💡 TL;DR - The 30 Seconds Version

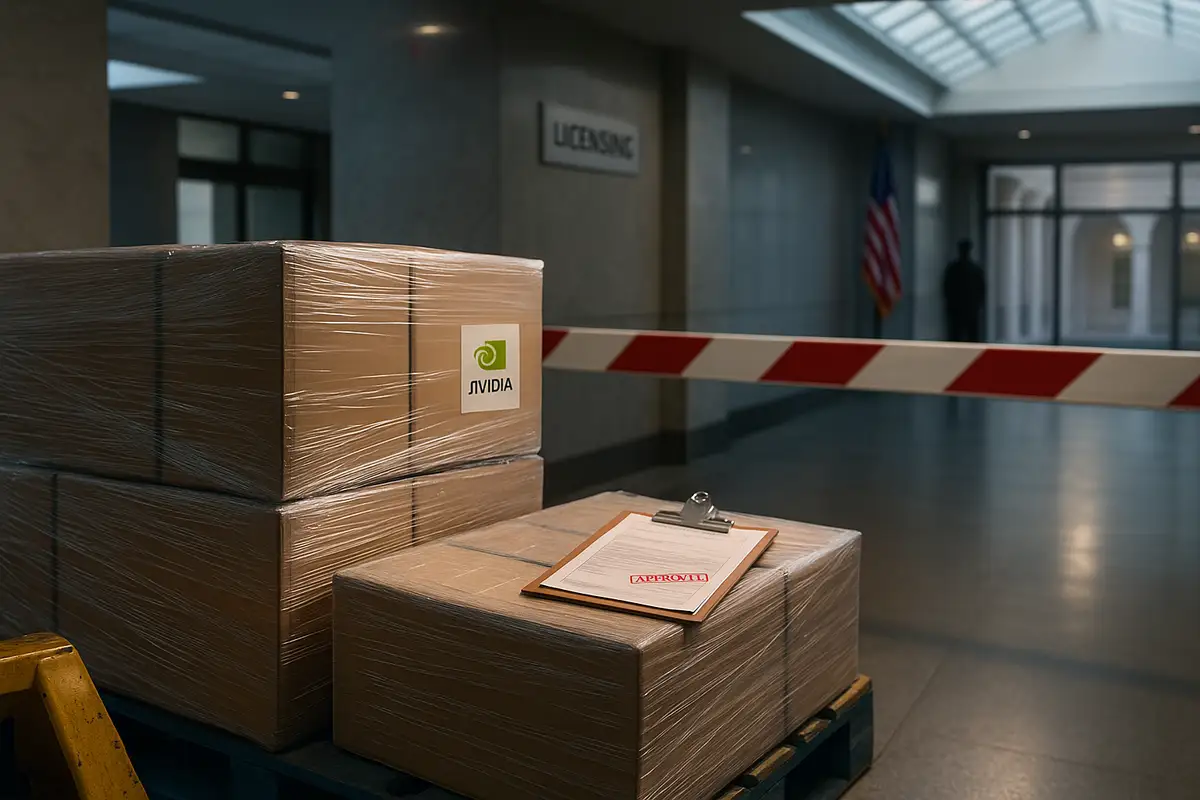

👉 US authorities reportedly embed location trackers in select AI server shipments to detect illegal diversions to China, targeting Dell and Super Micro boxes with Nvidia and AMD chips.

📱 The devices range from smartphone-sized units on shipping boxes to smaller trackers hidden inside server packaging and chassis, according to supply chain sources.

🇨🇳 China summoned Nvidia staff over H20 chip "security risks" and urged state entities to avoid the processors for government work, framing tracking as US surveillance.

📋 Court records show alleged smugglers already check for trackers, with one telling another to "look carefully" for devices on Quanta servers containing Nvidia chips.

🏛️ Washington weighs mandates for "location-verification" technology in advanced semiconductors, potentially requiring all AI chips to carry tracking capabilities.

🌍 The controversy transforms supply chains into policy battlegrounds, as companies must navigate competing security doctrines from Washington and Beijing.

Washington calls it export enforcement; Beijing calls it surveillance. The same devices carry both meanings.

U.S. authorities have begun placing location-tracking devices in select, high-risk shipments of AI servers to detect illegal diversion to China, according to a Reuters exclusive on embedded trackers. The trackers—used only in targeted investigations—have reportedly appeared in shipments from Dell and Super Micro containing Nvidia and AMD chips. Dell says it is not aware of a U.S. initiative. Nvidia declined comment; AMD did not respond. Super Micro declined to discuss its security practices. The frequency and start date remain unclear. That’s the tension.

What’s actually new

The tactic extends export controls beyond the point of sale. Instead of relying on paperwork and end-user promises, U.S. agencies can see where sensitive hardware physically goes. That changes incentives for middlemen and resellers. It also raises new questions for customers who buy legally but fear being swept into investigations. Trust is the first casualty.

The method isn’t novel, only the target is. Law enforcement has used trackers on export-controlled goods for decades. Applying it to AI servers—boxes built around Nvidia or AMD accelerators—connects an old tool to the hottest commodity in tech.

How the tracking reportedly works

People active in the AI server supply chain told Reuters they’ve seen two broad forms: larger, smartphone-sized units on shipping boxes and smaller devices concealed in packaging or within server chassis. Several sources said they did not know who installs them or at what stage of the route. That ambiguity may be part of the design. It keeps smugglers guessing.

Court records in a recent U.S. case suggest alleged traffickers are already checking for trackers. In one message, a co-conspirator told another to “look carefully” for any device on Quanta servers with Nvidia chips. The game is now two-sided: hide and seek.

Beijing’s countermove

China is recasting the tracker story as proof of American “backdoors.” The Cyberspace Administration of China recently summoned Nvidia staff to discuss security risks related to the company’s H20 chips, pointing to U.S. proposals for mandatory chip location verification. State media amplified the frame, calling any device with tracking capability “infected.” The message is aimed at global buyers as much as domestic ones. It’s about narrative power.

Officials have urged state-linked entities to avoid Nvidia’s H20 in government-related work. That advice serves two purposes: reduce perceived exposure to U.S. surveillance and nudge demand toward domestic alternatives. Markets noticed. Chinese chipmakers rallied on the headlines. That was predictable.

The policy maze in Washington

In parallel, U.S. policymakers are weighing mandates for “location-verification” on advanced accelerators. The White House AI action plan flagged “software or physical changes” to improve tracking, and senior officials have discussed delay-based techniques that infer geography from network timing. It’s surveillance-adjacent, supporters admit, but framed as an anti-smuggling control. Definitions matter.

Nvidia, for its part, issued a categorical line: “There are no back doors in Nvidia chips. No kill switches. No spyware.” That statement addresses both sides at once—Beijing’s suspicions and Washington’s ambitions. It also signals the bind suppliers face when hardware becomes a proxy for national strategy. You can’t satisfy both camps.

What it means for companies

Vendors and integrators now sit between competing security doctrines. If trackers become more common, logistics teams must assume a nonzero chance that sensitive freight contains government hardware. Compliance officers will need clearer playbooks: how to cooperate if informed, how to document chain-of-custody, and when to push back. Legal risk may shift from export paperwork to operational monitoring. Prepare accordingly.

Buyers face a reputational calculus. Even law-abiding organizations may worry about operational privacy if equipment can be traced post-delivery. That concern will be sharpest for firms operating in non-aligned countries or those supplying state customers. Procurement policies will follow politics. They always do.

Limits and unknowns

Key facts remain unsettled: how many shipments, which routes, what legal thresholds, and how long data is retained. Agencies sometimes obtain warrants to place trackers; at other times they rely on administrative approvals. That variation affects whether data is court-usable or solely investigative. The gray zone is intentional.

The other unknown is effectiveness. Smugglers learn fast. If trackers are discovered routinely, enforcement becomes whack-a-mole. If trackers are rare but credible, deterrence can work at scale. Expect a cat-and-mouse equilibrium.

The bigger frame

The tracker controversy compresses a decade of tech geopolitics into a single object. Washington seeks to keep its most advanced compute out of adversary systems while still selling globally. Beijing seeks autonomy without losing access to cutting-edge U.S. parts. Both aims are rational. They’re also incompatible in the same box.

Once enforcement follows the hardware into the field, every server looks like a boundary line. Supply chains turn into policy surfaces. And a small device hidden in foam can redraw markets far beyond China. That’s the reality.

Why this matters

- Export controls are shifting from paperwork to physical monitoring, raising operational and legal risks for anyone touching AI hardware supply chains.

- The surveillance framing will travel: allies and neutral markets now must weigh U.S. tracing proposals against their own sovereignty and security doctrines.

❓ Frequently Asked Questions

Q: Is it legal for the US to secretly place trackers in shipments?

A: Yes, with proper authorization. Export enforcement agents sometimes get warrants from judges, other times use administrative approval. Warrant-authorized tracking creates stronger evidence for criminal cases. The practice has been used on export-controlled goods since at least 1985.

Q: What happens when smugglers find the trackers?

A: Court records show smugglers actively scan for devices and share removal techniques. Some post images and videos of trackers being extracted from Dell and Super Micro servers. However, simply finding a tracker doesn't eliminate legal liability for export violations.

Q: How many shipments contain trackers and which routes are targeted?

A: Reuters couldn't determine frequency or specific routes. The practice targets only select "high-risk" shipments under investigation, not all AI server exports. Malaysia, Singapore, and UAE have previously been identified as diversion routes for $1 billion in chips quarterly.

Q: Can legitimate buyers be affected by tracker investigations?

A: Yes. Even law-abiding companies may worry about operational privacy if equipment can be traced post-delivery. Organizations in non-aligned countries or those supplying state customers face the highest reputational risks from being swept into investigations.

Q: What exactly did China do in response to the tracking reports?

A: China's Cyberspace Administration summoned Nvidia staff over H20 chip "security risks" and advised state entities to avoid the processors for government work. Chinese chipmaker stocks rallied on the news as investors bet on domestic alternatives getting more business.

Q: How is this different from proposed mandatory chip tracking?

A: Current trackers are physical devices added to select shipments during investigations. Proposed mandatory tracking would require built-in "location-verification" technology in all advanced chips, using techniques like network timing to determine geography automatically.

Q: Are US allies concerned about chip tracking capabilities?

A: The article suggests global governments may resist mandatory tracking, asking "which government would accept chips with mandatory location verification, knowing the data flows to Washington?" The concern mirrors previous US warnings about Chinese surveillance in Huawei equipment.

Q: How effective is tracker-based enforcement actually?

A: Unknown. If trackers are discovered routinely, enforcement becomes "whack-a-mole." If rare but credible, they could deter smuggling at scale. The effectiveness likely depends on maintaining uncertainty about which shipments contain devices.