💡 TL;DR - The 30 Seconds Version

👉 Tech CEOs attended dual White House events Thursday, with Microsoft pledging $4B for AI education and companies like Meta committing $600B in US investments.

📊 Microsoft offers free Copilot access to all US college students through October 2025, while OpenAI plans to certify 10 million Americans by 2030.

🚫 Elon Musk was notably absent from both events after his public split with Trump, while rivals like OpenAI's Sam Altman praised the president.

💰 Trump threatened "fairly substantial" semiconductor tariffs but exempted companies investing domestically, turning trade policy into industrial leverage.

⚡ The real AI bottleneck isn't software—it's electricity for data centers, with executives discussing power grid access and permitting challenges.

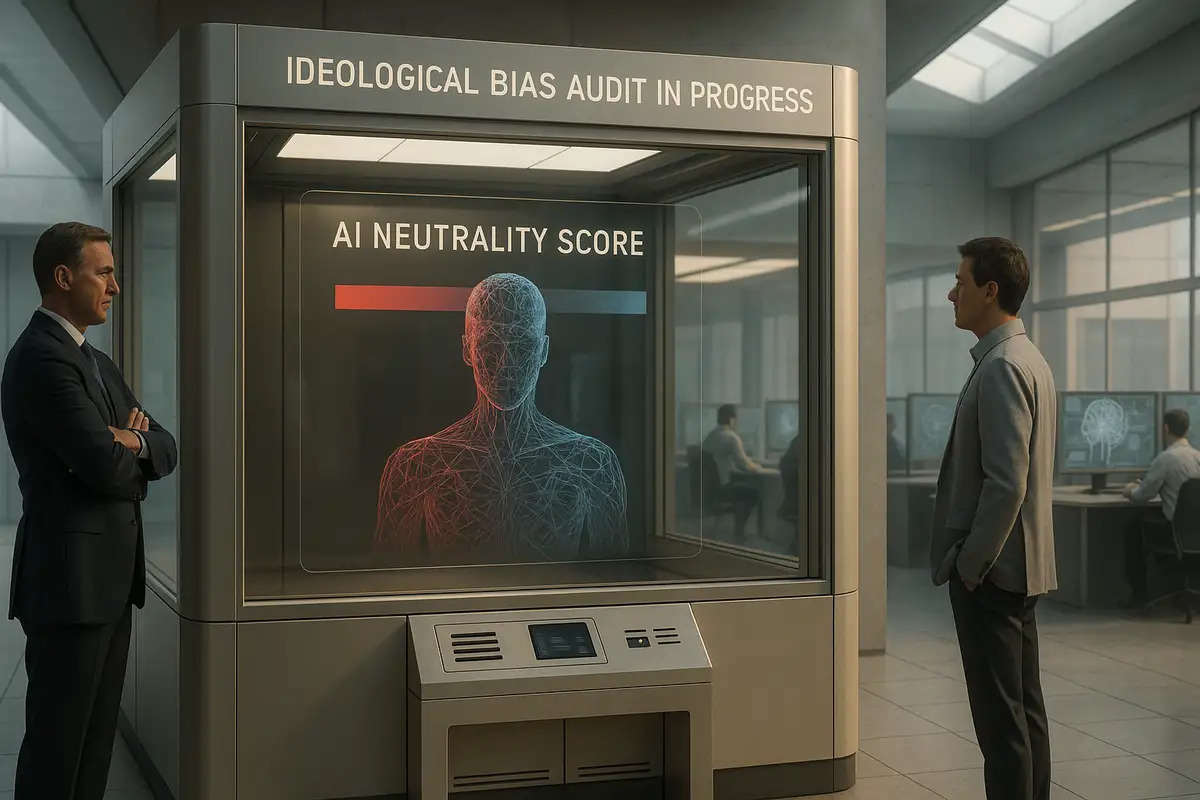

🏫 Investment pledges now function as regulatory insurance, giving tech giants political cover while they navigate antitrust cases and policy uncertainty.

Big pledges and bigger praise dominated a day that married Melania Trump’s AI-in-schools push with a primetime charm offensive for the president—while tariff threats sharpened the stakes.

Silicon Valley’s top brass spent Thursday in Washington promising money, tools, and training—and lavishing thanks on the host. At a White House task-force meeting chaired by First Lady Melania Trump, companies rolled out education commitments, including Microsoft’s education commitments that make Copilot-equipped Microsoft 365 free for U.S. college students for a year. The evening brought a State Dining Room dinner where tech chiefs took turns crediting the president for a friendlier climate on AI and manufacturing.

The tension on display

The day’s claim was unity: industry, schools, and government rowing together to build an AI-ready workforce. Reality was more complicated. The same stagecraft that showcased new programs also underscored how closely the sector is courting an administration that can swing antitrust remedies, procurement, tariffs, and energy approvals. Google earmarked $150 million toward AI education grants as part of a larger pledge, while Amazon touted multi-million-learner training targets. Those are real numbers—and strategically placed ones.

What was actually new

Some pledges were fresh and specific. Microsoft said U.S. college students can claim 12 months of Microsoft 365 Personal—Copilot included—through October 31, 2025; the company will also fund educator grants and free LinkedIn Learning AI courses. Anthropic backed the White House’s Presidential AI Challenge, committed a $1 million, multi-year boost to K-12 cybersecurity via Carnegie Mellon’s PicoCTF, and promised a Creative Commons-licensed AI-fluency curriculum designed to work with any model. These are the sorts of details schools can act on next week.

Melania Trump’s message set the tone: “The robots are here. Our future is no longer science fiction,” she said, urging “watchful guidance” during AI’s “primitive stage.” The line landed, but the program’s public materials and stage time focused far more on competitiveness than on mental-health or online-safety risks—a gap noted by observers given recent teen-safety headlines.

The dinner optics—and the missing mogul

The evening’s script echoed the president’s past cabinet rituals: go around the table, state your number, thank the boss. Meta’s Mark Zuckerberg and Apple’s Tim Cook each cited $600 billion in U.S. investment; Alphabet’s Sundar Pichai said $250 billion. Elon Musk was conspicuously absent after a public split earlier this year. Rain moved the dinner from the newly remade Rose Garden indoors, but the point remained: investment pledges buy political goodwill.

OpenAI’s Sam Altman called Trump a “pro-business, pro-innovation” leader—a quote that captured the night’s mood and the industry’s current calculus. Praise costs little; proximity can matter a lot when agencies are writing rules, judges are weighing remedies, and grid operators are rationing megawatts.

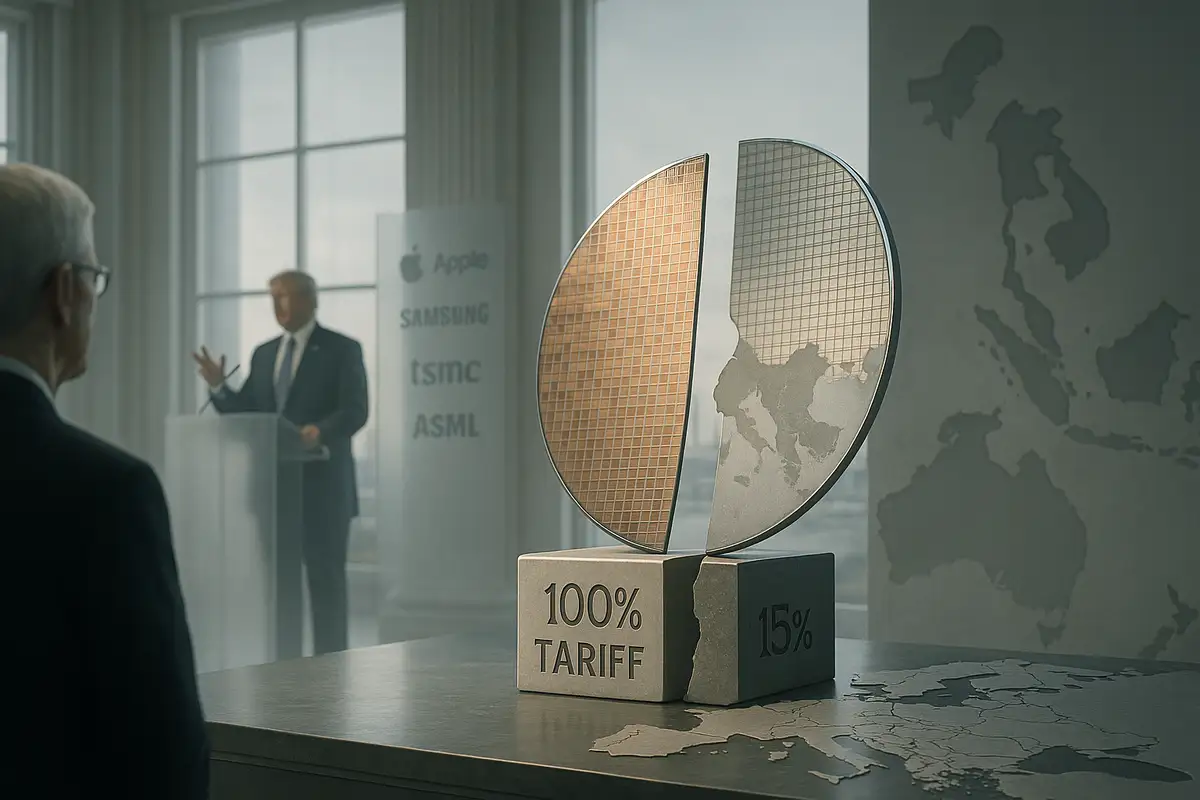

Tariffs as industrial policy

Between toasts, the president sharpened leverage. He said “fairly substantial” tariffs on semiconductor imports are coming “very shortly,” with carve-outs for firms that expand domestic production—explicitly name-checking Apple as “in pretty good shape.” It’s a familiar carrot-and-stick: convert trade tools into onshoring incentives, then let CEOs decide whether today’s pledge is cheaper than tomorrow’s duty.

What this means for classrooms—and for power bills

For schools, the upside is tangible: more licenses, more curricula, and more teacher training, plus national attention that makes AI literacy feel safe to adopt. Code.org and IBM skilling pushes add scale; Microsoft’s student offer trims costs that often stall pilots. Still, procurement and pedagogy will decide whether these tools deepen learning—or just add another dashboard.

For industry, the real bottleneck isn’t software. It’s electricity. Executives and the president discussed data-center power needs and permitting—reminders that AI timelines now run through utility interconnect queues. Investment theater helps; substation construction and transmission siting decide outcomes.

The missing safety chapter

The first lady has championed online safety and deepfake crackdowns this year. Yet Thursday’s programming tilted toward skilling and sizzle, not safeguards. That imbalance is the political bet: show momentum on jobs and education now, keep the tougher mental-health and content-risk fights for later rulemaking. Schools will want clearer guidance on age gating, monitoring, and failure modes if AI tools become classroom-default.

Bottom line

Thursday offered real money and momentum for AI education—and a reminder that the sector’s biggest wins in Washington still hinge on power, tariffs, and antitrust. The praise was loud. The bargaining was louder.

Why this matters

- Public-private skilling is accelerating, but districts need guardrails and evidence or today’s freebies become tomorrow’s lock-ins.

- Chip tariffs and data-center power shape AI’s map of America, turning corporate “pledges” into tools of industrial policy.

❓ Frequently Asked Questions

Q: What exactly is the Presidential AI Challenge that Melania Trump launched?

A: It's a nationwide contest for K-12 students and teachers to create AI-powered solutions to community problems. Examples include AI tools for healthier meal planning (middle school) or AI assistants for medical imaging (high school). Microsoft funded $1.25 million in prizes, with projects judged on creativity and accuracy.

Q: Why was Elon Musk absent from the White House events?

A: Musk had a public feud with Trump after leaving his government efficiency role in May 2025. Despite being invited, he sent a representative instead. His absence was notable since he owns AI company xAI, which competes directly with OpenAI—whose CEO Sam Altman was prominently featured.

Q: How do Trump's threatened semiconductor tariffs actually work?

A: Trump plans "fairly substantial" import tariffs on semiconductor companies that don't move production to the U.S. Companies investing domestically get exemptions—Apple was specifically named as "in pretty good shape" after pledging $600 billion in U.S. manufacturing. It turns trade policy into investment leverage.

Q: Why do AI companies need so much electricity for data centers?

A: Training and running AI models requires massive computational power, which translates to enormous electricity consumption. Data centers now compete with entire cities for grid capacity. Power availability and permitting have become bigger bottlenecks than software development for AI expansion.

Q: Are these billion-dollar commitments new money or repackaged existing plans?

A: Mixed. Microsoft's education commitments appear new, while some investment figures extend existing pledges. Apple's $600 billion builds on a previous $500 billion announcement from February. The timing and public presentation turn business plans into political capital, regardless of the underlying novelty.