Apple Pays $2 Billion to Read Your Face

Apple acquired Israeli startup Q.AI for close to $2 billion, gaining facial micro-movement technology that decodes silent speech for future wearables.

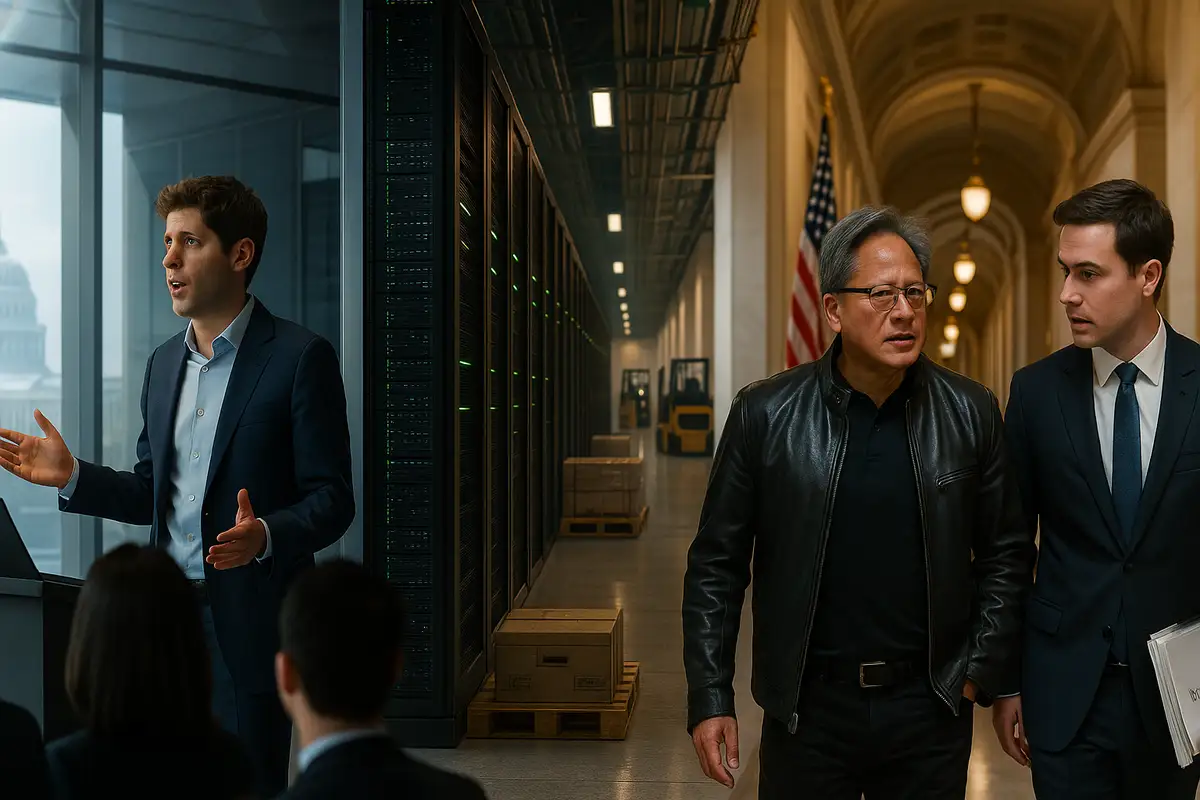

OpenAI's targeting a $1 trillion IPO by 2027—the largest in history. The restructure that made it possible gave Microsoft 27% and a revenue share. Now comes the hard part: convincing public markets to fund Altman's $1.4 trillion infrastructure vision.

OpenAI's planning a 2026 filing for what could become a $1 trillion public offering, the largest IPO in history by a wide margin. CFO Sarah Friar's told associates the company's targeting 2027, though some advisers think late 2026's more realistic. The ask: $60 billion minimum, likely more. This week's restructuring cleared the final obstacle. The nonprofit's now a 26% stakeholder called OpenAI Foundation; the for-profit arm's a public benefit corporation ready to tap public markets.

That's the headline. The structural story explains the urgency.

OpenAI's burning through capital at remarkable scale. Revenue's hitting $20 billion annualized by year-end, but losses are mounting. Altman wants to build 1 gigawatt of compute capacity per week—he's already committed to 30 gigawatts total at $1.4 trillion cost of ownership. An IPO opens two critical doors: cheaper capital than private rounds, and stock currency for acquisitions. Both matter when you're racing to spend trillions on infrastructure before competitors catch up.

Key Takeaways

• OpenAI targeting 2026-2027 IPO at up to $1 trillion valuation, seeking $60 billion minimum—would be largest tech offering in history by wide margin.

• Restructure gave Microsoft 27% stake plus 20% revenue share while OpenAI committed to $250 billion more Azure spending and compute independence.

• Altman's committed to $1.4 trillion in compute infrastructure spending, driving IPO urgency as private markets can't sustain capital requirements alone.

• Public benefit corporation status provides governance optics while California and Delaware preserved Musk's ongoing legal challenges through March trial.

The company denies any timeline. "An IPO is not our focus, so we could not possibly have set a date," the spokesperson said. "We're building a durable business and advancing our mission so everyone benefits from AGI." But Altman acknowledged the math on Tuesday: "I think it's fair to say it's the most likely path for us, given the capital needs we'll have."

OpenAI started as a nonprofit in 2015. It added a for-profit subsidiary in 2019 with nonprofit oversight. The stated goal: ensure safe AGI development instead of pure profit maximization. That structure's now dead. Tuesday's announcement flipped the architecture. The OpenAI Foundation keeps governance control but becomes a 26% equity holder with warrants for more if milestones hit. The for-profit, now OpenAI Group PBC holds the rest.

Microsoft landed 27% for its $13 billion investment history. That stake's worth roughly $135 billion at current private valuations. More importantly, Microsoft secured exclusive IP rights until 2032 and a 20% revenue share—not profit share, actual cash flow from operations. In exchange, OpenAI's buying another $250 billion in Azure compute and Microsoft gave up first-refusal rights on compute contracts. Both sides won and lost something.

The revenue share includes a catch: it stops when an "independent expert panel" declares OpenAI's achieved AGI. No clear definition exists yet. You're looking at large language models—sophisticated pattern-matching systems that generate text. The gap between that and anything resembling general intelligence is substantial. But incentives suggest everyone will find a way to define AGI when convenient.

SoftBank freed up the remaining $20 billion of its promised $40 billion investment immediately after restructuring approval. The arithmetic makes sense: burning $20 billion of actual cash lets SoftBank book $40 billion of OpenAI equity. Private valuations are generous when the IPO finish line's visible.

Microsoft jumped 2% on the news. The stock currency angle matters—OpenAI can now acquire companies without burning cash, and use public equity for talent retention instead of the pseudo-shares that circulated before. Those were traded like stock but weren't real equity. Now they are.

The infrastructure arms race explains the urgency. Altman's committed to 30 gigawatts of compute—for context, that's enough power to run a small country. The Stargate campus in Wisconsin alone promises 4.5 gigawatts. Building at this scale requires continuous capital injections that private markets can't sustain alone. An IPO creates permanent access to public capital markets and establishes a liquid valuation mechanism.

California and Delaware had to approve the nonprofit-to-profit transition. Both signed off quickly. California's memorandum hammered on two points: economic benefit to the state (OpenAI Group operates there) and the Safety and Security Committee that'll guard against AGI risks. Delaware emphasized similar safety governance requirements.

Both attorneys general preserved existing legal challenges. California's memo explicitly states the restructuring has "no impact on any other case." That's where Musk enters.

Musk's lawyer Marc Toberoff pledged continued litigation: "The AGs cannot sanitize OpenAI's unlawful conduct through a hastily arranged deal." Musk's suing OpenAI for abandoning its founding charitable mission—ironic given Musk's own xAI is structured as a public benefit corporation. A trial's scheduled for late March before Judge Yvonne Gonzalez Rogers.

OpenAI called the suit "further examples of Mr. Musk's ongoing pattern of harassment" and "a waste of time." The company's likely correct that the restructuring strengthens its legal position—it's now explicitly a for-profit entity with clear stakeholder obligations instead of a weird hybrid structure with ambiguous duties.

Musk tried buying the nonprofit's assets for $97.4 billion earlier this year. OpenAI rejected the offer. The litigation looks like competitive harassment more than principled objection, but it'll drag through 2026 regardless of merit.

OpenAI Group's now a PBC—public benefit corporation—which requires considering effects on society alongside shareholder returns. The charter's identical to the old nonprofit mission: ensure AGI benefits all humanity. It's not a binding constraint. Elon Musk's xAI is also a PBC; it runs X, the platform formerly known as Twitter. Public benefit status is marketing, not mechanism.

What changed is capitalization table clarity. The nonprofit held 100% before; now it's 26% with warrants. Investors and employees own 47%. Microsoft owns 27%. Those percentages drive decision-making more than any mission statement.

CoreWeave went public earlier this year at $23 billion and tripled. Nvidia hit $5 trillion market value Wednesday on AI infrastructure demand. Public markets are rewarding AI exposure aggressively. OpenAI's investors—SoftBank, Thrive Capital, Abu Dhabi's MGX—want liquidity. An IPO delivers that while keeping the company capitalized for continued infrastructure spending.

Interesting fact: Saudi Aramco raised $25.6 billion in 2019, the current record. Alibaba raised $26 billion in 2014, the tech record. OpenAI's targeting $60 billion minimum. That's not just an IPO, it's a bet that public markets will fund Altman's trillion-dollar infrastructure vision when private capital can't.

Q: What exactly is a public benefit corporation and does it constrain OpenAI?

A: A PBC requires considering societal impact alongside shareholder returns, but sets no binding constraints. Elon Musk's xAI is also a PBC despite running X (formerly Twitter). It's essentially a for-profit company with mission-statement marketing. OpenAI's charter mirrors its old nonprofit mission—ensure AGI benefits humanity—but profit incentives now drive decisions.

Q: How would a $1 trillion valuation compare to other tech companies?

A: It'd place OpenAI among the world's six most valuable companies. Apple's around $3.5 trillion, Nvidia just hit $5 trillion. Microsoft, Google's parent Alphabet, and Amazon all hover between $1.5-3 trillion. OpenAI would surpass Meta ($1.2 trillion) and Tesla ($800 billion) immediately. The $60 billion+ raise would dwarf Alibaba's current record of $26 billion.

Q: What happens when an "independent expert panel" declares OpenAI achieved AGI?

A: Microsoft's 20% revenue share stops, but its exclusive IP rights continue through 2032. There's no clear AGI definition yet—current systems are sophisticated pattern-matching language models, not general intelligence. Both companies have strong incentives to eventually declare AGI achieved, making the timing more about financial convenience than technical breakthrough.

Q: What does $1.4 trillion in compute infrastructure actually buy?

A: OpenAI's committed to 30 gigawatts of compute capacity—enough electricity to power a small country. The Stargate Wisconsin campus alone delivers 4.5 gigawatts. Altman wants to add 1 gigawatt weekly. This includes data centers, specialized AI chips, cooling systems, and power infrastructure. For comparison, a typical data center runs on 20-50 megawatts.

Q: How does Sam Altman personally benefit from the restructuring?

A: Altman receives equity for the first time—previously he owned nothing. The exact percentage hasn't been disclosed. Given the company's $500 billion private valuation, even a 2-5% stake would make him worth $10-25 billion. Investors and current/former employees split 47% of the company, with Altman's share coming from that pool.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.