Astra AI just won Slovenia's Startup of the Year. Arms raised, trophy hoisted, the Ljubljana team grinning for cameras. And why not? 170,000 users. A German expansion that's actually working. Parents flooding review sites with 4.9-star testimonials about saved grades and reduced homework stress. But buried in the coverage is a figure that deserves a second look.

According to Connecting the Region, a business publication covering the Adria tech scene, Astra's platform is "powered by over 50 billion AI tokens monthly." If accurate, that's a strange claim for a bootstrapped edtech startup charging €24 a month for unlimited tutoring.

A single GPT-4o query might consume a few hundred to a few thousand tokens depending on complexity. Fifty billion monthly would place Astra among serious enterprise operations, companies with venture backing and dedicated infrastructure teams. Not a three-person outfit from a country of two million. Something here doesn't add up.

The Breakdown

• Astra AI reports processing 50 billion tokens monthly on GPT-4o, implying $2.5-3 million in annual API costs alone

• At €24/month with typical freemium conversion rates, revenue barely covers compute before salaries or expansion

• OpenAI's Khanmigo partnership and falling model costs threaten every education wrapper's long-term position

From YouTube math guy to AI company

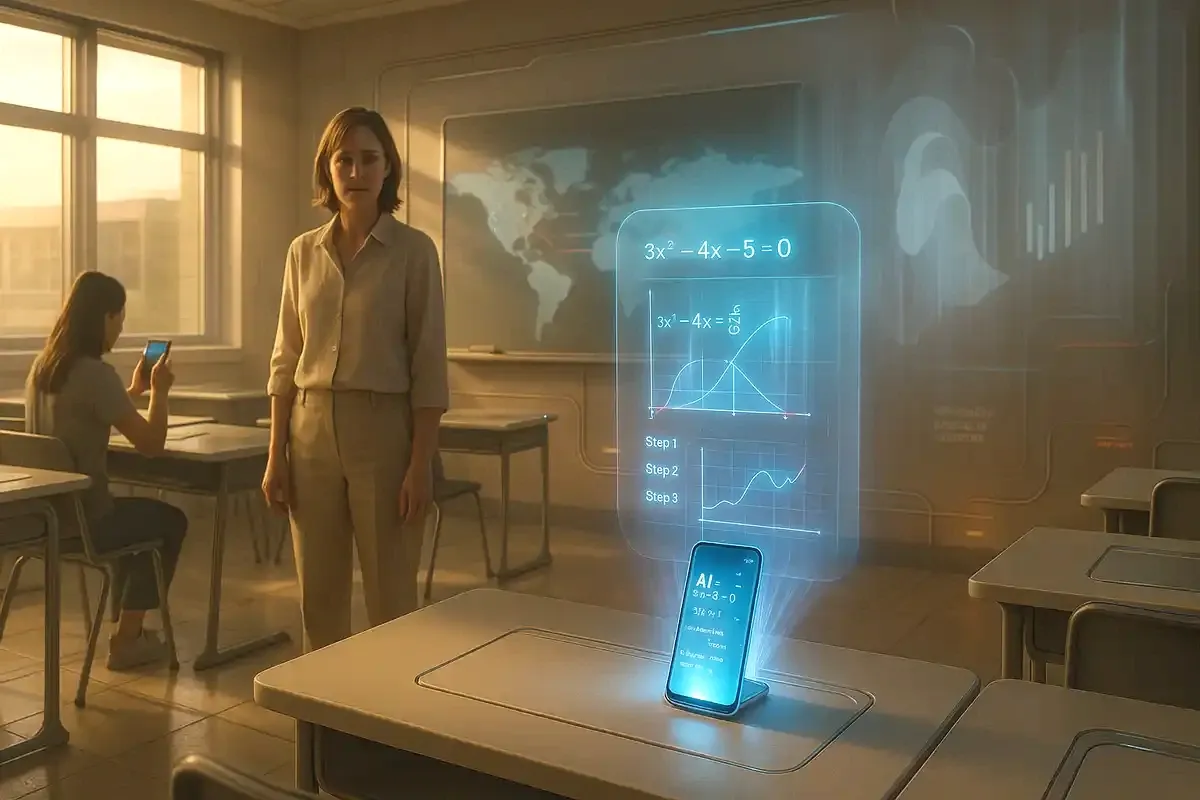

Astra's origin story follows a familiar arc. Andrej P. Škraba, a Slovenian economist, started uploading free math tutorial videos in 2013. The site, astra.si, became a local institution, the place Slovenian students went when algebra stopped making sense. Škraba built a following by doing something simple well: explaining math problems step by step, clearly, without condescension.

In 2023, he saw what everyone else in education saw. Large language models had gotten good enough to tutor. Škraba recruited Klemen Selakovič, a podcaster and UX designer with a following in Slovenia's tech community, plus Tjaž Silovšek as CTO. Within months they'd transformed a static video library into an AI-powered tutoring platform running on OpenAI's GPT-4o.

The pitch works because the alternative is expensive. One hour with a decent math tutor in Vienna or Munich runs €30-50. Astra offers unlimited AI tutoring across 13 subjects for €24 a month. They claim to be 77 times cheaper than human tutors. For parents watching their teenagers struggle through chemistry homework at 10 PM, that calculation is easy.

The traction is real

Give Astra credit where it's due. They've found product-market fit in a way most edtech startups never manage.

User reviews consistently praise the platform's pedagogical approach. Unlike raw ChatGPT, which will cheerfully solve your homework if you ask nicely, Astra's system refuses to give direct answers. It breaks problems into steps, asks follow-up questions, makes students show their work. One parent's testimonial captures the appeal: the AI "stops him and makes him think," which is exactly what expensive human tutors are supposed to do but often don't.

The company reports a 99.4% first-try exam pass rate among users. That number deserves an asterisk. Motivated students who pay for AI tutoring probably weren't failing anyway. But even accounting for selection effects, something is working. The platform now covers physics, chemistry, biology, languages, economics, philosophy, psychology. Matura prep for Slovenian students, Abitur modules for Germans, IB math for the international school crowd.

Sign up for Implicator.ai

Strategic AI news from San Francisco. Clear reporting on power, money, and policy. Delivered daily at 6am PST.

No spam. Unsubscribe anytime.

And the growth has crossed borders. The German-language version at astra-ai.de is now their fastest-growing market. For a bootstrapped startup from Ljubljana, pulling paying users out of Berlin and Vienna takes more than good marketing. The product has to deliver.

Where the math gets uncomfortable

Here's where harder questions start.

If Astra's reported token consumption is accurate, 50 billion monthly represents an extraordinary computational footprint. At current GPT-4o pricing, that volume would cost somewhere between $150,000 and $300,000 in API fees alone. Call it $2.5 million a year on the low end. Probably closer to $3 million.

Now the revenue side. Astra runs freemium, with limited free usage to hook students before converting them to paid subscriptions. Industry-standard conversion rates in edtech freemium hover around 3-7%. Even assuming 10% of Astra's 170,000 users pay the €24 monthly rate, that's 17,000 subscribers generating roughly €400,000 a month. Maybe €4.8 million annually.

The math can work. Barely. But it leaves almost nothing for salaries, marketing, infrastructure beyond API calls, or the curriculum development required to crack new markets. And that's with optimistic conversion assumptions.

Astra has disclosed no venture funding. The company appears bootstrapped, supplemented only by modest Slovenian government innovation grants. Either they've achieved remarkably efficient operations, or they're running hot, or these public numbers don't tell the whole story.

The wrapper problem

Even if Astra's unit economics work today, they face a structural vulnerability shared by every company building on someone else's AI infrastructure.

OpenAI is not going to ignore education forever.

The company already partners with Khan Academy on Khanmigo, an AI tutor that does approximately what Astra does. Google's experimenting with similar features. When foundation model providers decide to compete directly in your vertical, being a wrapper company gets uncomfortable fast.

Astra's defenders point to curriculum specialization. They've invested in adapting content to specific national exam systems. Austrian Matura. German Abitur. Local syllabi that generic AI doesn't understand out of the box. That's real work, and it creates some defensibility. A student preparing for Bavaria's math Abitur probably gets better results from a system trained on Bavarian exam patterns than from asking ChatGPT to help with calculus.

But how much defensibility, really? Curriculum adaptation is labor, not moat. Anyone with motivation and funding can hire subject-matter experts to build exam-specific content. OpenAI could partner with Pearson tomorrow and replicate Astra's approach across every major market simultaneously.

The margin compression coming for everyone

Astra's situation illustrates a broader tension in AI-powered services. Model costs are falling. Sounds like good news for wrapper companies until you realize it's even better news for their competitors.

Running tens of billions of tokens monthly on GPT-4o costs enough today that few players bother trying. Tomorrow looks different. Capable open-weight models keep proliferating. Inference costs keep dropping. Barriers to entry collapse. Some startup in Warsaw or Bucharest spins up an AI tutoring service on Llama 4 or whatever comes next, trains it on publicly available exam materials, and undercuts Astra's pricing by half.

The AI tutoring market is projected to hit nearly $8 billion by 2030, up from $1.6 billion in 2024. Every education company in the world sees those numbers. The competitive environment Astra faces in 2027 will bear no resemblance to what they face now.

First-mover advantage in Central European markets, a strong brand among Slovenian students, genuine pedagogical differentiation in how they structure AI interactions. All of that buys time. None of it buys permanent safety.

What survival looks like

If Astra wants to be more than a transitional player, they need to build something OpenAI can't easily replicate.

One path: own the relationship with schools and ministries. Becoming the officially endorsed AI tutoring partner for Slovenia's education system, or Bavaria's, or Austria's, creates institutional lock-in that pure product quality can't match. Government procurement moves at glacial speed. Once a platform gets vetted and approved, switching costs are enormous. Astra's local roots and existing reputation could be assets here.

Another path: accumulate proprietary data. Every student interaction generates information about how teenagers actually learn. Which explanations work. Where they get stuck. What sequences lead to genuine understanding. If Astra captures and applies this data intelligently, they could fine-tune their own models into something genuinely differentiated. Right now they're renting intelligence from OpenAI. They need to start building their own.

A third path: get acquired. Some larger edtech player or European tech company might value Astra's user base, curriculum library, and regional expertise enough to pay a premium before the competitive environment turns ugly. The founders have maintained full ownership by staying bootstrapped. That's worth something to the right buyer.

The timer on every wrapper

Look, Astra has done something real. 170,000 users didn't show up by accident. Teachers are recommending it. Parents are writing testimonials about kids who suddenly do homework without being nagged. For a Slovenian startup competing against the entire internet, winning Startup of the Year isn't participation trophy stuff.

But celebration photos don't change underlying dynamics. Every AI wrapper company operates on borrowed time. They build value on infrastructure controlled by others, in a market where pricing floors keep dropping and ceilings are controlled by companies with resources they can't match.

Fifty billion tokens a month, if accurate, proves Astra has built something people want. The question is whether they can build something that lasts, before the model providers, the competitors, or the math catches up with them.

❓ Frequently Asked Questions

Q: What exactly is an AI token, and why does 50 billion matter?

A: Tokens are fragments of text that language models process, roughly 3-4 characters each. A typical homework question and response might use 500-2,000 tokens. At 50 billion monthly, Astra would be handling the equivalent of 25-100 million tutoring exchanges, which at GPT-4o's pricing ($2.50-5 per million input tokens) implies serious infrastructure costs.

Q: Why wouldn't students just use ChatGPT directly instead of paying for Astra?

A: ChatGPT will happily solve your homework outright. Astra's system refuses. It breaks problems into steps, asks follow-up questions, and won't proceed until students demonstrate understanding. It's also trained on specific national curricula like Germany's Abitur and Slovenia's Matura exams, which generic ChatGPT doesn't know.

Q: What is Khanmigo and why is it a threat to Astra?

A: Khanmigo is Khan Academy's AI tutor, built in direct partnership with OpenAI. It uses the same step-by-step pedagogical approach as Astra but has Khan Academy's brand recognition, existing user base of millions, and a direct relationship with the model provider. When your supplier becomes your competitor, margins get squeezed fast.

Q: Could Astra cut costs by switching to cheaper open-source models?

A: Theoretically yes. Models like Llama or Mistral cost far less to run. But switching requires rebuilding the entire tutoring system, retraining on curriculum content, and hoping quality stays high enough that students don't notice. It's a major engineering lift. And if Astra switches, so can every competitor, eliminating the cost advantage.

Q: How big is the AI tutoring market Astra is competing in?

A: The global AI tutors market hit $1.6 billion in 2024 and is projected to reach nearly $8 billion by 2030, a 30% annual growth rate. The broader AI-in-education sector is even larger, expected to grow from $7 billion in 2025 to $112 billion by 2034. North America holds 35-38% market share, where Astra has minimal presence.