💡 TL;DR - The 30 Seconds Version

👉 Perplexity AI submitted an unsolicited $34.5 billion all-cash offer to buy Google's Chrome browser Tuesday.

📊 The bid nearly doubles Perplexity's own $18 billion valuation, with unnamed investors pledging to finance the deal.

⚖️ Timing coincides with Judge Amit Mehta's expected antitrust ruling this month on potential Google breakup remedies.

🌐 Chrome controls 3.5 billion users and 60% of global browser market, making it crucial for AI search competition.

🏢 OpenAI, Yahoo, and Apollo Global Management have also expressed interest if Google is forced to sell.

🚀 Browser control becomes strategic high ground as search shifts from links to conversational AI interfaces.

AI startup offers double its own valuation for Google’s browser. Timing suggests coordinated pressure on the court

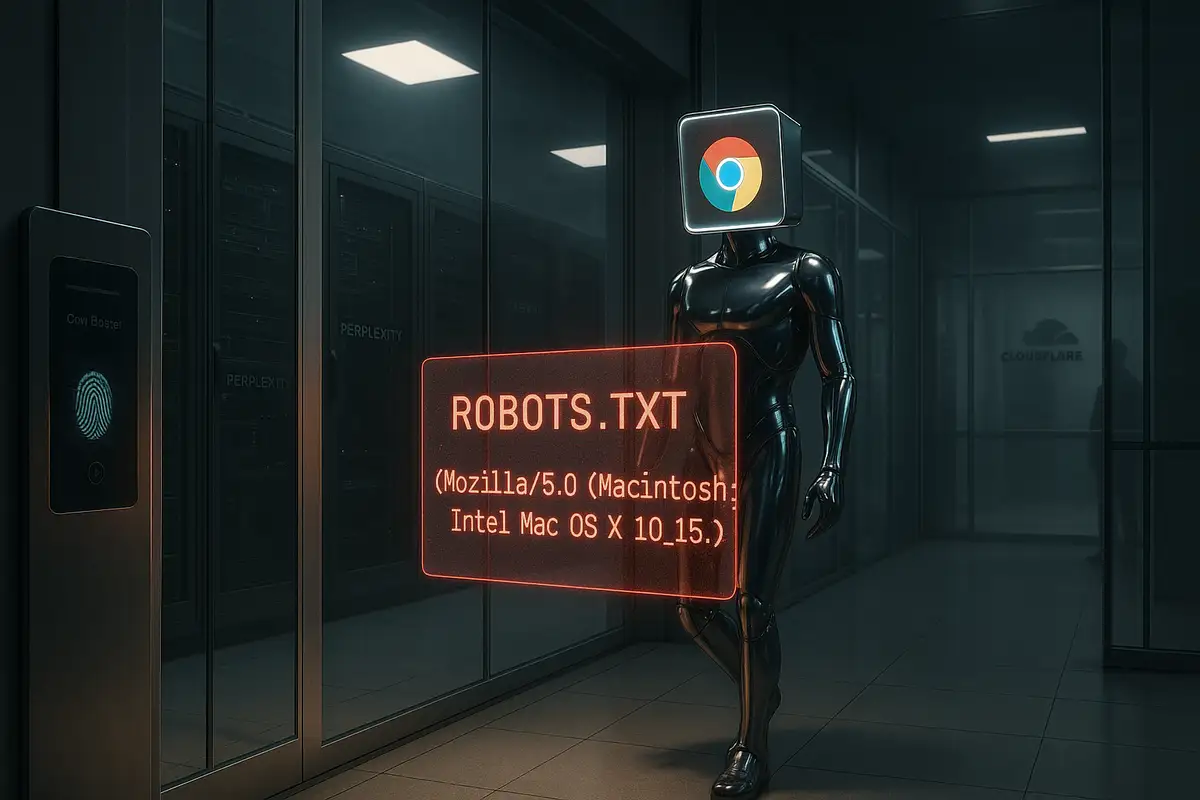

Perplexity AI lobbed an unsolicited $34.5 billion, all-cash offer to buy Google’s Chrome—an audacious proposal arriving just as U.S. District Judge Amit Mehta readies remedies in the government’s search-monopoly case. It’s a headline move for an asset Google insists isn’t for sale.

Last August, Mehta found Google illegally maintained its search monopoly and split the case: liability first, remedies after. The Justice Department’s wish list includes forcing a sale of Chrome, a “critical search access point,” according to its post-trial brief. A remedies decision is widely expected this month.

The strategic calculus

For Perplexity, Chrome is a distribution shortcut. Control the gateway, and your AI search product gets an instant audience. Chrome commands roughly two-thirds of global browser share and, by some tallies, 3.5 billion users. That reach is priceless when search is shifting from links to conversation.

The term sheet Perplexity circulated tries to blunt regulatory objections. It promises to keep Chromium open source, invest $3 billion over two years, and—crucially—leave Google as the default search engine while preserving user choice. That’s designed to reassure both the court and advertisers. Perplexity also launched its own AI browser, Comet, in July, underscoring why the entry point matters.

The pattern emerges

This isn’t Perplexity’s first headline play. In January, it floated a merger construct with TikTok meant to resolve U.S. ownership concerns. That proposal went nowhere, but it telegraphed a willingness to use regulatory flux as leverage. Now, with a Chrome bid on the table, Reuters reports other suitors—OpenAI, Yahoo, Apollo—have expressed interest if divestiture is ordered. The asset has gravity.

Financing remains murky. Perplexity says unnamed backers would fund the deal, but Axios notes some existing investors hadn’t been consulted. The company’s latest reported valuation trails far behind the bid number, making outside capital decisive. The price also sits below high-end estimates of Chrome’s value, a nod to legal overhang.

The legal reality check

Even with the DOJ pushing for a Chrome sale, forced divestitures are rare and appeal-prone. Antitrust scholar Herbert Hovenkamp expects Mehta—“a pretty orthodox guy”—could defer any sale until appeals conclude, potentially stretching years. And while Mehta has mused that divestiture may be “cleaner” than behavioral fixes, that’s not a commitment. The clock—and the D.C. Circuit—matter.

Google’s stance is unequivocal: selling Chrome would harm innovation and security. In testimony this spring, CEO Sundar Pichai warned the DOJ’s remedy package—divestiture plus compelled data sharing—amounts to a “de facto” breakup that jeopardizes user privacy and the company’s R&D engine. Expect Google to appeal any far-reaching order. It’s prepared for a long fight.

The deeper dynamics

Browsers are becoming AI operating layers. Owning the entry point means shaping defaults, capturing behavioral signals, and embedding assistants into everyday navigation. That’s why Chrome looms so large in the AI race—and why Perplexity’s bid is more than theater. Control of the gateway can tilt training data, habit formation, and monetization. The strategic uplift is obvious. So are the risks.

If Mehta orders a sale, the post-Chrome world will be chaotic. Browser stewardship raises thorny questions about security maintenance, search-default contests, and cross-platform interoperability. If he doesn’t, the mere plausibility of divestiture will still influence negotiations: bids, preinstall deals, and partnerships will evolve under the shadow of potential breakup. Either way, distribution is back at center stage.

Why this matters:

- Antitrust pressure is turning distribution assets into acquisition targets, reshaping AI competition at the browser layer.

- Control of Chrome—or its alternatives—could determine who sets defaults, captures data, and wins the shift from links to conversational answers.

❓ Frequently Asked Questions

Q: How much is Chrome actually worth?

A: Estimates range from $20 billion to $50 billion. DuckDuckGo's CEO suggested at least $50 billion if Google were forced to sell. Perplexity's $34.5 billion bid sits in the middle, likely accounting for regulatory complications that could depress the price.

Q: What exactly does Perplexity do?

A: Perplexity provides AI-powered search that gives conversational answers with source citations, competing with Google's traditional link-based results. Founded in 2022, it has raised $1 billion from investors including Nvidia and SoftBank and recently launched its own browser called Comet.

Q: When will Judge Mehta announce his decision?

A: Mehta is expected to rule on Google antitrust remedies sometime this month. However, any forced divestiture would likely face years of appeals through the D.C. Circuit Court and potentially the Supreme Court before taking effect.

Q: Who are the unnamed investors backing Perplexity's bid?

A: Perplexity hasn't disclosed the investors, only stating that "several large venture-capital funds" agreed to finance the deal. Multiple existing Perplexity investors told Axios they hadn't been consulted about the Chrome bid, suggesting new external backing.

Q: Why does owning a browser matter for AI companies?

A: Browsers control user entry points to the internet, providing access to search queries, behavior patterns, and the ability to set defaults. As search shifts toward conversational AI, controlling the gateway becomes crucial for data collection and user engagement.

Q: Has the government ever forced a tech company to sell major assets before?

A: Forced divestitures are rare in tech. The most famous precedent was AT&T's breakup in 1984, which split the telecom giant into seven regional companies. More recently, structural remedies have been proposed but rarely implemented in major tech antitrust cases.

Q: What would happen to Chrome users if Perplexity bought it?

A: Perplexity promises to keep Google as the default search engine while allowing users to change settings. The company would maintain Chromium as open source and invest $3 billion over two years in Chrome development, essentially preserving current functionality.