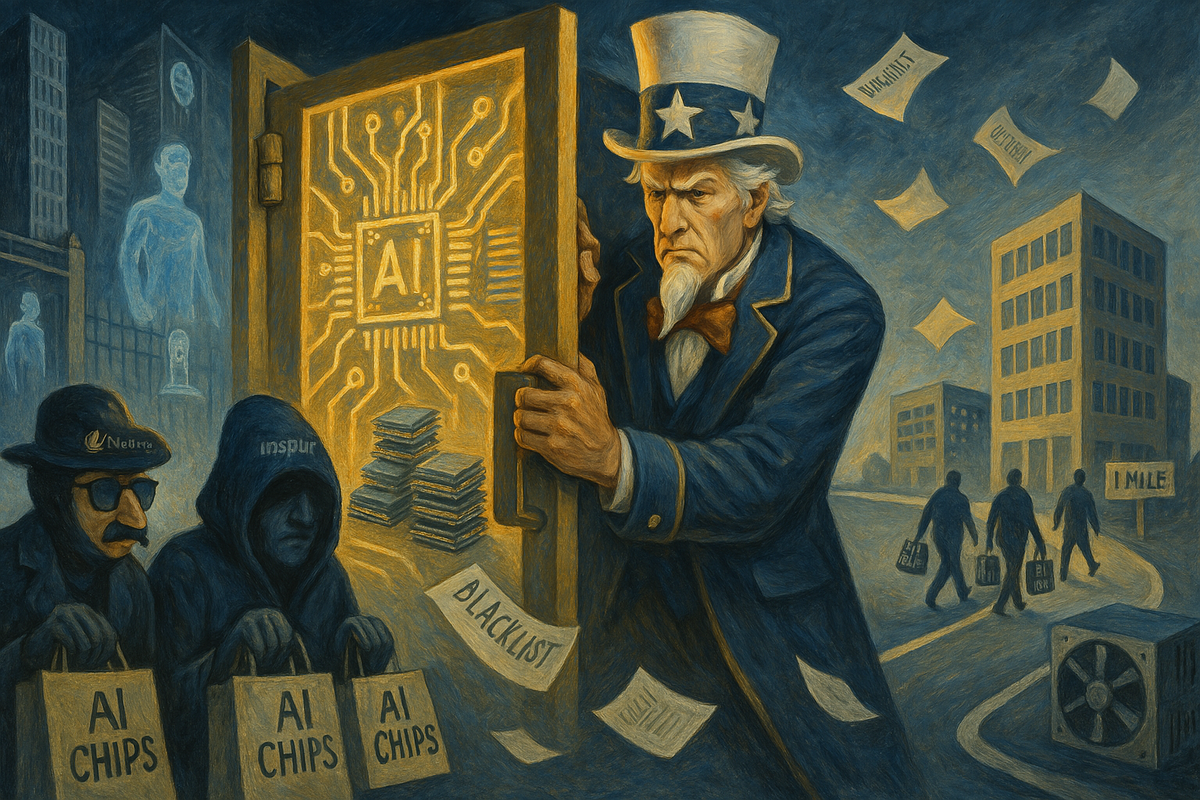

Page Runs. Huang Shrugs. Shenzhen Ships.

San Francisco | January 7, 2026 Larry Page spent late December filing paperwork. Family office, flu research vehicle, aircraft startups, all

Wall Street's love affair with tech stocks turned sour this week. The market darlings known as the Magnificent Seven tumbled hard, with Tesla leading the descent at a 10% drop.

Nvidia, the AI chip champion, fell 7%, while Apple shed over $533 billion in market value - roughly equivalent to erasing a company the size of Tesla. The carnage spread beyond the tech titans.

Semiconductor stocks crumbled as investors digested Trump's harsh tariffs on chip-making hubs. Taiwan Semiconductor Manufacturing Co., the world's largest chip maker, plunged 10%. Even crypto felt the pain, with Bitcoin dropping below $78,000 - a stark reversal for the "first Bitcoin president's" signature achievement.

Trump remained unmoved by the market chaos. "Sometimes you have to take medicine to fix something," he told reporters, displaying the bedside manner of a medieval barber. Meanwhile, Wall Street veterans broke their silence. Bill Ackman warned of "economic nuclear winter," while JPMorgan's Jamie Dimon cautioned against America going it alone.

Corporate America scrambled to respond. Car companies halted shipments, trade groups warned of price hikes, and tech firms watched their AI dreams get more expensive by the day. The semiconductor industry, caught between U.S. demands and Asian manufacturing realities, faces particularly thorny decisions.

Global markets showed no signs of recovery Monday. European chip makers joined the slide, with ASML and STMicroelectronics dropping over 3%. In Asia, markets bled red as investors priced in a new era of trade barriers.

Trump's team keeps listening to concerns from financial executives, but the channels aren't as open as during his first term. Some analysts still hope for deals to reduce tariffs, while others argue this market correction was overdue.

Why this matters:

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.