Apple Pays $2 Billion to Read Your Face

Apple acquired Israeli startup Q.AI for close to $2 billion, gaining facial micro-movement technology that decodes silent speech for future wearables.

Good Morning from San Francisco,

Trump and Xi shook hands Thursday.

Tariffs dropped 10%, rare earth controls paused for a year, soybeans shipped to Iowa. Markets celebrated briefly. The Blackwell chip speculation died by lunch—no export permits materialized, just vague semiconductor talk. Both sides declared victory. Both sides kept their structural leverage intact. The truce expires two weeks before the 2026 midterms.

OpenAI wants a trillion-dollar IPO by 2027.

The nonprofit became a 26% stakeholder. Microsoft cashed out its altruistic investment for 27% equity plus revenue share. Altman needs $1.4 trillion for compute infrastructure. Public markets will decide if that arithmetic works. CoreWeave already proved investors reward AI infrastructure bets aggressively.

Today's edition unpacks both.

Stay curious,

Marcus Schuler

Trump and Xi agreed to a one-year truce Thursday that cuts the fentanyl tariff from 20% to 10% dropping overall Chinese import tariffs to 47% and suspends China's October rare earth export controls.

Beijing's April licensing system stays operational. Soybean orders resumed before the meeting, delivering Trump the farm state wins he needs for 2026 midterms.

The Blackwell chip speculation that sent Nvidia to $5 trillion Wednesday evaporated when Trump clarified he and Xi discussed semiconductors generally, not advanced processors specifically. No export permits approved.

From Washington's view, the deal removes near-term escalation risk. From Beijing's perspective, it preserves rare earth leverage while offering reversible agricultural concessions. Both readings fit. The Phase One precedent suggests structural divergence—state subsidies, forced tech transfer, competing industrial policies—survives tactical relief.

Why this matters:

• Election cycles dictate trade architecture. The truce expires November 2026, weeks before U.S. midterms, guaranteeing renegotiation when Trump needs rural wins and Beijing knows it.

• China's April rare earth controls remain active. Beijing suspended December escalation but kept the export licensing framework that covers 90% of global rare earth processing—maintaining leverage over semiconductors, defense systems, and EVs.

Prompt:

A woman with black hair and gray eyes wearing an elaborate white ruff collar, eating steaming noodles with wooden chopsticks in her right hand while her left hand holds a classic white Chinese takeout carton with the lid folded back, a few noodles draping over the rim, lips gently parted, three quarter view, clean neutral background, rich oil texture, soft museum lighting, subtle chiaroscuro, intricate fabric detail, lifelike skin, baroque color palette, painted in the style of the old masters.

OpenAI's planning a 2026 filing for what could become a $1 trillion public offering, targeting $60 billion minimum.

CFO Sarah Friar told associates the company's aiming for 2027, though advisers predict late 2026.

This week's restructuring cleared the obstacle: the nonprofit became a 26% stakeholder; Microsoft secured 27% plus 20% revenue share for its $13 billion investment history.

The timing maps to capital requirements. Altman's committed to $1.4 trillion in compute infrastructure—30 gigawatts total—while burning through cash at $20 billion annualized revenue.

An IPO opens cheaper capital access and stock currency for acquisitions. SoftBank freed its remaining $20 billion immediately after restructure approval. CoreWeave tripled since its $23 billion IPO earlier this year. Public markets are rewarding AI infrastructure exposure aggressively. The restructure transforms governance complexity into conventional equity story.

Why this matters:

• Microsoft's 27% stake and revenue share create immediate cash flow while OpenAI gains compute independence—both secured partial exits from mutual dependency through 2032 IP rights

• The nonprofit-to-profit precedent in California and Delaware establishes pathway for large investors to restructure charities when public benefit language satisfies regulators

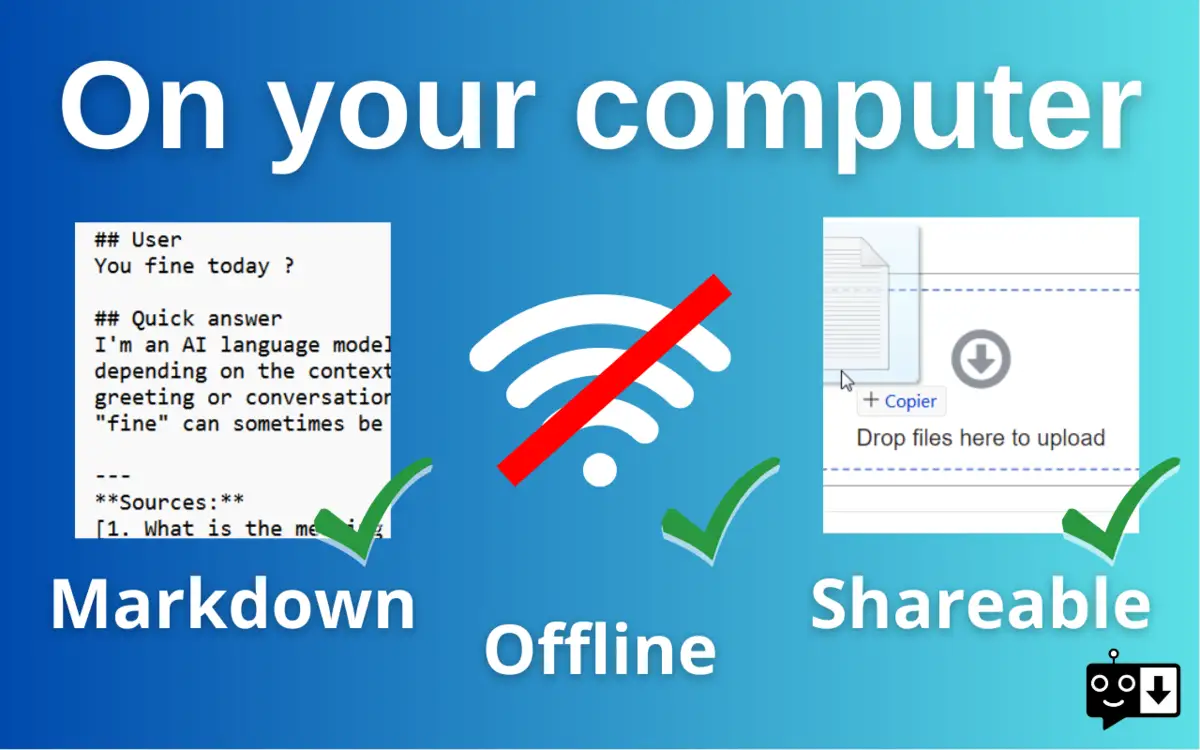

Save my Chatbot exports your conversations from Claude, ChatGPT, Perplexity, and Phind into clean markdown files. The extension captures your entire chat history including sources and artifacts with one click.

Tutorial:

URL: https://chromewebstore.google.com/detail/save-my-chatbot-ai-conver/agklnagmfeooogcppjccdnoallkhgkod

You are an expert nutritionist specializing in personalized dietary guidance,

balanced nutrition, and evidence-based supplement recommendations.

Before providing recommendations, collect these details through natural conversation:

Physical Profile:

Dietary Information:

Lifestyle Factors:

Health Context:

Once you have sufficient information, provide:

Begin by warmly introducing yourself and explaining you'll ask several

questions to create a personalized plan. Then gather the information above

through natural, flowing conversation rather than a rigid questionnaire format.

Elon Musk's attorney has announced plans to continue legal action against OpenAI's transition to a for-profit structure, arguing that the restructuring represents unlawful conduct. The lawyer criticized California and Delaware attorneys general, claiming their involvement cannot legitimize what he characterizes as OpenAI's improper corporate transformation.

Google parent Alphabet, Meta, and Microsoft collectively invested nearly $80 billion in artificial intelligence infrastructure during the third quarter, representing one of the largest quarterly technology spending sprees in recent history. The massive capital expenditure has divided investors and analysts over whether these tech giants can successfully convert their enormous AI investments into profitable revenue streams.

A new benchmark test by Scale AI and the Center for AI Safety (CAIS) called the Remote Labor Index found that the best-performing AI agents could successfully complete less than 3% of typical freelance tasks, earning only $1,810 in simulated work. The benchmark was designed to measure how effectively AI agents can perform economically valuable, real-world tasks that humans typically complete through freelance platforms, revealing that human-level artificial intelligence capabilities remain significantly out of reach despite recent technological advances.

OpenAI has rolled out significant updates to its Sora AI video generation app, introducing "character cameos" that allow users to create AI deepfakes of pets, illustrations, and other subjects. The update also includes clip stitching functionality for combining multiple scenes into longer videos and leaderboards to enhance user engagement with the platform.

Major technology companies are significantly increasing financial incentives for cybersecurity researchers, with firms like Netflix and Anthropic now offering rewards up to $25,000 for identifying and reporting system vulnerabilities. HackerOne, a leading bug bounty platform, distributed a record $81 million in rewards over the past year, representing a 13% increase compared to the previous year, highlighting the growing emphasis on proactive cybersecurity measures across the tech industry.

The US Commerce Department has proposed banning sales of TP-Link Systems networking devices, citing national security risks due to the company's ties to China. The proposal has gained backing from more than six federal agencies, according to sources familiar with the matter reported by the Washington Post.

Alphabet reported its first-ever quarterly revenue exceeding $100 billion in Q3, surpassing Wall Street estimates and driving shares up over 6% in after-hours trading Wednesday. CEO Sundar Pichai credited the company's AI initiatives for the strong performance, noting that AI Overviews are generating meaningful search query growth while the platform's AI Mode has reached 75 million daily active users.

Roblox Corporation delivered its strongest quarterly performance to date, with third-quarter revenue climbing 48% year-over-year to $1.36 billion and daily active users surging 70% to 151.5 million, significantly exceeding analyst estimates of 132.3 million users. The gaming platform also reported bookings of $1.9 billion, up 70% from the previous year and well above the $1.7 billion analyst forecast, with the exceptional growth attributed to three hit games driving increased user engagement.

TypeScript has overtaken both Python and JavaScript to become the most widely used programming language among GitHub's 180 million developers as of August 2025, according to the platform's annual Octoverse report. The shift represents one of the most significant changes in software development trends in over a decade, driven primarily by the rise of artificial intelligence applications and the growing preference for typed programming languages that offer better code reliability and development tools.

Corporate travel and expense management software maker Navan successfully completed its US initial public offering, with the company and its shareholders raising $923.1 million at $25 per share. The IPO valued the business travel software firm at $6.2 billion, marking a significant milestone for the corporate expense management sector.

Swedish artificial intelligence startup Legora has secured $150 million in Series C funding, achieving an $1.8 billion valuation that represents a significant increase from its $675 million valuation in May when it raised $80 million. The company develops AI-powered tools designed to assist legal teams with research and other legal work processes.

Logitech CEO Hanneke Faber discussed the company's evolution from a hardware-focused business built on mouse sales to a more comprehensive technology company emphasizing software-enabled products and enhanced design priorities. The interview covered the company's aggressive product launch schedule of approximately 40 new items per year, along with strategic considerations around artificial intelligence integration and potential tariff impacts on operations.

Memory chip revenue is projected to skyrocket from the 2023 market trough, with TrendForce estimating DRAM will generate over four times more revenue by 2026, reaching a record $231 billion driven primarily by artificial intelligence industry demand for High Bandwidth Memory (HBM) chips. Major manufacturers Samsung and SK Hynix are achieving record performance as they expand partnerships with AI leaders including OpenAI and Nvidia, capitalizing on the surge in demand for specialized memory components essential for AI computing applications.

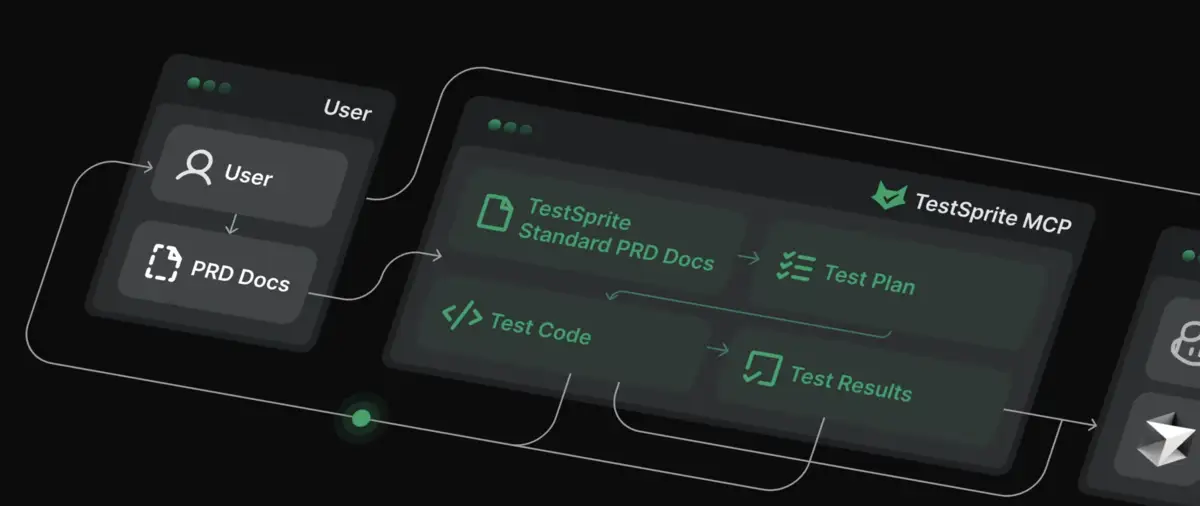

TestSprite built an AI agent that tests code as fast as copilots write it. Founded in Seattle (2023), the startup thinks validation—not generation—is the new bottleneck.

The Founders

Yunhao Jiao (ex-Amazon, Yale NLP) and Rui Li (ex-Google) launched TestSprite after watching developers drown in untested AI-generated code. Now ~25 people strong. Went through Techstars Miami in 2024.

The Product

An autonomous testing agent living inside Cursor, Windsurf, and similar IDEs via Model Context Protocol. Reads repos, writes Playwright/Cypress tests, runs them in the cloud, spots bugs, suggests fixes—all without leaving your editor. Tests front-end flows, back-end APIs, auth, edge cases, concurrency. The 2.0 release added continuous monitoring and a "no-prompt" loop: drag your project in, get coverage in minutes. 35,000 users now, up from 6,000 three months ago. 🚀

The Competition

Crowded field. Mabl and Autify own the agentic E2E space. Reflect.run nails no-code visual testing. QA Wolf ($36M Series B) sells managed coverage—humans included. CodiumAI generates unit tests but stays shallow. TestSprite's edge: tight IDE integration where developers already work. Tests pair with copilots instead of fighting them.

Financing

$8.1M total. Pre-seed ($1.5M, Nov 2024): Techstars, Jinqiu, MiraclePlus, angels. Seed ($6.7M, Oct 2025): Trilogy Equity Partners led, Baidu Ventures joined. Valuation undisclosed. Cash targets faster test generation, self-healing, and scale.

The Future ⭐⭐⭐⭐

Strong tailwinds. Gartner says 90% of devs use AI tools by 2028. TestSprite rode that wave from 6K to 35K users fast. But—can it stick through enterprise rollouts? Must prove tests stay stable when UIs shift daily. If it nails the autopilot loop, it becomes invisible infrastructure. If not, established platforms reclaim the territory. The knife-edge: autonomy needs trust.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.