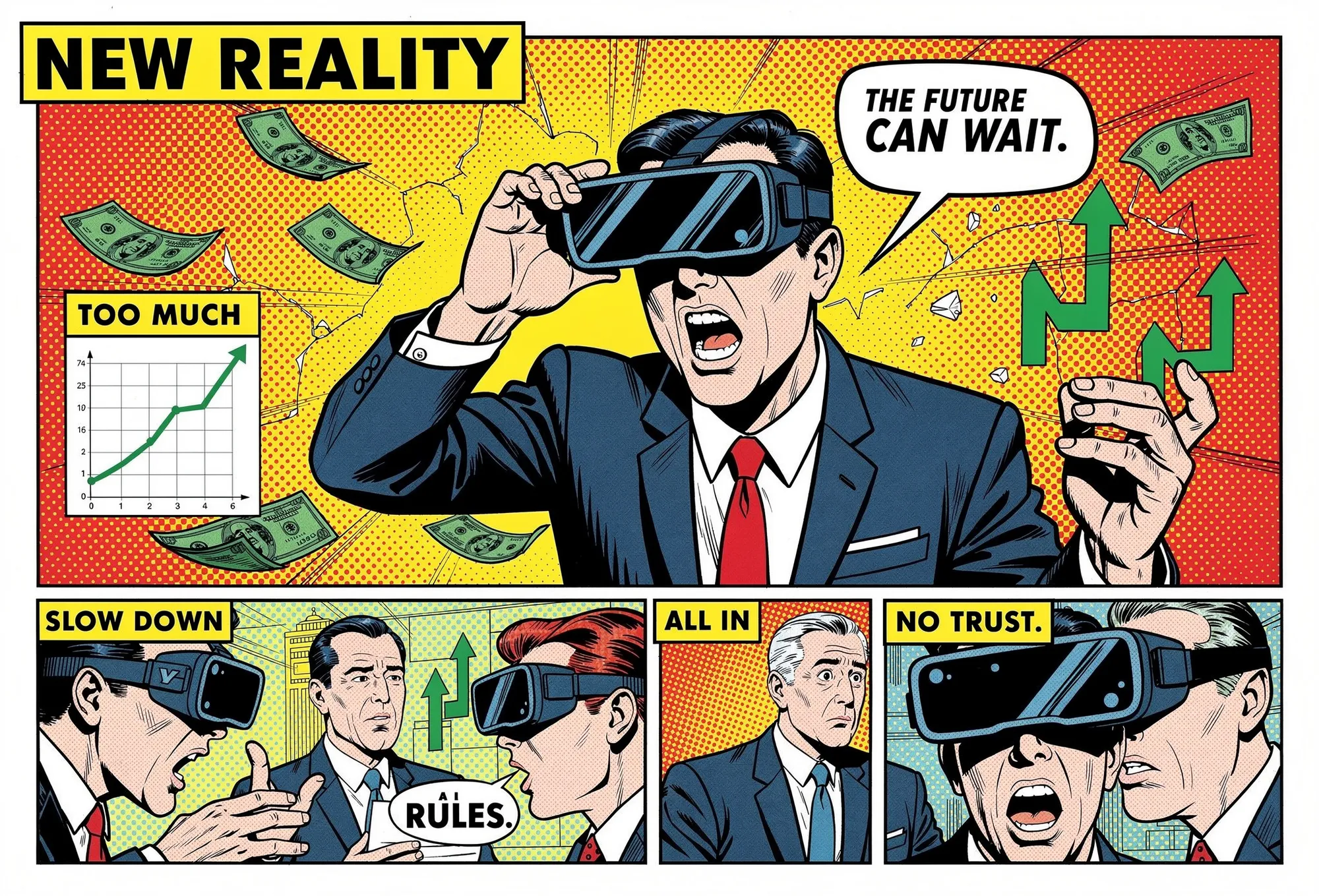

Zuckerberg spent $70 billion building virtual worlds nobody wanted. Now investors are rewarding him for walking away.

Meta's stock jumped 5.7% on December 4. Biggest intraday gain since July. The news that triggered it? Not a product launch. Not an earnings surprise. Investors were celebrating because the company finally signaled it might stop bleeding money on the metaverse.

That's the tell. Wall Street valued Zuckerberg's signature vision at less than zero.

The Breakdown

• Meta plans up to 30% budget cuts for Reality Labs, with layoffs possible in January. Stock surged 5.7% on the news.

• Reality Labs has burned $70 billion since 2021. Apple, Microsoft, and Google declined to compete for the metaverse market.

• One day before cut news broke, Meta hired Apple design veteran Alan Dye, signaling restructuring rather than full retreat.

• AI-attributed layoffs have reached 71,683 since 2023, but analysts argue many mask strategic failures rather than genuine transformation.

The Scope of Retreat

The numbers are brutal. Reality Labs, the division housing Meta's VR and AR ambitions, has torched more than $70 billion since 2021. Losses run past $10 billion annually. Quest headset sales have gone soft. Horizon Worlds can't keep users around. The platform was supposed to anchor the whole metaverse social experience, and it's mostly empty. Enterprise clients never showed up in meaningful numbers.

Budget cuts of up to 30% are now on the table for 2026, according to Bloomberg. Layoffs could start as early as January. VR software teams face consolidation. Long-term AR hardware projects are getting scaled back. Hiring for metaverse engineering roles is slowing.

Zuckerberg gathered executives at his Hawaii compound last month for annual budget planning. The standard ask across Meta has been 10% cuts in recent cycles. Reality Labs got told to go deeper.

Why? The official line points to market conditions. Meta claims it hasn't seen the "industry-wide competition over the technology" it once expected. Competitors never materialized to fight for Zuckerberg's vision of the future.

That absence deserves scrutiny.

The Competition That Never Came

Two ways to read this situation. Either Meta's $70 billion spending scared off rivals who couldn't match it. Or the vision was flawed enough that smart companies looked at the same opportunity and passed.

The market reaction tells you which interpretation investors prefer.

Apple shipped Vision Pro in early 2024 but called it "spatial computing." The company has avoided the metaverse label entirely. Microsoft killed its industrial metaverse push. Google's investments remain small. These aren't companies lacking resources. They chose different bets.

Competitors weren't outspent. They stayed home.

The Facebook-to-Meta rebrand happened in late 2021. Timing matters here. The company was getting hammered over user safety failures and privacy scandals. Skeptics wondered whether Zuckerberg's metaverse enthusiasm was strategic conviction or an elaborate distraction. Four years and $70 billion later, the skeptics look pretty good.

Forrester VP Mike Proulx called Reality Labs "a leaky bucket" back in April. He predicted Meta would shutter Horizon Worlds before year's end. The complete shutdown hasn't happened. But 30% cuts come close.

The Alan Dye Puzzle

Here's what complicates the retreat story. One day before the budget cut news dropped, Meta announced a major hire: Alan Dye, Apple's top design executive, joining to lead a new creative studio inside Reality Labs.

Dye shaped product design at Apple for nearly two decades. Apple Watch, iOS interfaces, the whole visual language. You don't recruit someone like that for a division you're abandoning. You recruit them for a division you're trying to fix.

The juxtaposition reveals something. Meta isn't exiting consumer hardware. Not completely. They're cutting the speculative stuff, the expansive multi-year moonshots, and doubling down on products that actually sell. Ray-Ban smart glasses. Mixed reality features in existing headsets. Things people use today.

Zuckerberg barely mentions the metaverse anymore. Earnings calls, public appearances, company messaging, the word has become awkward. Too associated with losses. But the underlying technology work continues, just reframed around AI integration and near-term applications.

The metaverse isn't dead at Meta. It's being quietly renamed.

The Layoff Pattern

Meta's cuts land in a broader wave. Challenger, Gray & Christmas has been tracking AI-related job losses since 2023. The running total stands at 71,683 positions. This year alone, through November, companies blamed AI for eliminating 54,694 jobs.

Zoom out and the picture gets darker. November brought 71,321 total job cut announcements. Up 24% from November 2024. The year-to-date number crossed 1.17 million, which is 54% higher than last year and the worst since pandemic-era 2020.

But here's where it gets interesting. Mike Hoffman, CEO of SBI Growth, argues that many AI-related layoffs are cover for strategic failures. He describes sitting in a board meeting where a director's only instruction was to "make the number" for one more month. No discussion of why revenue was declining. No strategic pivot. Just hit the target and figure it out later.

His claim: companies spent billions on AI infrastructure they never actually operationalized. Now they're cutting workers to manufacture productivity claims. Private equity investors tell him the opposite story from public earnings calls. They're hiring, not firing, because real AI implementation demands heavy upfront investment.

The pattern Hoffman describes, big spending on fashionable technology without strategic rigor followed by layoffs to paper over the shortfall, sounds uncomfortably familiar if you've been watching Reality Labs.

The AI Pivot and Its Problems

Meta frames the metaverse pullback as reallocation toward AI. Fair enough. The company has bet heavily on large language models. Llama launched as an open-source challenger to OpenAI's GPT lineup. Meta AI runs across Facebook, Instagram, WhatsApp. The Ray-Ban glasses have AI assistant features baked in.

But the AI story has complications. Llama 4's reception was poor. The model underperformed expectations, and questions emerged about whether Meta can actually compete with OpenAI, Anthropic, and Google on frontier research.

The response was revealing. Meta took a $14.3 billion stake in Scale AI earlier this year, 49% of the company, and launched a Superintelligence Lab. That's not the move of a company confident in its internal capabilities. It's an acknowledgment that building alone might not be enough.

AI advertising products have worked well. They drive the revenue growth that lets Meta absorb Reality Labs losses. But optimizing ad targeting is different from building frontier models. One is a proven business. The other is an expensive race where Meta keeps falling behind.

Cutting metaverse spending to fund AI makes for a clean narrative. Whether it makes strategic sense depends on questions the company hasn't addressed. Can Meta compete against labs with tighter focus and deeper pockets? Does the open-source Llama strategy generate actual returns, or just goodwill? Was the Scale AI investment about acquiring capability, or admitting weakness?

What the Market Is Actually Saying

The 5.7% stock surge carries a specific message. Investors aren't applauding Meta's AI ambitions. They're celebrating the end of an unpopular capital allocation.

Reality Labs represented a tax on shareholders. Every quarter's $3-4 billion loss was money spent on Zuckerberg's conviction that virtual worlds would matter someday. Maybe they will. But investors have been paying for that conviction without seeing returns.

Now the cuts signal acceptance. Zuckerberg, or at least Meta's board, has acknowledged limits on how long and how expensively the metaverse vision can be pursued. Wall Street is rewarding the discipline. Not the strategy. The discipline.

Stock moves tell you something. The metaverse rebrand in 2021 sent shares down. News of retreat in 2025 sent them up nearly 6%. Investors have been consistent on this one.

Analysts have long argued that spinning off or shuttering Reality Labs would create value. The division's losses exceed what many public companies earn in total profit. Redirect half that spending to buybacks and shareholder returns would improve meaningfully.

Zuckerberg's supervoting shares insulate him from activist pressure. But even founders with voting control respond to price signals eventually. A 5.7% one-day move registers.

What Remains

Meta says the metaverse stays on the long-term roadmap. The statement is accurate and essentially meaningless. This was supposed to be the company's central focus. The reason for changing the corporate name. The future of human connection. Now it's "part of the roadmap," one line item among many.

Strategy has shifted toward products that work today. Smart glasses people actually wear. Mixed reality features in current hardware. AI assistants available now rather than virtual worlds that might matter in 2035.

Zuckerberg keeps making the case that AI and VR will merge. Language models rendering virtual worlds on the fly, avatars that look and move like real people. Maybe. The logic isn't crazy. But $70 billion buys a lot of "maybe," and investors have grown tired of paying for it.

The Challenger data on AI-driven layoffs raises an uncomfortable question. Companies announce workforce cuts and frame them as technological transformation. Sometimes accurate. Sometimes, as Hoffman argues, it's narrative management covering strategic failure.

Meta's situation sits somewhere in that murky middle. Tech wasn't ready. Market wasn't ready. Rivals took a pass. Bad timing or bad bet? Hard to say.

One thing isn't hard to say. For at least one trading day, investors made clear they'd rather own a Meta focused on what works now than one chasing what Zuckerberg promised four years ago.

Why This Matters

For Meta shareholders: The stock surge says markets have been pricing metaverse investments below zero. Every additional Reality Labs cut likely unlocks more value, which creates pressure for continued retrenchment regardless of what Zuckerberg believes about the long term.

For the VR/AR ecosystem: Meta's retreat pulls the largest funding source from metaverse development. Startups, content studios, and hardware suppliers built business plans assuming Meta would keep spending. Those plans need rewriting.

For workers caught in AI-attributed layoffs: Challenger reports 71,683 AI-cited cuts since 2023. But Meta shows how technology narratives can mask capital misallocation. Worth asking whether your company is genuinely transforming or just using AI framing to cover bad bets.

❓ Frequently Asked Questions

Q: What exactly does Reality Labs include beyond Horizon Worlds?

A: Reality Labs covers all of Meta's hardware and immersive technology bets. This includes Quest VR headsets, augmented reality research, the Ray-Ban smart glasses partnership, and experimental AR glasses projects. The division also handles the underlying software platforms. Most of the $70 billion in losses comes from hardware development and research, not Horizon Worlds specifically.

Q: What happens to Quest headsets if metaverse spending gets cut 30%?

A: Quest headsets will likely continue, but with less ambitious development timelines. Meta is consolidating around commercially viable products rather than abandoning hardware entirely. The Alan Dye hire suggests Meta wants to improve existing products rather than chase speculative long-term projects. Expect fewer experimental features and more focus on what already sells.

Q: What's the Scale AI deal and why did Meta pay $14.3 billion for it?

A: Meta acquired a 49% stake in Scale AI, a company that provides data labeling and AI infrastructure services. The deal included creating a joint Superintelligence Lab with Scale CEO Alexandr Wang. The investment suggests Meta's internal AI development wasn't progressing fast enough to compete with OpenAI, Anthropic, and Google on frontier models.

Q: How much has Meta lost on Reality Labs each year?

A: Reality Labs loses roughly $10-16 billion annually. In 2022, losses hit $13.7 billion. In 2023, they reached $16.1 billion. The division has lost over $70 billion cumulatively since 2021. For context, that's more than the total annual profit of most Fortune 500 companies. Revenue from Quest headsets and other products covers only a fraction of these costs.

Q: Why did Apple and Microsoft avoid competing in the metaverse?

A: Apple launched Vision Pro in 2024 but positioned it as "spatial computing," avoiding metaverse branding entirely. The company focused on productivity and media consumption rather than social virtual worlds. Microsoft shut down its industrial metaverse efforts after early experiments failed to gain traction. Both companies appear skeptical of the social VR vision Meta championed.