The $2 Billion Escape Plan That Beijing Didn't See Coming

Meta's $2B Manus deal triggered reviews by three Chinese agencies. The 'China shedding' playbook for AI startups faces its first test.

Trump reverses China chip ban after Nvidia CEO's White House visit. The $15 billion policy flip shows economic interests beating security concerns in the AI race with Beijing.

💡 TL;DR - The 30 Seconds Version

👉 Trump administration reversed its April ban on Nvidia's H20 AI chip sales to China after CEO Jensen Huang met with the president last week.

📊 The policy flip could restore $15 billion in annual revenue that Nvidia had written off, plus reverse a $5.5 billion inventory impairment charge.

🏭 Chinese companies immediately began scrambling to place orders through Nvidia's "whitelist" system, with ByteDance and Tencent submitting applications.

🌍 China represents 50% of the world's AI developers and generated $17 billion in revenue for Nvidia in its most recent fiscal year.

🚀 The reversal signals economic interests now outweigh security concerns in US tech policy, potentially setting precedent for future restrictions.

Three months after slamming the door on Nvidia's chip sales to China, the Trump administration has done a complete about-face. The world's most valuable company can now resume selling its H20 AI processors to Chinese buyers, potentially restoring $15 billion in annual revenue that seemed lost forever.

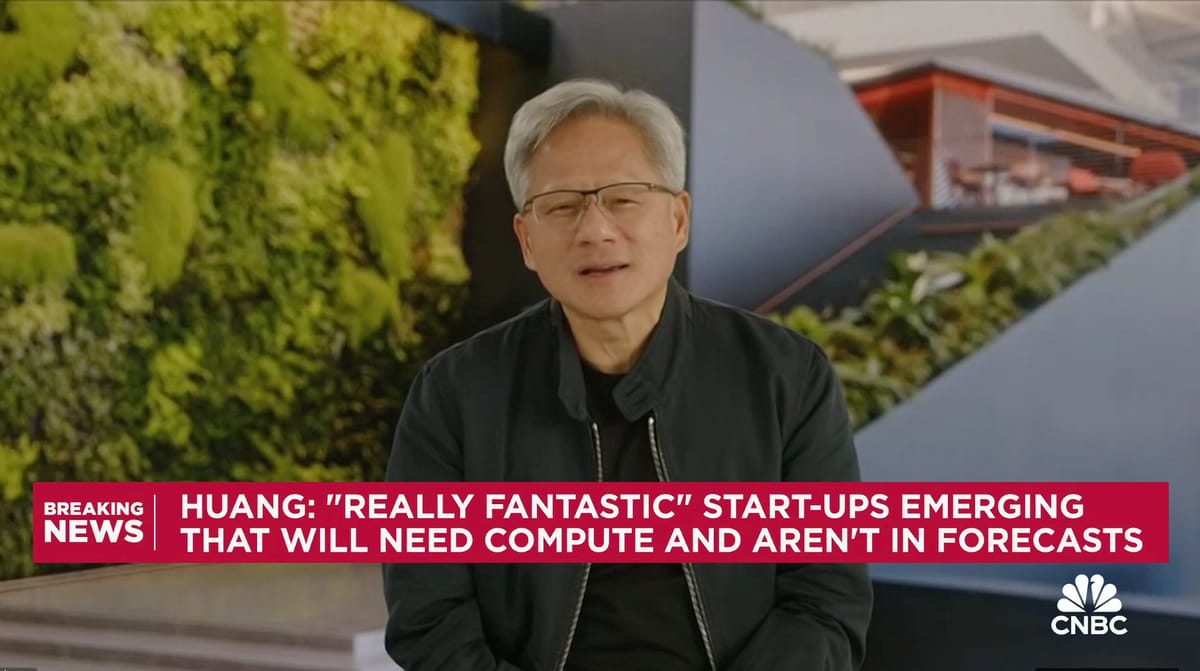

The reversal came after Nvidia CEO Jensen Huang met with President Trump last week. Huang had spent months lobbying Washington politicians to keep the China market open, arguing that restrictions only helped Chinese competitors like Huawei gain ground. His persistence paid off in spectacular fashion.

"The U.S. government has assured Nvidia that licenses will be granted, and Nvidia hopes to start deliveries soon," the company said Monday. Chinese firms immediately began scrambling to place orders through what sources describe as a "whitelist" system Nvidia created for potential buyers.

The Trump administration blocked H20 sales in April, citing national security concerns. Officials worried that Chinese military forces could use AI chips to coordinate attacks and develop advanced weapons. Commerce Secretary Howard Lutnick had told Congress that Nvidia and other companies needed to "stop helping China" use American tools to compete against the US.

The restrictions forced Nvidia to write off $5.5 billion in inventory and walk away from what Huang called $15 billion in potential sales. The H20 chip was specifically designed for China after earlier export controls. Nvidia had throttled the performance of its more powerful H100 processor to comply with US restrictions, then marketed the watered-down version as the H20.

But the H20 still packed significant memory capabilities valuable for running AI systems. Chinese companies from tech giants ByteDance and Tencent to AI startup DeepSeek had been eager buyers before the ban hit.

Huang had been making his case across Washington for months. He argued that closing off China would only strengthen Huawei and other Chinese chip makers, ultimately hurting American companies. China represents 50% of the world's AI developers and had generated $17 billion in revenue for Nvidia in its most recent fiscal year.

"They simply can't rely on it," Huang said about Chinese military use of Nvidia chips. "It could be, of course, limited at any time." His point was that Beijing couldn't build critical military systems on technology that Washington could shut off whenever it wanted.

The CEO also visited China several times this year, including a current trip to Beijing where he's scheduled to give a news conference. He met with government and industry officials to discuss AI's benefits and ways for researchers to advance the technology safely.

Huang's meeting with Trump last Thursday proved decisive. The president had been under pressure from multiple angles. Some Trump officials wanted to boost Nvidia's sales in markets beyond China. The company had just become the first to hit $4 trillion in market value, a testament to its central role in the AI boom.

Meanwhile, broader US-China trade talks were showing signs of progress. Washington had already lifted some export controls on chip design software in exchange for China relaxing restrictions on rare earth mineral exports. The H20 decision fits this pattern of gradual thawing.

During his Washington visit, Huang reaffirmed Nvidia's support for the administration's goals of creating jobs, strengthening domestic AI infrastructure, and ensuring American leadership in AI. He also made a broader strategic argument that resonated with Trump's team.

"We believe that every civil model should run best on the US technology stack, encouraging nations worldwide to choose America," Huang told reporters.

Nvidia shares jumped 4.5% in premarket trading after the announcement. Chinese stocks also surged, with Alibaba rising 6% in Hong Kong and the Hang Seng Tech Index climbing 2.2%. Data center operators like Beijing Sinnet Technology jumped 8.4%.

"This is a major catalyst for Nvidia shares, as many had written off the chance of any meaningful revenue coming from China," said Matt Britzman, senior equity analyst at Hargreaves Lansdown. He estimated the reversal could represent $15 billion to $20 billion in additional revenue this year, depending on approval timing and delivery speed.

The company might also reverse some or all of the $5.5 billion impairment charge it took in the first quarter, providing a double boost to earnings.

Nvidia also announced a new processor designed specifically for China called the RTX PRO GPU. The company described it as "fully compliant" with US export controls and suitable for digital twin AI applications in smart factories and logistics.

This chip appears to be positioned below the H20 in terms of capabilities and price. Reports had suggested Nvidia was preparing a lower-cost alternative based on weaker specifications and simpler manufacturing requirements.

The reversal marks a significant shift in US tech policy toward China. Economic interests appear to be outweighing the national security concerns that drove the original restrictions. This could signal a broader pattern as the Trump administration balances security fears against the desire to maintain American technological leadership.

Some lawmakers may push back. The House Select Committee on the Chinese Communist Party had opened an investigation into Nvidia's Asia sales, trying to assess whether the company knowingly provided Chinese firms with critical technology in violation of US rules.

But for now, Huang's argument has won the day. His view that restrictions mainly help Chinese competitors while hurting American companies has found receptive ears in an administration focused on economic competition with China.

Why this matters:

• The economic argument beat the security argument: Nvidia's potential $15 billion revenue hit proved more compelling than fears about Chinese military AI development, suggesting future tech restrictions will face tougher scrutiny.

• China's AI development gets a lifeline: While Chinese companies were working on Nvidia alternatives, they still prefer American chips for their superior capabilities, giving them more time to close the technology gap.

Q: What exactly is the H20 chip and how does it differ from Nvidia's other processors?

A: The H20 is a watered-down version of Nvidia's H100 chip, specifically designed for China. Nvidia throttled the H100's performance to comply with US restrictions, then marketed it as the H20. While less powerful than the H100, it still has significant memory capabilities valuable for running AI systems.

Q: Why did Trump ban H20 sales in April if he's now allowing them again?

A: The April ban came from fears that Chinese military could use AI chips to coordinate attacks and develop weapons. Commerce Secretary Howard Lutnick told Congress that Nvidia needed to "stop helping China" compete with US technology. The reversal shows economic interests now outweigh security concerns.

Q: How much money did Nvidia actually lose from the China ban?

A: Nvidia wrote off $5.5 billion in inventory when the ban hit and walked away from $15 billion in potential annual sales. China had generated $17 billion in revenue for Nvidia in its most recent fiscal year, representing 13% of total sales.

Q: What's this "whitelist" system that Chinese companies are using to place orders?

A: Nvidia created a registration system for Chinese companies to apply for potential H20 purchases. Sources say ByteDance and Tencent are submitting applications through this whitelist. Each sale still requires individual US government approval, but Trump has assured Nvidia that licenses will be granted.

Q: What's the new RTX PRO chip Nvidia announced alongside the H20 news?

A: The RTX PRO is a "fully compliant" processor designed specifically for China that doesn't require export licenses. It's positioned for digital twin AI applications in smart factories and logistics. Reports suggest it's less advanced than the H20 and priced lower.

Q: How quickly can Nvidia start shipping H20 chips to China again?

A: Nvidia says it "hopes to start deliveries soon" but still needs individual export licenses for each shipment. The company is filing applications with the US government and expects approval. Analysts estimate the reversal could represent $15-20 billion in additional revenue this year.

Q: How does this decision affect the AI competition between US and Chinese companies?

A: The reversal gives Chinese AI companies like DeepSeek and Alibaba continued access to superior US chip technology while they develop domestic alternatives. China represents 50% of the world's AI developers, so the decision keeps Chinese AI development dependent on American hardware.

Q: Could this decision be reversed again if security concerns resurface?

A: Yes. The House Select Committee on the Chinese Communist Party has opened an investigation into Nvidia's Asia sales, and lawmakers may push back. Huang himself argued that China can't rely on technology Washington could "limit at any time," acknowledging the policy could change again.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.