💡 TL;DR - The 30 Seconds Version

👉 Beijing pressures Chinese tech giants like Alibaba and ByteDance to justify Nvidia H20 chip orders over domestic alternatives just days after US approval.

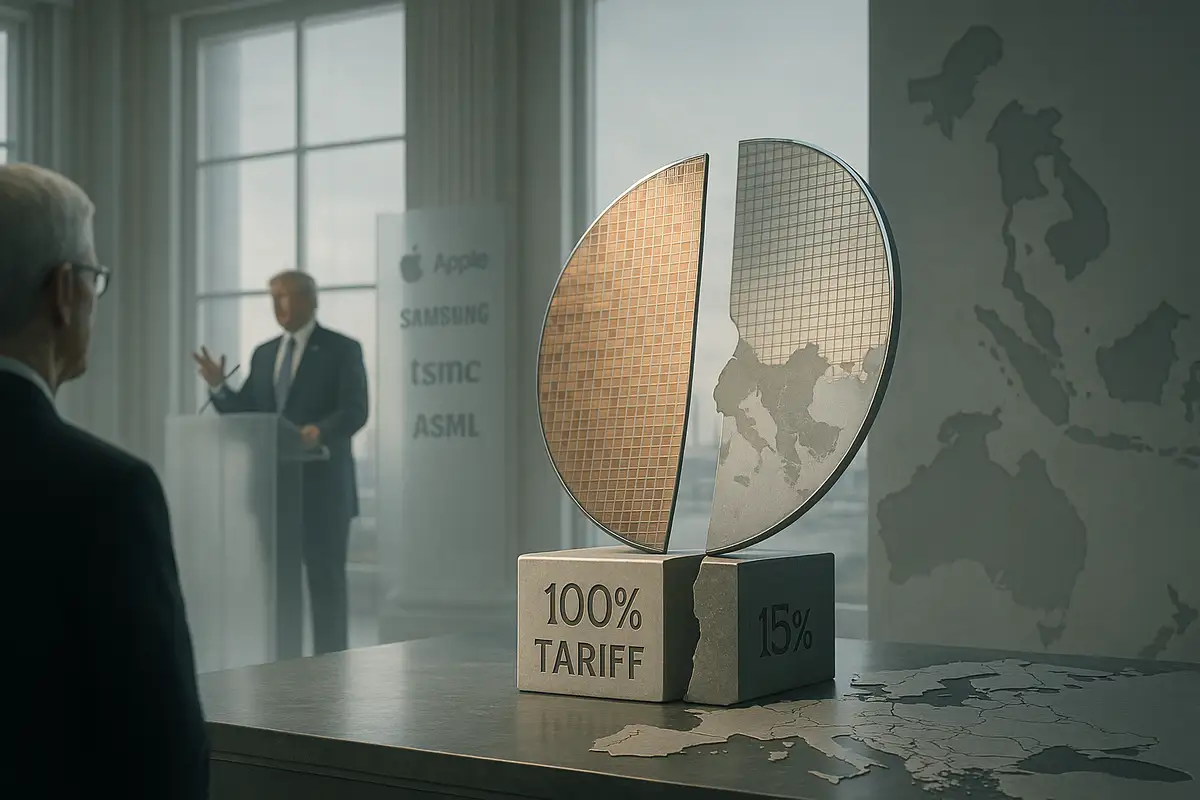

💰 The pressure comes after Trump's unprecedented deal requiring Nvidia and AMD to pay 15% of China sales revenue to the US government.

📊 Nvidia's China market share already dropped from 95% to 50% over four years, with analysts expecting further decline to mid-50s in 2025.

🏭 Chinese authorities target government and security projects specifically while leaving commercial AI applications in a regulatory gray zone.

⚖️ The strategy creates an unstable equilibrium where Washington gets revenue, Beijing promotes domestic chips, and Nvidia keeps limited access.

🌍 This "conditional access plus regulatory discouragement" template will likely spread to other strategic technologies like pharmaceuticals and quantum components.

Authorities question H20 orders just days after Trump approved sales; a three-way pressure campaign emerges.

Beijing is pressuring Chinese tech firms to explain why they need Nvidia’s H20 chips instead of domestic alternatives, according to China’s H20 justification notices. The push lands days after Washington reopened the door to China sales—this time for a cut of the revenue.

The choreography of managed competition

Claim and counterclaim arrived in sequence. On August 8, the U.S. Commerce Department began issuing licenses for Nvidia’s H20, and soon after, Chinese regulators asked companies like Alibaba and ByteDance to justify orders to the Ministry of Industry and Information Technology. The guidance isn’t a formal ban. It signals political risk.

The message targets government and security-linked projects first, leaving commercial uses in a gray zone. That ambiguity is the point. It nudges procurement away from American chips while avoiding a headline ban that could spook markets or trigger instant retaliation. Subtle pressure travels far.

The timing looks coordinated. Regulators moved as the Trump administration rolled out an unusual arrangement: export permission in exchange for a 15% cut of China sales from Nvidia and AMD. Beijing’s response reframes the deal as a reputational liability for buyers, especially those with state ties. No law needed.

The numbers behind the pressure

Capacity is the constraint. Huawei’s Ascend line leads local options, but manufacturing headroom remains tight. Cambricon and others are gaining ground, yet they’re not at parity for the largest training runs. That’s why the H20 exists: a downgraded, export-compliant part with strong memory bandwidth that’s well-suited for inference even if it can’t match Nvidia’s flagship training GPUs.

Analysts see Nvidia’s China share continuing to erode as policy and prestige steer buyers toward local silicon. In May, CEO Jensen Huang said the company’s slice had already fallen to about 50% from roughly 95% four years earlier. Most outlooks for 2025 put Nvidia around the mid-50% range—down from roughly two-thirds in 2024—as big platforms hedge with Huawei, Cambricon, and other domestic chips.

Costs sharpen the trade-offs. U.S. officials have estimated that losing H20 access could raise inference costs for Chinese companies by three to six times. That figure underscores why Beijing is using pressure rather than prohibition. It wants to bend the curve, not break it. Not yet.

The politics under the hood

Both sides are testing new levers. Washington’s “conditional access” model converts export control discretion into a revenue stream while preserving influence over which chips ship and how fast. It’s a tollbooth. Critics warn it risks institutionalizing pay-to-play and blurring security rationales with fiscal ones. The White House gets cash and control. Companies get a permit. That’s the trade.

Beijing’s “regulatory discouragement” complements it. By forcing buyers to write down technical rationales, authorities generate intelligence on which workloads still depend on U.S. hardware and where domestic options suffice. The process itself is disciplining. Firms learn which purchases invite scrutiny. That chills demand.

Security narratives harden the politics. Chinese state media has raised fears of remote shutdown or tracking features in U.S. chips—claims Nvidia denies. Washington, for its part, argues that controlled sales of neutered parts preserve leverage while slowing Chinese access to cutting-edge compute. Each side wants flexibility without conceding face. It’s calibrated conflict.

Three-way equilibrium emerges

For now, the result is an uneasy balance where each actor secures a partial win. Washington gets revenue and maintains some technical leverage. Beijing accelerates substitution and deters U.S. chips in sensitive contexts without risking immediate capacity shortfalls. Nvidia regains access but at thinner margins and under constant political risk. It’s workable. Barely.

The equilibrium is unstable by design. Overdo the pressure, and the U.S. could yank licenses, collapsing the toll road overnight. Lean too hard on revenue, and China will double down on independence faster. Either way, multinationals face a world where market access depends less on price-performance and more on choreography across capitals. That pattern won’t stop at semiconductors.

Expect the template to spread. Pharmaceuticals, lithography tools, and quantum components all invite similar “managed trade” playbooks—conditional licenses on one side, regulatory discouragement on the other. The old binary of “open vs. banned” is giving way to negotiated lanes with political speed limits. Companies will need compliance teams that think like diplomats. And fast.

Why this matters:

- Regulatory discouragement shapes behavior without formal bans, setting a playbook other sectors can copy.

- Conditional access plus political pressure creates a durable, global template for tech competition—messier than tariffs and harder for firms to navigate.

❓ Frequently Asked Questions

Q: What exactly is the H20 chip and how does it compare to Nvidia's regular chips?

A: The H20 is a deliberately downgraded version of Nvidia's H100 chip, designed specifically for China to comply with US export controls. It has reduced computational power but maintains strong memory bandwidth, making it effective for AI inference tasks but unable to match flagship chips for training large models.

Q: How much money could the US government make from this 15% revenue deal?

A: Before exports were banned in April, Nvidia expected to sell about $8 billion worth of H20 chips in China during the July quarter alone. At 15% of revenues, that single quarter could have generated $1.2 billion for the US government, though actual sales will likely be much lower due to Chinese pressure.

Q: What are China's domestic chip alternatives and how do they stack up?

A: Huawei's Ascend series leads Chinese alternatives, with companies like Cambricon gaining market share. However, none match Nvidia's capabilities for large-scale AI training. US officials estimate that losing H20 access would increase AI inference costs for Chinese companies by 3-6 times current levels.

Q: Is this revenue-sharing arrangement actually legal under US law?

A: Constitutional scholars are questioning whether the fees constitute export taxes, which the US Constitution explicitly prohibits. Critics from both parties have called it a "shakedown" that creates financial incentives for the government to approve potentially risky technology exports for revenue generation.

Q: How does China's "regulatory discouragement" actually work in practice?

A: Chinese authorities send notices to companies asking them to justify why they need foreign chips over domestic alternatives. While not formal bans, these create political pressure and reputational risk, especially for state-linked companies. The process also generates intelligence about which technologies China still depends on.

Q: What security concerns do US officials have about these chips?

A: A group of 20 security specialists warned that H20 chips could enable "autonomous weapons systems, intelligence surveillance platforms and rapid advances in battlefield decision-making." They argue any advanced chip access helps Chinese military capabilities regardless of performance limitations. Nvidia denies military applications.

Q: Could this "conditional access" model spread to other industries?

A: Experts expect similar arrangements for pharmaceuticals, advanced manufacturing equipment, and quantum computing components. The template combines US conditional licensing with revenue sharing and Chinese regulatory pressure, creating a new form of "managed trade" that avoids binary bans while maintaining government control.