Good Morning from San Francisco,

Yann LeCun built Meta's AI lab for twelve years. Then Mark Zuckerberg hired a 28-year-old to run it. Now LeCun's leaving to launch a startup where VCs will fund the exact decade-long research Meta just abandoned. Corporate humiliation meets ironic redemption.

Meanwhile, Masayoshi Son just posted SoftBank's best quarter ever. $16.2 billion in profit. His celebration? Dump $5.8 billion in Nvidia shares and take out massive loans to fund OpenAI. Paper billionaires face a peculiar problem when their winners burn billions quarterly.

Stay curious,

Marcus Schuler

LeCun Exits Meta: Corporate AI Research Dead

Yann LeCun spent twelve years building Meta's FAIR before Mark Zuckerberg hired a 28-year-old to be his boss.

Now LeCun is leaving to launch a world-models startup where VCs will fund the exact decade-long research Meta abandoned. Organizational humiliation followed Llama 4's flop against competitors. Meta cut 600 AI jobs in late October. Only 3 of 14 original Llama researchers remain.

Meta's shares dropped 11-12% on October 30, erasing $215 billion after Zuckerberg raised 2025 capex to $70-72 billion. He paid $14.3 billion for Scale AI and installed founder Alexandr Wang, 28, as chief of Superintelligence Labs. LeCun now reports to Wang. He calls current LLMs "dumber than a cat," predicts nobody will use them in three to five years. His alternative, world models learning from video rather than language, requires a decade to develop.

The VC arbitrage is real. Mira Murati raised $2 billion at $10-12 billion valuation mid-2025. LeCun will match or exceed it. Corporate AI labs are dissolving. Google Brain and DeepMind merged, Microsoft Research got sidelined, OpenAI commercialized, FAIR gutted. Replaced by product teams or VC-backed architectural bets.

Why this matters:

- Either LLM scaling reaches superintelligence or world models prove correct after a decade. Both cannot win. Meta bets everything on scaling while spending $70+ billion annually.

- LeCun bets the opposite and gets paid more for purer research outside than inside.

AI Image of the Day

Prompt:

macro shot of 14K white gold halo engagement ring on frosted glass plate, soft winter sunlight reflection, subtle glitter accents around ring, luxury minimalistic product photo, photorealistic diamond brilliance

SoftBank's Nvidia Exit Reveals the Paper Billionaire's Paradox at AI's Peak

Masayoshi Son just posted SoftBank's best quarter ever: $16.2 billion profit, more than doubled from last year, driven by OpenAI's valuation jump from $300 billion to $500 billion in seven months.

His response? Dump $5.8 billion in Nvidia shares, liquidate $9.2 billion in T-Mobile, expand the Arm margin loan from $13.5 billion to $20 billion, and secure an $8.5 billion bridge loan for OpenAI commitments.

Paper gains don't cut checks, so SoftBank's selling assets that generate real cash flow to fund OpenAI, which burns $5-7.8 billion annually on $13 billion in projected 2025 revenue.

The timing cuts deep. Nvidia hit $5 trillion in October, same month SoftBank exited. Son previously owned 5% after investing in 2016, sold in 2019. That stake today: worth $210 billion. Now he's exiting again at possible peak.

Circular financing dominates: Nvidia invests $100 billion in OpenAI, OpenAI buys Nvidia chips with that money, both report it as growth. OpenAI's $500 billion valuation rests on a 39x revenue multiple while losing billions. The recent $6.6 billion was a secondary sale where existing shareholders cashed out, OpenAI itself got zero new capital.

Why This Matters:

- The largest AI bull exited dominant hardware to fund loss-making applications. Secondary sales at $500 billion with minimal primary capital suggest insiders are de-risking.

- Circular financing and forced liquidations despite record paper profits mirror late-cycle bubble behavior.

🧰 AI Toolbox

How to Transform Your Documents Into AI-Powered Research Assistants

NotebookLM is Google's AI research tool that turns your uploaded documents into an interactive knowledge base. It uses Google Gemini to analyze PDFs, Google Docs, websites, YouTube videos, and audio files to generate summaries, study guides, timelines, and even podcast-style audio overviews of your content.

Tutorial:

1. Go to the NotebookLM website and sign in with your Google account

2. Create a new notebook and upload your sources (PDFs, links, docs, videos)

3. NotebookLM automatically generates a summary with key topics and questions

4. Ask questions about your sources and get AI answers with inline citations

5. Generate study guides, FAQs, briefing docs, or mind maps from your content

6. Create Audio Overviews to turn documents into conversational podcast-style discussions

7. Get personalized insights grounded in your specific sources, not generic web information

URL: https://notebooklm.google.com/

AI & Tech News

Michael Burry Warns Tech Giants on AI Chip Depreciation Risk

Michael Burry, the investor famous for predicting the 2008 housing crisis, is warning that major tech companies may be underestimating the depreciation costs of their expensive AI chip investments. With Nvidia's AI chips costing tens of thousands of dollars each and representing a significant portion of the $400 billion being spent on AI infrastructure, Burry suggests that tech investors are overlooking how rapidly these hardware assets could lose value and impact company finances.

Major Study Reveals How Users Actually Interact with ChatGPT

A comprehensive analysis of 47,000 publicly shared ChatGPT conversations has revealed that approximately 10% of interactions involve emotional or mental health topics, highlighting the AI chatbot's unexpected role as an informal counseling resource. The study also identified a "default to yes" behavioral pattern in ChatGPT's responses, suggesting the AI tends to be agreeable and accommodating rather than challenging or declining user requests.

UK Proposes New Law for AI Child Safety Testing

The UK government is proposing an amendment to the Crime and Policing Bill that would establish a system of "authorized testers" to proactively evaluate artificial intelligence models for their potential to generate child sexual abuse material (CSAM). The proposed legislation would create a legal framework allowing designated professionals to assess AI systems for harmful content generation capabilities as part of enhanced child protection measures.

Google Sues China-Based Hackers Over Massive Phishing Operation

Google has filed a lawsuit in the Southern District of New York against a group of China-based hackers operating the "Lighthouse Enterprise" platform, which the company alleges provides phishing services that have defrauded over 1 million victims of more than $1 billion. The tech giant seeks to dismantle the criminal operation through legal action, marking a significant effort to combat large-scale cybercrime targeting internet users worldwide.

Foxconn Q3 Earnings Beat Profit Expectations Despite Revenue in Line with Forecasts

Foxconn, the world's largest contract electronics manufacturer, reported third-quarter revenue of $66.3 billion that met analyst expectations, while net profit surged 17% year-over-year to $1.86 billion, exceeding the estimated $1.63 billion. The company expressed confidence in its near-term performance, stating that fourth-quarter results are expected to "remain favorable" as it continues to benefit from strong demand in the electronics manufacturing sector.

Infineon Beats Q4 Revenue Expectations, Forecasts Growth on AI Chip Demand

German chipmaker Infineon Technologies reported fourth-quarter revenue of €3.94 billion, representing a 1% year-over-year increase that exceeded analyst estimates of €3.91 billion, while posting a net profit of €231 million. The company expects sales growth to return in fiscal 2026, projecting moderate revenue increases from the current year's €14.66 billion as artificial intelligence applications continue driving strong demand for semiconductor chips.

IBM Unveils Revolutionary Quantum Computers with Advanced Connectivity

IBM has announced two new quantum computers named Loon and Nighthawk, featuring what the company describes as unprecedented qubit connectivity designs that represent a significant advancement in quantum computing architecture. These systems utilize newly intricate qubit connection methods specifically engineered to enable error-free computations, potentially marking a major step forward in making quantum computing more reliable and practical for real-world applications.

AI Chipmaker D-Matrix Secures $275M Funding Round at $2B Valuation

D-Matrix, a startup developing specialized AI inference chips, has raised $275 million in a funding round co-led by Bullhound, Triatomic, and Temasek, achieving a $2 billion valuation. The round, which also included participation from Qatar Investment Authority, brings the Microsoft-backed company's total funding to $450 million as it continues to develop semiconductor technology for artificial intelligence applications.

Teradar Secures $150M Series B for Revolutionary Autonomous Vehicle Sensor

Boston-based autonomous vehicle sensor startup Teradar has raised $150 million in Series B funding while exiting stealth mode, announcing plans to launch a solid-state sensor technology in 2028. The company claims its all-weather sensor system will outperform existing lidar and radar technologies currently used in autonomous vehicles, though specific technical details were not provided in the initial announcement.

Vista Equity Partners Plans Major Workforce Reductions Through AI Implementation

Vista Equity Partners, a major software-focused private equity firm, is planning significant workforce cuts in the coming years as the company increasingly relies on artificial intelligence to handle tasks previously performed by employees. The firm plans to use AI technology specifically for compiling investor presentations, aggregating data, and other business operations that currently require human staff.

Kraken Co-CEO Slams UK Crypto Regulations as Harmful to Retail Investors

Kraken co-CEO Arjun Sethi has publicly criticized the UK's cryptocurrency promotion rules, arguing that mandatory risk warnings and regulatory hurdles are counterproductive for retail investors. Sethi contends that these regulations slow down fund movements and create unnecessary barriers that ultimately hinder rather than protect individual traders in the crypto market.

Amazon Cracks Down on Illegal Sports Streaming

Amazon is implementing stricter measures to combat illegal sports streaming on its Fire TV Stick devices by targeting applications that distribute pirated content. The tech giant's enhanced approach represents a significant escalation in efforts to prevent unauthorized streaming of copyrighted sports broadcasts through its popular streaming hardware.

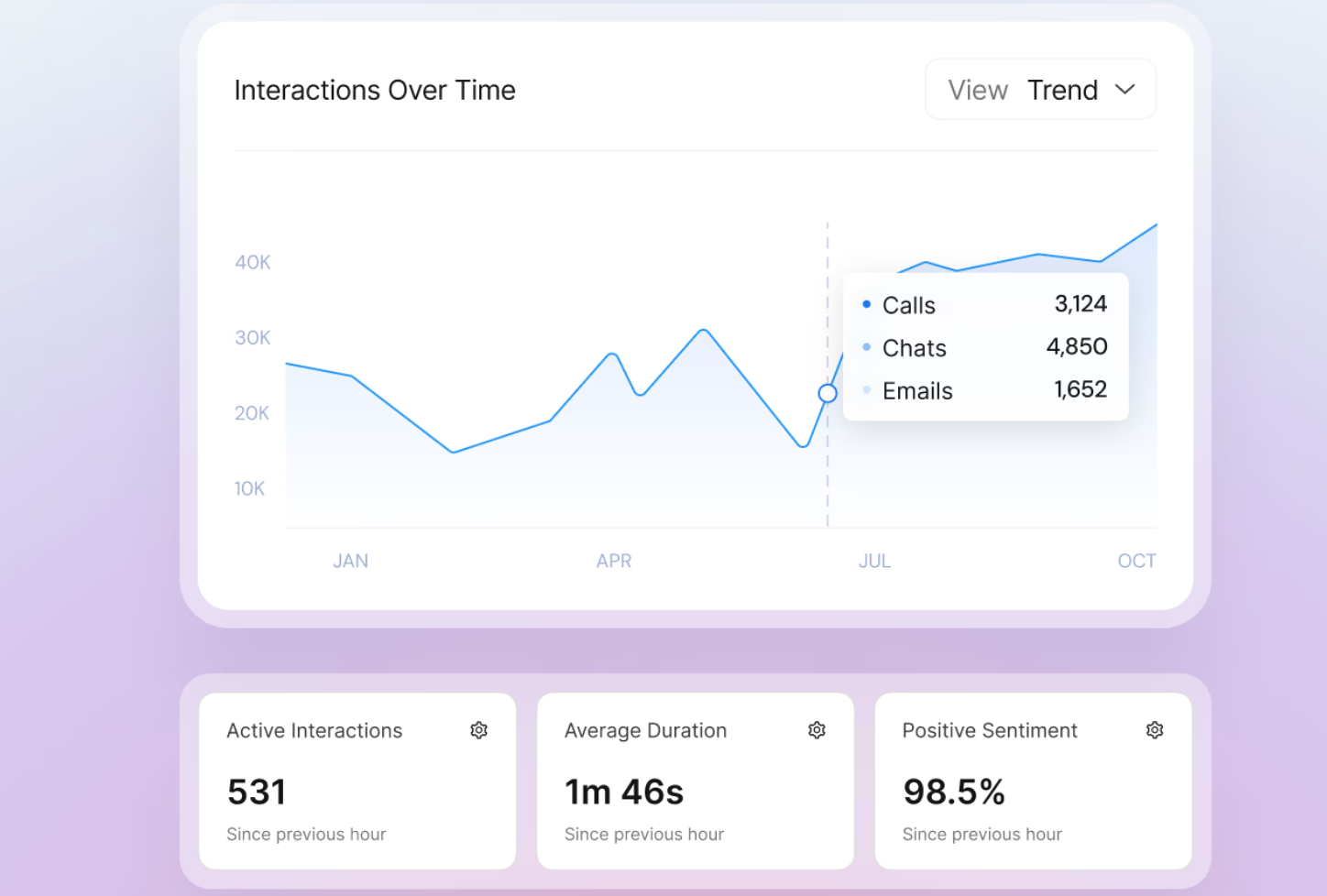

🚀 AI Profiles: The Companies Defining Tomorrow

Wonderful

Wonderful builds AI agents that actually speak your customers' languages. Founded in early 2025, the company skipped English-first and went straight for the markets everyone else treats as phase two.

The Founders

Bar Winkler (CEO) and Roey Lalazar started Wonderful in Tel Aviv in 2025. HQ moved to Amsterdam as they scaled across Europe. Winkler sold his last startup, Approve.com, to Tipalti in 2021. Lalazar built Kaps, an AI localization platform. Both founders understood a simple gap: most customer service AI starts in English, but most customers don't.

The Product

Enterprise voice, chat, and email agents trained on local language and culture. Not translation layers. Native speakers. The platform handles billing disputes, account updates, diagnostics, and scheduling. Resolution rates clock in above 80%. Integrates with CRM, ticketing, billing, and identity systems. Real voice quality in Greek, Dutch, Polish, Arabic, and dialects that global suites ignore. Low latency. Handles accents and noise. Deploys in weeks, not quarters.

The Competition

Specialist platforms like Kore.ai, Cognigy, and PolyAI hold enterprise logos. Cloud giants (Google, AWS, Microsoft, Salesforce, ServiceNow) bundle agents into broader suites. Voice-native startups like Replicant push speed and cost. Wonderful's wedge: win pilots in non-English markets where giants stumble, then expand.

Financing

$34M seed in July 2025 (Index Ventures, Bessemer, Vine). $100M Series A four months later (Index, Insight Partners, IVP). $700M valuation. Guiding to $10M ARR by year-end. Fast pace for a company launched this year.

The Future ⭐⭐⭐⭐

Contact centers need relief. Wonderful moves fast and wins where others don't bother localizing. Risks: suites can bundle, margins on voice get tight, and each new country multiplies complexity. Watch for reference customers outside Israel and APAC logos in 2026. If resolution rates hold and NRR climbs, this could work. 🚀