 2020. Now based in NYC with millions of mobile users.

🎯 Product

Event contracts. Yes/no questions about the future. Trade from 1¢ to 99¢, settle at $1 or $0. Over 3,500 active markets, covering Fed rate hikes, hurricane counts, Oscar winners, NFL spreads. Order book model, not a bookmaker. Sports now drives ~90% of volume 🏈. Integrated with Robinhood and Webull for frictionless access.

⚔️ Competition

Polymarket looms large, returning to the US via QCEX acquisition with ICE investing up to $2B. DraftKings and FanDuel are launching their own prediction platforms. First-mover regulatory advantage is Kalshi's moat. For now.

💰 Financing

December 2025: $1B Series E at $11B valuation. Paradigm led. Sequoia, a16z, CapitalG, Coinbase Ventures, ARK Invest all doubled down. Total raised: ~$1.6B. Weekly volume exceeds $1B. Both founders now paper billionaires.

🔮 Future ⭐⭐⭐⭐ Kalshi owns the "regulated prediction market" narrative. Cash pile is massive. User growth looks hockey-stick. But Nevada just ruled against them on sports contracts, and the legal path ahead gets bumpy. DraftKings and FanDuel know how to steal users. If regulators harmonize rules, Kalshi becomes mainstream financial infrastructure. If they don't, that $11B valuation becomes an expensive political bet. The irony? They can't list a contract on their own success.