Good Morning from San Francisco,

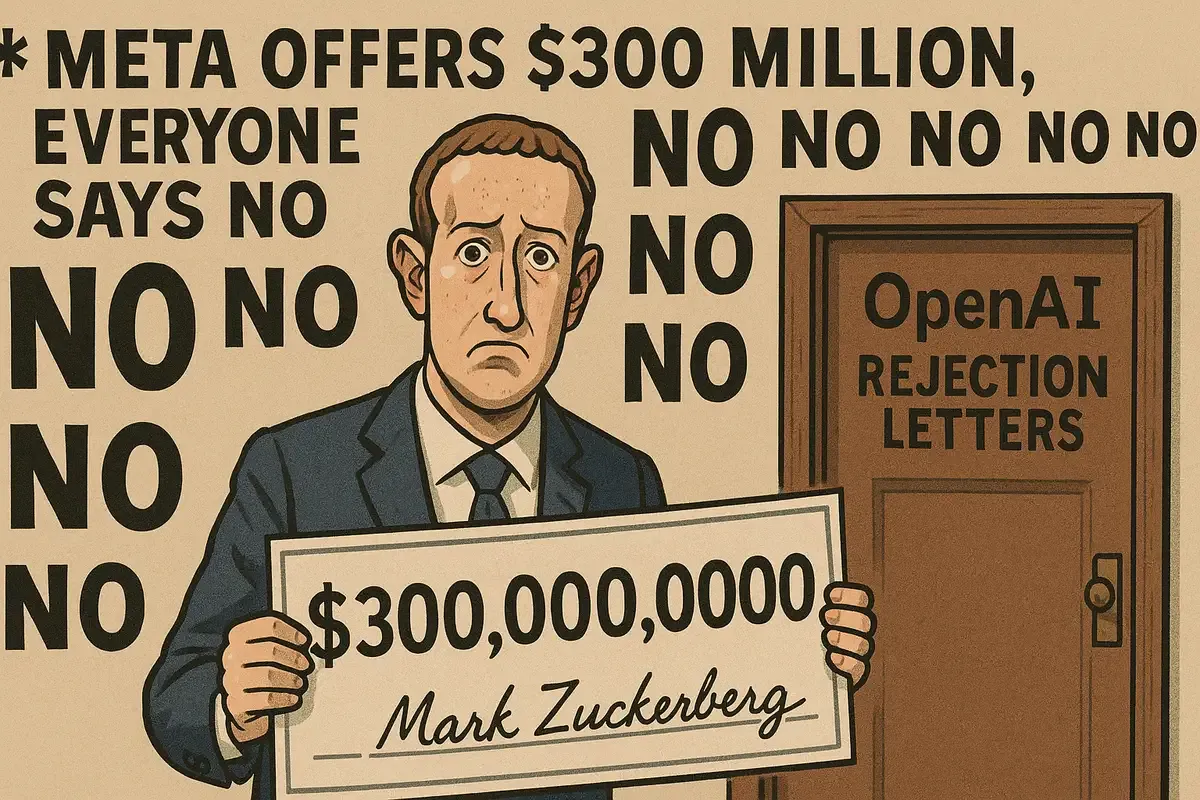

Meta wrote checks for $300 million. OpenAI researchers said no.

Zuckerberg offered packages that make CEO salaries look modest. Over $100 million upfront. Stock that vests immediately. The works.

Ten OpenAI researchers got these offers. Zero accepted.

Meta did snag seven people. But as Altman noted, they were "quite far down their list." The real talent stayed put.

Money can't buy everything. Top AI researchers want missions, not just millions.

Stay curious,

Marcus Schuler

Meta Offers $300 Million. Everyone Says No.

Mark Zuckerberg made offers that would make lottery winners jealous. He dangled $300 million packages at OpenAI researchers, according to Wired. Each deal front-loaded over $100 million in the first year with stock that vests immediately.

The response was universal: no thanks.

Meta pitched at least 10 OpenAI staffers with these record-breaking offers. One researcher got offered the chief scientist role. They all walked away. None of the people who received the headline-grabbing packages actually joined Meta's new superintelligence lab.

The company did manage to poach seven OpenAI employees. But they were, as Sam Altman put it, "quite far down their list." The actual leadership team tells the story. Alexandr Wang from Scale AI became chief AI officer. Nat Friedman, former GitHub CEO, joined as co-leader. Both are accomplished executives, not the hands-on researchers who build language models.

Altman dismissed Meta's recruiting success and positioned the departures as proof of OpenAI's mission-driven culture. "I am proud of how mission-oriented our industry is," he wrote to staff. "Of course there will always be some mercenaries." He framed it as "missionaries vs. mercenaries" and promised OpenAI stock had more upside than Meta shares.

The rejections reveal something important about top AI talent. Money alone doesn't win. These researchers want to work on problems that matter, with people they respect, at companies they believe in. OpenAI has spent years building credibility as the place where serious AI research happens. Meta, despite massive resources, still carries baggage as a social media company focused on ads and user data.

Why this matters:

• Top AI researchers chose mission over money, rejecting offers worth more than most Fortune 500 CEO compensation packages.

• The talent war shows AI competition has moved beyond technology into a deeper battle for credibility and purpose-driven researchers.

Read on, my dear:

AI Image of the Day

Prompt:

A detailed, hyperrealistic digital painting depicts a cup of coffee with splashes of liquid spilling over the rim, cascading in a dynamic pattern, surrounded by vibrant, stylized calla lilies. The scene sets a pleasant, good morning mood. The coffee in the cup and the splashes are rich dark brown and light tan tones, while the lilies are a soft, pastel, iridescent white and light purple. The design is detailed, showcasing the delicate veins and petals of the flowers and the swirling texture of the coffee splashes. A cursive script, "Good Morning," is elegantly positioned above the cup in gold or yellowish-gold. The coffee beans are scattered realistically on the saucer surrounding the cup. The background is a deep, rich indigo blue, complementing the coffee and flower's color palette. The entire piece has a smooth, almost glossy aesthetic, with vivid colors and strong light reflections.

Why Intel's CEO Plans to Write Off Billions in Chip Investment

Intel's new CEO wants to scrap a multibillion-dollar chip technology before it even launches. Lip-Bu Tan thinks the company should stop selling its 18A manufacturing process to outside customers and jump straight to the next generation instead.

The move would trigger massive write-offs. Intel already lost $18.8 billion last year—its first unprofitable year since 1986. Now Tan wants to write off hundreds of millions more, possibly billions, to bet on 14A technology.

The math is brutal but simple. Intel's 18A process matches technology TSMC shipped in late 2022. That's not exactly a compelling sales pitch when you're trying to steal customers from the world's leading chip manufacturer.

The Timing Problem

Tan started voicing doubts about 18A by June, just three months into his job. The technology wasn't attracting the external customers Intel desperately needs. Meanwhile, TSMC's newer N2 process stays on schedule.

Intel will keep using 18A for its own chips. The company's Panther Lake laptop processors are designed for 18A and production starts later this year. Intel also has contracts with Amazon and Microsoft that are too far along to change.

But for new customers? Tan wants to skip ahead.

The TSMC Challenge

Intel's foundry business represents the company's path back to relevance. Right now, TSMC makes chips for Apple's iPhones and Nvidia's AI processors. Breaking that dominance requires more than matching TSMC's technology—Intel needs to beat it.

The 18A process includes new power delivery methods and advanced transistor designs. On paper, these improvements should help Intel catch up. Reality proved different. Delays hit 18A while TSMC kept executing.

High-Stakes Gamble

Intel's board will discuss the strategy this month but might not decide until autumn. The stakes couldn't be higher. Success with 14A could restore Intel's manufacturing edge. Failure might cement permanent second-place status.

The irony cuts deep. Intel once dominated chip manufacturing so completely that "Intel Inside" became a household phrase. Now it fights to convince anyone outside to use its factories.

Why this matters:

- Intel's foundry strategy determines whether America keeps any serious chip manufacturing capability as AI drives unprecedented demand for advanced processors

- If Tan lands Apple or Nvidia as customers, it cracks TSMC's monopoly—failure relegates Intel to permanent also-ran status

Read on, my dear:

AI & Tech News

Chinese AI companies challenge US dominance worldwide

Chinese AI companies are winning customers across Europe, Asia, Africa and the Middle East by offering performance nearly as good as American models at much lower prices. Banks like HSBC and Standard Chartered test DeepSeek internally, while Saudi Aramco installed it in its main data center. Even Amazon, Microsoft and Google now offer Chinese AI models to their customers, despite US security concerns about Chinese technology.

Google's Green Claims Don't Add Up, Report Finds

Google's carbon emissions rose 65% between 2019 and 2024, far higher than the 51% increase the company reported, according to a new analysis by advocacy group Kairos Fellowship. The researchers found Google's emissions have skyrocketed 1,515% since 2010, with the biggest jump happening between 2023 and 2024 when emissions rose 26% in a single year.

Oracle beats tech giants at their own AI game

Oracle jumped from database company to AI powerhouse by making bold bets others wouldn't take, including a $15-20 billion deal with an unproven datacenter developer in Texas to serve OpenAI's massive computing needs. The company also struck a major partnership with ByteDance that helped create the world's second-largest AI hub in Malaysia, showing how smart risk-taking can reshape entire industries.

Tech billionaires plan new bank for startups after Silicon Valley Bank collapse

Palmer Luckey and Joe Lonsdale want to fill the gap left when Silicon Valley Bank collapsed in 2023. Their new bank, called Erebor, will focus on startups that traditional banks won't touch - particularly crypto companies, AI firms, and defense contractors. The bank has applied for a national charter and plans to operate mostly through a smartphone app from offices in Ohio and New York.

Foxconn sends Chinese workers home from India iPhone factories

Foxconn sent more than 300 Chinese engineers and technicians home from its iPhone factories in India over the past two months, disrupting Apple's manufacturing expansion in the country. The move appears linked to Beijing's efforts to restrict technology and skilled labor exports to India and other countries where companies are shifting production away from China.

AirPod maker Luxshare plans $1 billion Hong Kong listing

Luxshare, the Chinese company that makes AirPods for Apple, has picked Goldman Sachs and two Chinese banks to handle its Hong Kong stock listing that could raise over $1 billion this year. The move follows other Apple suppliers rushing to Hong Kong's recovering market, where Chinese companies now account for three-quarters of new share sales.

US judge rejects Huawei's bid to dismiss criminal charges

A Brooklyn federal judge rejected Huawei's attempt to dismiss most criminal charges against the Chinese telecom company, ruling prosecutors provided enough evidence of racketeering, trade secret theft from six companies, and bank fraud. The case heads to trial in May 2026 and stems from allegations that Huawei stole US technology and misled banks about its Iran operations through a Hong Kong subsidiary.

Alibaba pumps $7 billion into China commerce battle

Alibaba will spend $7 billion on coupons and vouchers over the next year to defend its turf in China's brutal commerce wars, while also building new data centers in Malaysia and the Philippines. The moves show how hard the company is working to stay relevant as competitors like JD.com muscle into food delivery and the AI race heats up across Asia.

Climate AI Startup Scores Big in Europe's Energy Gamble

Dexter Energy raised 23 million euros to expand its AI trading platform that helps renewable energy companies navigate Europe's unpredictable power markets. The Amsterdam startup claims its technology can boost wholesale revenues by 30% for clean energy producers by predicting price swings using weather data and market intelligence.

Computer science schools scramble to adapt as AI changes everything

Computer science programs face their biggest shake-up in decades as AI tools that write code force schools to reconsider what they should teach. Carnegie Mellon plans a faculty retreat to redesign its curriculum, while the National Science Foundation funds efforts to develop new AI education standards. The challenge: preparing students for a job market where AI assistants handle basic coding tasks, making traditional programming skills less valuable than computational thinking and AI literacy.

Design software Figma files for IPO after Adobe deal collapsed

Figma filed to go public on the New York Stock Exchange under ticker "FIG" after its $20 billion sale to Adobe fell through due to regulatory concerns last year. The design software company grew revenue 46% to $228 million in the first quarter and turned profitable, with CEO Dylan Field saying he wants the company's community to share ownership through public markets rather than staying private indefinitely.

🧰 AI Toolbox

How to Rewrite Your Text Instantly

Quillbot rewrites your sentences while keeping the same meaning. It helps you avoid repeating yourself and makes your writing clearer. You can choose how much it changes - from small tweaks to complete rewrites.

Tutorial:

- Go to the Quillbot website

- Paste your text into the input box

- Choose a mode like "Standard," "Fluency," or "Creative"

- Click "Paraphrase" to rewrite the text

- Review the new version and make changes if needed

- Use the thesaurus to swap specific words

- Copy the final text for your document

🚀 AI Profiles: The Companies Defining Tomorrow

Figma: The Design Tool That Broke Adobe's Bank

Two Brown University dropouts turned a browser-based design idea into a $20 billion acquisition target that regulators killed. Now Figma's going public, armed with Adobe's $1 billion breakup fee and a stranglehold on modern design workflows.

The Founders

Dylan Field and Evan Wallace launched Figma in 2012 after meeting in Brown's computer science department. Field dropped out at 20 with a Thiel Fellowship, Wallace joined after graduation. The San Francisco company now employs over 1,000 people. Their mission: democratize design by killing desktop software bloat.

The Product

Figma runs entirely in browsers—no downloads, no platform wars. Multiple designers edit simultaneously like Google Docs. Core strengths: real-time collaboration, cross-platform access, integrated prototyping, and developer handoff tools. Added FigJam whiteboarding (2021) and testing presentation slides. The freemium model hooks users, paid plans scale with teams.

The Competition

Sketch owned Mac-based UI design until Figma's browser assault. Adobe XD launched as a direct counter-punch but flopped. Adobe's attempted $20 billion buyout admission of defeat—regulators agreed, blocking the deal as anti-competitive. Figma now claims 31% market share vs Adobe XD's 15%. InVision, Framer, and open-source Penpot nibble at the edges.

Financing

$333 million raised across six rounds from Index, Greylock, Kleiner Perkins, Sequoia, and A16z. Hit $10 billion valuation in 2021. Adobe's blocked acquisition valued it at $20 billion. Secondary sale in 2024 reset expectations at $12.5 billion. IPO filing submitted for NYSE ticker "FIG" in July 2025.

The Future ⭐⭐⭐⭐

$400 million annual revenue, cash-flow positive, plus Adobe's $1 billion consolation prize creates a war chest for expansion. Design teams worldwide depend on Figma daily—that's sticky revenue gold. The IPO timing hits as AI design tools emerge and Adobe sharpens its knives for revenge, but Figma's collaborative moat runs deep. 🎨