Nvidia's $100 Billion OpenAI Deal Is Dead. The Relationship Isn't.

Nvidia's $100 billion OpenAI infrastructure deal never progressed past preliminary talks. Jensen Huang says he'll still invest, but the terms have changed.

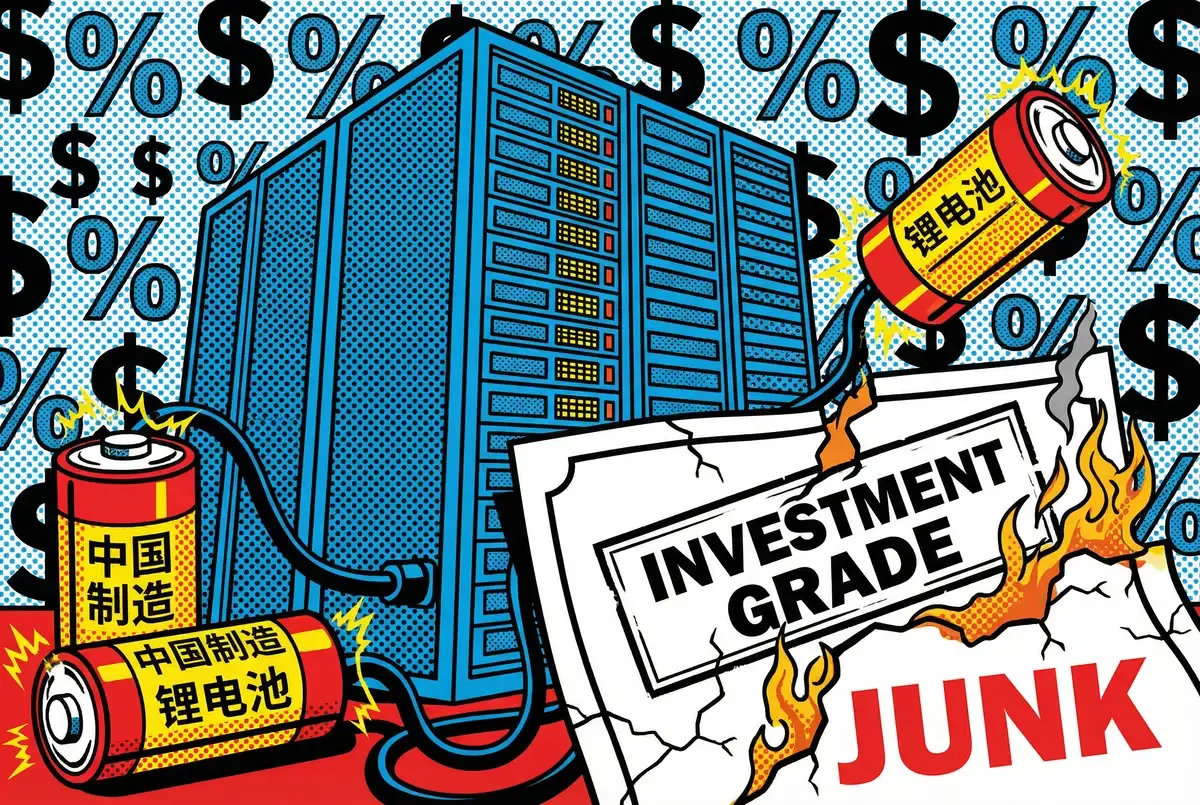

Oracle's bonds carry investment-grade ratings. They trade like junk. Barclays projects the company runs out of cash by November 2026. Behind this single balance sheet sits a $5 trillion industry financing crisis—and a Chinese supply chain nobody wants to discuss.

Oracle holds investment-grade ratings of Baa2 from Moody's and BBB from S&P. Secondary markets price the debt differently. As of December 2025, credit default swaps on Oracle debt traded above 125 basis points, a spread three times wider than Microsoft or Google and consistent with junk-rated credits.

Barclays downgraded Oracle debt to underweight in November, projecting a cash exhaustion date of November 2026 based on current capital expenditure guidance. A downgrade to BBB- would leave the company one notch above high-yield status. Many institutional charters prohibit holding debt below investment grade, forcing automatic divestment if that threshold is crossed.

The divergence between official ratings and market pricing has emerged as AI infrastructure financing enters a new phase. Behind Oracle's balance sheet sits an industry-wide capital structure problem: debt accumulating faster than revenue, supply chains dependent on Chinese manufacturers that American policy seeks to exclude, and revenue requirements that exceed demonstrated market capacity.

The Breakdown

• Oracle's 500% debt-to-equity ratio dwarfs peers at 7-23%; Barclays projects cash exhaustion by November 2026

• Microsoft and Meta use off-balance-sheet SPVs to finance AI infrastructure; Oracle loads $100 billion directly onto its books

• Bain calculates $2 trillion annual AI revenue needed by 2030 to justify current spending—more than three Amazons

• Chinese battery imports hit 60% of U.S. supply with no viable alternatives at scale despite planned tariff increases

Venture capitalist Tomasz Tunguz calculated Oracle's debt-to-equity ratio at 500%. For comparison, Amazon, Microsoft, Meta, and Google all fall between 7% and 23%. The gap reflects both Oracle's smaller equity base, $20 billion versus $340 billion-plus for Microsoft and Google, and aggressive borrowing. Oracle's absolute debt of roughly $100 billion actually exceeds Microsoft's $80 billion, but Microsoft has seventeen times more equity cushion absorbing it.

Oracle's December earnings surprised analysts. Q2 capital expenditures came in at $12 billion, nearly 50% above the $8.25 billion consensus. Management then guided full-year capex to $50 billion. Free cash flow went negative by $10 billion in that single quarter. Each quarter at this pace eats into the equity base.

Barclays analysts project OpenAI could represent a third of Oracle's revenue by 2028. That dependence on a single customer, itself a company seeking financing and operating at a loss, layers counterparty risk on top of leverage risk.

While Oracle finances infrastructure on its corporate balance sheet, competitors use special purpose vehicles to isolate debt. In October 2025, Microsoft and BlackRock acquired Aligned Data Centers for $40 billion via the AI Infrastructure Partnership, which launched in September 2024 with Global Infrastructure Partners and MGX. The fund carries 70% leverage, but the debt remains non-recourse to Microsoft. It does not appear in the company's 10-K filings.

Strategic AI news from San Francisco. No hype, no "AI will change everything" throat clearing. Just what moved, who won, and why it matters. Daily at 6am PST.

No spam. Unsubscribe anytime.

Meta executed a similar structure with Blue Owl Capital in October. The $27 billion vehicle, anchored by PIMCO and BlackRock, holds the debt. Meta retains 20% equity and leases the Hyperion facility, its largest AI-optimized data center, from the SPV. Rather than drawing down corporate credit, Meta received $3 billion in cash at closing.

The structural difference matters for credit risk. Microsoft participates in $100 billion of AI infrastructure exposure without adding corporate debt. Meta finances $30 billion and walks away with cash. Oracle carries $100 billion directly on its books while its credit default swaps price at distressed levels.

Hyperscalers issued $121 billion in bonds in 2025, more than four times the five-year average. Oracle led issuance across 2022-2025, driven by its Cerner acquisition and AI infrastructure financing. Meta's October offering was the largest corporate bond sale since 2023. Microsoft, notably, has not tapped debt markets for direct corporate issuance during this period, relying instead on partnership structures.

Oracle management has stated they will need "substantially less" than analysts estimate, citing customer-supplied chips, vendor rentals, and late-stage equipment purchases. Starting June 2026, Oracle faces financing gaps that will require either additional debt issuance or reduced buildout pace. Barclays' November 2026 cash runway projection assumes current capex trajectory continues.

CoreWeave, the GPU cloud provider that went public in March 2025, carries a debt-to-equity ratio of 120%. In December, the company announced a $2 billion convertible debt offering. CoreWeave reported $310 million in interest expense in a single quarter after borrowing billions using Nvidia GPUs as collateral. The arrangement means interest accrues whether or not those GPUs are running customer workloads.

Broadcom shed over $300 billion in market value across three trading days in December. The stock had its worst week since March 2020. On the earnings call, CFO Kirsten Spears told analysts to expect lower gross margins as the company spends more on components for server racks. CEO Hock Tan maintained that AI chip sales would double to $8.2 billion. But the mix has changed. Custom processors carry thinner margins than Broadcom's traditional chip business, so revenue growth and profit growth have started moving in different directions.

JPMorgan puts the total AI infrastructure buildout at roughly $5 trillion, with a $1.4 trillion gap that will need to come from private credit or government sources. Oaktree Capital Management, in a December note, flagged what it called late-cycle credit behavior: more vendor financing, weaker coverage ratios, capital spending running ahead of revenue growth.

Bain consultants worked backward from current infrastructure spending to calculate what revenue would justify it. Their answer: $2 trillion annually by 2030. To put that in perspective, Amazon's 2024 revenue projection runs around $600 billion. The $2 trillion figure would require the entire AI industry to generate more than three Amazons' worth of new revenue within five years.

Matt Witheiler, head of late-stage growth at Wellington Management, stated that "every single AI company on the planet is saying if you give me more compute I can make more revenue." IBM's CEO has characterized current investment levels as unsustainable. Google's CEO has described market conditions as showing signs of irrationality.

Goldman Sachs estimates AI capital expenditure will exceed 3% of U.S. GDP in 2026. Defense spending runs about 3.5%.

American data centers increasingly rely on Chinese battery and power equipment suppliers, even as U.S. policy officially seeks to reduce that dependence. The share of U.S. lithium-ion battery imports originating from China has climbed steadily, reaching 60% through September 2025. Chinese manufacturers CATL and Sungrow have seen their stock prices surge this year on the strength of export demand.

"China is not only powering China," said Matty Zhao, co-head of China equity strategy at BofA Global Research. "It's actually powering the U.S., Europe and the rest of the world."

The demand stems from data center power requirements that existing grids cannot meet. Data center operators have turned to battery banks and microgrids, independent systems that bypass legacy infrastructure. The U.S. Department of Energy expects microgrids will constitute the majority of distributed energy resources in coming years. Those microgrids need batteries, and the batteries come overwhelmingly from China.

Strategic AI news from San Francisco. Clear reporting on power, money, and policy. Delivered daily at 6am PST.

No spam. Unsubscribe anytime.

BofA estimates Chinese manufacturers earn profit margins three to five times higher on exports than domestic sales for energy storage systems. For transformers, the spread is even wider: 10% to 20% margins domestically versus 40% to 50% for U.S. and European customers. "They would rather continue to export and eat up the tariff," Zhao said.

Raymond Yeung, chief economist for greater China at ANZ, characterized the relationship directly: "China and the U.S. have basically not decoupled. They're a single economy of two different jurisdictions."

Why do buyers keep coming back despite tariffs and political pressure? CATL dominates the market for lithium iron phosphate batteries. The chemistry doesn't catch fire the way other lithium-ion variants can, and the cells last longer. Brian Ho, equity research analyst at Bernstein, noted "just no other suppliers outside China" can match that combination at scale. Lead times matter too. Korean transformer orders take two to three years. Chinese suppliers ship faster, which counts when you're racing to bring a data center online.

The Trump administration plans to raise tariffs on Chinese batteries from 30.9% to 48.4% in 2026 and restrict federal tax credits for equipment with high Chinese content. HSBC noted that 2025 saw "frontloaded installation in the U.S. ahead of the implementation of the foreign entity of concern requirements."

Q: What are credit default swaps and why do Oracle's matter?

A: Credit default swaps are insurance contracts against a company defaulting on its debt. Buyers pay a premium; sellers pay out if default occurs. The spread (price) reflects perceived risk. Oracle's CDS at 125 basis points means buyers pay $125,000 annually to insure $10 million in Oracle debt—three times what Microsoft or Google debt costs to insure, despite similar official ratings.

Q: How do Microsoft's and Meta's off-balance-sheet structures actually work?

A: Both companies created separate legal entities (special purpose vehicles) that borrow money and own the data centers. Microsoft or Meta contribute equity and lease the facilities back, but the debt belongs to the SPV, not the parent company. If the SPV fails, creditors can't pursue Microsoft or Meta's other assets. The debt stays invisible on corporate balance sheets and doesn't affect credit ratings.

Q: What happens if Oracle gets downgraded to junk status?

A: Many pension funds, insurance companies, and bond funds are legally prohibited from holding junk-rated debt. A downgrade to BB+ or below would trigger forced selling by these institutional holders, flooding the market with Oracle bonds and driving prices down further. This raises Oracle's borrowing costs precisely when it needs cheap capital most. Barclays warns Oracle is one notch away from this threshold.

Q: Why can't U.S. companies source data center batteries from somewhere other than China?

A: China controls the lithium iron phosphate (LFP) battery supply chain from mining to manufacturing. CATL alone produces more LFP cells than all non-Chinese manufacturers combined. Building comparable capacity takes 5-7 years and billions in investment. Korean alternatives use different chemistry with shorter lifespans and higher fire risk. For companies racing to bring data centers online now, waiting isn't an option.

Q: What does needing $2 trillion in annual AI revenue by 2030 actually mean?

A: Current global AI revenue sits around $200 billion annually. Reaching $2 trillion requires 10x growth in five years. That means nearly every company currently experimenting with AI must convert to paying customers at enterprise prices. Every pilot project becomes production. Every free ChatGPT user becomes a subscription. If conversion rates disappoint, infrastructure investors face losses measured in trillions.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.