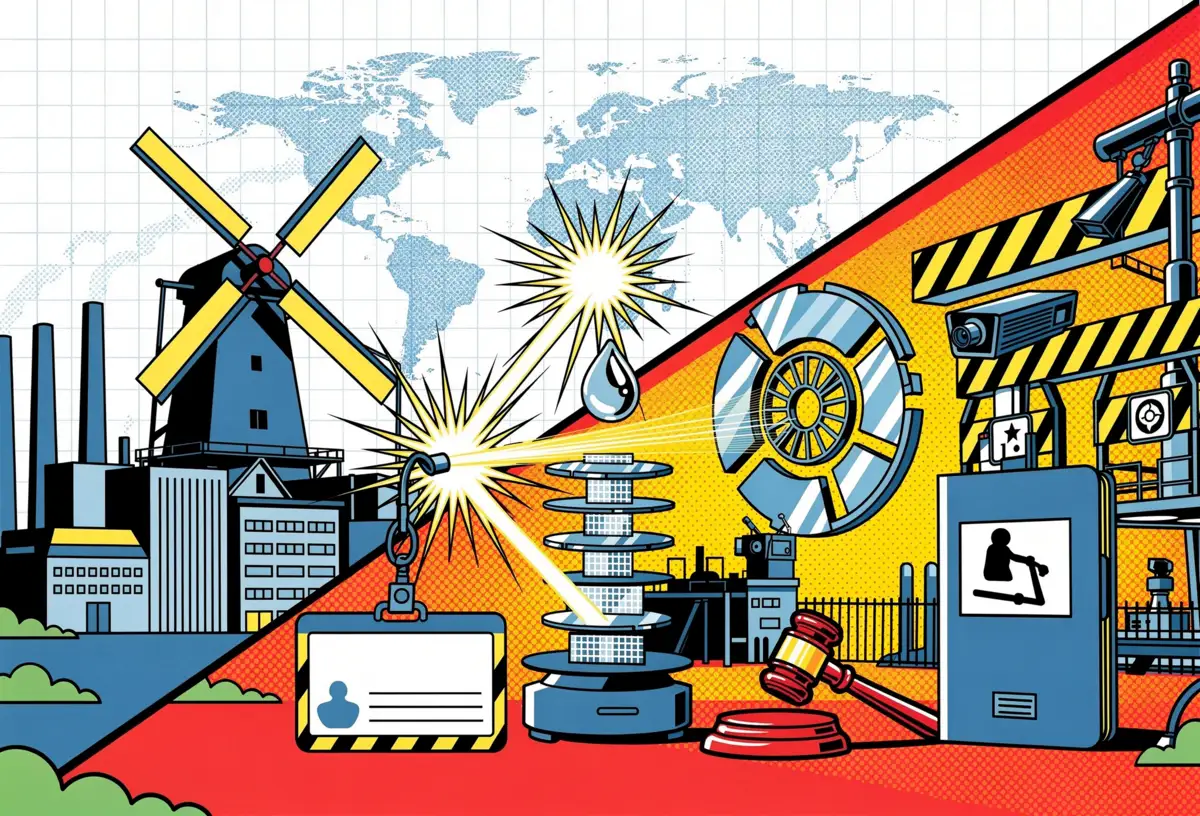

MiniMax and Zhipu AI are locked in a sprint to become the world's first publicly listed foundation model company. Both Chinese AI startups filed for Hong Kong IPOs within 24 hours of each other last week, each seeking roughly $600 million at identical $6.5 billion valuations, with debut dates separated by a single day in early January. That timing? Desperation with a press release.

In 2024, Hong Kong raised $11.3 billion from new listings. This year the city pulled in $36.5 billion from 114 debuts. Chinese AI and semiconductor companies account for most of that jump. The city has become a capital lifeline for firms that can't access American markets and aren't ready for Shanghai's scrutiny. MiniMax targets a January 9 debut. Zhipu AI—officially Knowledge Atlas Technology, marketed overseas as Z.ai—plans to list one day earlier. The message: get in now.

The rush tells a different story than the prospectuses. These filings reveal an industry burning cash faster than it generates revenue, operating in a geopolitical environment that just got more hostile, using metrics designed to obscure rather than illuminate. The Manus sale to Meta for $2.5 billion, announced the same week these IPOs launched, exposed what Beijing already knew: Chinese AI talent is for sale, and the buyer is usually American.

Key Takeaways

• MiniMax and Zhipu AI filed competing Hong Kong IPOs within 24 hours, both seeking $600M at $6.5B valuations with January debuts one day apart.

• Zhipu AI lost $271M on $27M revenue in H1 2025, with R&D costs hitting $227M—revealing the brutal economics of Chinese AI development.

• Meta's $2.5B Manus acquisition exposed a template: build with Chinese talent, relocate to Singapore, sell to U.S. buyers—capital washing that Beijing dislikes.

• December was Hong Kong's busiest IPO month since 2019, driven by Chinese AI firms racing through a window that may close amid escalating tensions.

Beijing's surprise tells the real story

When Meta announced it would acquire Manus for $2.5 billion on December 30, officials in Beijing were caught off guard, according to people familiar with their thinking reported by the Wall Street Journal. They disliked the deal intensely. Somewhere in a government office, someone closed the news alert and stared at their screen for a long moment. Manus represented Chinese AI innovation reaching global scale. Mark Zuckerberg just bought it.

The Manus trajectory establishes a template other Chinese AI founders can follow: build in China with Chinese talent and funding, relocate headquarters to Singapore to sidestep U.S. investment restrictions, sell to American tech giants at valuations that dwarf domestic alternatives. Call it capital washing—scrubbing the geopolitical origin off the code so it fits cleanly in a Silicon Valley portfolio. Washington tolerates this. "The indicators on this one seem to be all pointing at least on the surface in the right direction," Chris McGuire, a former Biden administration official on technology export controls, told the Journal. Treasury reviewed Benchmark's $75 million investment in Manus earlier this year for potential violations of rules restricting investments in critical technologies. Concerns faded after the Singapore move.

For Chinese officials, watching homegrown AI companies exit through this channel represents strategic failure. Beijing poured resources into developing domestic AI capabilities to reduce dependence on American technology. When those capabilities mature, the founders cash out to U.S. buyers. The government lacks tools to block deals involving companies domiciled outside China, even when the core technology and talent remain Chinese. Perverse incentives emerge: the more successful a Chinese AI startup becomes, the more attractive it looks to American acquirers.

The MiniMax and Zhipu AI IPOs happen against this backdrop. Going public in Hong Kong offers an alternative to the Singapore-to-U.S. pipeline, with tradeoffs. Public markets demand disclosure. MiniMax's prospectus lists cornerstone investors including Alibaba and Abu Dhabi Investment Authority. Zhipu AI secured backing from Tencent and Alibaba in earlier rounds. These aren't just investors—they're strategic relationships that tie the companies to Chinese tech infrastructure. A Hong Kong listing makes those ties permanent and visible, limiting future exit options to Western buyers wary of Chinese entanglements.

The capital hunger Washington can't stop

Open Zhipu AI's IPO prospectus. Several hundred pages. You find the brutal economics buried in the financial tables. In the first half of 2024, the company generated $6.4 million in revenue. Operating losses: $146.9 million. Six months later, revenue hit $27.2 million. Losses? Nearly doubled to $271.1 million. R&D costs jumped from $122.5 million to $227.5 million between those periods. The numbers ask you to value potential over a quarter-billion-dollar hole.

Get Implicator.ai in your inbox

Strategic AI news from San Francisco. No hype, no "AI will change everything" throat clearing. Just what moved, who won, and why it matters. Daily at 6am PST.

No spam. Unsubscribe anytime.

This is a spending race. More investment in model development means faster losses, even when revenue grows. Those R&D figures represent server racks in data centers somewhere, hardware running hot around the clock, burning electricity and cooling capacity while training models that might or might not find paying customers. OpenAI will generate around $13 billion in revenue for 2025. MiniMax brought in $30.5 million last year. Both companies face similar compute costs. Both need expensive AI talent. Chinese AI firms lack the enterprise subscription base that gives OpenAI relatively stable recurring revenue. They rely instead on API access fees and partnerships—lumpy, unpredictable income.

Washington's investment restrictions were designed to slow Chinese AI development by limiting access to U.S. capital and advanced chips. The restrictions make American funding difficult. They don't stop Chinese companies from finding alternative capital sources. Hong Kong's market provides that alternative, supplied by investors driven less by careful analysis than by fear of missing the AI premium that sent Moore Threads and MetaX up 400-700% on their Shanghai debuts.

The regulatory arbitrage creates instability. Companies like Zhipu AI and MiniMax operate with Chinese engineering teams using hardware that increasingly comes from domestic suppliers like Moore Threads and MetaX. But they need international capital to scale. That requires playing to Western investor expectations about governance, disclosure, market opportunity. You end up with companies too Chinese for Silicon Valley, too international for Beijing.

Look at December's numbers. Hong Kong hadn't seen this many listings in a single month since November 2019. Twenty-five companies debuted. Ten more are scheduled for January. Chinese AI and semiconductor firms? Roughly half the total. This isn't organic demand—it's a coordinated sprint. U.S.-China tensions could worsen. Washington could tighten investment restrictions. Either scenario closes Hong Kong as a capital bridge. The companies filing now understand this. The urgency is visible in the clustering.

Revenue run rates and other fairy tales

In early December, Manus told investors its revenue run rate had climbed to $125 million. In August, that figure was $90 million. The company used this metric to demonstrate momentum ahead of the Meta acquisition. A revenue run rate takes a short period of actual revenue—often a month or quarter—and annualizes it to project yearly performance. Startups deploy this metric when actual revenue figures would disappoint.

Here's the practice. Generate $10 million in a particularly strong month—big enterprise contract lands, viral adoption drives a temporary spike. Multiply by twelve, claim a $120 million run rate. Sounds impressive until the enterprise contract ends or the viral moment fades. Run rates assume current performance continues unchanged for twelve months. Wishful thinking packaged as projection.

Manus launched its public demo in March 2025 and experienced explosive growth driven by viral adoption. Extrapolating peak growth rates into the future ignores reality: early adopters behave differently than mainstream users, and competitors like Zhipu AI, MiniMax, and dozens of other Chinese AI firms are fighting for the same customers. An invitation code for early access to Manus was resold for more than $1,000 on Chinese social media sites. That's hype, not sustainable customer acquisition.

Neither MiniMax nor Zhipu AI disclosed revenue run rates in their prospectuses. They opted for actual historical financials instead. Hong Kong's disclosure requirements are stricter than standards for private fundraising rounds. The gap between private-market storytelling and public-market accountability becomes visible. Manus told investors its run rate was $125 million. That's selling growth. Zhipu AI disclosed $27.2 million in half-year revenue alongside $271.1 million in losses. That's showing reality.

The metrics question matters because it shapes how investors value these companies. A $6.5 billion valuation for a company losing $271 million on $27 million in revenue implies extraordinary future growth. Investors are making three bets. First: revenue will scale faster than costs. Second: Chinese AI firms can compete globally despite geopolitical headwinds. Third: the current capital environment will support continued losses until profitability arrives. All three bets are questionable.

Zhipu AI operates a model-as-a-service platform serving more than 2.7 million enterprise and application developers, according to its prospectus. That's a meaningful user base, but it's unclear how many are paying customers versus free-tier users. The company said it expects the bulk of future revenue to come from enterprise customers, which makes sense given the limited consumer subscription market for AI tools in China. But enterprise sales require direct relationships, customization work, longer sales cycles. All of which increase costs and slow revenue growth.

MiniMax's prospectus provides less detail on customer metrics, but it notes that 70% of IPO proceeds will fund ongoing R&D efforts. Only 10% is allocated to expanding commercial offerings, with another 10% for partner ecosystem development and the final 10% for working capital. This allocation suggests the company views itself as still in a research-and-development phase rather than a commercial scaling phase. For a company targeting a $6.5 billion valuation, that's a concerning signal about near-term revenue potential.

The window and what happens when it closes

Hong Kong's IPO market is hot because mainland Chinese markets are hotter, and both are running on emotion more than analysis. Moore Threads and MetaX didn't surge 400-700% on their debuts because investors carefully analyzed semiconductor economics. They surged because Chinese retail investors, locked out of direct access to many AI investments, poured money into any ticker symbol connected to the sector. That's greed tinged with anxiety about being left behind in the AI economy.

Hong Kong offers less explosive first-day gains—average returns across all 2025 IPOs were about 40%—but better liquidity and international credibility. For MiniMax and Zhipu AI, the January debuts represent a calculated bet that this environment persists long enough for them to convert IPO proceeds into sustainable businesses. The companies need 12-18 months of runway to demonstrate that revenue growth can outpace cost growth, that their models can compete with Western alternatives despite U.S. chip restrictions, that enterprise customers will commit to long-term contracts.

Beijing's unhappiness with the Manus exit creates additional pressure. Chinese officials want domestic AI champions, not startups that use China as a talent pool before selling to American buyers. Hong Kong listings offer a middle path—companies remain nominally Chinese while accessing international capital. But that middle path only works if the companies actually build sustainable businesses rather than burning through IPO proceeds before seeking acquisition targets.

Companies losing $271 million on $27 million in revenue need continuous capital infusions. Public markets provide that capital, but they also demand results. When you're spending $227.5 million on R&D in six months, you're making a promise that the models you're training will generate returns that justify the investment. The server racks keep humming, the electricity bills keep coming, and the quarterly earnings calls will demand answers about when the spending stops and the profits start.

Washington's investment restrictions create ongoing uncertainty. The Treasury Department's review of Benchmark's Manus investment earlier this year shows that U.S. officials are paying attention to capital flows into Chinese AI firms. If these Hong Kong IPOs attract significant U.S. institutional money, expect renewed scrutiny. The Singapore headquarters trick that worked for Manus won't work for companies listing on Hong Kong exchanges with disclosed Chinese operations.

Both companies will debut in January with roughly $600 million in fresh capital. That money buys them 18-24 months at current burn rates—maybe less if they accelerate R&D spending to keep pace with competitors. The IPO prospectuses show companies that haven't figured out how to make money at scale, operating in markets where the biggest players command 400x their revenue, under regulatory constraints that make international expansion difficult and domestic consolidation necessary. The window opened in late 2025 because investor appetite for AI exposure temporarily exceeded skepticism about Chinese AI economics. When it closes, these companies will face the same choice Manus did: find a buyer willing to pay for talent and technology, or explain to public shareholders why $6.5 billion valuations were justified for businesses losing a quarter-billion dollars annually. The evidence suggests most won't survive that conversation.

❓ Frequently Asked Questions

Q: Why are these companies listing in Hong Kong instead of Shanghai or US markets?

A: US markets are closed to Chinese AI firms due to national security concerns and investment restrictions. Shanghai requires stricter profitability standards and regulatory approval that companies losing hundreds of millions can't meet. Hong Kong offers international capital access with looser requirements—average 2025 IPO gains hit 40%, attracting companies that need cash fast without proving they can make money.

Q: What exactly is a revenue run rate and why is it misleading?

A: A revenue run rate takes one month's revenue and multiplies it by twelve to project annual performance. If you earn $10 million in a strong month (maybe from a big contract or viral spike), you claim a $120 million run rate. It's misleading because it assumes peak performance continues for twelve straight months—ignoring that contracts end, viral moments fade, and competitors emerge.

Q: How does relocating to Singapore help avoid US investment restrictions?

A: US Treasury restricts investments in Chinese companies developing critical technologies like AI. By moving headquarters to Singapore while keeping Chinese engineering teams and talent, companies create legal distance from China. Treasury reviewed Benchmark's $75 million Manus investment but dropped concerns after the Singapore move. It's effectively scrubbing the geopolitical origin off Chinese technology to make it acceptable for US capital.

Q: What are cornerstone investors and why do they matter for these IPOs?

A: Cornerstone investors commit to buy large blocks of shares before the IPO at the offering price, guaranteeing the company raises minimum capital. MiniMax secured Alibaba and Abu Dhabi Investment Authority as cornerstones. This signals institutional confidence and ensures the IPO won't fail, but it also creates strategic ties—Alibaba's involvement makes MiniMax less attractive to Western buyers wary of Chinese tech entanglements.

Q: How long will $600 million in IPO proceeds last at current spending rates?

A: Zhipu AI burned through $271 million in six months (H1 2025), suggesting a run rate of $542 million annually. At that pace, $600 million buys roughly 13 months of runway. MiniMax allocates 70% of proceeds to R&D, implying similar burn rates. Both companies have 18-24 months maximum before needing more capital—less if they accelerate spending to compete with rivals.

Sign up for Implicator.ai

Strategic AI news from San Francisco. Clear reporting on power, money, and policy. Delivered daily at 6am PST.

No spam. Unsubscribe anytime.