OpenAI’s finance chief didn’t quite say “bailout,” but the implication was hard to miss. At The Wall Street Journal’s Tech Live conference on Wednesday, CFO Sarah Friar said the U.S. could “backstop the guarantee that allows the financing to happen” for massive AI-infrastructure investments—language that points to taxpayer underwriting of private risk.

Friar also said OpenAI is on pace for roughly $13 billion in 2025 revenue. Even taking that at face value, it would take about 108 years of today’s revenue to match the $1.4 trillion build-out OpenAI and its partners are now telegraphing. That’s the tension. A spend first, justify later strategy—underwritten by the public.

Key Takeaways

• OpenAI's CFO floated federal guarantees for AI infrastructure financing at WSJ conference

• Company committed $1.4 trillion in infrastructure spending against $13 billion annual revenue

• Nvidia may guarantee OpenAI loans while selling chips, creating circular financing concerns

• Executives frame AI as national security issue requiring government support versus China

The financing machine, explained

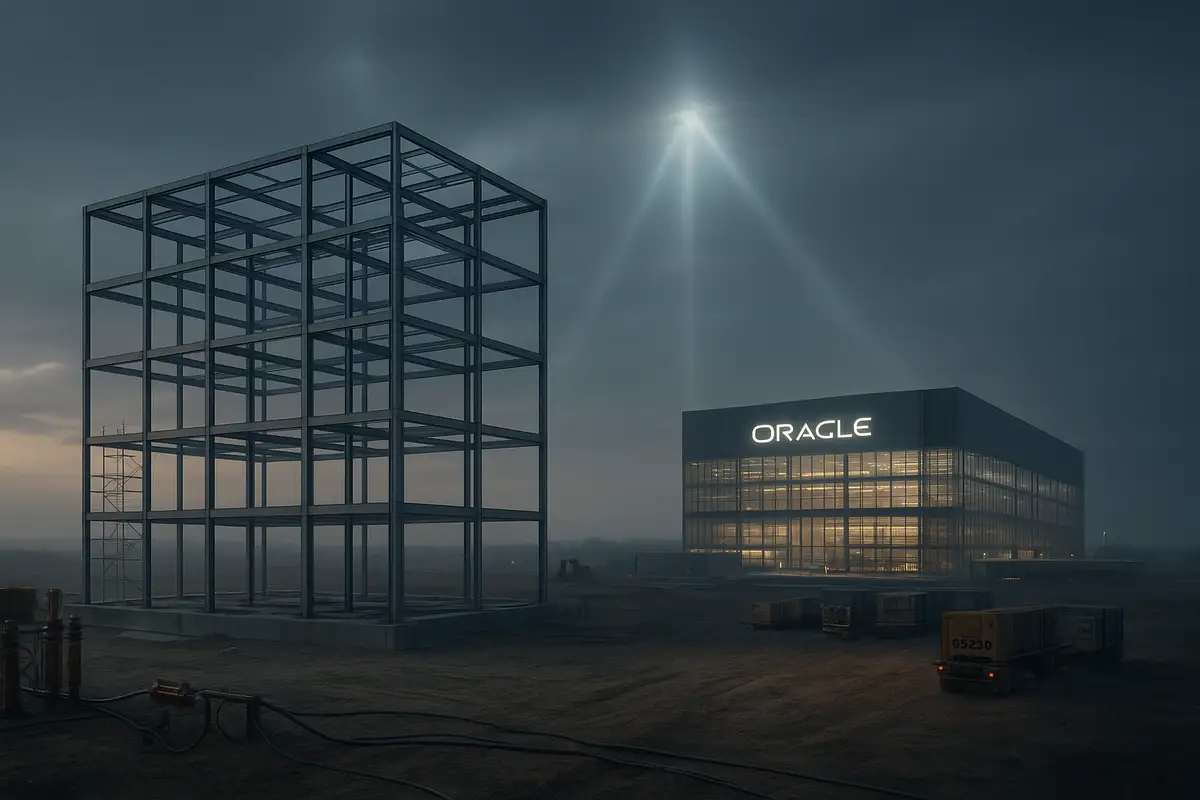

Strip away the glow and you see a web of mutual reinforcement. Nvidia has discussed guaranteeing portions of OpenAI’s data-center debt while selling it the chips those loans buy, according to Wall Street Journal reporting echoed by industry trades. AMD’s pact goes further: OpenAI secured an option to purchase up to 10% of AMD via warrants, contingent on chip deliveries and share-price milestones, per Reuters and other outlets. Oracle inked what the Journal called a $300 billion compute contract starting in 2027. Microsoft, after revising its OpenAI agreements, disclosed a $250 billion Azure commitment. Amazon followed with a $38 billion AWS deal.

Add it up and you approach $600 billion in cloud obligations alone—before counting Nvidia chip leases or the rest of the ecosystem. Each leg props up the others’ valuations and roadmaps. When critics call that circular financing, Friar rejects the premise. But the structure is the point: shared risk that becomes systemic.

The national-security frame

Friar cast AI as “almost a national strategic asset” and urged policymakers to consider U.S.–China competition when weighing support. That line is not accidental. OpenAI executives have repeated variations for months, positioning government guarantees as industrial policy rather than corporate subsidy.

The backdrop is Stargate: a private-sector venture launched at the White House in January that pledged up to $500 billion for U.S. AI infrastructure, fronted by OpenAI, Oracle and SoftBank. Greg Brockman, OpenAI’s president and de facto infrastructure czar, has cultivated political cover for that vision, publicly praising the administration’s “optimism” on domestic build-outs at a September White House dinner. Silicon Valley donors, including Brockman, also backed “Leading the Future,” a pro-AI super PAC that quickly amassed more than $100 million, according to national press reports. The lobbying came before the ask.

What’s actually new this week

Two things advanced on Wednesday. First, Friar put the phrase “federal backstop” into the bloodstream, then later sought to soften it, saying her wording “muddied the point.” Second, she affirmed that profitability is close, if OpenAI weren’t investing so aggressively, suggesting the company expects Washington and Wall Street to bridge the gap until hyperscale demand catches up.

That’s a bet on scale dynamics. If the next generation of models unlocks step-function utility, the infrastructure pays for itself. If not, guarantees are the parachute.

The evidence vs. the pitch

OpenAI touts more than a million business customers and a swelling enterprise mix. Independent surveys, though, are mixed. Several recent reports describe meaningful ROI for a majority of adopters; others find pilots that stall or never graduate to production. The divergence matters, because it determines whether trillions in capex are financing durable productivity—or speculative overflow.

Meanwhile, the hard infrastructure is real. Stargate expansion plans name specific counties and gigawatts. One gigawatt is commonly equated to power for roughly 750,000 homes. Multiply by the dozen sites under discussion and you get a grid-scale footprint that no single balance sheet can comfortably shoulder without creative financing.

The political moment

The request lands amid a government shutdown that has already forced missed federal paychecks and put November SNAP benefits at risk before courts intervened. Voters will notice the optics: CEOs lauded at White House dinners while social-safety-net programs wobble. That contrast will shape how Congress hears any “national strategic asset” pitch tied to loan guarantees.

Externalities and local pushback

Communities slated for data centers are doing their own math. Water-cooled campuses can draw millions of gallons per day in hot months. Wholesale power prices have surged in some data-center corridors, with regulators warning of rate impacts on households to fund grid upgrades. After construction peaks, permanent headcount at a hyperscale site is modest relative to its land, power, and subsidy footprint. Officials who sign up for jobs and tax base are also signing up for water, wires, and politics.

The precedent question

Tech has sought public help before: credits, grants, the occasional lifeline. But nothing has approached a trillion-dollar sectoral guarantee. In 2008, Washington backstopped finance to prevent a system collapse. OpenAI is asking to backstop ambition to accelerate one company’s—and one industry’s—curve. If the curve flattens, taxpayers own a lattice of stranded concrete and silicon. If it steepens, private holders capture the upside.

OpenAI’s executives say the future is worth the risk. Maybe they’re right. But a decision of this size cannot ride on optimism alone.

Why this matters:

- A federal guarantee for AI build-outs would normalize trillion-scale corporate risk-sharing, rewriting the playbook for public-private tech finance.

- Interlocking deals across Nvidia, AMD, Oracle, Microsoft, and Amazon concentrate exposure; if growth stalls, “too big to fail” becomes policy, not prophecy.

❓ Frequently Asked Questions

Q: What exactly is a federal backstop and how would it work for OpenAI?

A: A federal backstop means the government guarantees private loans. If OpenAI can't repay its data center debt, taxpayers cover the losses. This lowers OpenAI's borrowing costs since lenders face no risk. The 2008 bank bailouts used similar mechanisms, though that totaled $700 billion versus OpenAI's implied $1.4 trillion ask.

Q: How does the Nvidia-OpenAI circular financing actually work?

A: Nvidia may guarantee OpenAI's data center loans while OpenAI uses those borrowed funds to buy Nvidia chips. Nvidia also takes equity in OpenAI. So Nvidia profits from chip sales, gains ownership stake, but assumes debt risk if OpenAI fails. AMD's deal includes OpenAI options for 10% equity contingent on chip deliveries.

Q: What is the Stargate Project mentioned in the article?

A: Stargate is a $500 billion AI infrastructure venture announced at the White House in January by OpenAI, Oracle, and SoftBank. It plans massive data centers across Texas, Ohio, New Mexico, Wisconsin, and Michigan. Each site could consume gigawatts of power—one gigawatt equals electricity for 750,000 homes.

Q: Is OpenAI actually profitable or close to it?

A: OpenAI claims $13 billion in 2025 revenue but isn't profitable. CFO Friar said the company could achieve profitability "quickly if it weren't seeking to invest so aggressively." They're burning through $600 billion in cloud computing costs alone from Microsoft, Oracle, and Amazon over the next few years.

Q: Why do different studies show wildly different AI success rates?

A: OpenAI cites studies showing 75% of enterprises report positive ROI. But MIT found 95% of generative AI pilots failed, Rand reported 80% implementation failure rates, and TechRepublic found 85% failures. The gap likely reflects different definitions of success, timeframes measured, and whether pilots that never reach production count as failures.