The $500 billion AI firm cited platform lock-in—even as it builds one of its own.

OpenAI walked into the European Commission on September 24 and flagged anticompetitive concerns about three companies: Google, Apple, and Microsoft. That last one matters. Microsoft has poured roughly $13 billion into OpenAI and remains its largest investor. The conversation, detailed in Bloomberg’s report on the meeting, stopped short of a formal complaint, but the signal was clear: OpenAI wants scrutiny on the platforms that control AI’s distribution and inputs.

According to notes from the session, OpenAI described “difficulties” competing with “entrenched companies” and urged action to prevent customer lock-in by large platforms. The firm emphasized that “access to key data” is essential to preserve competition in AI markets. The concerns span cloud infrastructure, app distribution, and the gatekeeping points where platforms can prefer their own AI over rivals. That’s the heart of the dispute.

Microsoft, Google, and Apple declined to comment. OpenAI pointed to prior public arguments about bottlenecks in AI competition, with Google’s search and distribution heft often the primary example. No one here is neutral.

Key Takeaways

• OpenAI flagged Microsoft, its $13 billion investor, to EU antitrust chief for platform lock-in concerns on September 24

• ChatGPT's 800 million weekly users and new app SDK position OpenAI as platform competitor, not just AI supplier

• Multiyear chip deals with AMD and Nvidia secure up to 16 gigawatts of compute capacity, reducing platform dependency

• Data access dispute centers on platforms' proprietary datasets creating structural advantages for in-house AI models

The investor-regulator calculus

The Microsoft relationship is now both glue and grit. Microsoft has embedded OpenAI’s models across its product line, from Windows to Copilot, and helped fund the compute behind them. Yet Copilot competes head-to-head with ChatGPT for attention. OpenAI, meanwhile, is pushing deeper into enterprise accounts—historically Microsoft’s core franchise. Cooperation and competition now run in parallel.

From OpenAI’s vantage, Azure’s dominance and Microsoft’s enterprise bundle create structural advantages that tilt the field. Google controls search distribution and Android’s app ecosystem. Apple governs iOS access and placement. These are leverage points. OpenAI can’t win if its rival-platforms decide who gets placement, defaults, or privileged APIs. That’s the complaint.

Microsoft’s view is different. OpenAI isn’t merely a supplier anymore. At DevDay, OpenAI launched an app SDK that lets developers build software directly inside ChatGPT. The company says ChatGPT now sees 800 million weekly users. That is distribution at scale. Suddenly, OpenAI looks less like a tenant on Big Tech’s platforms and more like a competing platform owner. That complicates the underdog story. One sentence captures it: partners turned into rivals.

The platform shift underneath

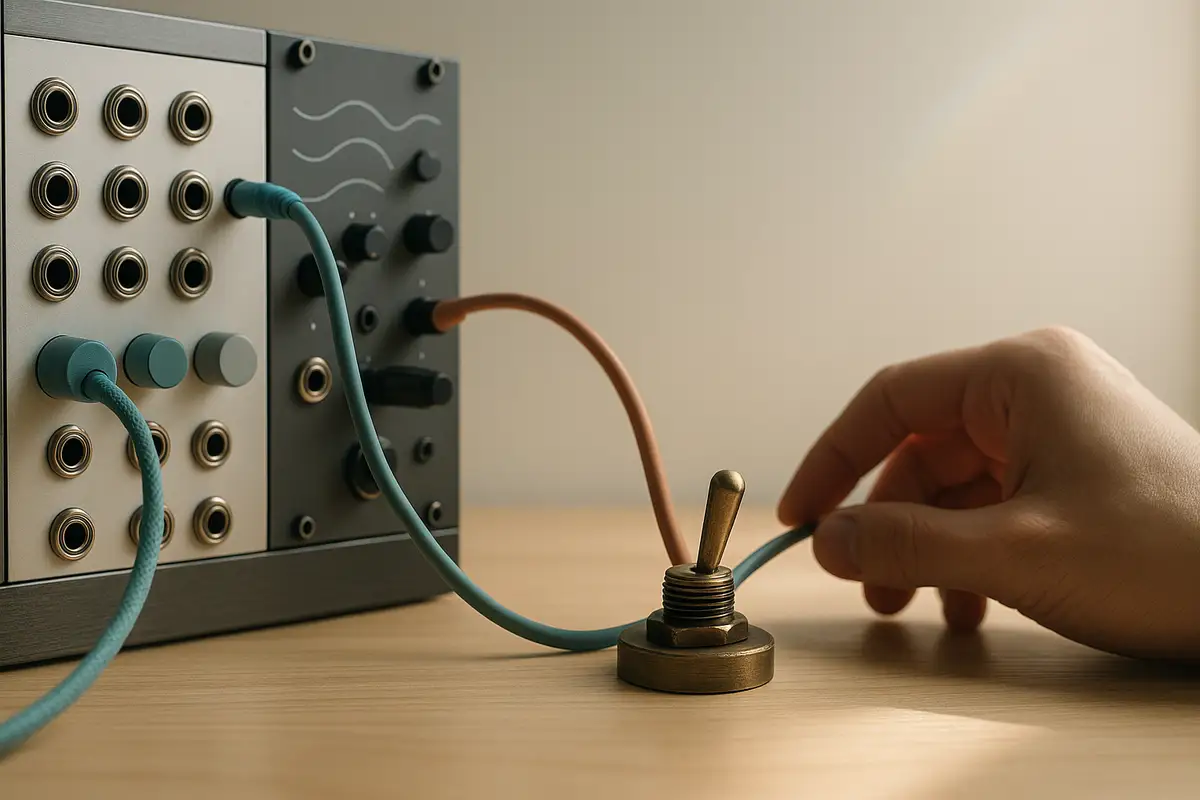

OpenAI’s recent infrastructure moves underscore a platform play, not just a model shop. The company signed a multiyear chip-supply deal with AMD that includes warrants for up to 10% of AMD’s shares, a structure that ties OpenAI’s growth to AMD’s upside. It also inked a letter of intent with Nvidia to deploy roughly 10 gigawatts of Nvidia systems, backed by up to $100 billion of staged investment as capacity is built. Custom silicon with Broadcom is slated to arrive as soon as 2026. That’s vertical integration, not a spot-market strategy.

The logic is straightforward. If distribution and inputs are the choke points, you secure your own. By turning ChatGPT into an app platform and locking in compute at multi-gigawatt scale, OpenAI reduces its dependency on rivals’ app stores and hardware supply. It wants to own more of the stack—users, developers, and the compute underneath. That is how platforms win.

There’s a rub. The stronger OpenAI’s platform becomes, the harder it is to argue that only others’ platforms deserve regulatory constraint. The difference is timing, not intent. Regulators will notice.

Data: the essential input

The sharpest edge of OpenAI’s case is data. Platforms hold vast proprietary datasets—search logs, device telemetry, enterprise usage—that are hard to replicate at scale. Those datasets improve in-house models and can be walled off from competitors. OpenAI’s argument is familiar from earlier tech fights: when a gatekeeper controls access to essential inputs, it can starve rivals and preference its own services.

Europe has frameworks for this. The Digital Markets Act targets gatekeepers and self-preferencing. The competition chief can still open targeted inquiries or impose remedies short of a sweeping case. Even a soft remedy—on interoperability, defaults, or data access—could shift bargaining power in distribution negotiations. Small changes at gatekeeper chokepoints matter. One tweak to a default can move millions of users.

What changes now

Expect two tracks. First, OpenAI will keep building out its direct platform—apps inside ChatGPT, enterprise features, and a developer ecosystem that routes around iOS and Android. That raises the stakes for Apple and Google. Second, it will keep pressing on access and interoperability with gatekeepers, using EU regulators as leverage to pry open channels where it doesn’t yet have power. Both tactics can proceed at once.

No party is standing still. Microsoft is hardwiring Copilot into its enterprise contracts. Google is pushing Gemini across search and workspace. Apple is tightening its platform while exploring AI tie-ups. Competition is already live; antitrust pressure is the side bet that shifts the odds at the margins. That may be enough.

The contradiction to watch

OpenAI denounces platform lock-in while building a platform with massive distribution and bespoke compute. The company can argue it’s countervailing power against entrenched gatekeepers. Critics will call it a pivot from “regulated rival” to “future gatekeeper.” Both can be true in different time frames. The scoreboard is moving.

Why this matters:

- Data access and distribution—not model novelty—are setting the pace in AI; remedies on defaults, APIs, or datasets could realign who reaches users and on what terms.

- OpenAI’s EU gambit reveals a strategy shift from supplier to platform owner, using regulators to pry open rivals’ choke points while it assembles its own end-to-end stack.

❓ Frequently Asked Questions

Q: What's the Digital Markets Act and how could it help OpenAI?

A: The EU's Digital Markets Act targets "gatekeeper" platforms with over 45 million monthly users and €75 billion market cap. It prohibits self-preferencing and requires interoperability. Google, Apple, and Microsoft all qualify. If OpenAI can demonstrate these platforms restrict access to essential data or distribution, the EU can impose remedies—like mandated API access or default choice screens—without OpenAI filing a formal complaint.

Q: Why did the AMD chip deal include warrants for 10% of AMD's shares?

A: Warrants tie OpenAI's chip supply to AMD's equity upside, creating alignment beyond a standard purchase agreement. If OpenAI's demand drives AMD's data center revenue—which grew 122% year-over-year in Q3 2024—OpenAI captures part of that gain. The structure also gives AMD confidence in long-term demand, justifying the capital to build out capacity. Both sides hedge their bets through shared risk.

Q: How much compute is 10 gigawatts, and who else operates at that scale?

A: Ten gigawatts powers roughly 7.5 million homes or one large nuclear reactor's output. Meta's data centers consumed about 8.5 gigawatts in 2024; Google's total infrastructure uses approximately 15 gigawatts globally. OpenAI securing 16 gigawatts combined from Nvidia and AMD deals positions it at hyperscaler energy consumption—a level previously exclusive to companies with decades of infrastructure investment. That's the platform shift.

Q: Can the EU force changes without OpenAI filing a formal antitrust complaint?

A: Yes. Under the Digital Markets Act, the Commission can open compliance investigations based on meetings, market monitoring, or third-party information. Remedies can include mandated interoperability, data portability requirements, or restrictions on self-preferencing—all without a formal complaint. The September 24 meeting gives regulators justification to probe Microsoft, Google, and Apple's AI distribution practices. OpenAI gets leverage without the legal costs of litigation.

Q: Why did Microsoft invest $13 billion in OpenAI if they're now direct competitors?

A: Microsoft's investment began in 2019 when OpenAI was purely a research lab. The partnership gave Microsoft early access to GPT models, Azure compute revenue from OpenAI's infrastructure, and a seat on OpenAI's board. By the time OpenAI launched ChatGPT in late 2022 and began competing with Copilot, Microsoft had already committed capital and couldn't easily exit. The relationship now combines cooperation (model licensing) with competition (enterprise sales).