In the last days of December 2025, while California rehearsed its usual end-of-year pieties, Larry Page’s world did what it does best: it reorganized. His family office shifted its corporate domicile out of California; so did a clutch of Page-linked entities, converted and re-addressed with the quiet efficiency of counsel who understands that politics is often a calendar, not a debate.

Call it “relocation.” Better: call it exit.

A week later, at CES in Las Vegas, Jensen Huang was asked about the same proposed California billionaire wealth tax. He replied, with a kind of engineered nonchalance, that he hadn’t even thought about it, he was “perfectly fine” with whatever taxes came with living where the work is.

Two men, two fortunes, one state. One turns citizenship into paperwork; the other treats it as overhead.

Money is not the point.

Not at this altitude.

California’s ballot initiative is blunt: a one-time 5% levy on the net worth of people who are California residents as of January 1, 2026, due in 2027, with an option to spread payments over five years (at a cost). For Larry Page, worth “about” the high-two-hundreds of billions on common rich lists, this is an almost comic bill. It is too large for a human mind to picture, yet too small to change a human life. The private jet still flies. The islands remain islands. The children’s children remain funded.

So why run?

Greed is too small a word. Greed belongs to the hungry. This is something colder: the refusal to be governed by people who cannot be bought, optimized, or ignored.

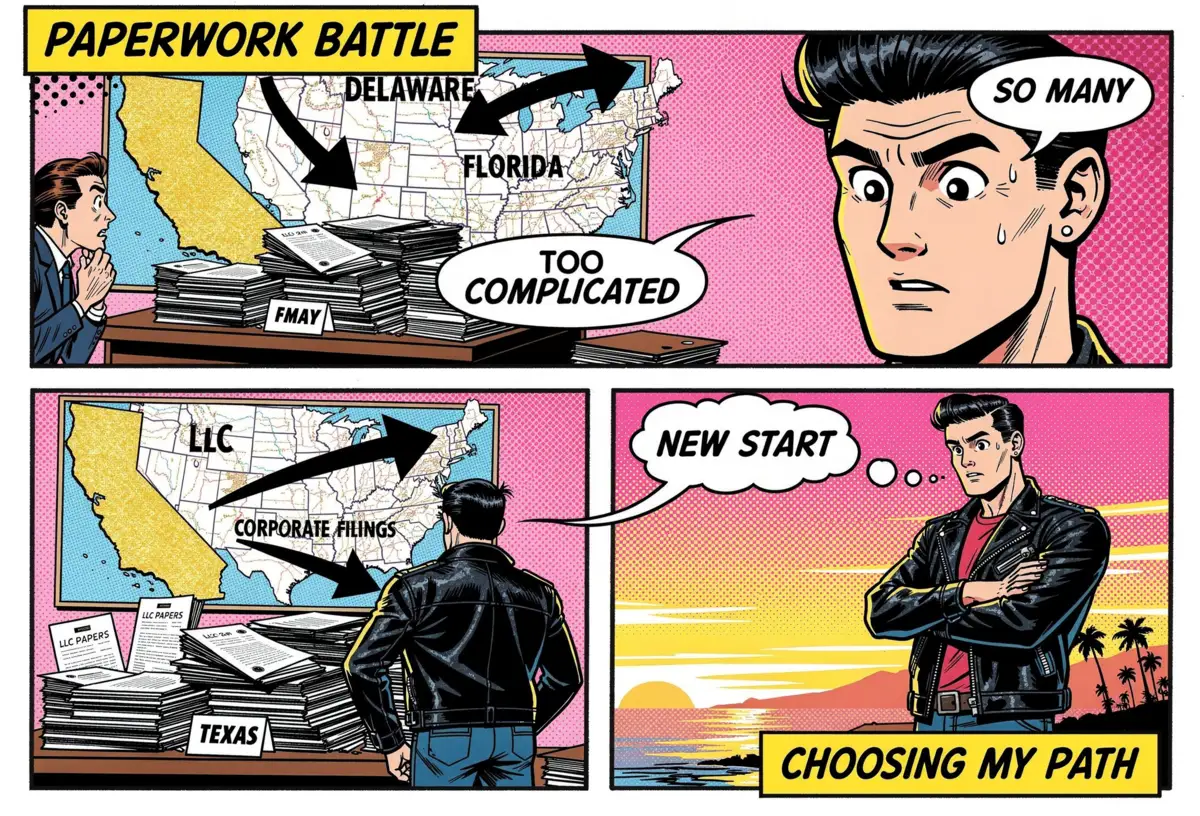

Here is the historical rhyme worth remembering. In 2012, France tried to dramatize equality with a symbolic super-tax on the ultra-rich; the policy’s cultural aftertaste, its invitation to flight, its conversion of civic argument into border-crossing, outlived its fiscal utility. The lesson was not “don’t tax.” The lesson was simpler: when politics turns taxation into theater, the wealthy turn citizenship into logistics.

Exit is a veto without a speech.

Albert O. Hirschman, in Exit, Voice, and Loyalty, explained the basic trilemma of institutions: dissatisfied members can leave (exit), complain and reform (voice), or stay bound by attachment (loyalty). Page’s move is Hirschman with a passport stamp. The richest man does not argue with California; he simply reduces California to a jurisdictional nuisance, to be routed around like latency. From this follow three lessons: each unpleasant, each clarifying.

First: Exit converts public questions into private strategies. If the price of belonging is a ballot measure, the billionaire’s answer is not persuasion; it is residency counsel.

Second: Exit corrodes voice. Once the most powerful actors treat democracy as optional, the remaining citizens are left arguing over a shrinking base—more coercion, more resentment, less legitimacy.

Third: Exit is contagious. When a founder makes a departure look normal, the epigones imitate it, and the state discovers that “community” cannot be enforced by audit.

Huang’s shrug matters because it is the opposite posture. He may be motivated by optics, by operational necessity, by a genuine immigrant’s gratitude for stable institutions—choose your psychoanalysis. The point is that he signals an older idea: that the place that made you is not merely a cost center. Silicon Valley’s “talent pool” is not a weather pattern. It was built by public universities, immigration policy, enforceable contracts, predictable courts, safe streets, dull infrastructure, and the unglamorous peace that lets people invent. Even the right to sneer at Sacramento is a public good.

A republic is not a subscription.

Page became wealthy in the California order. That order tolerated the scale of Google, the data centers, the labor markets, the zoning fights, the antitrust anxieties, the protests, the politics—every messy feature of a free society that refuses to be streamlined. And now, faced with the prospect that voters might demand a one-time payment for that order, he does not contest the policy in daylight. He leaves—or at least he constructs a legal architecture designed to make leaving effective.

That tells you something about what he believes citizenship is. Not membership, but convenience. Not obligation, but optionality. Not responsibility, but risk management.

This is the real sadness: a builder deciding that the hardest thing to build is not a search engine, but patience for democracy.

A short scenario, since Silicon Valley prefers simulations. It is 2027. The tax is due. Sacramento, staring at the arithmetic, tries to collect, litigate, bargain, and posture. Some pay; some sue; some “move” again. Headlines multiply; trust thins. The state learns—too late—that a fiscal system premised on a handful of hyper-mobile individuals is not a system at all. It is a cartel of reluctance. And the public, watching the rich treat residency as a costume, decides the only remaining instrument is coercion.

Is that the future California deserves—or the one Page is helping to manufacture?

None of this requires sanctifying the wealth tax. A one-time net-worth levy is a rough tool; rough tools invite rough evasions. But Page’s exit is not a principled critique of policy. It is a confession of temperament: the desire to be beyond the reach of ordinary politics, to live in a private archipelago where the only votes are share counts.

I admired Larry Page for his life’s work. This maneuver diminishes it—not because billionaires must be saints, but because citizens, especially the most empowered citizens, must accept that self-government occasionally costs them something.

Liberty is not tax-free.

It is the bill we share.

The Simple Math (Larry Page's Rough Bill)

Assumption: 5% of net worth for California billionaires who are residents on Jan 1, 2026. (Legislative Analyst's Office)

- If Page's net worth is $270 billion (round number used in multiple contemporary rich lists), then: 5% × $270B = $13.5B one-time wealth tax.

- Spread evenly over 5 years (ignoring the initiative's added charge for installment plans): $13.5B / 5 = $2.7B per year ≈ $225M per month.