💡 TL;DR - The 30 Seconds Version

👉 DeepSeek delays R2 AI model after Huawei Ascend chips failed training runs, forcing hybrid approach with Nvidia

📊 Launch pushed from May as Huawei engineers couldn't solve persistent stability and connectivity issues on-site

🏭 Chinese startup now uses Nvidia H20 chips for training, relegates Huawei Ascend to easier inference tasks

🌍 Beijing recently demanded companies justify Nvidia orders to push domestic chip adoption among AI developers

🚀 Pattern suggests China's AI independence timeline extends beyond government projections as performance gaps persist

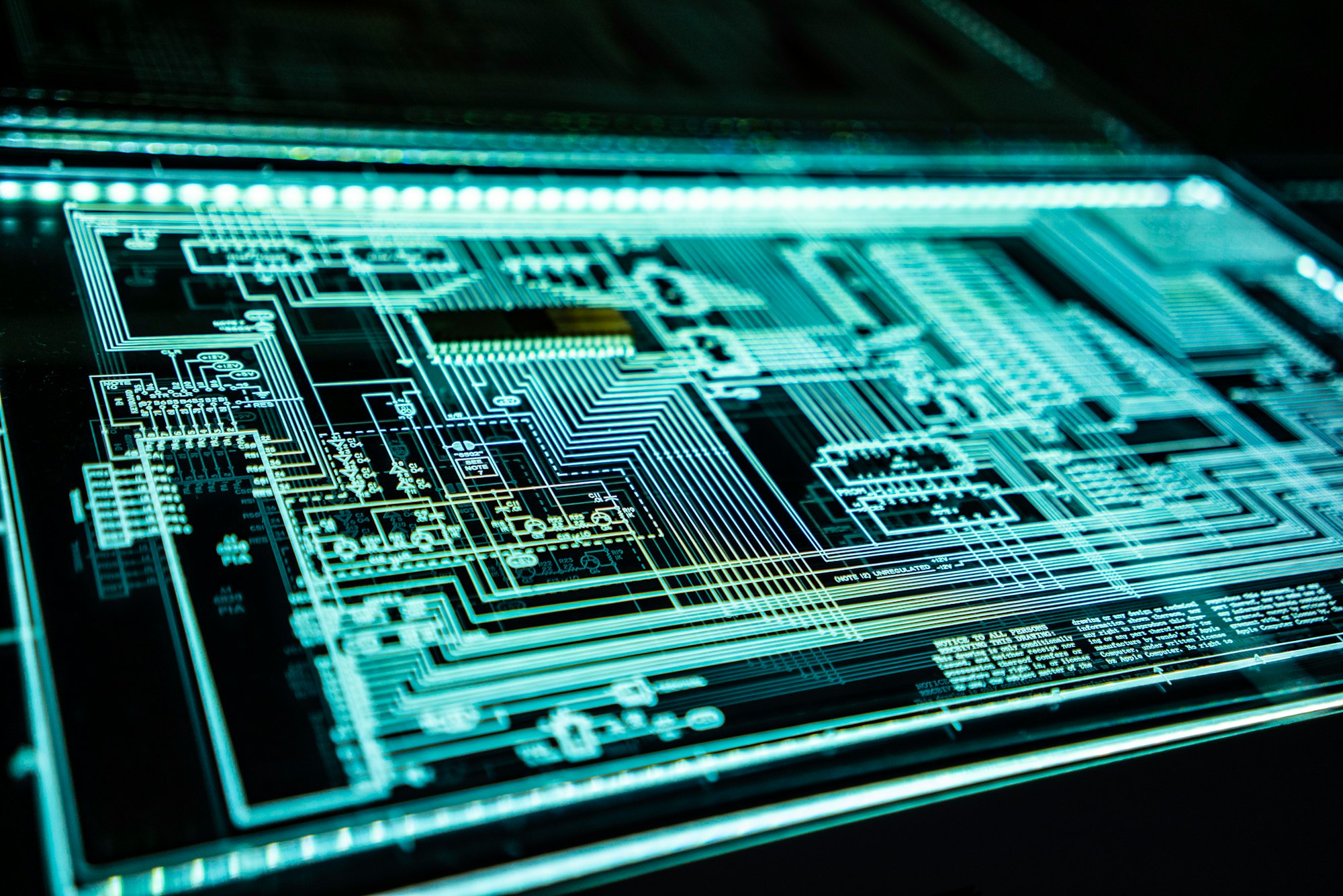

DeepSeek’s much-anticipated R2 AI model is stuck in development limbo after the Chinese start-up failed to train it on Huawei’s Ascend processors—forcing an awkward compromise that undercuts Beijing’s campaign for technological self-reliance.

The model’s launch, originally slated for May, now depends on a hybrid approach: Nvidia’s H20 chips for the compute-heavy training phase, Huawei’s Ascend for inference—the less demanding task of running a trained model.

Chinese regulators had encouraged DeepSeek to go all-in on domestic chips after its R1 model shook the AI sector in January. But persistent technical failures during R2’s training runs made that impossible, according to three people familiar with the matter.

The engineering breakdown

Huawei dispatched engineers to DeepSeek’s offices to troubleshoot the Ascend system. Even with on-site support, the start-up couldn’t complete a single successful training run.

Industry insiders cite the same sticking points: stability problems, slower inter-chip connections, and weaker software tooling compared to Nvidia. Training modern AI models requires thousands of processors working in perfect sync—precisely where these shortcomings matter most.

Founder Liang Wenfeng has voiced frustration internally and pushed for more development time to build a model that can defend DeepSeek’s position. The project also faced delays from prolonged data-labelling work, suggesting bottlenecks beyond just hardware.

Chinese media now suggest R2 could arrive within weeks, though the timeline is fluid. DeepSeek is still working with Huawei to fine-tune Ascend for inference workloads, where the chips have performed better.

Beijing’s difficult calculus

China’s semiconductor strategy faces a fundamental trade-off between political goals and engineering reality. This summer, regulators demanded local developers justify orders for Nvidia chips—an effort to push adoption of Huawei and Cambricon alternatives.

For Beijing, the logic is straightforward: chip independence is national security. U.S. export controls have repeatedly targeted China’s AI hardware supply, making Nvidia reliance a geopolitical liability.

For DeepSeek, the calculation is just as simple: use what works. R1’s success on Nvidia H20s proved Chinese AI firms can compete globally when they have optimal hardware. Sacrificing performance for political alignment risks that edge.

Huawei is caught in the middle. It needs high-profile wins to prove Ascend’s viability, but failed partnerships—like this one—damage its credibility. The DeepSeek case is both a test and a setback for its AI ambitions.

A broader pattern emerges

DeepSeek’s problems mirror those of ByteDance, Baidu, and Alibaba, all of which still lean heavily on Nvidia despite political pressure. In AI, raw chip performance can’t be finessed the way it sometimes can in consumer electronics or telecoms—closing the gap requires years of engineering work.

UC Berkeley AI researcher Ritwik Gupta calls Huawei’s struggles “growing pains,” and predicts the company will adapt over time. But time is exactly what Chinese AI firms lack as U.S. rivals race ahead.

Strategic implications crystallize

The DeepSeek episode shows how China’s AI companies are settling on hybrid strategies: public compliance with domestic-chip mandates for lower-stakes functions, quiet reliance on U.S. hardware for mission-critical tasks.

That means partial dependence on American technology will last longer than Beijing intended. Export controls may slow Chinese AI progress but have yet to trigger a clean break.

For Nvidia, it’s validation. The firm recently agreed to share Chinese revenues with Washington to maintain market access—an arrangement that looks increasingly shrewd as Chinese rivals stumble.

The hybrid approach DeepSeek adopted could become the norm: Ascend for show, Nvidia for the real work.

Why this matters:

- China’s AI hardware gap is proving harder to close, extending the timeline for tech independence.

- Export controls give the U.S. leverage without knocking Chinese players out of the race entirely.

❓ Frequently Asked Questions

Q: What's the difference between AI training and inference?

A: Training involves feeding massive datasets to teach an AI model, requiring thousands of chips working together for weeks or months. Inference is using the trained model to answer questions—much less demanding. Training is like teaching someone math; inference is them solving a problem.

Q: What are Nvidia H20 chips and why does everyone want them?

A: H20 chips are Nvidia's export-compliant processors designed for China, with reduced performance compared to top-tier A100/H100 chips. They still outperform Chinese alternatives in stability, inter-chip communication, and software support—critical for AI training workloads requiring thousands of processors.

Q: How much slower are Huawei's chips compared to Nvidia's?

A: Huawei claims its Ascend 910B achieves 91% of Nvidia A100 efficiency, but real-world performance lags due to connectivity and software issues. Industry insiders report stability problems that make sustained training runs—lasting weeks—nearly impossible on Ascend clusters.

Q: Which other Chinese AI companies have similar chip problems?

A: ByteDance, Baidu, and Alibaba all rely heavily on Nvidia chips despite government pressure to use domestic alternatives. No major Chinese AI breakthrough has been achieved using only domestic chips for training—all still depend on U.S. hardware for frontier models.

Q: Why can't China just reverse-engineer Nvidia's designs?

A: Modern AI chips require advanced manufacturing processes (like TSMC's 4nm technology), specialized software ecosystems, and years of optimization. China lacks access to cutting-edge chip manufacturing equipment due to export controls, making reverse-engineering insufficient for competitive performance.

Q: How long will it take Huawei to catch up to Nvidia?

A: Industry experts suggest 3-5 years minimum for competitive training performance, assuming continued investment and no new export restrictions. However, Nvidia isn't standing still—they're advancing to next-generation architectures while Huawei struggles with current-generation stability issues.

Q: Does this delay hurt DeepSeek's competition with ChatGPT?

A: Yes. DeepSeek's R1 model gained attention in January for matching GPT-4 performance at lower cost. The R2 delay allows OpenAI and other rivals to advance while DeepSeek remains stuck, potentially losing its competitive edge in the rapidly evolving AI race.

Q: What happens if U.S. export controls get stricter?

A: Stricter controls could force Chinese companies into full domestic-chip adoption before the technology is ready, potentially crippling their AI development. Current hybrid approaches would become impossible, creating a stark choice between performance and compliance with Chinese government directives.