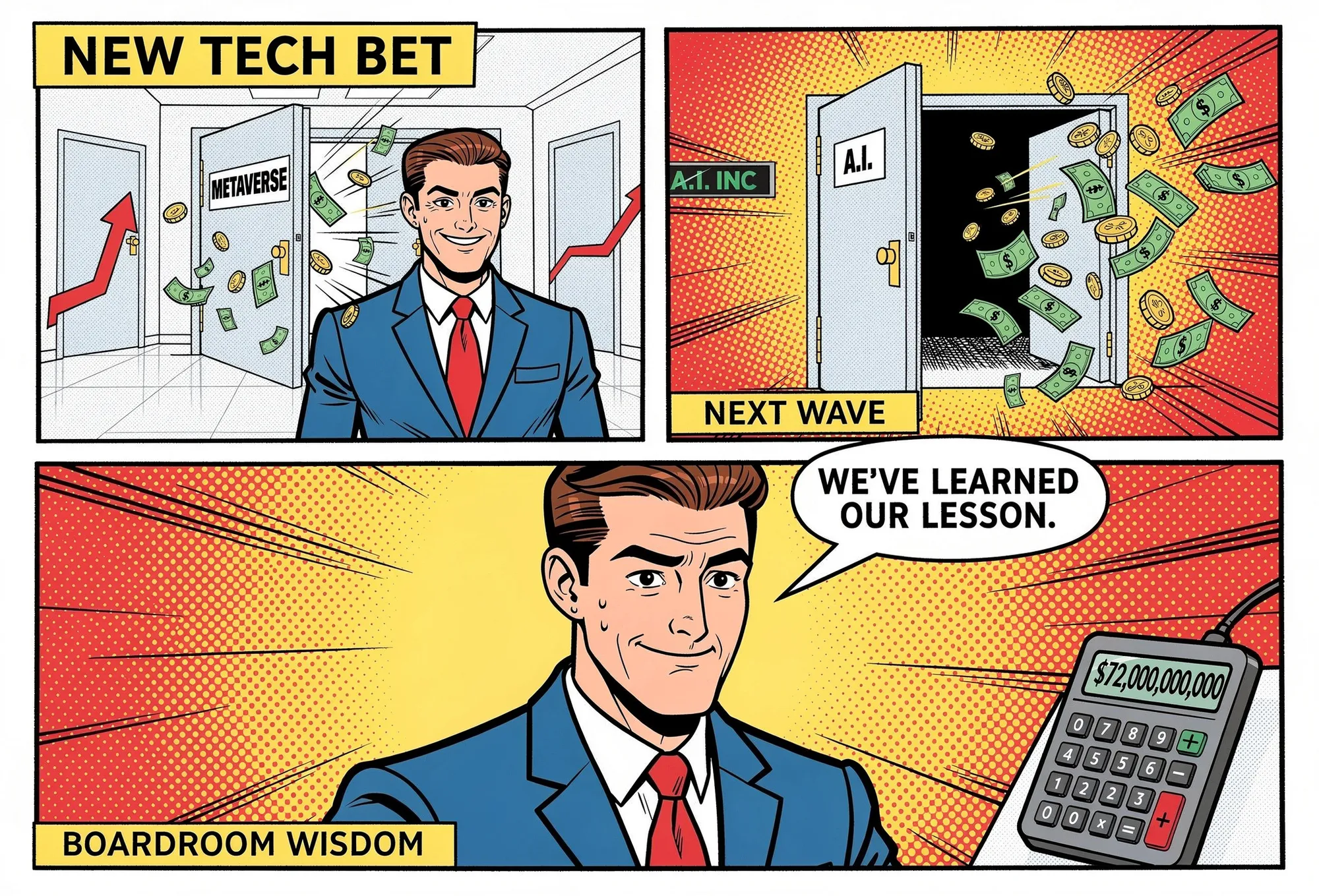

Meta's $70 billion virtual reality bet is getting slashed by 30%. But the money isn't leaving Reality Labs. It's just moving next door to smarter glasses and AI wearables. Wall Street is celebrating discipline that doesn't actually exist.

Two months ago, Meta's stock dropped 10% in a single day. Investors wiped $208 billion from the company's value. The crime? Mark Zuckerberg announced plans for even more aggressive spending on artificial intelligence.

On December 4, Meta's stock jumped 7% at the open before settling at a 3.4% gain. The company added roughly $60 billion in market cap. The catalyst? News that Zuckerberg plans to cut up to 30% from his metaverse division.

Read those two paragraphs again. Investors punished spending. Then rewarded cutting. The technology didn't matter. AI, metaverse, whatever. Wall Street wanted to see the checkbook close.

That's the real story hiding behind the metaverse obituaries.

The Breakdown

• Meta plans 10-30% budget cuts for its metaverse division, with layoffs possible in January. Stock gained $60 billion on the news.

• Reality Labs has lost $70 billion since 2021. Savings will shift to AI glasses and wearables, not leave the division entirely.

• Meta committed $72 billion in capital spending for 2025, mostly on AI infrastructure—undermining the "fiscal discipline" narrative.

• In October, investors wiped $208 billion from Meta after Zuckerberg announced aggressive AI spending. Two months later, they're cheering cuts.

What's Actually Getting Cut

Reality Labs is where Meta parks its hardware dreams. Quest headsets live there. So does the AR research team, the smart glasses group, and various experimental projects that haven't shipped yet. The division has torched more than $70 billion since 2021. Losses top $10 billion every year. Investors have grown tired of watching that money vanish.

Now comes the haircut. Budget cuts of 10 to 30 percent are under discussion for 2026, according to Bloomberg and the New York Times. Layoffs could begin in January. The cuts would hit two areas hardest: Horizon Worlds, the social VR platform that became a punchline, and the Quest virtual reality headset division.

Zuckerberg gathered executives at his Hawaii compound last month for annual budget planning. The standard ask across Meta has been 10% cuts in recent cycles. The metaverse team got told to go deeper.

The official explanation points to competition that never materialized. Four years ago, Apple and Google looked like they might chase the same VR future Meta was building. Meta spent to stay ahead of a race that never happened. Apple eventually shipped Vision Pro but positioned it as something else entirely, avoiding the metaverse framing. Google's efforts stayed small. When rivals pulled back, Meta executives figured they could slow down too.

Here's what the headlines miss. The money isn't leaving Reality Labs. It's being redirected within the division toward AI glasses and wearables. Same budget bucket, different projects.

The Ray-Ban Surprise

Everyone's writing metaverse obituaries. Meanwhile, a different product is quietly working.

Meta partnered with EssilorLuxottica back in 2021 to make Ray-Ban smart glasses. First generation was basic. Cameras and microphones stuffed into frames that looked mostly normal. You could take calls, snap photos, listen to music. Not exactly life-changing, but not embarrassing either.

The newer versions got interesting. Meta added an AI assistant that actually works. Talk to the glasses and they respond. Ask what you're looking at and the camera figures it out. Sales have beaten internal forecasts, the New York Times reports. People are buying these things.

This context changes how to read the metaverse cuts. Meta isn't abandoning consumer hardware. They're killing the stuff that flopped and doubling down on what sells. Different story than the headlines suggest.

The day before budget cut news leaked, Zuckerberg made an announcement. Alan Dye was joining Meta. Dye ran design at Apple for close to 20 years. Apple Watch, iOS, the whole visual system. That's who you hire when you're serious about making better products. Not the hire of a company in retreat.

"We're entering a new era where A.I. glasses and other devices will change how we connect with technology and each other," Zuckerberg wrote on Threads. "With this new studio, we're focused on making every interaction thoughtful, intuitive, and built to serve people."

The metaverse—virtual worlds, avatar-filled social spaces, the whole 2021 vision—is getting cut. But Reality Labs continues. AI glasses continue. The hardware bet continues. Just with different priorities and, presumably, better product-market fit.

The Spending Hasn't Stopped

Here's a number that should give pause to anyone celebrating Meta's newfound fiscal discipline: $72 billion. That's what the company committed to spend on capital expenditures this year. Data centers, mostly. Chips. The kind of infrastructure you need if you want to train large AI models and run them at scale for billions of users.

Zuckerberg has been personally recruiting AI researchers. According to Reuters, he's sliding into WhatsApp DMs with million-dollar offers. Earlier this year, Meta dropped $14.3 billion on a 49% stake in Scale AI and spun up something called the Superintelligence Lab. The company wants to build what Zuckerberg calls "personal superintelligence." Whatever that means.

Large tech companies will spend around $400 billion on AI collectively in 2025. Meta is pulling its weight.

So the metaverse gets cut but overall spending stays enormous. Discipline? Not really. The money just moved. Investors cheering fiscal restraint are watching one budget line shrink while ignoring the one next to it.

Craig Huber of Huber Research Partners captured the mood: "Smart move, just late. This seems a major shift to align costs with a revenue outlook that surely is not as prosperous as management thought years ago."

Late, sure. Smart remains to be seen. Nobody knows yet whether the AI infrastructure bet will pay off any better than virtual worlds did.

The Horizon Worlds Problem

Let's be honest about what failed. Horizon Worlds was embarrassing.

Remember the legless avatars? That was real. Meta launched a social platform in 2021 where your character floated around like a ghost because they hadn't figured out how to render legs yet. The graphics belonged on a Wii console circa 2006. Leaked internal documents from 2022 showed the retention numbers were brutal, with most people never coming back after their first session. The kicker: even Meta's own employees weren't logging in.

Gizmodo's James Pero put it bluntly: "The seven people using Meta's Horizon Worlds just got some potentially harrowing news."

The mockery was deserved. Meta changed its entire corporate name to signal commitment to a product that couldn't hold user attention. Zuckerberg stood on stages promising that billions of people would work, play, and socialize in virtual worlds. The vision was grand. The execution was a mess.

Consumer appetite for social VR simply didn't materialize. People bought Quest headsets for gaming, used them occasionally, then forgot they owned them. Engadget's Lawrence Bonk nailed the disconnect: "It's one thing to throw on a headset to shoot bad guys for 20 minutes but it's a whole other thing to wander around a fake Abercrombie & Fitch for hours looking to spend real money on fake clothing for an avatar."

The metaverse wasn't just technically difficult. It was solving a problem most people didn't have.

Zuckerberg still thinks he'll be proven right. His line now is that AI will eventually make virtual worlds work, rendering environments in real-time and creating avatars that actually look human. Could happen. But that's a lot of money to spend on "could happen." Seventy billion dollars and counting.

The October Lesson

Context matters here. In October, Meta reported strong earnings but announced plans for accelerated AI spending. The stock cratered. More than $208 billion in market value evaporated in a single session, the company's second-biggest one-day loss ever.

Investors weren't objecting to AI specifically. They were objecting to open-ended spending on speculative technology without clear returns. Sound familiar?

The metaverse cuts don't represent a pivot from speculation to discipline. They represent a shuffle from one long-shot bet to another. Virtual worlds out, superintelligence in. The spending continues. The uncertainty continues. Only the label changed.

What shifted is market sentiment. AI has momentum right now. The metaverse lost that momentum years ago. Cutting metaverse spending signals that Zuckerberg is listening to the market, even if he's still writing enormous checks for something else.

Financial Times noted that Meta's market cap now sits at $1.7 trillion. The $60 billion added on December 4 reflects investor relief more than investor enthusiasm. They're not cheering the AI pivot. They're cheering that the metaverse bleeding might finally slow.

What Survives

Company line: the metaverse remains part of the long-term vision. Technically true. Reality Labs still exists. Some VR projects will keep going. But what "metaverse" means at Meta has shrunk dramatically from what Zuckerberg was selling four years ago.

Back then, this was supposed to be everything. The reason to rename a trillion-dollar company. The next chapter of human communication. Now? A budget item getting trimmed so the glasses team can hire more people.

The Alan Dye hire signals where energy is going. Wearables that work today. AI assistants you can talk to. Products people actually use rather than virtual worlds that might matter in 2035.

Quest headsets will likely continue in some form. They sell reasonably well to gamers. The Quest 3 and 3S are genuinely good devices if you want affordable VR. But a device people use "sometimes, if they remember they own it" doesn't justify billions in annual investment.

Horizon Worlds faces the deepest uncertainty. Forrester VP Mike Proulx predicted back in April that Meta would shutter it before year's end. That hasn't happened yet. But 30% cuts to a product that's already struggling to find users doesn't inspire confidence.

The metaverse, as Zuckerberg defined it in 2021, is effectively dead at Meta. The infrastructure survives. The vision doesn't. What remains is a hardware company making glasses and headsets, trying to find products that sell while AI consumes the corporate oxygen.

The Discipline Question

Here's what should trouble investors celebrating this news. Meta's pattern isn't discipline. It's hype cycles.

Mobile gaming got big investment, then quiet retreat. Same with cryptocurrency features. The metaverse followed the same arc, just with more zeros attached. Each time: executive attention, public commitment, billions spent, then the pivot when results disappoint.

The bull case for AI is that this time is different. Real applications exist. Revenue potential is clearer. The competitive stakes are higher. All fair points. But Meta's Llama 4 model got lukewarm reviews when it launched. That $14.3 billion Scale AI deal looks less like confidence and more like an admission that the internal team can't keep pace. OpenAI and Anthropic and Google aren't standing still.

Cutting the metaverse to fund AI tells a clean story. Execution is messier. Meta hasn't shown it can win in foundation models yet.

The stock surge reflects hope. Hope that billions in AI infrastructure spending will generate returns that virtual worlds never did. Maybe that's right. AI advertising products have already worked well for Meta. The technology has clearer near-term applications than the metaverse ever did.

But the underlying behavior hasn't changed. Zuckerberg picks a technology he thinks will reshape everything. He commits the company. Investors go along until losses accumulate. Then the cutting starts. Then the next bet.

The metaverse is dead. Long live AI. Investors are celebrating because one wound stopped bleeding. They haven't noticed the new one opening.

Why This Matters

For Meta shareholders: The December rally and October crash tell the same story. Investors want spending restraint on speculative technology, whether it's VR or AI. The current enthusiasm for metaverse cuts could flip to punishment for AI spending if returns don't materialize.

For the VR industry: Meta was the metaverse's biggest funder by far. These cuts remove the primary source of capital for VR content, hardware suppliers, and platform development. Startups built around Meta's ecosystem need to find new backers or new strategies.

For AI watchers: Meta's pivot illustrates how quickly corporate priorities shift toward whatever technology has market momentum. The $72 billion in 2025 capex shows the company is betting heavily on AI infrastructure. Whether that bet works better than the metaverse bet remains an open question.

❓ Frequently Asked Questions

Q: What's the difference between Reality Labs and the metaverse division?

A: Reality Labs is the parent division that houses all of Meta's hardware efforts. The metaverse unit sits inside Reality Labs and focuses on VR headsets and Horizon Worlds. A separate wearables unit, also inside Reality Labs, handles smart glasses and other devices. The cuts target the metaverse unit specifically, while the wearables unit is actually gaining resources.

Q: What is Scale AI and why did Meta pay $14.3 billion for a stake?

A: Scale AI provides data labeling services and AI infrastructure that companies need to train machine learning models. Meta acquired a 49% stake and partnered with Scale's CEO Alexandr Wang to create a Superintelligence Lab. The deal suggests Meta's internal AI development wasn't moving fast enough to compete with OpenAI, Anthropic, and Google.

Q: Why did Apple and Google back away from competing in VR?

A: Both companies slowed their VR efforts after initial development. Apple shipped Vision Pro in early 2024 but branded it as "spatial computing" for productivity, not social metaverse experiences. Google kept investments modest. Neither company saw consumer demand for the social virtual worlds Meta was building, which gave Meta permission to decelerate its own VR spending.

Q: Are Quest headsets being discontinued?

A: Not entirely. The Quest line will likely continue since it sells reasonably well to gamers. The Quest 3 and Quest 3S are considered solid affordable VR devices. However, the cuts mean less investment in future development and fewer resources for ambitious new features. The VR unit will shrink, but existing products should remain available.

Q: What makes the Ray-Ban smart glasses different from previous smart glasses failures?

A: Earlier smart glasses like Google Glass looked obviously techy and sparked privacy concerns. Meta's Ray-Ban partnership uses familiar frame designs that look like regular sunglasses. The latest versions added a voice-activated AI assistant that can identify objects through the camera. Sales have exceeded internal targets, making them Meta's most successful hardware product outside of Quest gaming.