A U.S. investigation into a Singapore firm that bought roughly $2 billion of Nvidia’s most advanced chips now collides with Beijing’s new rare-earth export curbs. Each side is pressing on the other’s supply-chain bruises while insisting trade talks should continue.

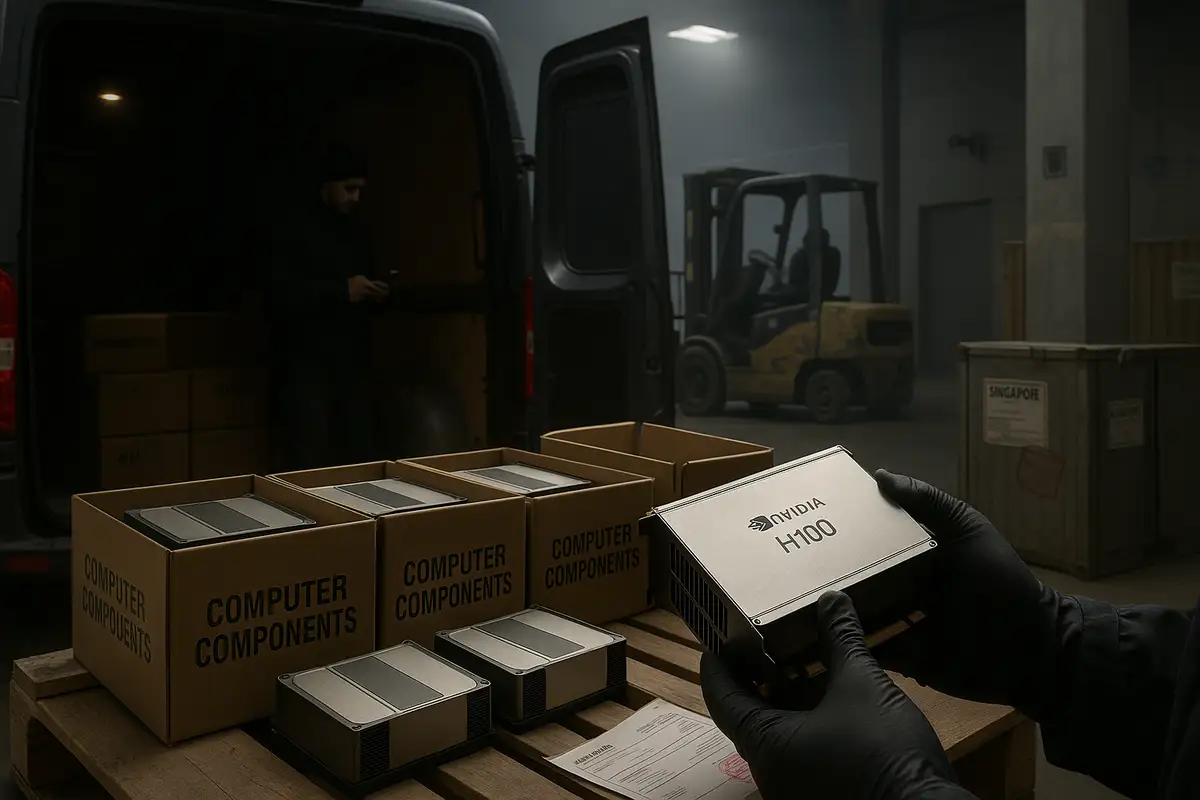

Beijing’s rule lands first. China moved to require export licenses for goods containing more than 0.1% Chinese rare-earth content by value, a threshold that touches semiconductors, chip-making gear, and some defense systems. Days earlier, Commerce Department officials confirmed active scrutiny of Megaspeed International, a little-known buyer that ramped up purchases of Nvidia H-class accelerators in 2024 and 2025 before abruptly stopping this summer. The timing reads like negotiation by other means. It also surfaces the limits of today’s export-control playbook.

The Breakdown

• Megaspeed bought $2B in Nvidia chips through Singapore shell with Chinese parent, stopped ordering after September 2024 Commerce inspection found boxed inventory

• China announced export licenses required for products with 0.1% Chinese rare-earth content, covering semiconductors and chip-making equipment across 90% global supply

• Legal ownership rules allow billions in restricted tech to flow while agencies investigate operational control, creating structural enforcement lag measured in quarters

• Both measures timed ahead of expected Trump-Xi meeting, using supply chain chokepoints as negotiation leverage while claiming commitment to trade dialogue

Nvidia says there is no evidence Megaspeed diverted chips to China and that company checks show Megaspeed has no Chinese shareholders. That’s the formal defense. Yet Megaspeed was carved out of 7Road, a Chinese gaming and cloud company with state-backed investors. Trade records show most of Megaspeed’s orders flowed through Aivres, the U.S. arm of Inspur, which Washington previously sanctioned for supporting China’s military supercomputing. Singapore police say they are investigating Megaspeed for potential breaches of local law. Details are scarce. The questions aren’t.

What’s actually new

Smuggling headlines are not new; enforcement waves have followed the AI boom since 2023. What changes here is the concentration, proximity, and choreography.

Alice (Huang Le) Huang, Megaspeed’s former executive, appeared alongside Nvidia CEO Jensen Huang at industry gatherings in Taipei during the same period Megaspeed was placing nine- and ten-figure orders. Nvidia frames those encounters as routine customer outreach at conferences. Fair enough. Still, Megaspeed accounted for a meaningful slice of the company’s 2024 data-center revenue while operating from sparse offices and routing gear through addresses that investigators later found half-empty. That contrast is the point. Scale on paper; thin substance in person.

Commerce officials also escalated from monitoring to inspection. In September 2024, they visited Megaspeed’s Malaysian site and found high-end Nvidia systems still in shipping boxes. That can be innocent. It can also be a tell. By late July 2025, the orders stopped.

The compliance gap

On paper, Megaspeed clears the bar. Its registration shows Singaporean ownership through a shell controlled by a local director; corporate filings list no China-based equity holders. Under current rules, that’s decisive. If it isn’t Chinese-owned, it can buy restricted chips.

But ownership is not control. Employees described directors who work from Shanghai, clients who are mostly Chinese, and a director who is never present. The group’s predecessor—again—was Chinese and state-backed. The law draws a bright line for ownership and leaves operational control to case-by-case proof. That proof runs through contracts, payment flows, and service footprints. It takes time. Commerce is now asking those questions while the hardware is already in the field.

Chips routed to Malaysian and Indonesian data centers that remotely serve Chinese clients may still be legal if the operator is not acting “on behalf of” a Chinese entity. That’s the crux. It is also the loophole.

Asymmetric chokepoints converge

China processes about 90% of the world’s rare-earths. Its 0.1% rule is designed to be hard to certify away. Most tech companies cannot prove trace content in complex assemblies, let alone redesign supply chains on a deadline. The immediate effect is uncertainty. The intended effect is leverage.

Beijing paired that move with tighter port checks on AI-class semiconductors, including models tuned to comply with U.S. rules. The message is two-sided. Unauthorized imports will be squeezed at the border. Authorized exports of critical inputs will be gated at the source. It is a pincer.

Washington is not standing still. The Senate approved a measure to further restrict Nvidia and AMD exports to China as part of the annual defense bill, though its path to law remains unclear. The administration is also leaning into domestic rare-earth mining and processing. None of that arrives in time for this negotiation cycle. That is China’s short-run advantage.

The enforcement paradox

Controls are strongest on paper and slowest in practice. Companies structure around rules in real time; agencies build cases in arrears. By the time authorities trace ownership and service patterns across shells and subsidiaries, the gear is provisioned, depreciating, and sometimes re-sold.

Singapore arrested several executives in February over misleading claims about server destinations. Malaysia tightened permits for Nvidia chip exports and transfers in July. Those steps hit after the fact. The pattern repeats: detection, then deterrence. The lag is structural.

Rare-earths invert the sequence. China can constrain upstream materials before substitute processing comes online in the U.S., Japan, or Europe. Building those plants takes years. Re-wiring supply chains takes longer. In the interim, both sides test how far they can push without breaking growth or talks. No one wants a hard decoupling. Everyone wants the other to blink first.

What to watch next

Three tells matter now. First, how Beijing implements the 0.1% threshold: rubber-stamped licenses preserve leverage without immediate shock; tight issuance forces rapid redesign. Second, the expected Trump–Xi meeting: whether rare-earth threats trade for tariff or export-control relief. Third, Megaspeed’s endgame: charges, settlements, or silence—and whether parallel networks surface once the spotlight moves.

Megaspeed’s orders paused in July. China’s new controls start phasing in November. The window for leverage is open. For now.

Why this matters:

- Both capitals are experimenting with pressure that hurts the other side more tomorrow than today, turning mutual dependence into a negotiating weapon across chips, inputs, and cloud services.

- A legal-structure loophole—ownership versus control—lets billions in restricted technology flow while investigations crawl, leaving export controls closer to signaling than to airtight barriers.

❓ Frequently Asked Questions

Q: What are rare earths and why does China control 90% of supply?

A: Rare-earth elements are 17 minerals critical for semiconductors, defense systems, and electric motors. China doesn't hold 90% of reserves, but it controls 90% of processing capacity—the refining infrastructure built over decades. Other countries have deposits but lack the plants to turn raw ore into usable materials. Building that processing capacity takes 5-10 years and billions in capital.

Q: How does China's 0.1% threshold actually work in practice?

A: Companies must prove that Chinese rare-earth content represents less than 0.1% of a product's total value to export without Beijing's license. For complex assemblies like semiconductors with dozens of components, tracing and documenting every input's origin is nearly impossible. Most tech firms can't certify compliance, forcing them to either apply for licenses or halt exports.

Q: Why were chips "still in boxes" suspicious to Commerce officials?

A: Legitimate data centers unpack and install chips immediately—they're buying capacity to run workloads. Finding $2 billion in advanced hardware still boxed nine months after purchase suggests the site is a waypoint, not the destination. It's a known smuggling tactic: show inspectors the inventory, then quietly reroute it elsewhere once officials leave.

Q: What's Aivres and why does it matter that Megaspeed bought through them?

A: Aivres is the California-based subsidiary of Inspur, a Chinese tech firm sanctioned in 2023 for providing supercomputer technology to China's military. Because Aivres operates as a U.S. entity, it can legally buy Nvidia chips despite its parent being blocked. Trade records show Aivres supplied most of Megaspeed's $2 billion in orders—creating a two-hop path around sanctions.

Q: How long does it take to build alternative rare-earth processing capacity?

A: Independent processing facilities require 5-10 years from permitting to production, plus $500 million to $2 billion in capital depending on scale. The U.S. announced equity stakes in MP Materials and Trilogy Metals in July and October 2025, but neither will produce refined rare earths at commercial scale before 2030. That's why China's restrictions carry immediate leverage.