OpenAI on Thursday released Frontier, a platform that lets companies build, deploy, and manage AI agents from multiple vendors inside a single system. The product works with agents built by OpenAI, by the enterprise itself, and by competitors including Google, Microsoft, and Anthropic. Uber, State Farm, Intuit, and Thermo Fisher signed on as early customers. Broader availability is coming, though OpenAI won't say when.

This is OpenAI repositioning itself. Rather than selling only its own models and tools, the company is now pitching itself as the control layer that sits between corporate data and whichever AI agents a company happens to run. "Frontier is really a recognition that we're not going to build everything ourselves," Fidji Simo, OpenAI's CEO of Applications, told reporters during a briefing. "We embrace the fact that enterprises are going to need a lot of different partners."

Enterprise customers already make up roughly 40 percent of OpenAI's business, CFO Sarah Friar told CNBC last month. Friar wants that number at 50 percent by December. Frontier is how OpenAI plans to stay inside those accounts, even when a customer picks somebody else's agent for a particular job.

What Frontier actually does

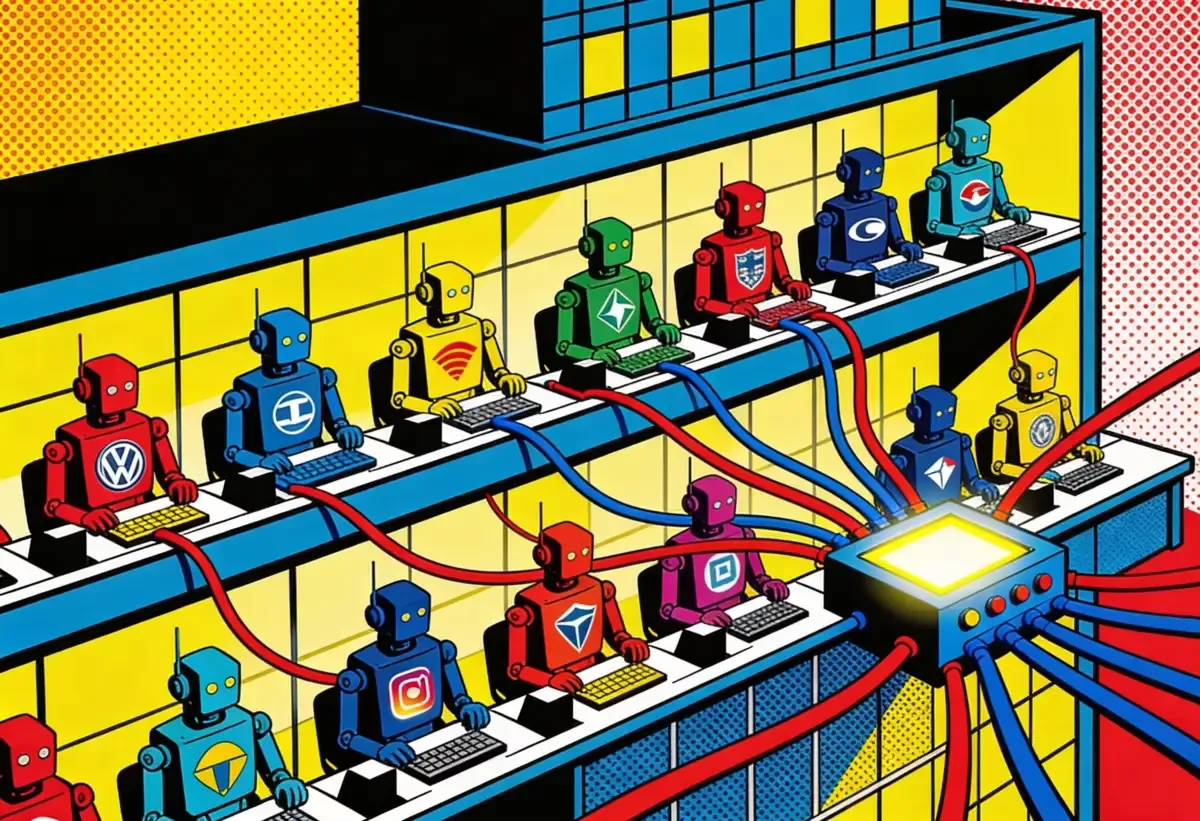

Think of it as an operating layer for AI agents. Most companies today run agents on top of whatever systems they already have. The tools don't talk to each other. The data sits in separate silos. Every new agent adds another integration headache, and Frontier is designed to sit above all of that.

The Breakdown

• Frontier manages AI agents from OpenAI, Google, Microsoft, and Anthropic inside one enterprise platform

• Enterprise customers account for 40% of OpenAI's revenue; CFO Sarah Friar wants 50% by December

• A $200 million Snowflake deal gives OpenAI distribution across 12,600 customers on AWS, Azure, and Google Cloud

• No pricing disclosed despite $1.4 trillion in data center commitments over the next year

The platform creates what OpenAI calls a "shared business context" by connecting an organization's data warehouses, CRM systems, ticketing tools, and internal applications into one layer that any agent can reference. An Anthropic agent could, in theory, pull the same corporate context as an OpenAI one. Same data, same permissions layer. And you can run the whole thing on your own servers or hand the hosting to OpenAI. No rearchitecting required.

OpenAI branded them "AI coworkers." That framing tells you exactly where the company thinks this is going. Barret Zoph, OpenAI's general manager for B2B, put it plainly: "What we're fundamentally doing is transitioning agents into true AI coworkers." Zoph returned to OpenAI in January after a brief stint at Thinking Machines Lab, the startup he co-founded with former OpenAI CTO Mira Murati.

Frontier also includes built-in evaluation and optimization tools. Agents learn from past interactions and build memory over time, something OpenAI compares to how new employees absorb institutional knowledge during onboarding. The company said it modeled the entire product on how enterprises already scale people. Hire them, train them, give them the right access, then measure their performance.

That onboarding metaphor runs deep. OpenAI claims one unnamed semiconductor manufacturer used agents to cut chip optimization work from six weeks to a single day. A global investment company reportedly freed up 90 percent of its salespeople's time by deploying agents across the sales process. An energy producer said agents boosted output by up to five percent, adding over a billion dollars in revenue. OpenAI didn't name these companies or provide independent verification, but the numbers give you a sense of the pitch: agents that work like employees, not just tools that answer questions.

The software stock panic as backdrop

Join 10,000+ AI professionals

Strategic AI news from San Francisco. No hype, no "AI will change everything" throat clearing. Just what moved, who won, and why it matters. Daily at 6am PST.

No spam. Unsubscribe anytime.

Frontier's timing is deliberate. It launched the same week that software stocks across Wall Street were getting hammered. Anthropic had just released a tool automating clerical legal work, and investors panicked. SaaS companies shed billions in market cap in days. Voices pronouncing the death of traditional enterprise software were louder than they'd been in years.

Simo addressed the anxiety head-on. "Are software companies going to need to adapt to AI in general? Yes, of course," she told reporters. "But I think the ones that do adapt to AI will actually find Frontier to be a massive opportunity for them."

Her argument: Frontier is not another agent competing with Salesforce or ServiceNow. It is a platform those companies can deploy their own agents on top of. She said the design was shaped by conversations with software vendors before she formally joined OpenAI's leadership team last May. Those companies asked for a platform that simplifies integration and lets them distribute agents through OpenAI's enterprise relationships. OpenAI obliged.

Whether software executives buy that framing is another question. OpenAI controls the context layer, which means it controls the data access. Platform owners tend to accumulate power over time. The companies plugging into Frontier know this. So does anyone who watched what happened to app developers building on top of Apple's App Store, or merchants who built their businesses on Amazon's marketplace. Becoming somebody else's plumbing works right up until the platform owner changes the rules.

The Snowflake deal and the distribution play

Frontier doesn't exist in isolation. Snowflake had announced a $200 million partnership with OpenAI just three days earlier, putting OpenAI's models natively inside Snowflake's data platform on AWS, Azure, and Google Cloud. Snowflake counts 12,600 customers. All of them can now build AI applications on their own data without shipping it anywhere.

What's driving the Snowflake deal, for OpenAI, is distribution beyond Microsoft. The urgency is hard to miss. Last October, OpenAI restructured its Microsoft partnership to allow building non-API products with third parties on any cloud provider. Microsoft keeps Azure API exclusivity through 2032, but OpenAI can now reach enterprise customers through data platforms like Snowflake without requiring Microsoft infrastructure. Depending on a single distribution partner that also competes with you is uncomfortable, and OpenAI's moves over the past six months suggest the company knows it. Simo's own words about Snowflake said as much. "A trusted platform that sits at the center of how enterprises manage and activate their most critical data," she called it.

Both moves point at the same strategy. OpenAI wants to be the default intelligence layer inside large companies, regardless of which cloud, which data platform, or which agent vendor a customer prefers. That ambition requires being genuinely multi-vendor. It also requires trust. Bloomberg reported that Frontier will allow companies to integrate AI agent software from rivals including Anthropic, a detail OpenAI stressed repeatedly during the press briefing. Anthropic, for its part, has at times prevented competitors from accessing its own underlying technology, making this openness a competitive differentiator if OpenAI follows through.

The Forward Deployed Engineers and the Palantir playbook

OpenAI is pairing Frontier with something that looks a lot like Palantir's old go-to-market model: Forward Deployed Engineers embedded directly inside enterprise customers. These FDEs work alongside a client's own teams to build and run agents in production. They also feed real-world deployment problems back to OpenAI's research organization, creating what the company describes as a loop between customer needs and model development.

That loop is the quiet part of the announcement. Most AI companies sell a model and walk away. OpenAI is selling a model, a platform, and a consulting relationship, and it is betting aggressively that the bundled approach wins. The FDE model locks in customers more tightly than any API contract can, because the engineers accumulate institutional knowledge about how a specific company operates. Leaving becomes expensive when your AI infrastructure was custom-built by the vendor's own staff sitting in your office.

Databricks has run a similar playbook for years. So has Palantir, which grew from a defense contractor into a commercial AI company largely by embedding engineers inside big organizations and making itself hard to remove. OpenAI appears to have studied both models. The question is whether it can recruit and deploy enough FDEs fast enough. Hiring engineers who can work inside Fortune 500 environments while translating between business problems and AI capabilities is not simple, and not cheap either.

No pricing, and no public timeline

OpenAI declined to share what Frontier costs. Chief revenue officer Denise Dresser sidestepped the question during the briefing. The company also declined to estimate how much revenue the platform might generate. That silence lands differently given that OpenAI has roughly $1.4 trillion in data center commitments over the next year and recently announced plans to test ads on lower tiers of ChatGPT. Revenue pressure is real, and growing.

Frontier is launching to "a limited set of customers." HP, Oracle, BBVA, Cisco, and T-Mobile have piloted the approach. OpenAI is also assembling what it calls Frontier Partners, a group of AI-native companies including Harvey, Sierra, Abridge, Clay, Ambience, and Decagon that will build agents specifically for the platform.

The bet is large. OpenAI is spending heavily on a product that, by design, works with competitors' agents. If Frontier succeeds, OpenAI becomes the plumbing of enterprise AI, collecting revenue whether a company uses GPT-5.2 or Claude or Gemini. If it fails, the company has built a management layer that nobody needed while the actual agents kept improving fast enough to sell themselves.

For now, the pricing page is blank and the customer list is short. What sits underneath is a company that just told Wall Street it wants to be the HR department for every AI agent in corporate America, and hasn't yet said what it plans to charge for the privilege.

Frequently Asked Questions

Q: What is OpenAI Frontier?

A: Frontier is an enterprise platform that lets companies build, deploy, and manage AI agents from multiple vendors in one system. It creates a shared business context layer connecting an organization's data warehouses, CRM tools, and internal applications so agents from OpenAI, Anthropic, Google, or Microsoft can all reference the same corporate data.

Q: Which companies are using Frontier at launch?

A: Uber, State Farm, Intuit, Thermo Fisher, HP, and Oracle are among the first customers. BBVA, Cisco, and T-Mobile have piloted the approach. OpenAI said broader availability is coming but did not provide a specific timeline.

Q: How much does Frontier cost?

A: OpenAI has not disclosed pricing. Chief revenue officer Denise Dresser declined to share details during the launch briefing. The company also would not estimate how much revenue the platform might generate.

Q: How does Frontier relate to the $200 million Snowflake partnership?

A: Snowflake announced a $200 million deal with OpenAI three days before Frontier launched. The partnership puts OpenAI models natively inside Snowflake's data platform across AWS, Azure, and Google Cloud, giving OpenAI enterprise distribution independent of Microsoft.

Q: What are Forward Deployed Engineers?

A: FDEs are OpenAI engineers embedded directly inside enterprise customers to help build and run agents in production. The model mirrors Palantir's go-to-market strategy. FDEs feed real-world deployment problems back to OpenAI's research organization, creating a feedback loop between customer needs and model development.